Klarna’s Fashion Flex

Future of Fintech - Edition #147 (26th Dec‘24- 6th Jan‘25)

Happy New Year, fintech fam! 🎆 We’re back to track every breakthrough, buzz, and bold move in the world of finance. This week’s brew is packed with:

✔️ Acquisitions making bold statements,

✔️ Partnerships unlocking new doors, and

✔️ Trends setting the tone for what’s to come.

🥂Let’s raise a toast to a year of innovation, growth, and game-changing fintech moments. Ready to dive in? 🚀

Catch the fintech wave and subscribe for your weekly dose of insights ☕

What’s on the fintech menu today?

📖 Today’s Must Read: Why Q4 2024 Was Embedded Finance’s Main Character Moment

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Fin-teresting Stories in Fintech 📰

Why Q4 2024 Was Embedded Finance’s Main Character Moment

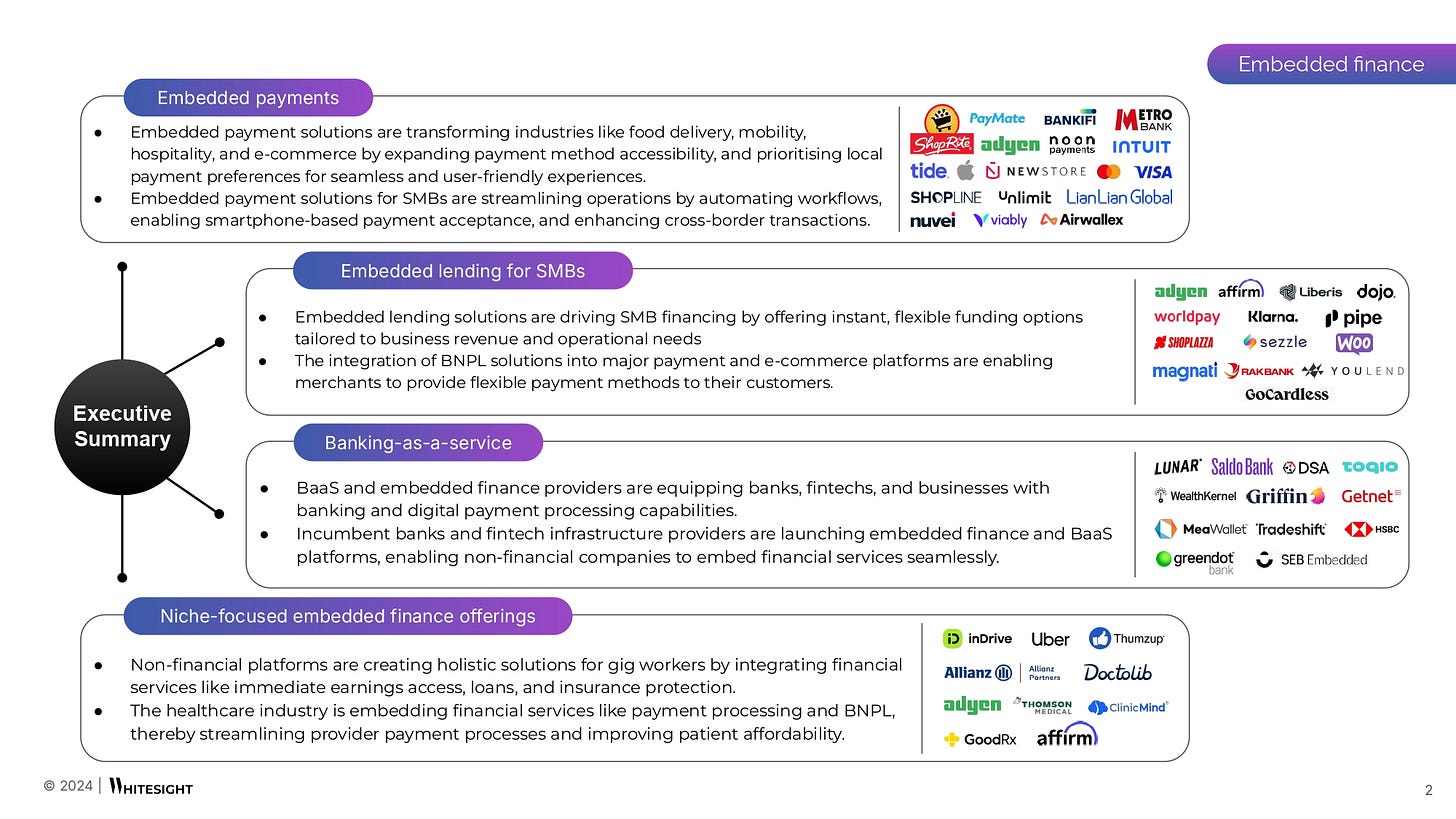

The fourth quarter of 2024 showcased why embedded finance was the ultimate glow-up for players across industries. From hyper-personalised payment experiences to transformative SMB lending solutions, businesses are embedding finance not just as a service but as a core growth strategy. The result? Frictionless customer experiences, new revenue streams, and game-changing partnerships that are shaping the future of how brands embrace finance.

🔍 Here are 3 standout trends you absolutely need to know:

1️⃣ Checkout Redefined: Major players like Lyft and Cash App are removing payment friction, while partnerships like Stripe X Tillster bring multi-market, multi-method acceptance to industries like hospitality. E-commerce is racing ahead with Mastercard’s biometric-powered checkout—goodbye OTPs, hello speed and security!

2️⃣ SMB Enablement: Platforms like Magnati and RAKBANK are leveraging real-time POS data to create hyper-personalized lending solutions. Meanwhile, Intuit and Adyen are simplifying payment workflows for SMBs, bridging operational gaps with automation and smarter financial management.

3️⃣ Gig Worker Inclusion: Uber’s instant payouts and inDrive’s income-based loans signal a massive shift toward holistic financial support for gig workers. From faster access to earnings to integrated protections like vehicle downtime insurance, gig platforms are stepping up.

Want the full breakdown of these trends and actionable strategies to capitalize on them? Our Q4 2024 Roundup delivers all the emerging trends to supercharge your strategies. This is your calling to take your seat at the table of tomorrow’s biggest financial disruptors.

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Grab, Wise, Shopify, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

🎉 New year, new fintech brew! Edition #147 is here to kick off 2025 with a bang! 🚀

The Week's Hot 10!♨️🔟

Flexing Financial Flexibility

⤷ Fashion membership retailer Fabletics teamed with Klarna to bring flexible payments to subscription members across the US.

⤷ GoTyme expands into Indonesia, aiming to empower small businesses with flexible financing solutions and drive growth in the country’s SME ecosystem.

Central Banks in the Spotlight

⤷ The Central Bank of Brazil joined the BIS' Project Apertato to enable cross-border data sharing via open finance, with Brazil, UAE, UK, and Hong Kong SAR in the initial phase.

⤷ The Central Bank of Oman approved Banking Deposits Protection regulations, advancing its tech roadmap to drive innovation and enhance consumer control over financial data.

The Acquisition Power Play

⤷ Employer.com acquired SMB platform Bench just three days after its shutdown, expanding its services for small business owners.

⤷ Binance gained approval from the Central Bank of Brazil for its acquisition of Sim;paul, becoming the first crypto exchange with a broker-dealer license in Brazil.

⤷ Coinbase acquired BUX’s Cyprus unit to expand its operations in Europe under the MiCA regulation, strengthening its presence in the region.

Tech-Driven Financial Alliances

⤷ PXP Financial partnered with DisputeHelp to launch Visa’s Fraud Prevention Framework, tackling first-party fraud and reducing chargebacks for merchants.

⤷ Tokio Marine North America collaborated with Earnix to create a centralized rate repository, improving pricing and rating strategies for US insurance businesses.

⤷ Qi Card launched SuperQi, a digital lifestyle app and bank in partnership with Ant International, with an aim to boost financial inclusion and digital services in Iraq.

Now, for the ‘byte’-sized fintech buzz –

The Embedded Finance playground is on an acquisition spree, expanding into new frontiers - from gig worker solutions to smarter financial tools.

Fiserv entered into a definitive agreement to acquire Payfare, a Canada-based earned wage access (EWA) firm, in a $147M deal. The company aims to broaden its payment options for gig economy workers.

Thomson Reuters acquired tax and accounting automation software firm SafeSend for $600M. The acquisition will see Thomson Reuters strengthen its tax and accounting software offering.

Open Finance is making things easier, from quick account openings to smoother, more secure payments—all through smarter, connected tech.

US-based FinTech Automation launched the ‘EZForm Digital Account Opening (DAO)’ tool to simplify the account opening process for banks and credit unions. The solution works by digitising and automating workflows to improve compliance and deliver a “user-friendly experience” for banks, credit unions and their customers.

The European Payments Council (EPC) launched a request for proposal (RFP) as it seeks a technology service provider responsible for the provision of an API test environment for its forthcoming Verification of Payee (VoP) scheme.

Digital Finance is reshaping how we bank and fund businesses—faster, smarter, and easier.

Mashreq Pakistan secured an SBP licence from the State Bank of Pakistan (SBP) to begin pilot operations as a digital retail bank in the country. The bank plans to “onboard millions of retail customers catering to all their personal and business needs” over the next five years.

Klub, a fintech leader in revenue-based financing, partnered with ADGM’s Numou platform to provide faster, accessible funding for SMEs and startups in the UAE. This collaboration aims to bridge the financing gap for small businesses in the region, ensuring faster and more accessible funding for entrepreneurs.

From smarter fraud prevention to AI-driven customer service, Fintech Infrastructure is powering the future.

Risk Intelligence Platform Bureau raised $30M in Series B to combat the exponential rise in sophisticated fraud attacks worldwide.

Glia, a customer interaction tech leader, expanded its Responsible AI platform and introduced Quality AnalystGPT, an advanced tool for analyzing customer interactions.

DeFi is making its mark, with regulations in place and tokenized stocks paving the way for a new era in finance.

The European Union's MiCA crypto regulation came fully into force, aiming to protect consumers and provide regulatory clarity for businesses across the bloc.

Coinbase to explore the possibility of offering tokenized shares of its stock, COIN, to US users via Base, its Ethereum layer-2 network, while navigating U.S. regulations.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cup full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Global Payments Report 2025 Report - Ravelin

Obsolete to Absolute, with Banking-as-a-Service Report - audax X Thought Machine

2024 FinTech Review and How Banks can monetize Open Banking Blog - Panagiotis Kriaris via Panagiotis' FinTech Newsletter

Cultivating an ecosystem mindset Blog - Platformable

The State of Digital Finance (Q3 2024) Report - WhiteSight

Nubank’s Global Playbook: Big Bets, Bigger Moves Blog - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️