Future of Fintech | Edition #53 – Jan 2023

Summary of news from 17th to 23rd January

Hola, FinTech Geeks!

Need help getting over the Monday funk? Say no more – ‘cause we are back with our weekly newsletter, serving a rundown of the latest affairs that are sure to keep you in the loop on everything fintech. Grab your favourite cup of Joe while reading about the industry's hottest topics! ♨

Open finance saw growth in 2022 with new players, customers, and attention due to the value of its services. Open banking and finance, which enable data sharing with third parties, have disrupted the industry. Collaborations within the industry have equally helped turn data into practical and valuable services for consumers and businesses. Grab a copy of The State of Open Finance I FinTech Roundup 2022 report to indulge in the explorative study on the notable open finance trends.📝

Edition #53 is here to boost your week with the added pumps of zesty happenings surrounding the ever-evolving realm of fintech!

Here's the TL;DR

‘Open’ing our fintech tour this week, upSWOT forged an open banking partnership with Mastercard to help upSWOT’s SME customers access actionable insights and financing. At the same time, PayJunction partnered with Plaid to integrate its account-to-account payments feature, streamlining the ACH enrollment process for PayJunction's customers.

Expanding to new geographies, Salt Edge entered the Jordanian market to aid banks and financial institutions in the country in providing open banking API solutions. Further in the north, Nigerian neobank Kuda secured a banking licence from the State Bank of Pakistan to run a digital bank under the name ‘KT Bank.’

Making leaps into the corporate banking space, Grasshopper teamed up with finance automation platform Ramp to provide SMEs in the US access to corporate card and finance automation software.

Streaming BNPL on fintech TV, BillEase tapped Alipay+ to allow local Filipino customers to utilise the option of "buy now, pay later" and card-free instalment payments for purchases on global websites. UAE-based BNPL player Tabby was also seen securing $58M in Series C funding to support its product expansion.

Turning a corner for the credit space, Temenos rolled out its AI-driven corporate lending solution to assist banks in consolidating global commercial loan portfolios. Meanwhile, TransUnion supported Mortgage Magic, an online mortgage platform, in introducing credit report integration, making it easier for brokers to suggest tailored products.

Making headway in the DeFi space, Polygon completed its proof-of-stake hard fork upgrade to reduce gas spikes and chain reorganisations.

For the longer read, let's get going –

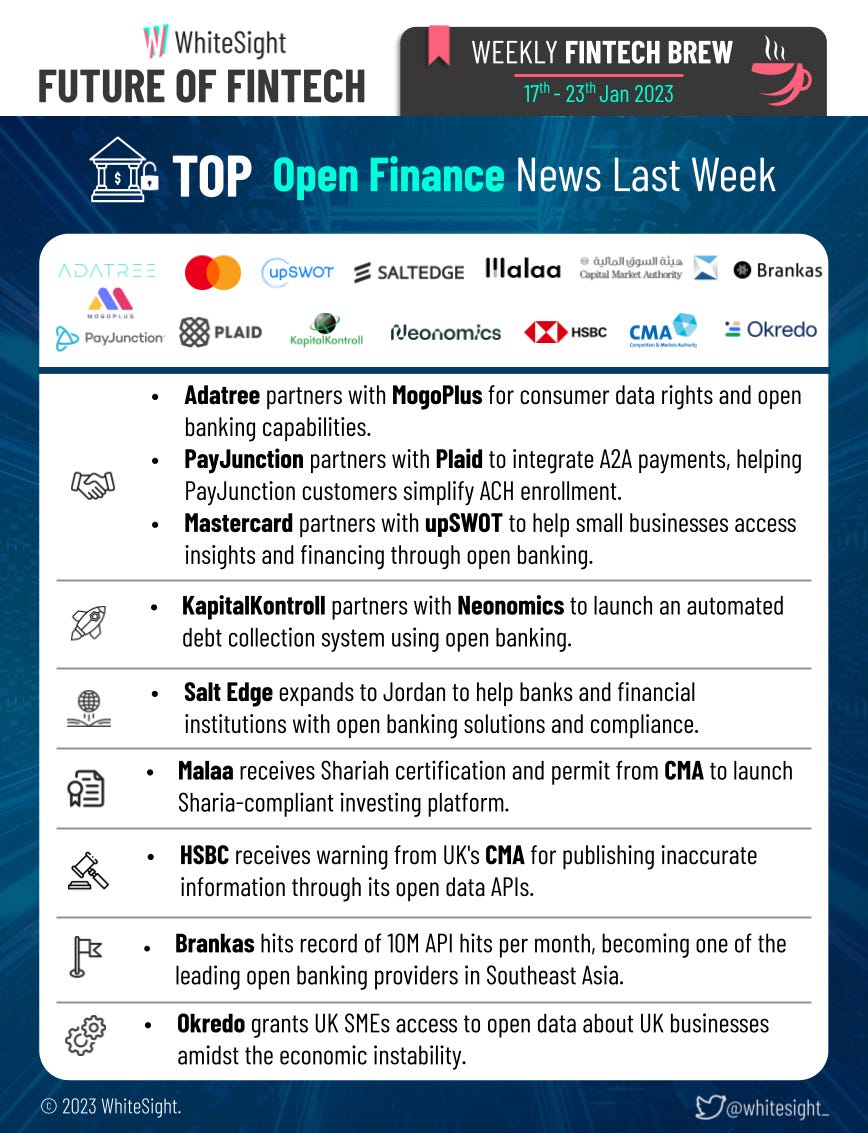

Last week, the Open Finance realm witnessed a flurry of activity, with new licences being granted, strategic alliances being formed, and innovative products emerging on the scene.

Saudi-based Malaa Technology obtained Shariah certification and authorisation from the Capital Market Authority to launch a Shariah-compliant investment platform, allowing users to invest in Shariah-compliant ETFs easily.

Making debt collection easier in Norway, KapitalKontroll joined forces with Neonomics to launch a fully automated debt collection system, which manages all payments through Neonomics' open banking platform.

Stepping up its efforts to help small businesses in the UK, Okredo granted SMEs access to open data about UK businesses to navigate through economic instability. The company plans to roll out business linkage reports, international credit and sanctions reports, and information on adverse media and PEP (Politically Exposed Persons) to support its SME customers.

Regulatory winds swept through the Digital Finance landscape last week, leaving a trail of new initiatives in their wake:

Opening doors to the digital banking revolution, The State Bank of Pakistan issued NOC (Non-Objection Certificate) to five applicants for establishing digital banks:

Easy Paisa DB, a joint venture of Telenor Pakistan and Alipay;

Hugo Bank, by Getz Bros, Atlas Consolidated, and M&P Pakistan;

KT Bank by Nigerian-based Kuda Technologies;

Mashreq Bank, a subsidiary of the UAE’s Mashreq Bank; and

Raqami, by Kuwait Investment Authority.

Making headways in regulating BNPL, Zilch started reporting its 3 million customers' borrowing data to UK credit bureaus, potentially impacting their credit scores.

The Embedded Finance sphere erupted with collaboration, as companies joined forces to tap into the powerful synergies that come with strategic partnerships.

Fly Now Pay Later, a London-based provider of BNPL services, teamed up with Eastern Airways to enable customers to divide the cost of their trip into instalments, making travel within Britain more convenient.

Insurtech ConsumerOptix partnered with Afficiency and Western & Southern Financial Group to integrate the ‘IncomeSense’ insurance product developed by Afficiency and Western & Southern into distribution platforms ConsumerOptix develops for clients.

Paradigm Finance teamed up with Momnt to launch a financing platform called Paradigm Finance for home improvement contractors that offer point-of-sale financing right inside the company’s Paradigm Vendo platform.

The FinTech Infrastructure space saw a harmonious blend of collaboration and regulatory oversight:

Sage partnered with Equifax to automate financial and employment checks for UK workers applying for loans, mortgages, and new jobs.

BMO teamed up with Blend to use its digital mortgage technology, allowing customers to refinance their mortgages online quickly.

On the regulatory front, Nova Credit received a green flag from the Financial Conduct Authority as a cross-border credit reference provider, which will ease the process for UK immigrants when applying for credit products and services.

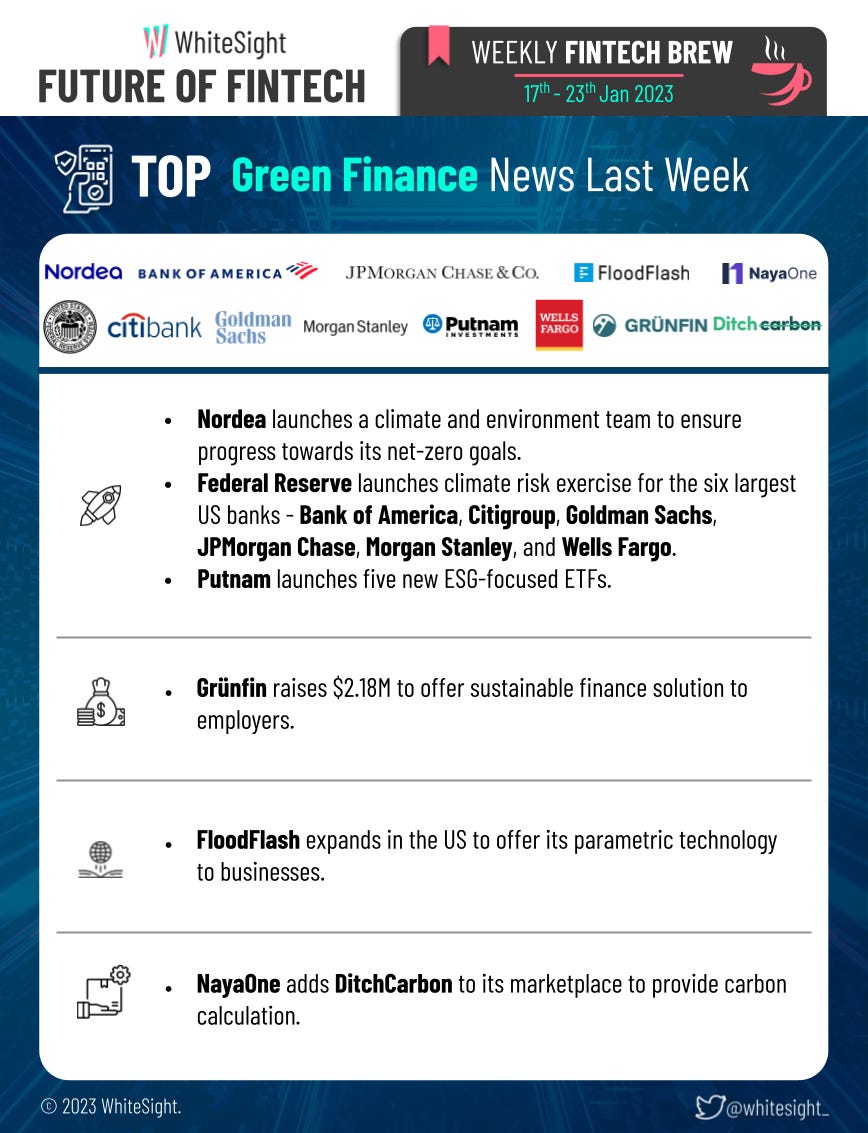

The Green Finance arena took a pivotal turn last week, as companies embraced new initiatives and took bold steps towards reaching their net-zero goals.

Sustainable investment startup Grünfin grabbed $2.18M from existing investors to expand its product suite with a new investment plan.

NayaOne added DitchCarbon on NayaOne Marketplace to provide carbon calculations via AIP for companies.

On the green regulatory front, The Federal Reserve rolled out climate risk exercises for Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, and Wells Fargo. The exercises assess the banks’ climate-related risk management practices and their resilience to various climate outcomes.

The DeFi space was bustling with funding activity as it charts its course into the future.

Obligate, a platform offering blockchain-based regulated debt securities, raised $4M in a seed extension round to scale its debt platform.

DeFi portfolio builder Arch grabbed $2.75M to expand its team and make financial partnerships.

Mapping the road ahead, Sushi laid out its 2023 roadmap, focusing on user experience and profitability, with further plans to release its decentralised exchange aggregator in the first quarter.

Some other happenings in the FinTech universe 🪐

Here are a few more top-ups to keep your fintech cravings satisfied –

The Saudi Central Bank granted licences to two debt-based crowdfunding companies – Forus and Tameed – after successful testing in SAMA's Regulatory Sandbox.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include our annual FinTech roundups of 2022, with a lot more exciting content in the pipeline to come –

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️