Future of FinTech | Edition #24 – June 2022

As another Tuesday dawns upon us, we bring you the weekly serving of the Future of FinTech newsletter! If you're new and curious, read on to find out what happened in FinTech across six dynamic themes and join other FinTech nerds in receiving some fresh Weekly FinTech Brew served right to your inbox every Tuesday! ☕️

FinTech FunFact: China’s Ant Group holds the record for money raised by the FinTech industry as well as a record in investment history for the $14B it raised in investments in 2018. One small step for the group, a ‘giANT’ leap for FinTech.

We also provide the add-in of the week’s Top 10 FinTech News Stories to up your FinTech brew:

Back to business then 😎:

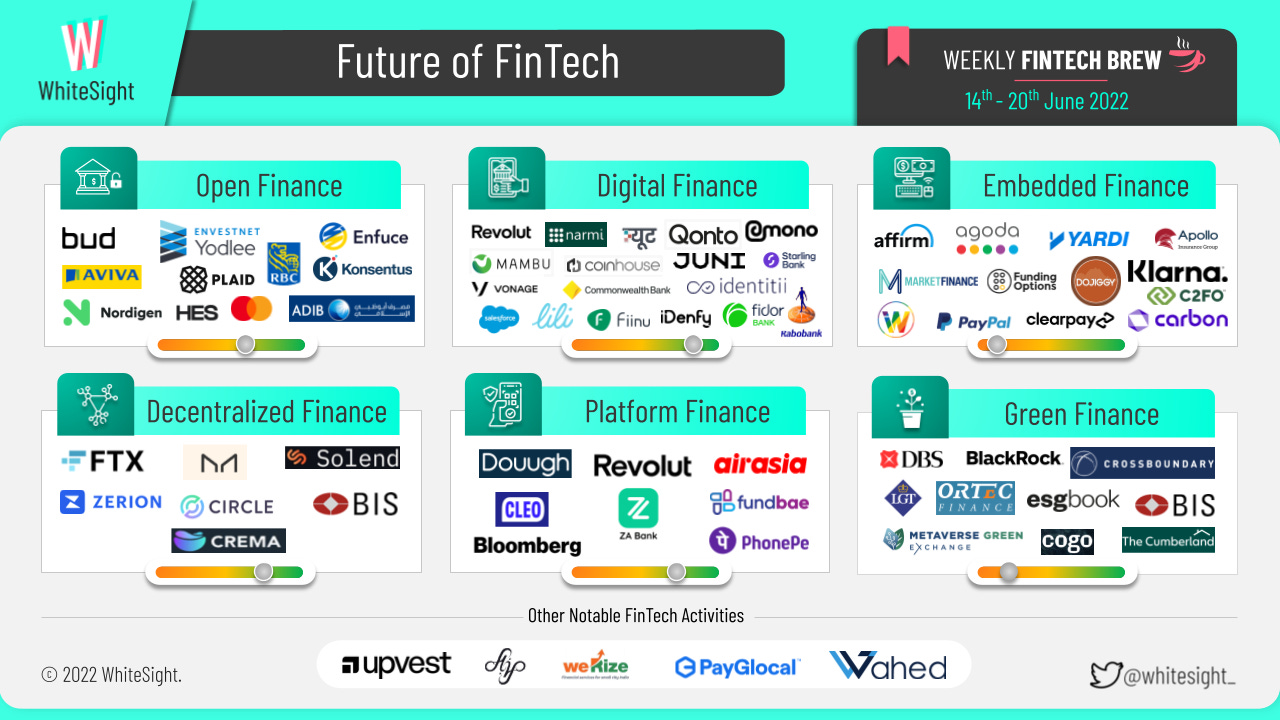

Edition #24 observed a range of striking partnerships across all segments as ecosystem participants gear up to enhance financial offerings for the consumers.

Here’s the TL;DR:

Mastercard launches Open Banking Start Path program.

Revolut releases a simplified app version in five countries.

PayPal goes beyond 'Pay in 4' with a new buy now/pay later option

MakerDAO pauses Aave-related lending activity.

DBS LiveBetter allows users to track and offset their carbon footprint with two new features.

For the longer read, let's get going –

The Open Finance landscape had various industry players teaming up last week as the Open Banking phenomenon rapidly makes its way into the mainstream.

Insurance giant Aviva picked Bud as its Open Banking partner, where the latter will provide insights that will help Aviva's pension customers make better saving decisions.

RBC partnered with Envestnet’s Yodlee platform to allow RBC users to share their financial data securely across Yodlee’s 1,500+ third-party applications. It also integrated Plaid, allowing RBC customers to connect their credentials with Plaid’s data network comprising over 6,000 apps.

HES FinTech partnered with Nordigen to provide seamless, integrated, end-to-end digital lending solutions with multiple financial providers to rejuvenate the existing European financial ecosystem.

Enfuce chose Konsentus Verify to protect its customers from unauthorized or fraudulent third parties gaining access to valuable account data and funds.

In other news, Mastercard launched the Open Banking Start Path program, where participants can access Mastercard's expertise and insights, interacting with the company's Open Banking subsidiaries Finicity and Aiia. Abu Dhabi Islamic Bank (ADIB) also launched its first API developer portal, allowing FinTech developers to use ADIB APIs to develop their own applications. Additionally, OBIE head of stakeholder engagement Constanza Castro Feijóo revealed that less than four months after reaching a milestone of 5 million Open Banking users, the UK had hit a new record of 6 million users.

The Digital Finance sector seemed to be bustling with several activities the past week, with the partnerships domain coming out on top.

Identitii Limited announced signing a five-year SLA with the Australian arm of the Dutch-led multinational banking and financial services group Rabobank. Rabobank Australia will use Identitii’s cloud-hosted reporting platform to help further automate IFTI reporting to AUSTRAC.

Revolut announced a new partnership with Salesforce to optimize business operations by using the latter’s cloud technology.

Australian banking major Commonwealth Bank of Australia (CBA) joined forces with Mambu for its new digital mortgage brand, dubbed ‘Unloan.’

iDenfy joined forces with e-commerce financial management platform Juni to provide the latter with combined ID verification and know-your-business services.

Revolut selected the Vonage Contact Center (VCC) for the Salesforce solution to improve customer communications.

Qonto and Coinhouse announced a partnership to leverage existing services to enable SMEs and others to invest in crypto assets.

Intesa Sanpaolo announced the strengthening of its partnership with merchant acquiring business Nexi to expand the areas of collaboration in Croatia.

As for the products:

Dave banking app announced the rollout of Dave ExtraCash™ $500 and Instant to eligible new members with a plan for a full rollout through the summer months.

Banking platform Lili announced an extension of its offering by adding payment solutions and third-party integrations into its platform.

German neobank Fidor Bank was also in the news for its plans to roll out a new generation of contactless bank cards later this year, including a fingerprint ID to authorize payments.

Starling Bank upgraded its Spending Insights tool to help people improve their money management skills by giving customers instant access to monthly spending data across each category to deal with the cost of living crisis.

Even banking start-up Fiinu, which is set to be listed on the London Stock Exchange (LSE), made the bulletin for its plans to roll out a plug-in overdraft, which will provide access to an overdraft facility without the need to switch banks and current accounts.

When it comes to the funding rounds:

Narmi announced $35M in Series B funding co-led by Greycroft and existing investors NEA and Picus Capital to ramp up hiring in advance of launching their business account opening platform and further build out openness, including full support for middleware layers, their proprietary AppXchange, and their developer ecosystem.

FinTech startup mewt raised $4.6M in its seed funding round led by Quona Capital to hire talent across product development and engineering and launch its debit card for MSMEs.

Mono also raised $6M in San Francisco in a seed round led by Tiger Global to focus on growing their business.

As for other news, Revolut grabbed headlines for introducing a streamlined version of its app in Sri Lanka, Chile, Ecuador, Azerbaijan, and Oman, allowing users to transfer money to 50-plus countries in more than 30 currencies. Starling Bank acquired a ~$613M mortgage book from specialist lender Masthaven in an undisclosed deal to grow its balance sheet by acquiring its rivals. Additionally, Minna Bank notched over 1 million app downloads and over 400,000 new accounts in their first 12 months. Despite the recent crash in the market, Monzo also hit the headlines for its plans to press ahead with its crypto investment plans.

Many industries joined forces in the Embedded Finance space last week to drive their ambitions of seamless user experiences forward.

APOLLO Insurance partnered with Yardi Systems to offer an insurance interface embedded into Yardi’s software to allow tenants and landlords an effortless digital insurance experience.

Affirm announced a partnership with global travel platform Agoda, part of Booking Holdings, the world’s leading online travel and related services provider.

MarketFinance embedded its suite of loans and lending products directly within Funding Options’ lending marketplace as part of a new partnership, resulting in more streamlined applications and faster decisions.

Fundraising software provider DoJiggy announced a new integration with PayPal, which will be available for their industry-leading golf tournament platform. With this new PayPal Checkout integration, organizations can provide customers with more payment options in one seamless checkout experience.

Ideal World TV also partnered with Clearpay on a buy now pay later service, allowing customers to pay for their purchases in four installments over six weeks.

As for various product launches, Carbon released Carbon Zero, a BNPL web app that helps customers spread the cost of purchases into interest-free installments, in-store or online. Similarly, C2FO announced the launch of the C2FO CashFlow+™ Card, a new and innovative option that enables businesses to accelerate invoice payment without the discount typically required in exchange for early payment. PayPal went beyond its Pay in 4 offers with a new BNPL option called Pay monthly.

Moreover, FinBox raised $15M in Series A led by A91 Partners, enabling FinBox to disburse over $2.5 billion worth of credit by 2023. It also plans to expand to several parts of South East Asia. What’s more – Klarna was in the news for its plans to raise fresh cash at a slashed valuation of $15B.

Regulations seemed to have been pouring in on the DeFi segment as clouds of uncertainty loom over.

Solana lending protocol Solend passed governance proposal SLND2 that invalidates the controversial emergency power proposal as Solend plans to take less drastic measures on the liquidation of a large Solana borrower.

MakerDAO suspended tokens from being deposited and minted in Aave’s crypto lending platform.

Cryptocurrency lending platform Babel Finance also announced the halting of withdrawals as it faced unusual liquidity pressures.

When it comes to the product launches, USDC’s parent company Circle launched a Euro-backed stablecoin, EUROC token, which users will be able to mint and redeem starting June 30th, 2022. Similarly, the Bank for International Settlements (BIS) Innovation Hub announced the launch of a new set of projects targeting various aspects of traditional and crypto payments — including a cryptocurrency market intelligence platform and security for retail CBDC.

That’s not all — the Polygon Network was integrated within the recently launched Zerion Wallet — a non-custodial smart wallet for web 3 that enables users to access DeFi and NFTs and connects directly to any dApp in just a few clicks. Liquidity protocol Crema Finance raised $5.4M in private round fundraising led by Qiming Venture Partners, continually enhancing product power and expanding market influence. FTX announced the acquisition of Canadian crypto trading platform Bitvo in an undisclosed deal to transform FTX from a cryptocurrency exchange into a platform where customers can trade numerous assets, including equities.

Want to satisfy your curious 💭 tastebuds with a warm cuppa brimming with Crypto happenings? Subscribe to the Future of Crypto Newsletter to get your weekly serving!

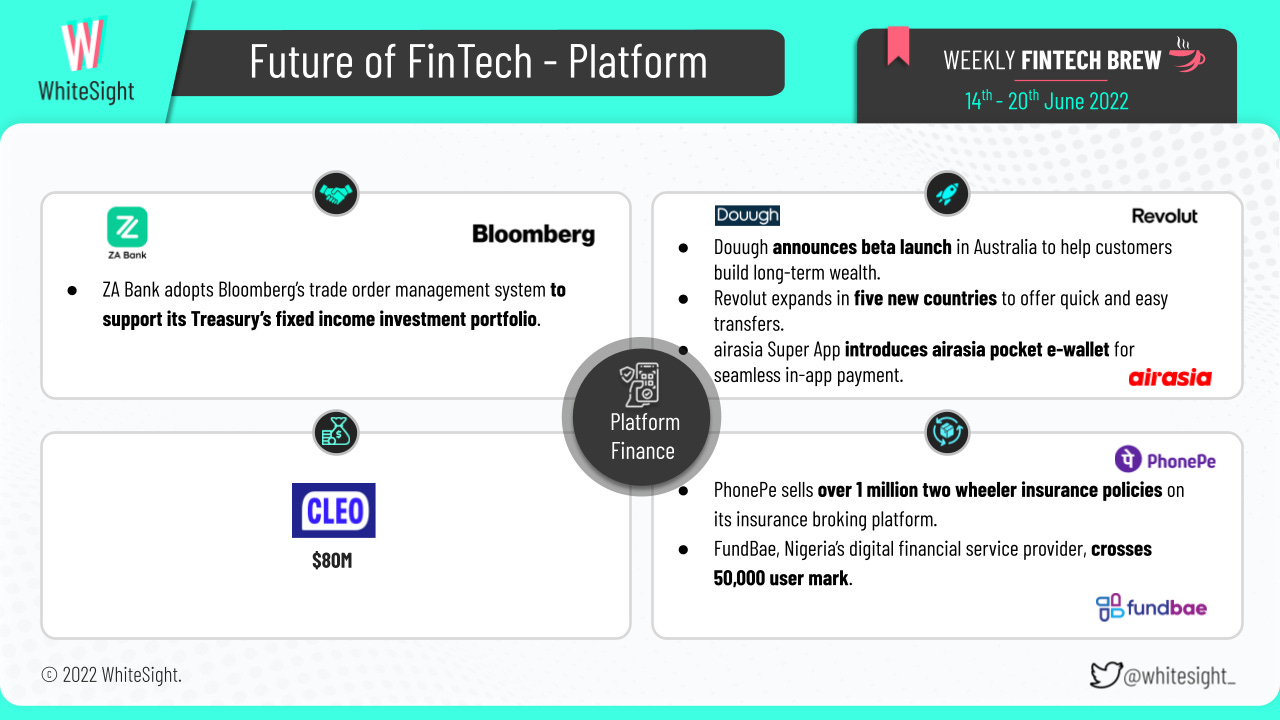

An assorted range of product launches made most of the Platform Finance sphere’s highlights.

Financial super app Douugh announced its beta launch in Australia, which will last for up to 90 days, and follows on from Douugh obtaining the necessary accreditation via partner Railsr to be able to issue banking services to select Australian customers.

Fluid announced the release of a financial super app with a range of features where users will be able to use the app to transfer, spend, swap, and save money.

Revolut announced a streamlined version of the Revolut app that will be available in five new countries in the next couple of months, enabling consumers in more countries to access fast, convenient, and secure money transfers – at best possible exchange rates.

airasia super app announced a new feature, the airasia pocket, a closed-loop e-wallet that enables users to reload and make payments for products and services on the app.

A new FinTech startup named Atlantic Money entered the market to fill the gap in the foreign exchange service without the markups.

On the other hand, Gen-Z super-app Cleo consumers hit a $500M valuation despite the turbulent backdrop which has afflicted technology companies since Russia invaded Ukraine. Similarly, FundBae – a Nigerian company that builds and preserves wealth through its value offerings, savings, investments, and payments – crossed 50,000 users. Walmart-owned digital payments firm PhonePe sold over 1 million two-wheeler insurance policies on its insurance broking platform since the launch of the product. ZA Bank Limited also made the news for adopting Bloomberg’s sell-side trade order management system (TOMS) to support its treasury’s fixed income investment portfolio.

Many brands have committed to managing their environmental impact as the Green Finance space continues to gain traction.

On the product launch vertical:

DBS LiveBetter rolled out two features – Track Better and Offset Better – that seek to educate and empower users to make sustainable lifestyle choices and live more consciously.

Franklin Templeton announced the launch of its new MSCI China Paris-Aligned Climate UCITS ETF, providing European investors with equity exposure to large and mid-capitalization stocks in China while reducing exposure to transition and physical climate risks.

UK credit risk consultancy 4most won government backing to develop a green credit score that will offer cheaper financing to environmentally conscious SMEs.

BlackRock announced plans to launch a new perpetual infrastructure strategy to pursue long-term investment opportunities in the megatrend themes of energy transition and energy security.

MetaVerse Green Exchange (MVGX) announced the launch of Net Zero Card, a new tool to enable businesses to track and offset hard-to-manage carbon emissions such as travel.

The Bank for International Settlements (BIS) Innovation Hub announced a new set of projects across its various centers, updating its 2022 work program. They include the upcoming Eurosystem Centre's first three projects and the first comprehensive cyber security explorations.

On the funding front, British International Investment (BII) subscribed to a $75M Green Basket Bond arranged by Symbiotics to direct much-needed financing through MSME banks to support small-scale green projects across Africa, South Asia, and Southeast Asia. LGT Capital Partners announced the raise of $550M for the final close of Crown Impact, its augural impact fund that invests across three core impact themes: climate action, inclusive growth, and healthcare. Similarly, CrossBoundary Energy Access (CBEA) announced $25M in new funding commitments from ARCH Emerging Markets Partners Limited, Bank of America, and Microsoft Climate Innovation Fund. This investment will leverage an additional $25M in senior debt to deploy $50M of capital into CBEA’s near-term pipeline of solar-powered mini-grids.

But wait! There’s more –

Cogo partnered with The Cumberland to help customers track their carbon footprints with a tool that will also give customers suggestions on how to reduce or offset their carbon footprint based on their personalized spending.

One Concern partnered with WTW to bring climate resilience scores to the US insurance market to facilitate a better understanding of dependency risk and accelerate the adoption of parametric insurance.

ESG Book and Ortech Finance announced a new partnership to deliver next-generation ESG data and insights to investors by leveraging ESG Book’s suite of climate and sustainability data solutions to provide clients with a one-stop-shop for sustainability analysis.

Additionally, The Basel Committee on Banking Supervision issued a set of climate risk guidelines to help financial regulators across the world assess bank preparedness in a coordinated fashion.

Some other happenings in the FinTech universe 🪐

A couple of more headlines from beyond the six dynamic themes to keep your FinTech tea brewing with all the FinTech hubbub –

German neobroker Trade Republic topped up its Series C funding round with an extra $264M at a $5.27B valuation.

Brazilian FinTech Marvin secured $15M in Series A funding led by venture capital firm Canaan, allowing it to expand its B2B payments solution.

Israeli startup Hourly.io raised $27M in a Series A investment led by Glilot Capital Partners.

NFT-powered play-and-earn gaming project Kryptomon raised $10M in funding led by NFX.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include exploring how The Future of Financial Services Will Run on Open Rails and Unearthing The Bustle In Green Finance: Earth Day 2022.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch with our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️