Future of FinTech | Edition #10 – March 2022

We’re back with another serving of the weekly FinTech brew to keep your curious cups filled with the stirring affairs in a new edition of the Future of FinTech Newsletter! If you're new and curious, read on to find out what happened in the world of FinTech across six dynamic themes, and join 571 other FinTech nerds in receiving some fresh Weekly FinTech Brew delivered right to your inbox every Tuesday ☕️

Edition #10 welcomed the Open Finance segment as the most active segment of the week, with an assortment of activities making up for the headlines for the vertical.

Here's the TL;DR

Some brands that joined forces to expand their offering portfolios:

MX + UW Credit Union to give people greater access to their financial data,

Credit Libanais + Codebase + Visa for eKYC mobile app for virtual prepaid cards,

Revolut + IRIS for on-demand pay service,

FTX + Stripe for payments and identity verification, and

Shopify + Royal Bank to advance renewable energy in Alberta.

Blockbuster funding rounds – Acorns ($300M Series F), Stilt ($100M Debt and $14M Series A), Lunar ($77M Series D-2), Branch ($75M Series C)

For the longer read, let's get going –

The Open Finance vertical was witness to various players from across industries integrating open models for a more seamless payments process.

Financial data platform MX announced its data access partnership with UW Credit Union to implement Open Banking APIs in giving people greater access and control of their financial data. Ebitly was also in the news for choosing to integrate Open Banking into their account platform by joining forces with freemium Open Banking platform Norgiden. Additionally, NCR Corporation purchased FinTech intellectual property for Open Banking from Canada-based Spoke Technologies to accelerate NCR’s move into open and international digital banking.

Southeast Asia’s largest open finance platform Ayoconnect and Bank Rakyat Indonesia signed a memorandum of understanding that extends their existing collaboration on a new direct debit capability that allows BRI’s merchant partners to directly deduct payments from their customers’ bank accounts. next, from Bradesco, bought payment technology company Aarin, a startup that is focused on promoting invisible banking experiences. Visa also completed its acquisition of Open Banking platform Tink to enable clients to deliver substantial benefits for consumers for better control of their financial experiences.

On the regulatory front, FinTech company Malaa Technologies obtained a permit from the Saudi Central bank to engage in Open Banking activities in the Kingdom, while also concluding its integration efforts with the Arab National Bank’s systems to become the first lender whose customers can link their bank accounts directly through open banking. The Open Banking Implementation Entity supported UK's Financial Conduct Authority’s recent decision to extend the deadline for ending the Open Banking 90-day authentication rule change. Open Banking platform Bud also hit the headlines for becoming an Accredited Data Recipient under the CDR in a bid to support global customers and Australian businesses.

At the same time, the National Institute of Standards and Technology (NIST), a non-regulatory agency of the U.S. Department of Commerce, published an internal report explaining what Open Banking is and highlighting the importance of cybersecurity and privacy safeguards in the consumers financial data sharing ecosystem. On the other hand, NatWest made the news for its prep to live roll out variable recurring payments with its Open Banking payments product Payit.

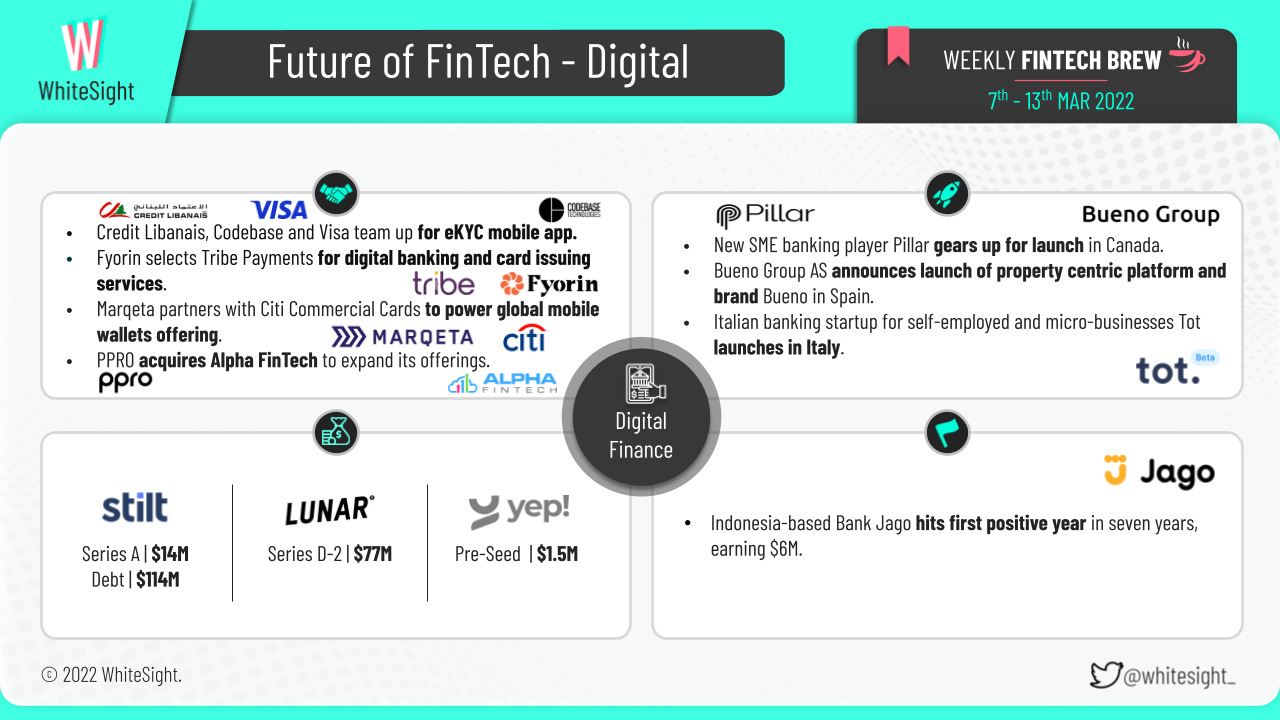

The Digital Finance vertical was influx with a variety of new digital players making their official debuts in the space.

New SME banking player Pillar, designed to make it easy for small business owners to stay on top of their expenses and improve their business’ overall financial management, was in the news for its plans to launch in Canada. Bueno, a property centric platform and brand of the Bueno Group AS also launched as one of the first B2C FinTech challengers in Spain, with full support for local direct debits. Italy also witnessed the launch of Tot, a startup that focuses on self-employed professionals and micro-enterprises by providing them digital banking tools. Additionally, Hong Kong’s Mox grabbed headlines for its ‘Instant Clear’ Credit Card Balance Transfer Plan that will provide customers a smarter way to clear their credit card bills.

When it comes to partnerships, Marqeta announced a new partnership with Citi Commercial Cards to facilitate the provisioning of cards into mobile wallets to enable users to pay seamlessly and securely on the go. Fyorin selected payment technology provider Tribe Payments for digital banking and card issuing services to enable its business clients to send and receive money across borders using multiple payment methods and create Mastercard virtual cards instantly for online spending. Not only that, but Credit Libanais, Codebase and Visa also teamed up to develop a frictionless, eKYC omni-channel onboarding experience for customers looking to acquire virtual prepaid cards. PPRO, the leading provider of digital payments infrastructure, further announced the acquisition of Alpha Fintech, a next-gen payments technology company to expand its offerings, strengthen its presence and networks in Asia Pacific (APAC), and allow it to deliver products and services faster to its customers. Gojek-backed Bank Jago’s first profitable year milestone, with an earning of around $6M, too made for a noteworthy event in the Digital Finance sector.

Moreover, many notable funding rounds made for a key highlight in the happenings for the digital industry for the week.

Stilt secured $114M in debt and equity to help FinTechs and neobanks launch credit offerings with its API.

Nordic neobank Lunar stole headlines for raising $77M in a Series D-2 funding round at a $2B valuation, accompanied by the launch of a crypto trading platform and B2B payment services.

Nigerian digital bank Yep! also made it to the list with its $1.5M pre-seed funding for its plans to leverage the E-Settlement’s network and convert the underbanked customers online.

A plethora of partnerships and funding rounds marked for most of the activities in the Embedded Finance vertical last week.

FinTech startup Lendai raised $35M in equity and debt seed funding for letting the company enable foreign, non-residential borrowers access immediate funding and competitive rates using its artificial intelligence (AI)-based Triple Digital Underwriting System.

Leading employment data platform Argyle secured $55M Series B to make user-permissioned employment data ubiquitous and reinvent credit decisioning for lenders and consumers.

Branch, a company that aims to power faster payments to contract workers with its technology, also raised $75M in a Series C funding.

mmob, a UK-based embedded finance network, closed $6.5M in seed funding in order to advance the development of its technology platform, enter new markets, and further its leadership position within the embedded sphere.

Additionally, Dubai-based BNPL Tabby’s completion of a Series B extension of $54M co-led by Sequoia Capital India and STV, and Mastercard’s $30M investment in FinTech unicorn Zeta were also key highlights for the space.

Many platforms are gearing up to build a formidable financial services portfolio, and partnerships account for one way towards achieving the same. Leading global embedded finance experience platform Railsbank became the BIN sponsor for the Sodexo Engage Spree Card programme, aimed at providing a smooth and secure end-to-end payment process to all cardholders. Verisk announced an agreement with Ford, giving the former the license to supply connected car data to insurers in the UK, France, Germany, Italy and Spain. Revolut also made the news for expanding on-demand salary service with IRIS partnership in the UK.

Furthermore, Bharti Airtel and Axis Bank forged a telco-bank partnership that will see the introduction of a co-branded credit card, instant loans and BNPL offerings for Bharti Airtel, while Axis Bank will leverage Airtel’s suite of digital and cybersecurity services. Visa’s collaboration with Dubai-based Multi Level Group to promote contactless digital solutions in North Africa, and Clip’s alliance with Chilean startup AgendaPro to encourage use of payment terminals in SMEs also account for the eventful collaborations in the embedded landscape.

What’s more – Absa in partnership with WIZZIT Digital launched its mobile payment acceptance solution Absa Mobile Pay to offer SMEs a cost-effective solution to facilitate contactless payments. Square was also in the news for introducing two new products by the names of Square Marketing and Square Loyalty in Ireland, to help businesses grow their sales and engage their customers with just a few clicks.

The DeFi and Crypto segment was witness to quite a stir of activities on the dynamics of partnerships, funding rounds and product launches.

One of the world’s leading crypto companies FTX, along with its US regulated affiliate FTX US, teamed up with Stripe to build a seamless onboarding and identity verification flow for users joining the exchange, and to power payments for users adding funds to their FTX account. Stripe also made it to the bulletin for launching its global payment solutions for the web 3, with features such as fiat payment APIs, crypto exchanges and on ramps, as well as crypto wallets and NFT marketplaces.

Centre – the consortium founded by Circle Internet Financial and Coinbase – teamed up with crypto exchange FTX and decentralized liquidity network Alkemi Network for its recently launched set of decentralized identity protocols, Verite. The collaboration is aimed at promoting broader adoption of crypto payments, decentralized finance, and access to the wider ecosystem. Yield Guild Games, a blockchain-focused gaming startup based in the Philippines, signed a memorandum of association with UnionDigital, the digibank unit of Union Group, with the deal aimed towards making financial products and services accessible to the play-to-earn and web 3 communities in the country.

The space also garnered attention from a diverse range of players who are keen to incorporate and expand their portfolios to leverage from the novel notion of digitized transactions. Pandora Digital announced the launch of its DeFi platform in a bid to overcome the limitations of conventional DEXs. World’s leading blockchain ecosystem and cryptocurrency infrastructure provider Binance announced the launch of Bifinity as its official fiat-to-crypto payments provider. Bifinity is a payments technology company that allows businesses and merchants to use Bifinity’s intuitive APIs to get their business crypto-ready and start accepting crypto payments and enables consumers to have access to more user-friendly buy-sell crypto services and entry points.

Santander also announced its partnership with Agrotoken in a bid to develop token-secured loans for Argentine farmers – with a pilot having already been carried out with local producers that enables them to access finance against agricultural products. DeFi Yield Protocol unveiled plans for a complete rebranding process including a new logo, website, Dapps for users to give DYP a new face, as well as their intentions to launch new smart contracts for yield farming, staking, borrowing, and lending to allow the community to benefit from high rewards and maximize their profits. Apart from integrating new exciting products, the DeFi Yield Protocol team is also designing a metaverse platform that features the ‘Cats and Watches Society’ NFTs collection as one of the main characters.

The funding front was bustling with activities as Bain Capital Ventures, one of the world’s biggest startup-investment firms announced the launch of a $560M fund focused exclusively on crypto-related efforts. Singapore-based Cake DeFi, a FinTech platform that provides decentralized finance services and applications, launched Cake DeFi Ventures, a new $100M venture capital arm, to invest in startups operating in the web 3, gaming, and FinTech industries – with a special focus on those offering metaverse, NFT, blockchain, and esports offerings. While Nested Finance, a DeFi platform, raised a $7.5M series A funding round led by billionaire Alan Howard, Thetanuts Finance secured $18M seed funding with participation from Three Arrows Capital, Deribit, QCP Capital and Jump Crypto. Cega, a newly established protocol, announced the closing of a $4.3M seed round at $60M valuation, with an aim to build exotic DeFi derivatives.

Crypto curious and want to know more about the buzz surrounding the Cryptosphere? 🧐 Well, then you definitely need to get yourself a weekly cuppa of the Future of Crypto newsletter!

The Platform Finance space was abuzz with activities with a number of firms celebrating the achievement of their respective company milestones.

Investment super app moomoo marked one year since its entry into the Singapore market by becoming the only one-stop investing platform to break through the top five most downloaded apps in the finance category, both in the Apple App Store and Google Play Store in 2021. Similarly, Nedbank’s super app Avo surpassed 1 million users, doubling its customer base in the last 4 months, with a staggering 50% of that being achieved in the last 4 weeks. On 6th March, Africa’s first mobile payments service M-Pesa celebrated its 15th birthday. It launched in 2007 via Vodafone and Kenya's leading mobile operator Safaricom – when they initially used to offer limited money transfer facilities on 2G ‘feature phones’.

Southeast Asian firm Capital A’s airasia super app inked a memorandum of understanding with CGS-CIMB Securities in a bid to introduce stock trading as a new feature via ProsperUs – CGS-CIMB Securities’ digital investment platform. Sandbox Banking, a BaaS infrastructure company, and Upstart, an artificial intelligence lending platform, announced a partnership to facilitate Upstart’s bank and credit union partners to more efficiently integrate Upstart loan and borrower data into their core and customer relationship management systems.

Car ownership super app Jerry launched an auto refinancing service that limits the data gathering and loan application process to under 10 minutes by leveraging artificial intelligence and machine learning. Southeast Asia’s first SME super app Enstack launched in the Philippines, with the beta version of the app having already helped over 10,000 merchants by providing them with all the tools to run their small business directly from their mobile phones.

On the fundings front, savings and investing app Acorns raised $300M in a Series F funding round that values the company at nearly $2B so as to explore more acquisitions and to fund growth and innovation.

A plethora of activities across various fronts made for the majority of the headlines for the Green Finance space.

British banking app Novus teamed up with Sustainability-as-a-Service provider ecolytiq to launch Novus’ sustainable banking app in the UK that will provide Novus customers in the region transparency on their personal carbon footprint with each payment transaction. Two of Canada’s biggest companies, Shopify and Royal Bank of Canada, signed a “purchase power agreement” with the currently under construction Rattlesnake Ridge Wind Power Project, that commits them to buying 90,000 KWh of electricity annually from the wind farm owned by Berkshire Hathaway Energy Inc. BBVA and North American Stainless signed a $100M sustainability-linked deposit, with an aim to utilize the funds for the maintenance of BBVA Corporate & Investment Banking’s sustainable portfolio.

Likvidi, a sustainable finance company, announced the launch of its carbon trading platform and ‘Liquid Carbon Credit’ (LCO2), a tokenized carbon credit designed to be traded at high liquidity on Likvidi’s own platform and on other blockchain-based exchanges and platforms. On International Women's Day, Finastra launched its fourth annual global Hackathon, with this year’s edition encouraging engagement beyond the global fintech ecosystem with a focus on financial sustainability, inclusion, embedded finance and decentralized finance. Philippines’ leading digital mobile wallet company GCash achieved a major milestone, as the company successfully completed the plantation of 1 million trees through GForest, the platform’s environmental sustainability feature on the GCash app.

The fundings space was buzzing with activities as HBAR Foundation, a philanthropic and independent subsidiary of distributed ledger firm Hedera Hashgraph, announced the launch of a $100M environmentally-conscious Sustainable Impact Fund, conceived to foster the development of climate-conscious solutions within the Hedera ecosystem. The first recipient, a Welsh blockchain company called DOVU, has been granted an undisclosed portion of the treasury which will help them to pursue their open-source Guardian technology in a bid to develop publicly transparent mechanisms to verify carbon-offsetting data.

According to a report published by fintech-focused VC firm CommerzVentures, climate FinTech startups raised $1.2B in 2021 – three times more than all previous years combined. Although US firms raised $403M against the EU’s $239M, Europe remains the home to four times as many climate FinTechs as the US. The report also revealed that the UK received the most funding in Europe, with $194M, followed by France ($143M), Germany ($96M), Finland ($59M) and Sweden ($50M). On the other hand, Bank of America CEO Brian Moynihan also voiced his high expectations from the green bond market, with sustainable bonds having the potential to expand to include issues such as biodiversity.

Some other happenings in the FinTech universe 🪐

Besides the brewing buzz across these six themes that are painting the Future of FinTech, several other headlines also made for the scoop for the week – with

British consumer finance platform Lendable raising $210M,

US paytech Stax hitting $1B valuation with a $245M funding round,

FinTech firm Curve expanding to the US after raising $95M,

UK’s Funding Circle reporting its first full-year profit of $70M in 2021,

Otis joining the Public platform to empower fractional investing in NFTs, art, and collectibles,

RBI launching its flagship ‘UPI123Pay’ payment service for feature phones, and

PostNord Strålfors and Tink partnering to transform how invoices are paid and handled through Open Banking powered payments.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

Till then, if you're hungry for more FinTech insights, check out some of our other work at WhiteSight. Our latest publications include honoring women's history month by exploring the FinTechs Championing Financial Services for Women, and taking a closer look at Open Banking Innovation in Saudi Arabia in partnership with Mod5r.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for our strategic intelligence and research content services, reach out to us at hello@whitesight.net

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter and don't be shy to show some 💛