Future of Fintech | Edition #7 – February 2022

Another week, another edition of the Future of FinTech Newsletter to keep your curious cups filled with the brimming headlines of the week! If you're new and curious, read on to find out what happened in FinTech across six dynamic themes and join 502 other fintech nerds in receiving some fresh Weekly FinTech Brew delivered right to your inbox every Tuesday ☕️

With edition #7, a lot of buzz surrounding partnerships and product launches remained at the forefront.

Here's the TL;DR

Embedded Finance took the crown for being the most active theme last week.

Some interesting partnerships that stole the headlines with their collaborative efforts:

Marqeta + Plaid to simplify ACH transfers,

U.S. Bank + Payactiv to bring Earned Wage Access solution to clients

Breach Insurance + Boost Insurance for the first crypto insurance product

Cogo and Moneythor to lower climate impact of users’ spending, and

Western Union + Travel Wallet for South Korea expansion.

Several novel launches that introduced new products and services to the FinTech world, including Tinkoff’s first fully digital mortgage offering, CoinJar’s crypto-to-GBP CoinJar Mastercard, and Yapily’s first digital catalog of 12,000 products and services listed on the AWS marketplace.

Some eyebrow-raising big moves – NatWest to further restrict lending to clients in the oil and gas sector from the 21% it did in 2021, BNPL firms were ordered to refund charges to users following FCA crackdown, while Mastercard expanded its consulting services with new practices dedicated to Open Banking, Crypto and ESG.

Funding rounds that caused a stir the past week – Neon ($300M), Genesis ($200M), ViaBill ($120M Equity & Debt), Thought Machine ($54M)

Interested to get more details? Let's dive in –

The Open Finance segment was bustling with a happening mix of partnerships and innovative product debuts.

While on one hand, ConnectPay selected Open Banking solutions provider Salt Edge to improve the payments experience in Germany and the Netherlands, Marqeta and Plaid joined hands to enable the easy initiation of ACH transactions to send money between customer accounts and external accounts. Yoti and Ecospend likewise partnered to combine digital identities with Open Banking to help minimize the risk of fraud and have more secure next-generation payments.

As for product launches,

Open Banking infrastructure provider Yapily launched its first listing of 12,000 payment products and services on the AWS marketplace;

Global payments platform Trustly introduced new product FlexPay by Trustly that gives consumers the flexibility to defer the settlement date of a debited amount to a future date;

Portfolio+ Inc. launched its robust cloud platform that serves as a catalyst to transform traditional banks into cloud-first enterprises; and

Commerce Bank went live with Temenos core banking platform to further its modernization project of moving to a modern, agile and open platform.

At the same time, the statutory review on the operation of the Consumer Data Right (CDR) in Australia was announced to explore the extent to which implementation of the CDR statutory framework supports the core policy objectives of driving value, competition, and innovation. On that tangent, the Open Banking ecosystem celebrated the passing of 5 million active users milestone in the UK, with payments being the driving force behind this rapid growth.

In addition, Turkish investment platform fonbulucu’s $1.13M raise in growth capital to expand its services into Germany, and FinTech startup Banked’s $20M Series A raise for US expansion also made it to the list of news for the week’s bulletin.

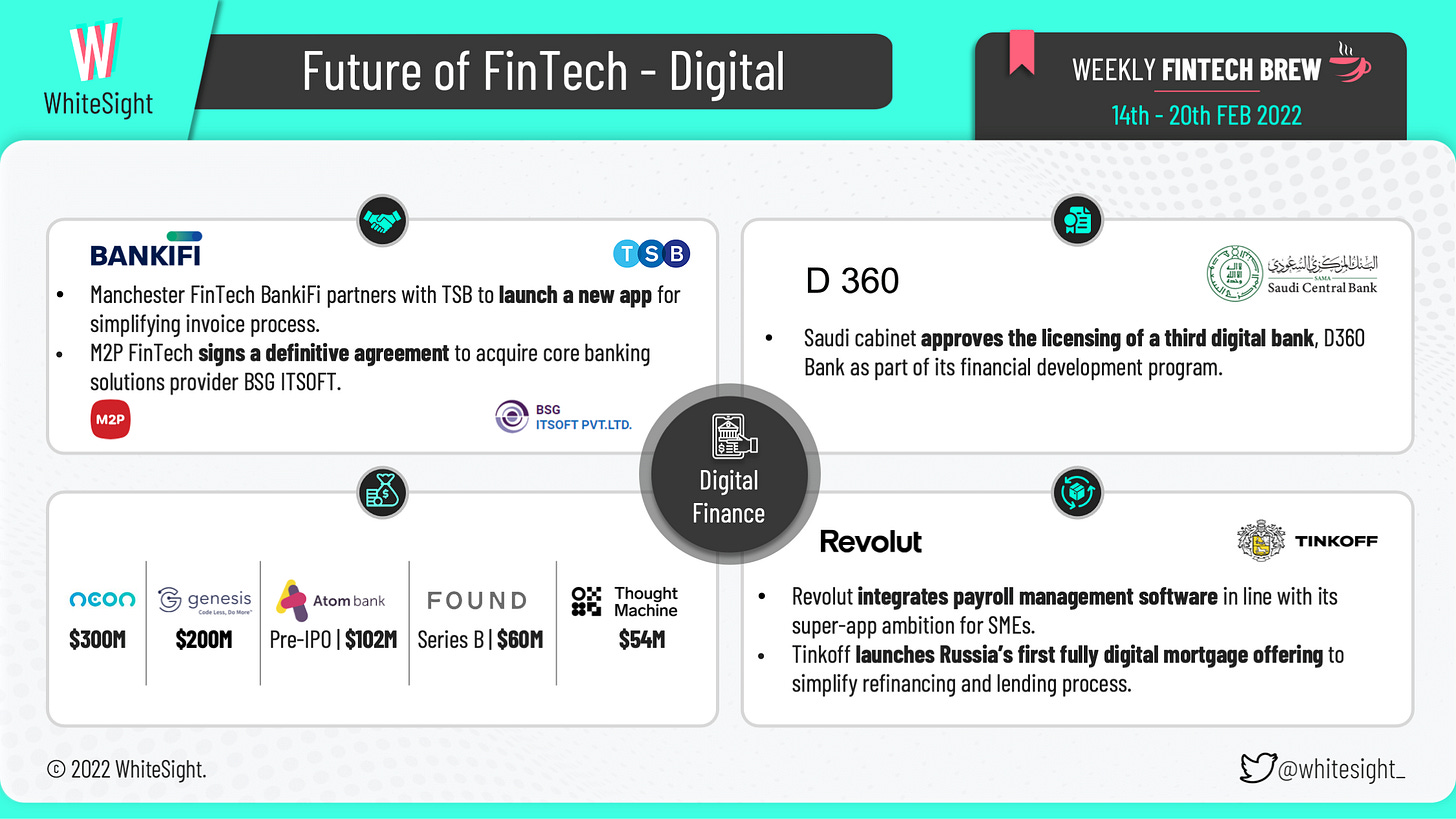

Funding rounds were the key highlight for the Digital Finance vertical the past week with –

Atom Bank raising more than $102M in new equity as it heads towards IPO;

UK challenger bank Novus closing its crowdfunding round after reaching $5M under nine months;

Genesis landing a $200M investment led by Tiger Global Management;

Intesa Sanpaolo investing $54M in cloud-based vendor Thought Machine;

BBVA reaching an agreement to invest $300M in Brazilian digital bank Neon; and startup

US-based SMB neobank Found raising $60M in Series B funding led by Founders Fund.

Several innovative products also made their mark in the digital space. In a bid to further its ambition of providing a one-stop shop for business banking services, Revolut integrated payroll management software that affords business owners the flexibility to make real-time salary adjustments. Challenger bank Tinkoff stole headlines for the launch of a fully digital mortgage offering, which it claims to be Russia’s first. The move will make refinancing and the lending process extremely simple and 100% digital.

Brex, the company reimagining finance for growing businesses, also announced a set of new mobile cash flow management features that are designed to meet the financial and productivity needs of startup founders. Similarly, Manchester FinTech BankiFi partnered with TSB to launch Revenu app to enable small businesses to receive quicker payments.

India-based M2P FinTech hit the headlines for signing a definitive agreement to acquire core banking solutions provider BSG ITSOFT to further bolster its approach to providing a new generation cloud-native platform. To accelerate the Saudi Vision 2030 program, the Saudi cabinet approved the licensing of a third digital bank called D360 with a capital of $440M.

Many firms joined forces in a bid to enhance their product capabilities and expand upon their embedded ambitions such as

Delta Airlines giving travelers a BNPL option with the help of American Express’ Plan It tool;

U.S. Bank announcing a new Earned Wage Access solution in partnership with Payactiv; and

Zimpler and Rabble teaming on instant payouts from cashback for customers in Sweden.

Digital commercial bank Piermont entered a strategic partnership with BaaS startup Unit to make launching banking products easy while empowering seamless and accessible embedded finance. Synctera, a new solution for partnership banking at scale, announced the new partners of its recent Bank Match program – Lineage Bank and GoGetr – with a focus on delivering better financial products and substantially making an impact. Furthermore, buyout firm Apollo Global neared an agreement to acquire Worldline’s point-of-sale terminal business for close to $2.3B so as to promote the continued growth of digital payments.

Many players from emerging markets raised funds for their respective contributions to the embedded landscape –

South African API FinTech Stitch raised $21M in Series A funding as part of its plan to create a “financial graph” ecosystem across the continent;

Indonesian BNPL provider Akulaku received $100M from Siam Commercial Bank to continue its vision of meeting the daily financial needs of underserved customers; and

Danish BNPL firm ViaBill secured $120M in debt and equity round to accelerate expansion of their new BNPL solution that can be used anywhere, online or in-store.

But not all is sunshine and rainbows for the BNPL sector, as the Financial Conduct Authority (FCA) is pushing BNPL firms in the UK to amend their contract terms that may hold potential risks of harming customers.

With firms far and wide remodeling their portfolios to incorporate more crypto-based offerings, a plethora of launches were in the limelight for the space last week. While CoinJar partnered with EML Payments to debut a fully-featured debit Mastercard that allows customers to make purchases by instantly converting cryptocurrencies into fiat currency, European neobank Lunar announced the launch of its hassle-free Nordic crypto platform as part of their new blockchain arm – Lunar Block – to explore how both crypto and blockchain can benefit their customers.

On the other hand, DeFi Technologies received the approval to begin trading Valour Polkadot (DOT) and Valour Cardano (ADA) on the Frankfurt Stock Exchange. NYC-based FinTech Yotta made the news by introducing a new product called “Crypto Buckets” that allows any Yotta user to earn an average 4.0% Annual Percentage Yield (APY) and a chance to win $10M every week.

Centre – a consortium founded by Circle Internet Financial, LLC, and Coinbase – unveiled decentralized ID solution Verite that is designed to give people and organizations direct control over the sharing of their personal information. Remote hiring startup Deel’s new product feature that enables employers to instantly pay their teams in USDC, and Yieldstreet’s partnership with Pantera Capital to announce its first-ever Pantera Early Stage Token Fund I crypto fund were also events that captured the headlines.

Additionally, BVNK integrated Copper’s ClearLoop technology to offer clients the ability to allocate cryptocurrencies to earn yield and deploy digital assets to lending counterparties to earn returns. Fireblocks acquired fellow Israeli company First Digital to expand its existing payments capabilities by allowing payment service providers (PSPs) and acquirers to accept payments and make payouts in digital currencies. BlockFi also appeared on the cover for its $100M settlement with the Securities and Exchange Commission based on the accusation of failing to register its lending product as a security, among other things.

Crypto curious and want to read more about what's happening in the space? 🧐 Well, then you definitely need to check our weekly Future of Crypto newsletter!

The Platform Finance space witnessed an assortment of happening events across various activities. While Egypt’s Contact invested $9M in e-commerce super app Wasla to support its product rollout and regional expansion, Indian FinTech RapiPay attracted $15M to launch a new-age digital banking super app under the name NYE. Singapore-based super app platform Appboxo also raised $7M in Series A funding for further product development and international expansion.

On the partnerships and acquisitions front, Western Union announced its expansion in South Korea through a collaboration with Korean FinTech company Travel Wallet to enable convenient and reliable financial flows. West African super app Gozem made the news for expanding its taxi-booking operations in Douala, Cameroon. FIS enhanced its embedded payments strategy with the acquisition of innovative FinTech firm Payrix to unlock the value of its broad solution portfolio by delivering embedded finance capabilities. AirAsia also made the bulletin for its Memorandum of Understanding (MoU) with the Singapore Tourism Board to promote travel to Singapore, which will equally help in strengthening its super app.

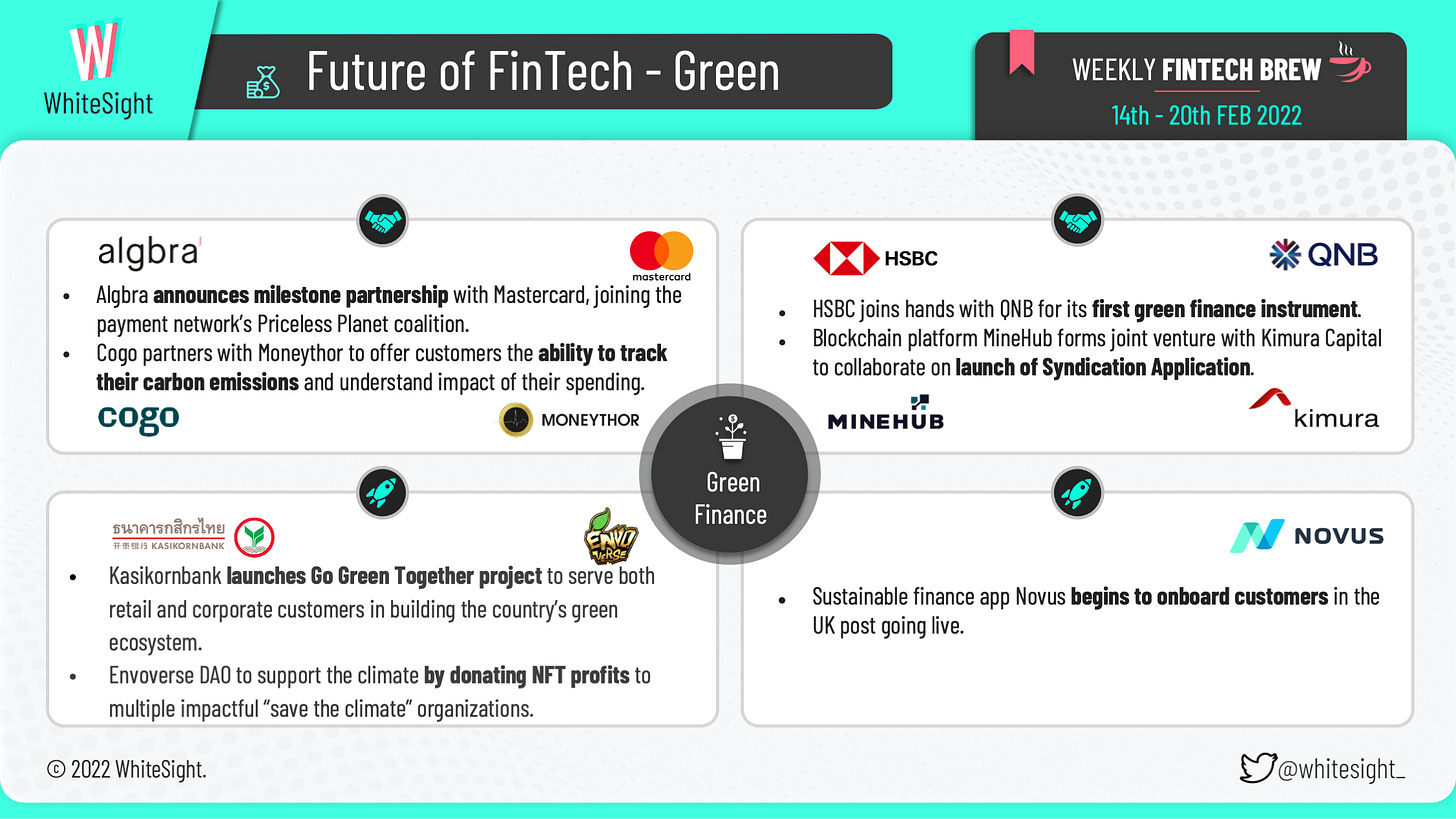

As companies gear up to integrate a more climate-oriented framework, many of them took to collaborating or introducing new solutions to better reach their respective sustainability ambitions.

Carbon footprint tracker Cogo joined hands with digital banking innovator Moneythor to offer customers the ability to understand their carbon footprint off the back of spending habits directly via their banking apps. MineHub partnered with asset management firm Kimura to launch a standalone platform, Syndication Application, that will enable investors to syndicate their capitals to provide sustainable trade finance to commodity supply chains.

Partnering with QNB on the first green instrument of its kind, HSBC made the headlines for its strategy to help increase the short-term sustainable funding options for banks and major companies and boost demand for green assets in the Middle East, North Africa, and Turkey regions. Algbra also announced its strategic Mastercard partnership, through which the former will become an active member of Mastercard’s global Priceless Planet Coalition – a move that emphasizes meaningful investments in preserving the environment.

Sectors far and wide are pitching in their own green movements to make their mark in going green. Envoverse, a DAO NFT initiative, unveiled its plan to support the climate by donating the NFT profits to multiple impactful “save the climate” organizations. Sustainable finance app Novus—which offers real-time ‘impact’ points to various environmental and social causes every time a user taps their card—also went live as it onboarded customers in the UK. Even Kasikornbank joined the green wave by launching the Go Green Together project to expand Green Zero loans for both retail and corporate customers.

In other news, British bank NatWest aims to further limit lending to clients in the gas and oil sector from the 21% it did back in 2021 as part of its efforts to decarbonize its loan book and reach net-zero emissions. Singapore will issue its first green sovereign bond to tap markets for as much as $26B of environment-focused financing by 2030.

And That’s A Wrap!

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with another round of the weekly FinTech refill next week!

Till then, if you're hungry for more FinTech insights, check out some of our other work at WhiteSight. Our latest publications include an overview on the Most Impactful WealthTech M&As and Apple taking a bite into the world of FinTech.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for our strategic intelligence and research content services, reach out to us at hello@whitesight.net

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter and don't be shy to show some ❤️