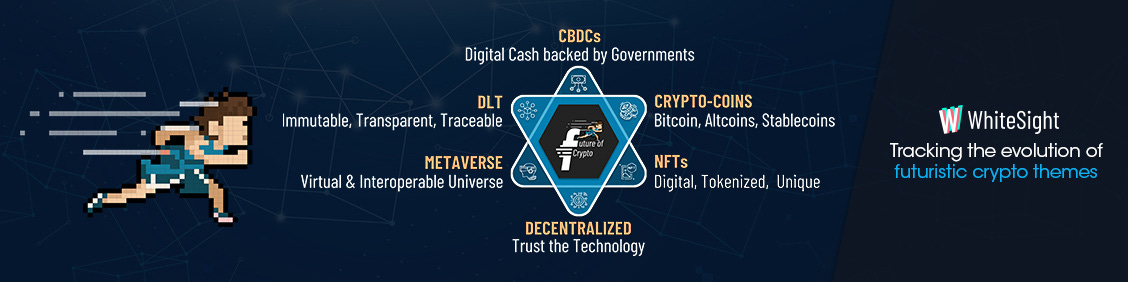

Welcome back to another edition of the Future of Crypto Newsletter! If you're new and curious, read on to find out what happened in the crypto space across six dynamic themes and join other crypto nerds in receiving some fresh Weekly Crypto Cuppa delivered right to your inbox every Saturday!☕️

Edition #2 comes with a lot of head-turning funding rounds and partnerships that remained at the forefront for the week, having NFTs and CBDCs tied as the most active segments.

Here's the TL;DR:

Many novel launches took place within the last week – Moss.Earth’s NFT to protect the Amazon, MiHoYo's HoYoverse, and Concordium's native CCD token to name a few.

Partnerships drew the attention of the Cryptosphere with some notable ones like:

Ripple + Digital Euro Association for assistance in CBDC pilot.

Valliance bank + Baktt for crypto trading services.

Coinbase + MasterCard for NFT purchases.

Flare + Ola Finance for expansion of their DeFi offerings.

Sandbox + DanceFight to create a dance venue in the metaverse.

Moonstake + deBridge to create a cross-chain bridge for NFTs and assets.

Some company-specific big moves – Intel expands into crypto mining with an energy-efficient blockchain accelerator chip that is more efficient than other GPUs; while JPMorgan officially enters metaverse by opening a lounge in Decentraland.

Some fascinating funding rounds of the week included – PDAX ($50M Series B), Morpher ($6M Series A), and Ref Finance $4.8M.

For the longer read, let's get going –

The emerging CBDC segment was bustling with quite a few activities for the week.

The European Central Bank has upped its research and investigation phase as the European Commission is gearing up to present a CBDC legislation by 2023. Many other new and emerging markets have also joined this investigation race – with Iran, Jamaica, and Kenya actively looking at the prospects of CBDC in their respective economies. Additionally, Bank of Russia commenced their CBDC trials as they rolled out a digital ruble prototype in which twelve banks applied to join the pilot group for the project; and three of them have already connected their systems to the platform. The Zambian central bank is also accelerating the research for these centralized digital tokens and expects to complete a study that explores the benefits of launching the same by the end of 2022. Taiwan joins the game by expecting to complete its retail CBDC simulations by September.

The digital yuan (e-CNY) launched by China in the Winter Olympics made the news for overtaking Visa in the number of transactions taking place during the game, pertaining to the “no international processing fees” for using e-CNY in China.

On the partnerships front, the Digital Euro Association (DEA) partnered with cross-border payment operator Ripple, as the former plans to use the latter’s technical expertise in developing a CBDC pilot.

The Crypto-coins vertical has been touching new heights as of late – with a plethora of product expansions making their mark, and companies equally embracing its potential.

While Mastercard is diving deeper into the crypto world by planning to add payments-focused consulting services for crypto and digital assets that will cover everything from cryptocurrency, NFT strategy and crypto cards to eventually developing CBDCs, Uber has hinted that it may start accepting cryptocurrencies as a mode of payment in the future. Singapore-based DBS bank plans to expand its existing Bitcoin trading services to its retail customers. Blockchain network Tezos integrated Baanx’s Cryptolife app, which will allow former users access to Baanx's stablecoin loan service called Cryptodraft, unlocking up to 50% loan-to-value backed by baanx (BXX) token. Coinbase's 60-sec award-winning QR code Super Bowl ad—that offers $15 in free bitcoin to new users upon scanning, and $3M sweepstakes to existing users upon signing up—made the headlines for bringing 20 million people to its site within a minute.

In other news, Bitcoin payment provider Opennode closes a $20M Series A funding round led by UK firm Kingsway to expand its Bitcoin and Lightning Network payments infrastructure globally. PDAX, an important Philippines-based crypto exchange, raised $50M in a Series B funding round led by Tiger Global to build a safe and accessible infrastructure for the digital asset economy.

Cryptocurrency prices for the week plummeted as Bitcoin's price fell below $41000. It rose by 8.9% in the second week of February after 2 weeks of dipping. While the second-largest cryptocurrency in the market, Ether, tanked over 7% falling below $3100 to $2,917, Dogecoin plunged further 5% to $0.14.

An assorted mix of launches and partnerships surrounded the NFT space this week, with notable names debuting the buzzing field.

As part of a noble movement, Brazilian environmental FinTech company Moss.Earth launched Moss Amazon NFT enabling contributors to preserve a small part of the Amazon rainforest. Similarly, a Samsung-backed South Korean university, Sungkyunkwan University, became the first institution to issue NFT certificates to the students. Veteran Indian news outlet Hindustan Times made the bulletin by launching their own NFTs that include digitized versions of crucial events from India's history under the banner "HT Timeless Tokens''. Fashion brand Ambush also made it to the news by launching their signature "Pow!" rings as NFT. MetaNFT, a newly launched multi-crosschain market, allows artists to deposit NFTs only once through its ‘multicrosschain’ routing system and have access to all the fans irrespective of their method of payment. Other platforms that introduced new products to the market include decentralized cloud protocol Cere Network’s launch of NFT-based content creation product DaVinci. Creator commerce platform Spring’s partnership with Bondly to launch NFT creation product "Mint-on-Demand" was also a key highlight in this space.

On the partnerships vertical, VC firm RR² joined hands with DeFi platform Aleph Zero through a strategic investment to disrupt its technology investment portfolio, supported by a thesis on digital assets, blockchain technology, A.I., and Machine Learning. Leading crypto exchange platform Coinbase also made the news for its partnership with Mastercard to override all hassles involved in purchasing an NFT and simplify the overall process by using credit and debit cards.

The ever-evolving world of NFTs is on its way to making it to the stock exchange, as The New York Stock Exchange has filed an application to register the term "NYSE" for a marketplace that will launch as an online trading place for cryptocurrencies and NFTs.

Interestingly, an anime art collection dubbed Azuki has silently made it to the top of NFT sales with a $300M sales volume, overtaking the infamous Bored Apes and CryptoPunks.

A number of product expansions and launches made circles within the DeFi space, as companies gear up for the decentralization ride.

The world's first CEX-DEX hybrid crypto derivatives exchange platform Apollox joined forces with Regtech platform for digital assets Banxa to provide crypto trading services via Visa and Mastercard. Along similar lines was DeFi ecosystem Flare Finance’s teaming up with blockchain lending protocol Ola Finance to launch a lending network that will help expand Flare’s growing suite of DeFi offerings.

The potential of DeFi has been well recognized by nations—such as the United Arab Emirates—that plans to issue a federal license for virtual asset service providers to attract crypto companies to the country, and create a favorable environment for crypto mining with a hybrid approach on the regulations front. On the other hand, DeFi platform Telcoin, that provides blockchain-powered financial services to consumers worldwide, rolled out digital asset trading within its application under the name “Trade”, with the aim to become the easiest and most affordable way for users to trade cryptocurrencies across DeFi protocols. DeFi app Chainge made it to the news by introducing cross-chain roaming interoperability around the DeFi sphere that will lower the barrier for liquidity pools. Simply put, LPs can now leverage liquidity in different assets on different chains to build flexible and diversified investing strategies.

On the fundings front, Vienna-based DeFi app Morpher raised $6M in a Series A round led by Draper Associates. Similarly, automated market maker and stableswap marketplace for the Near blockchain Ref finance closed a $4.8M round led by Jump Crypto. DeFi lending protocol Minterest also made it to the headlines for closing a $5.52M sale of MNT token, standing at a $514M valuation. Amidst all these, a new P2P NFT lending protocol Arcade, which specializes in matching blockchain art owners with interested lenders, created a buzz after facilitating over $9M in total loan transactions in the first 15 days of its launch.

Many players from across different industries and sectors that are expanding into the Metaverse have created quite a stir around the sphere.

Stealing headlines was JPMorgan’s debut in becoming one of the latest banks to venture into the Metaverse, not just by creating a lounge named Onyx in Decentraland for its clients, but also by releasing a paper exploring how businesses can find opportunities in this segment. Victoria’s Secret’s plans to mark its debut on the metaverse has also become official, as they filed a trademark application that suggests the organization is ready to offer its products in the metaverse. L’Oréal also seems to be gearing up to venture into the virtual goods economy, according to its recent trademark filings in the NFT and metaverse categories.

Chain games, a blockchain-integrated gaming network, partnered with Sandbox to allow users to play Chain games from the Sandbox metaverse. Another news revolving around The Sandbox includes the metaverse leader partnering with dance battle app DanceFight to launch street dance battles in the metaverse.

On the launch front, game developer MiHoYo launched metaverse brand "HoYoverse" to create virtual world experiences for players around the globe that integrates games, anime, and other diverse types of entertainment. Furthermore, a DeFi optimizer dubbed Crowdswap has been launched in the Polygon blockchain, which uses algorithms based on the coins and tokens of a wallet, and is capable of determining the best route and the best prices for choosing DeFi options.

It’s raining product launches and partnerships in the Blockchain segment as players do not want to miss out on the web3 ship.

In an effort to optimize the blockchain processes, Intel created a new sustainable blockchain chip dedicated to operations like Bitcoin mining, with the promise of a better performance than existing GPUs. Jack Dorsey-led Block will be among the first buyers of the chipset. Similarly, Digital Asset Management firm One River launched One Digital SMA – a separately managed account (SMA) powered by Coinbase Prime technology to map investment processes, operational workflows, security requirements, permissions, and application programming interface (API) integrations. Public, proof-of-stake blockchain called Concordium officially launched its native CCD tokens on Bitfinex and BitGlobal, where users will be able to trade them against BTC, ETH, and USDT.

Many of these decentralized platforms have been in the limelight for their respective partnership activities, with Zurich-based FinTech and blockchain startup FQX partnering with SIX Digital Exchange (SDX) to build blockchain-based short-term debt instruments, by bringing FQX’s eNotes (blockchain technology that ensures unconditional promise to pay a specific sum to another party at a specific future date) on to SDX. London’s SETL and New York’s Digital Asset recently entered into a partnership to develop a protocol that may be used by regulated institutions to introduce interoperable tokens – where each digital token should represent a “promise” from the issuer to the holder of the token. Web wallet Moonstake also made it to the headlines by partnering with cross-chain interoperability and liquidity transfer project deBridge. The former will become a validator for the deBridge network that facilitates the seamless bridging of any arbitrary asset and data, and NFTs across a wide range of blockchains including Ethereum, Binance Smart Chain, HECO, Arbitrum, and Polygon initially.

In other activities, 5ire, a fifth-generation blockchain network, secured a $100M capital commitment from Luxembourg-based private investment group GEM Global Yield ahead of its IPO. Blockchain-based investing protocol Syndicate, which landed investments from a16z and Coinbase Ventures among others, has claimed that 10% of all decentralized autonomous organizations (DAO) in existence have been created on their platform in less than three weeks of operation.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Crypto Cuppa, and we'll be back with more next week!

Till then, if you're hungry for more FinTech insights, check out some of our other work at WhiteSight. Our latest publications include an overview on the Most Impactful WealthTech M&As and Apple taking a bite into the world of FinTech.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for our strategic intelligence and research content services, reach out to us at hello@whitesight.net

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter and don't be shy to show some ❤️