Future of FinTech | Edition #2 – January 2022

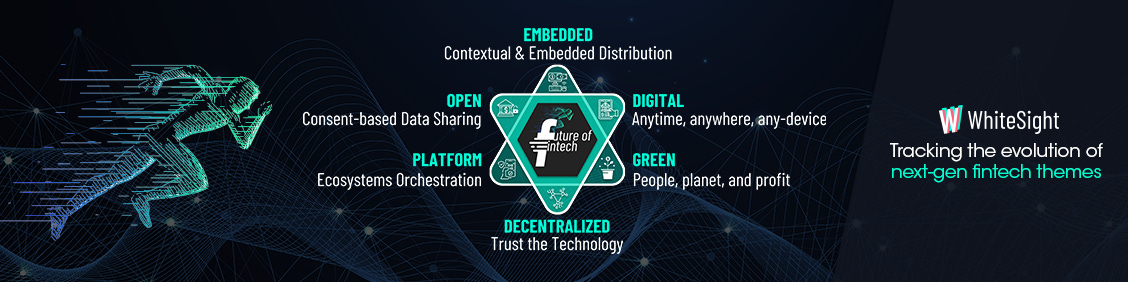

As another week makes its swift retreat, we bring you a fresh round of some hot FinTech brew to keep you in the loop of last week’s stirring headlines. The Digital Banking segment stole the scene with eventful happenings that garnered our attention, with the whirl from Embedded Finance being hot on the heels. A rather close call in terms of the buzz from the DeFi, Open Finance, Green Finance, and Platform Finance verticals made for an intriguing refill in the Weekly FinTech Brew.

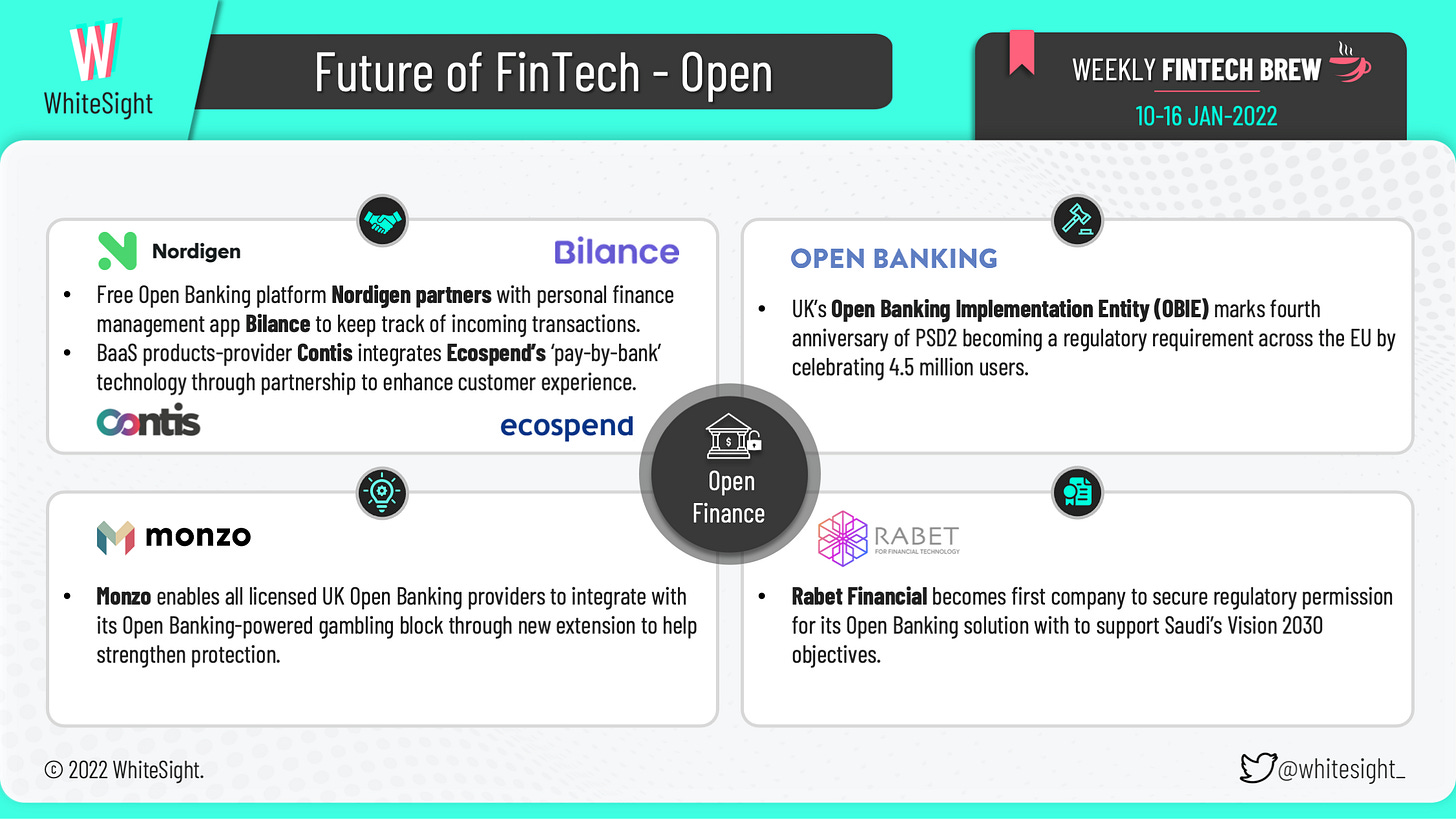

The second week of the month accounted for an assortment of activities in the Open Finance sector –

While one-stop Open Banking solution Nordigen partnered with personal finance management app Bilance to monitor incoming transactions, European Banking-as-a-Service (BaaS) provider Contis added Ecospend’s ‘pay-to-bank’ technology to offer customers the ability to make instant payments, whilst helping them gain better financial insight through AIS enabled solutions.

UK-based challenger Monzo also extended its Open Banking-powered gambling block to prevent gambling transactions made by any Open Banking provider in the UK. Rabet Financial stole headlines for emerging as the first Open Banking solution to secure regulatory permission in Saudi Arabia, with Saudi National Bank and Bank AlJazira becoming the first institutions to connect to Rabet. UK’s Open Banking Implementation Entity (OBIE) closed the week by celebrating 4.5 million users to mark the fourth anniversary of PSD2 becoming a regulatory requirement across the EU.

The Digital Finance space witnessed money pouring in from every nook and cranny last week, with a plethora of funding rounds responsible for the majority of the titles. SMB neobanks came out on the top with incredible valuations to boast –

Novo closed a $90M Series B round that values the startup at $700M;

Tech-friendly business Brex raised $300M in Series D-2 funding at a $12.3B valuation;

French FinTech Qonto neared $5B valuation after a fresh $552M fundraising;

Kaleidofin secured $10M in Series B funding round that took its total funding raised till date to $18M;

Indonesia’s KoinWorks raised $108M in fresh Series C round with a total of $180.1M in funding; and

Payments company Checkout.com closed a $1B Series D round that places it at a $40B valuation.

German-based N26’s plans to launch crypto trading, and US FinTech Current’s new high-yield offering “Interest” with 4% APY also made headlines. Amongst other affairs were the acquisition of consumer lender Oplo by digital challenger bank Tandem, and One Zero’s establishment as a fully-licensed new bank in Israel.

A series of new product launches, fundings, and partnerships make up for the scoop around the embedded finance vertical for the week with –

Global Processing Services announcing $100M in funding which comes as an extension to its previous $300M investment back in October;

Embedded finance platform in fashion RESPONSIBLE’s largest $6.6M reCommerce seed capital raise; and

British FinTech Fly Now Pay Later’s $75M debt funding package to support expansion into the United States.

On the products front, Visa’s new platform—Visa Acceptance Cloud (VAC)—to help innovators transform almost any device into a cloud-connected payment terminal; Railsbank’s new Buy Now Pay Later (BNPL) launch to give retailers a greater share through the offering of branded and fully-integrated payment experiences; and PayU’s introduction of BNPL instrument LazyCard to empower and elevate the underserved made for some significant news.

Other players took the partnership route in a bid to support their growth, with Zilch expanding its partnership with Mastercard to bring Zilch’s BNPL product to Europe, and DriveWealth partnering with stock rewards company Bits of Stock to enable first-time investors to learn, grow, and develop the skills necessary to take control of their financial futures.

Last week observed the introduction of a diverse set of new products from several DeFi players. While Jack Dorsey’s Block set out to build an open bitcoin mining system to expand into new technologies like blockchain, payments firm PayPal also actively researched the launch of a stablecoin backed by the US dollar.

TransUnion partnered with FinTech startup Spring Labs to provide crypto lenders a better ability to assess the risk profiles of borrowers who don’t want regular legal tender. Multi-asset brokerage company eToro also unveiled its fully allocated thematic MetaverseLife Smart Portfolio, a product that will enable customers to gain exposure to the metaverse and spread the risk across a variety of assets.

Amongst the noteworthy partnerships that took place within the sector, Visa’s move to join the CBDC train via a partnership with blockchain venture production studio Consensys; and Computer Services Inc. (CSI) integration of NYDIG’s secure environment to offer Bitcoin-related services to community banks takes the cake. In other news, digital payments company Mogo announced its expansion into the Metaverse through strategic investment in NFT Trader to navigate the Canadian regulatory landscape.

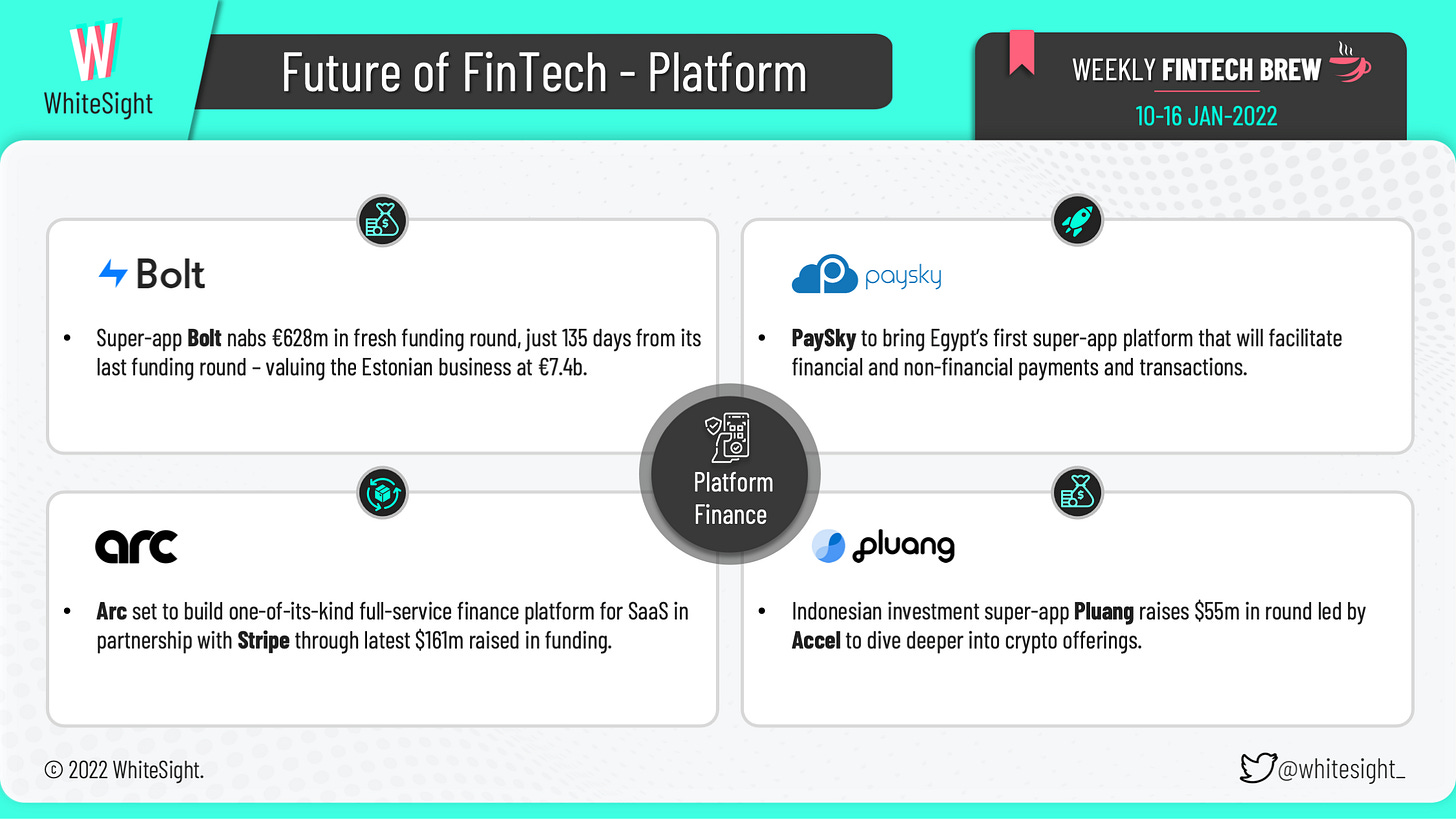

A variety of fundings took the crown in turning heads towards the Platform Finance segment. Indonesian financial super-app Pluang announced a $55M round led by Accel, the funds for which will be used to build out both its traditional stock as well as crypto offerings. Full-service SaaS platform Arc also raised $161M to launch its introductory fintech solution product via a partnership with Stripe.

Super-app Bolt’s latest round values the firm at €7.4B, just 135 days after its last funding round which valued it at €4B at that time. Not only that, but the MENA region also witnessed the launch of its first super-app via PaySky’s “Yalla Super App” – an app that will behave as a single point of service for individuals, merchants, financial institutions, and businesses around the globe to process, accept, and facilitate financial and non-financial payments and transactions.

The Green Finance industry saw a diverse mix of events – from funding to industry highlights, and acquisitions. With Web 3.0 becoming a concept that firms want to incorporate, UK circular economy scaleup Twig raised $35M in Series A round of funding to accelerate its web3 green payment ambitions. Singapore’s ESG-driven SME neobank Crowdo also secured $5.9M in a pre-Series B round to scale its ESG financing portfolio. As for acquisitions, sustainability-as-a-service provider Aspiration acquired Carbon Insights, a climate-tech startup that translates spending behavior and transactions into carbon footprints.

The MENA Fintech Association also made headlines for its launch of the Sustainable Fintech Alliance, with the mission enabling purposeful collaborations between the Fintech community and policymakers within the financial sector and beyond. Kuwait Investment Authority (KIA) similarly jumped the net-zero carbon emissions goal, by transitioning towards a 100% ESG compliance for their entire portfolio.

That's a wrap for this week, folks! Let us know how you liked this Weekly FinTech Brew and what we can do to make it better. See you next week 👋