Future of FinTech | Edition #3 – January 2022

The third week of this month enters with a whirlwind when it comes to the news around the Fintech space. Last week’s colossal buzz encompasses a range of players – from the nascent stages to the giants alike. For the second time in a row, the Digital Finance segment takes the crown for serving us the brew with the most happenings, followed by a tie between the eventful Embedded and Platform Finance spheres. The Open, Green, and DeFi verticals are not far behind in providing their active support for the refill of the Weekly FinTech Brew.

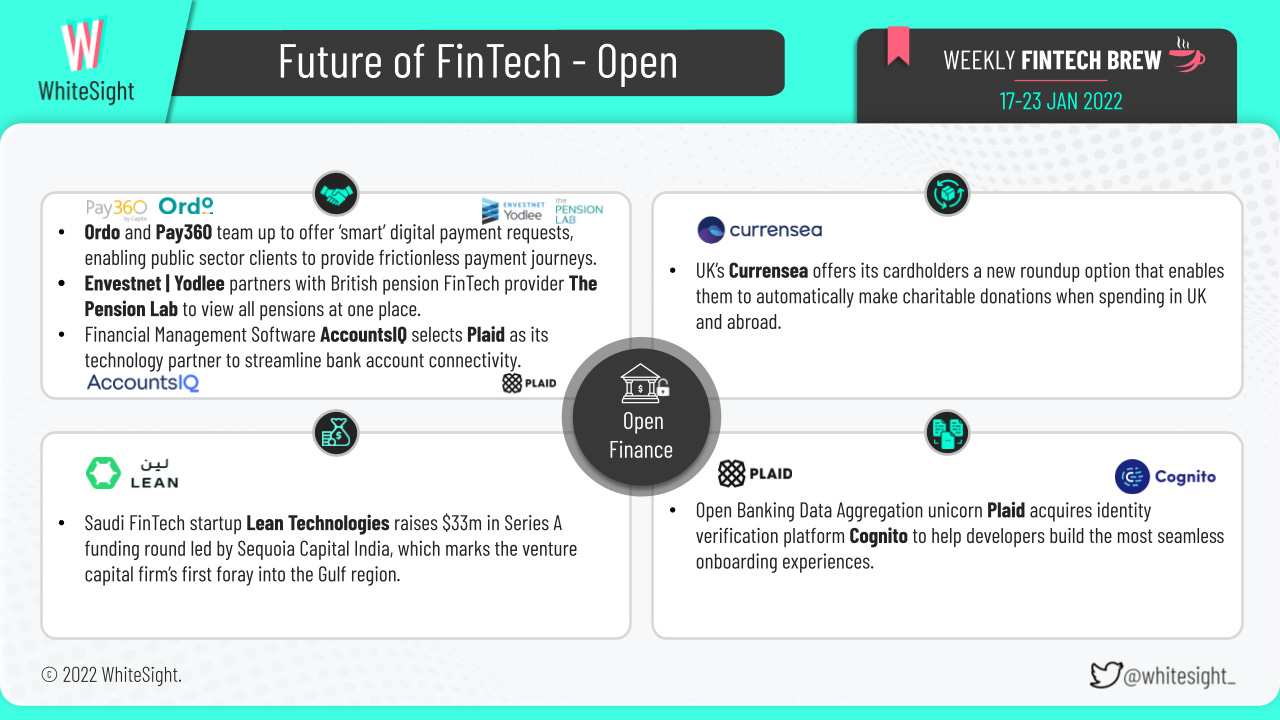

The Open Finance segment accounted for some significant partnerships that laid emphasis on enhancing customer experiences.

While data aggregation platform Envestnet | Yodlee partnered with British FinTech The Pension Lab to provide aggregated financial data from different pension pots in one place; AccountsIQ’s Open Banking integration of Plaid’s encrypted connections will facilitate access to banks in the UK, Ireland, and overseas for bank feeds.

The Open Banking unicorn, Plaid, also made headlines for buying verification services provider Cognito to layer more services atop its core remit of consumer bank account connections via developer hooks. Pay360’s partnership with Ordo’s Open Banking platform similarly aims to ensure a frictionless payments process through consumer choice.

Not only that, but many players also made moves pertaining to notable fundings and product launches. Saudi Arabia has finally come to the Open Banking party with Lean Technologies raising a $33m Series A led by Sequoia Capital India. This is on top of the last week’s announcement of Rabet Financial which obtained regulatory permissions for its Open Banking solution and Saudi Central Bank (SCB) seems to be on course on the anticipated Open Banking go-live date during the first half of 2022. UK-based card scheme Currensea was also in the news for offering a new roundup option to allow travelers to make donations while spending.

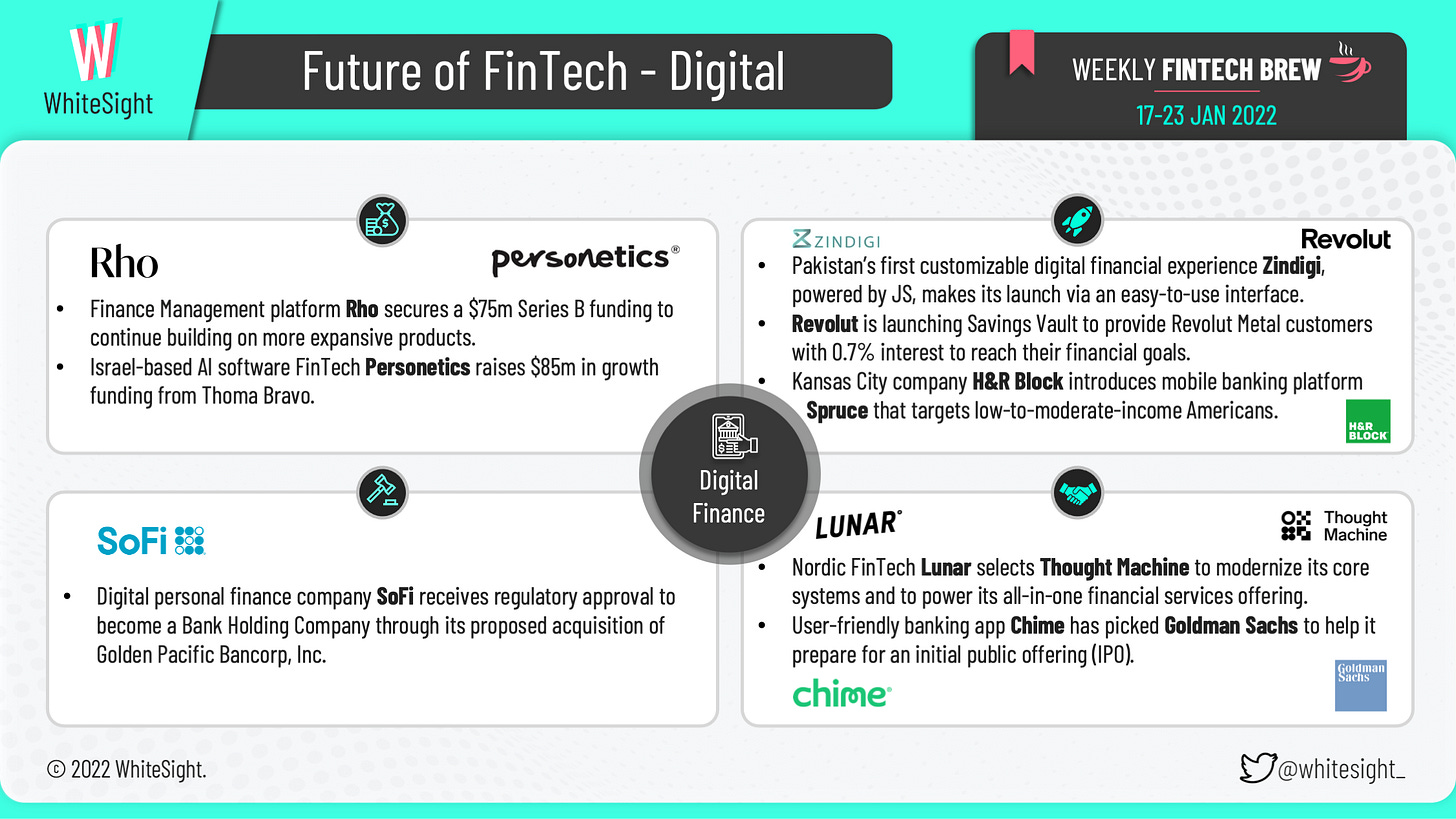

A number of launches stirred the third week for the Digital Finance vertical, with emerging markets entering the game with their own set of breakthroughs.

Pakistan witnessed the launch of its first customizable digital financial experience via Zindigi, while Israel-based AI software platform Personetics secured $85m to continue supporting banks in creating personalized marketing and product nudges for each individual customer.

The US was abuzz with quite a few prominent headlines – from SoFi’s regulatory approval to become a National bank; Chime calling in Goldman Sachs to help prepare it for a possible IPO; to Rho’s $75m Series B for a one-stop corporate spend and cash management solution, and Kansas City’s H&R Block’s introduction of challenger bank Spruce to diversify the company’s product set.

However, the American marketplaces weren’t the only ones sprucing things up. London-based Revolut introed its Savings Vault that offers a 0.7% interest rate as a step towards its goal of democratizing the financial services industry; while Nordic FinTech Lunar also stole headlines for selecting cloud-native technology firm Thought Machine to deploy its core banking engine, Vault, to develop new products and enter new markets.

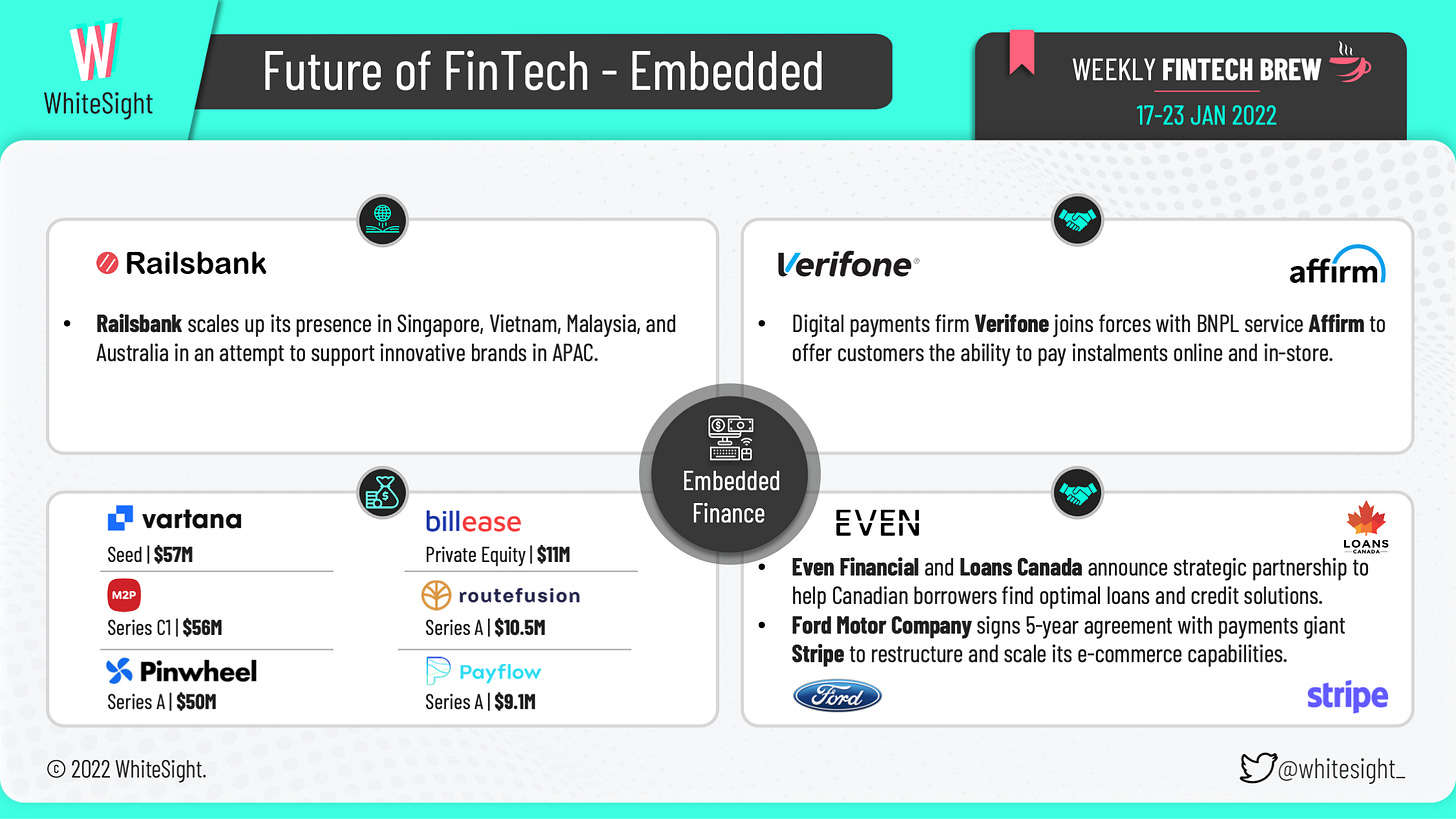

A series of joint ventures made for most of the activity surrounding the Embedded Finance space last week, with payments providers taking the center stage.

Multiple firms took to enhancing their e-commerce offerings and meet the ensuing customer demands – with Verifone making Affirm’s BNPL payment options available through its network; Ford signing a five-year agreement with Stripe to help facilitate transactions for vehicle orders and reservations, handle financing options for Ford’s commercial customers and route customer’s payments from the automaker’s website; and BNPL behemoth Klarna teaming up with NBA franchise Chicago Bulls promote the all-in-one shopping service and Pay in 4 option to the Bulls’ fans. Embedded finance marketplace Even also announced its strategic partnership with loan comparison site Loans Canada to connect Canadian consumers to the financial products they need.

An influx of money through funding rounds held across the globe is next in line for this bustling sphere.

Barcelona-based Payflow raised a $9.1m Series A in order to further its salary-advancement vision into the evolution of a neobank.

The Philippines' BNPL startup BillEase wasn’t far behind with its $11m Series B investment, the same of which will be used for customer acquisition, developing new products, and hiring.

Payroll connectivity platform Pinwheel nabbed another $50m in a round, only six months after its $20m Series A.

BNPL startup Vartana, who aims to be the “Affirm for B2B”, also made the news for securing $7m in equity and $50m in credit.

India’s embedded finance firm M2P’s $56m Series C1 raise would help expand its suite of API-based services internationally.

Speaking of expansions, Railsbank expanded its presence in Malaysia, Australia, Singapore, and Vietnam intended to support innovative brands in APAC that aim to leverage the power of embedded finance experiences.

An array of various affairs “DeFined” the pace for the DeFi sector.

While Coinbase’s partnership with Mastercard to simplify the purchase process of the revolutionary NFTs was the highlight of the week, certain others were also in the limelight for their doings. Popular cryptocurrency exchange Crypto.com was in the news for its expansion to more aggressively back the early-stage startups in an attempt to keep an eye out on everything in the ecosystem. NFT marketplace OpenSea bought crypto wallet startup Dharma Labs, so as to build across their core priorities surrounding the NFT and web3 ecosystems.

Amongst other pioneers were Australia’s Baxe, who released a decentralized blockchain ecosystem for DeFi that uses facial authentication for biometric identity verification; Bahrain’s Rain Financial, which aims to pursue licensing in additional countries and for bringing the Middle East deeper into the new crypto economy through its recent $110m funding; Canadian crypto-focused app Shakepay, whose $35m raise to support its belief of widespread adoption of bitcoin; and lastly, technology company DeFi Technologies, who joined the Crypto Climate Accord as a supporter to build on the industry’s commitment to clean energy.

Players from the Asian markets dominated the Platform Finance news for the third week of this month.

Indian startup INDmoney’s goal of becoming a one-stop super finance app was given a boost through the recent Tiger Global-led $75m Series D funding. Additionally, India’s Tata Digital also floated Tata Payments Ltd., a new wholly-owned subsidiary in its attempt to enter the digital payments business.

Indonesia’s financial sector has also been on the receiving end of attention as of late, with Singapore’s Grab and Singapore Telecommunications having invested in an Indonesian Bank Fama to serve the unbanked and underbanked communities of the archipelago. Even the domestic front is experiencing progress, as Jakarta-based unicorn Traveloka expanded into ride-hailing the past week as part of its plan to join the heated super-app race. Furthermore, Hong Kong’s No.1 virtual ZA Bank is set to officially launch its investment fund service in response to receiving a Type 1 SFC license.

Revolut’s roll-out of a stock trading feature on its US app also proved to turn heads, enabling Revolut users to be able to trade 1,100 securities, such as shares on the New York Stock Exchange and Nasdaq. The company will also offer access to 200 ETFs.

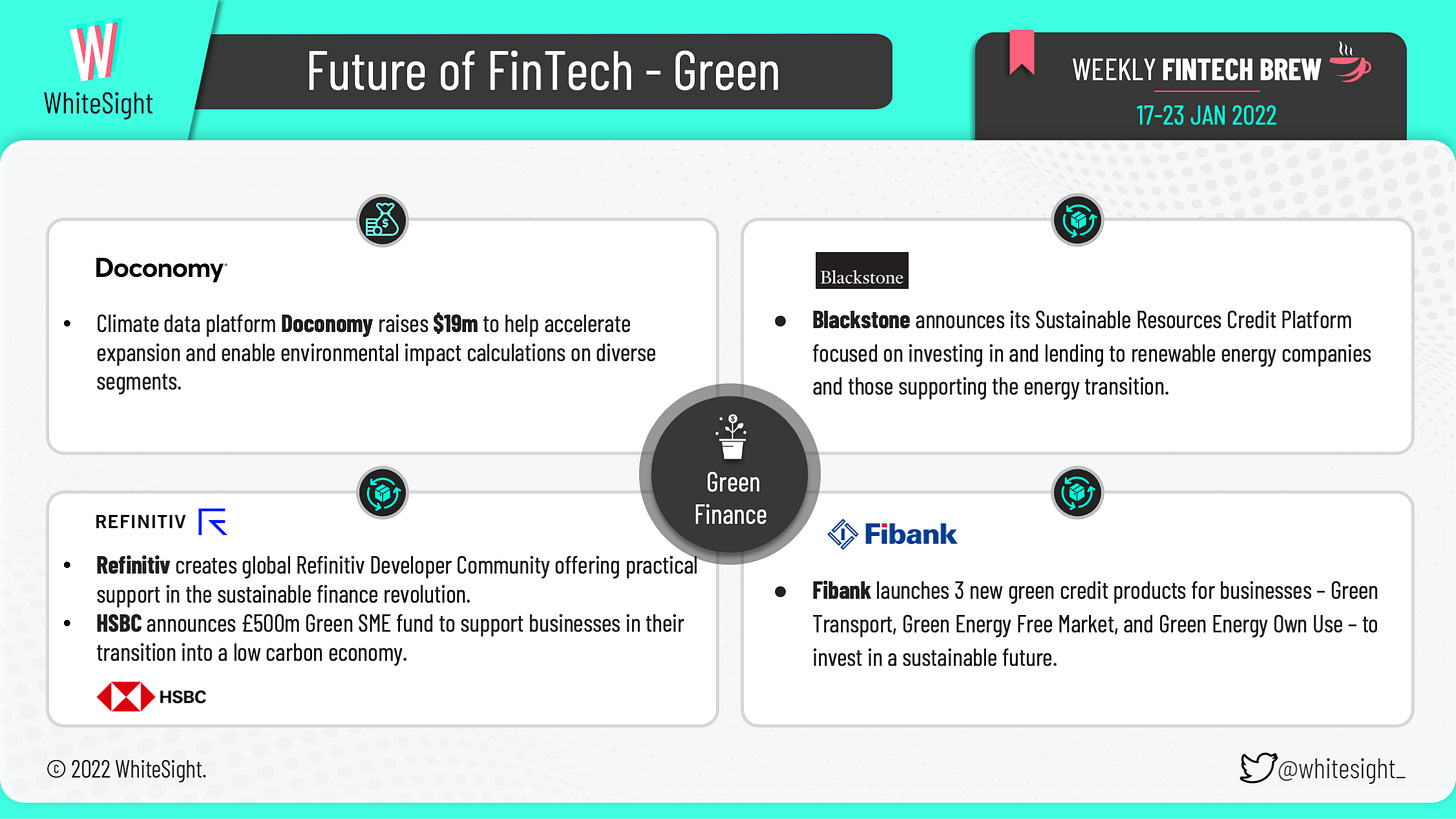

The Green Finance domain was subjugated to the whiz of some interesting product launches the past week.

Blackstone's credit initiative of a Sustainable Resources Platform intends to deliver value by providing new solutions and sources of capital to companies driving the broader energy transition. HSBC also made its £500m Green SME Fund offering available for businesses that face cost as a key barrier in attaining their carbon-neutrality goals.

On similar lines is the $50bn Climate and Resilience Lending Plan by the International Monetary Fund (IMF), which will enable about three-quarters of IMF nations to be eligible for money in addressing their sustainability commitments. Refinitiv takes the opportunity to offer practical support towards sustainable finance a step further through the creation of its new Developer Community that will offer the right tools and insights on adopting greener strategies. And already putting green products to use is Fibank through the introduction of three new green credit products that are tailored for SMEs, micro-enterprises, and corporate clients.

Amidst all this whir, a few other noteworthy events equally captured our attention. Abu Dhabi Global Market’s achievement of a “carbon-neutrality” status helped it make its mark as the first IFC in the world to do so. Climate data platform Doconomy also successfully added $19m in its overall funds to further the development of its Impact Applied Portfolio. Other sectors are also paving their way to get their thumbs green, as Open Banking platform Tink formed a partnership with sustainability FinTech Cogo to provide banking customers with personalized carbon footprint tracking services.

That's a wrap for this week, folks! Let us know how you liked this Weekly FinTech Brew and what we can do to make it better. See you next week 👋