We believe there’s no such thing as too much crypto tea, which is why we bring you a new edition of the Future of Crypto Newsletter to sweeten your tastebuds with the latest scoop! If you're new and curious, read on to refill your curious cups and join other crypto nerds in receiving some fresh Weekly Crypto Cuppa, delivered right to your inbox every Saturday! ☕️

Go ‘Hard’ Or Go Home: In 2013, James Howells, who lives in Wales, accidentally threw out a hard drive with 7,500 Bitcoins on it. When he realized how much the value of Bitcoin had shot up in recent years, he went looking for the drive. Now, he’s trying to get his local city council to allow him to excavate the landfill in an attempt to find the drive. Talk about finding the end of a rainbow…

Back to the usual:

Despite the ongoing winter in the Cryptosphere, various partnerships and launches acted as the light at the end of the tunnel for the 19th Edition of the Future of Crypto newsletter. The avant-garde NFT segment came out as the most dynamic theme of the week.

Here’s the TL;DR:

Mastercard partners with various platforms to allow its cardholders to buy NFTs without purchasing crypto.

American Express adds the first crypto product with the Abra rewards card.

Binance partners with Splyt to offer users ride-hailing services on its platform.

JPMorgan plans to bring trillions of dollars of tokenized assets to DeFi.

Huobi Global launches a $1B investment arm focused on DeFi and web 3.

Icing On The Cake – the week’s Top 10 Crypto News Stories are also here to pump your crypto cuppa:

For the longer read, let’s get going –

Regulatory bodies worldwide continue to recognize the potential of CBDCs in fostering financial inclusion and boosting economic development, which is why regulation seemed to be on the rise for last week’s affairs in the emerging space.

In Africa, the Nigerian central bank was in the news for its plans to extend its e-Naira CBDC payment service to feature phones to target financial inclusion. The same will be done using Unstructured Supplementary Service Data (USSD) codes that operate similarly to SMS. In Asia, the government of Bangladesh plans to conduct a feasibility study to launch the CBDC in the country. In Europe, the Russian lower house of parliament introduced a bill to ban the use of digital assets as a payment method, clarifying that only a Russian ruble is a unit of payment in the country.

In other news, IMF turned its attention to the environmental impact of DLTs, recommending energy-efficient CBDCs that rely on non-PoW networks. The US thinktank Atlantic Council also released a report on cybersecurity issues related to CBDC. The authors provide a generalized discussion of CBDC security, but with a clear focus on the US and matters specific to it.

A diverse range of activities marked most of the happenings in the Crypto-coins landscape last week.

MoneyGram hit the headlines for launching an on- and off-ramp service for digital wallets, making it easy for digital wallet customers to move between fiat to cryptocurrency to fiat again without needing a bank account or credit card. Crypto security firm Forta released its own FORT token, intended to increase the incentives for security researchers to monitor blockchain networks. Similarly, American Express (AXP) confirmed that it would be offering crypto rewards, teaming up with digital-assets services major Abra.

As for the partnerships, Binance was in the news twice – once for choosing crypto payment processor TripleA as its new universal crypto payment gateway for its Binance Pay payment feature on its mobile applications, and the other for partnering with Splyt to offer users ride-hailing services on its platform.

On the various regulations, cryptocurrency lending firm Celsius Network grabbed headlines for its plans to pause withdrawals and transfers between accounts due to extreme market conditions. The government in Vilnius also approved amendments introducing more stringent regulations for the country’s growing crypto space. The legislation aimed at managing risks associated with crypto assets and preventing Russian attempts to circumvent Western sanctions imposed over the war in Ukraine.

In other news, MicroStrategy (MSTR) sat on an unrealized loss of more than $1B on its Bitcoin holdings as the price of the largest crypto. Crypto payment gateway Nume Crypto raised $2M in its Pre-Seed funding round led by Sequoia Capital India.

Turbulent waves persist in the Stablecoins segment as stablecoins continue to tumble one after the other.

The Tron network’s stablecoin, USDD, lost its peg to the US dollar dipping to a new low of 91 cents. As crypto markets nosedive, investors grow increasingly concerned about persistently high inflation, tightening financial conditions, and a potential recession. TronDAO will deploy $2B to fight against the negative APR. Binance US and its CEO Brian Shroder were named as defendants in a lawsuit claiming that the crypto exchange falsely marketed the safety of stablecoin TerraUSD (UST), which collapsed in a spectacular fashion earlier in 2022.

Last week, the NFT space was vibrant with eventful happenings, witnessing several partnerships and market expansions across different platforms.

Canon announced that several members of its exclusive Canon Legends program partnered with Immutable Image to create NFTs from a limited collection of their photographs and publish them as a collective. UFC and DraftKings announced plans to launch a new iteration of DraftKings’ “Reignmakers” gamified digital collectibles franchise focused on UFC. Reignmakers UFC will allow fans to build collections of their favorite UFC fighters and utilize them in games to compete for prizes. Similarly, OnChain Studios announced a multi-year global partnership with toy maker Mattel for its Crptoys NFT platform, which will give rise to a new generation of toys that will exist in the blockchain.

When it comes to the expansions, NFT platform Fractal announced its new feature, ‘Sign In With Fractal,’ which lets users create a crypto wallet in a matter of moments by logging in with a Google account. Bitcoin exchange and wallet provider Blockchain.com made the bulletin for giving its users a free NFT domain, a tool that will let them use a simple, human-friendly username in place of the long string of random characters that make up a wallet address. Similarly, Mastercard announced plans to partner with several platforms to allow its 2.9 billion cardholders to buy NFTs without first purchasing cryptocurrencies.

What’s more –

Ultron Foundation released an innovative digital asset growth instrument called Staking Hub NFT as a new way of financing blockchain development.

NFT infrastructure platform NFTPort raised $26M in a Series A funding round co-led by Taavet+Sten, to further develop its infrastructure proposition.

Yuga Labs announced a major change to the underlying code of the Bored Ape Yacht Club NFT, deleting a segment of the code that enabled the creation of infinite Bored Ape NFTs after continued attacks on its platform.

A couple of launches and partnership rounds dominated the DeFi segment this week:

Digital asset exchange Huobi Global spun out a new $1B investment arm focused on DeFi and web 3 projects, further highlighting venture capital interest in the blockchain economy. A decentralized algorithmic lending protocol Hatom was launched on the Elrond blockchain. Hatom uses an on-chain governance mechanism that enables the protocol’s users to vote for protocol changes directly on the blockchain.

On the partnerships front, RPC provider and web 3 developer toolset Ankr announced that it would become a remote procedure call provider for Optimism, incentivizing independent Optimism node operators to add their nodes to the load balancer in return for ANKR tokens. Similarly, Banxa announced a partnership with WonderFi to enable the latter’s customers to utilize local payment and banking options with less friction, fewer fees, and better fraud protection. Users can easily and securely convert fiat currency to cryptocurrencies and back again.

In other news, JPMorgan announced its plan to bring trillions of dollars of tokenized assets to DeFi to help DeFi developers leverage the yield-generating potential of non-crypto assets.

The metaverse vertical has witnessed a range of product launches in the past week.

Yahoo announced its plans to host a series of virtual events and concerts for Hong Kong residents in the Decentraland metaverse and an NFT exhibition called The Abyss of Kwun Tong, which will see local artists virtually recreate the historic neighborhood of Kwun Tong.

HTC was in the news for its plans to launch a high-end smartphone with metaverse-focused features under its ‘Viverse’ brand in June 2022.

Similarly, Meta announced it is adding the ability to easily socialize in virtual reality with an update to its Quest 2 headsets in another step toward the metaverse.

Bharti Airtel launched Xstream multiplex, a 20-screen platform with access to content portfolios from leading OTT partners available on its Xstream app, which will be accessible on a metaverse platform called Partynite Metaverse.

That’s not all – Meta was also in the news as it plans to open a ‘metaverse academy' in collaboration with a French digital training firm which will train the first 100 students for free in 2 roles. Adobe announced major updates to Adobe Substance 3D, expanding on the tools’ extensibility and performance, including a 3D Materials SDK for developers, powerful new plugins, and native Apple M-series chips support for Painter, Designer, and Sampler. Additionally, play-and-earn metaverse developer Atmos Labs announced the closing of an $11M seed round for Atmos led by Sfermion to build the foundation of the virtual game world of Atmos, grow its community and expand the Atmos team.

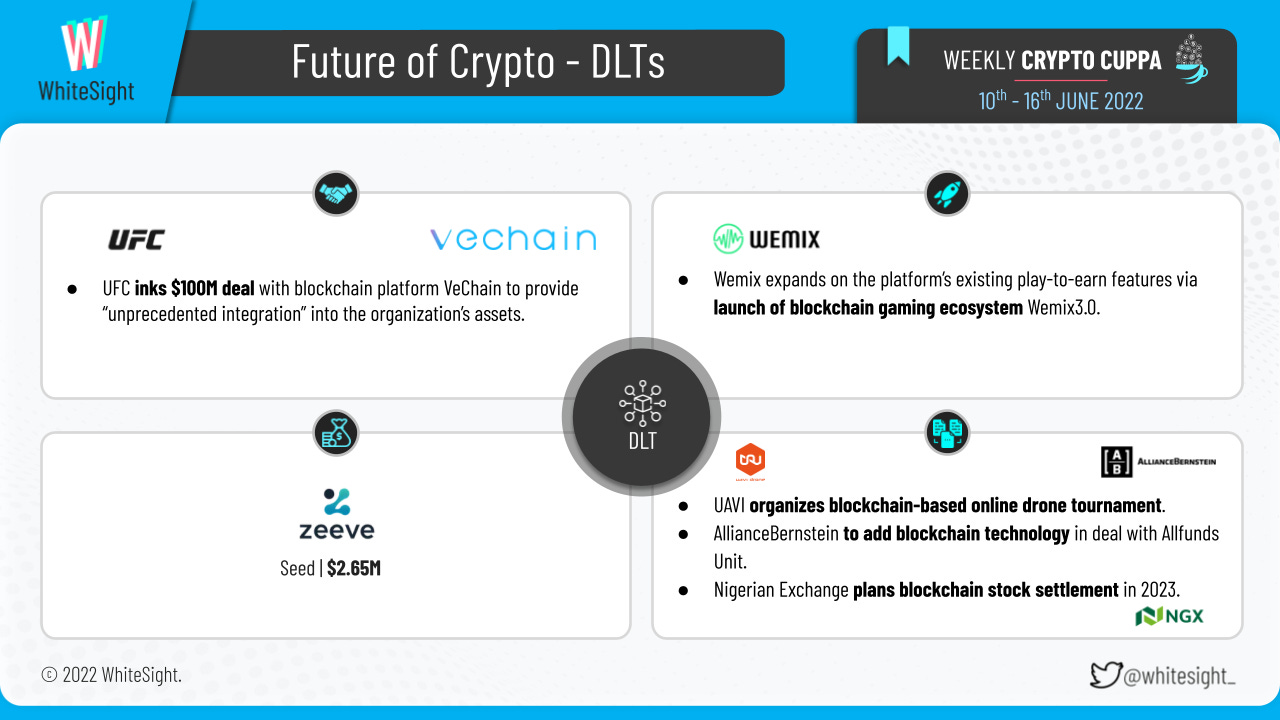

Various market expansions took the spotlight in the DLT segment last week.

UAVI made the news for its plans to celebrate its one-year anniversary and its cooperation with Real Drone Simulator by organizing a blockchain-based online drone tournament on June 23 in Budapest, where it will also announce the listing of the UAVI token on the Indoex exchange and will introduce the UAVI ecosystem to the wider world.

Global asset manager AllianceBernstein Holdings (AB) announced it is working with Allfunds Blockchain to adapt its services to the blockchain ecosystem to provide an additional layer of security and efficiency.

The Nigerian exchange also grabbed attention as it plans to use blockchain for stock settlement by 2023.

Additionally, blockchain gaming platform Wemix announced the launch of a platform-driven, service-oriented ecosystem for blockchain gaming Wemix3.0, which will expand on the platform’s existing play-to-earn features, blockchain infrastructure automation platform. Zeeve also raised $2.65M in a seed round from Leo Capital and Blu Ventures to bolster product development, augment the tech team and enhance the firm's reach among DApp developers and global corporations.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Crypto Cuppa, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include exploring how The Future of Financial Services Will Run on Open Rails and Unearthing The Bustle In Green Finance: Earth Day 2022.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch with our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️