Future of FinTech | Edition #11 – March 2022

New week, new FinTech brew to keep your cups abuzz and recharged with the eventful happenings in a new edition of the Future of FinTech Newsletter! If you're new and curious, read on to find out what happened in the world of FinTech across six dynamic themes, and join 615 other FinTech nerds in receiving some fresh Weekly FinTech Brew delivered right to your inbox every Tuesday ☕️

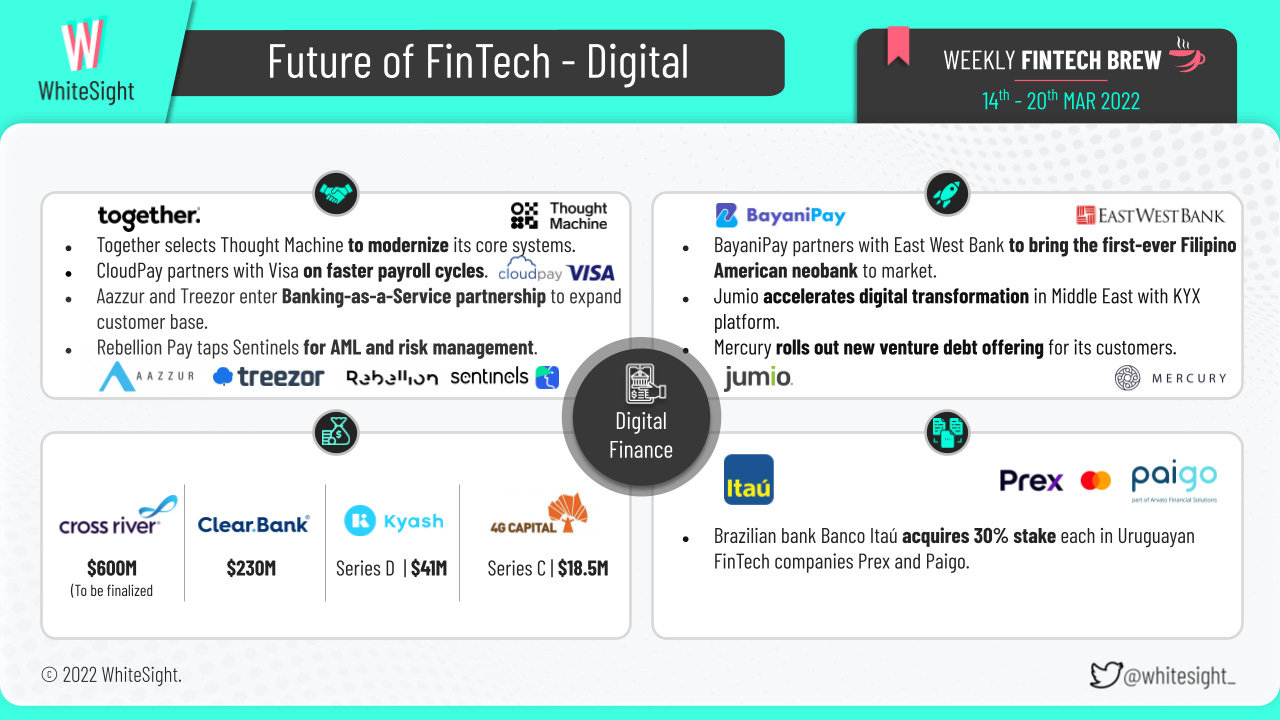

Edition #11 comes with the assorted mix of headline-grabbing partnerships and launches. The Digital Finance segment takes the crown as the most active theme of the week.

Here's the TL;DR

Collaborations that stole the headlines last week:

Moneyhub + Samsung for world-first Open Banking self-service payments,

CloudPay + Visa on faster payroll cycles,

Klarna + BigCommerce to extend global partnership to New Zealand,

Starbucks + Grab to elevate the Starbucks Experience for Southeast Asia, and

JustCarbon + NFT Design Works to bring blockchain benefits to support climate change.

Some company-specific moves:

Cross River Bank to close a deal to raise more than $600M, valuing the company at over $3B;

Nordigen connects with Mallard Finance, PFM app Saveengs, and Ebitly over different Open Banking initiatives; and

Mastercard announces a growing list of BNPL specialists and globally recognized brands to expand Mastercard Installments further.

On the regulatory front, Australia's Treasury Department has commenced consultations to expand the scope of Consumer Data Right (CDR) to include open finance.

For the longer read, let's get going –

With Open Banking-powered payments gaining traction across diverse geographies, numerous partnerships remained at the forefront for the Open Finance vertical.

PostNord Strålfors, the market-leading player in Customer Communication Management, chose Tink as its Open Banking payments technology provider.

Moneyhub partnered with Samsung to facilitate the world’s first Open Banking payments on a retail self-service point-of-sale (POS) Kiosk.

Adatree and Personetics also joined forces to provide comprehensive financial data to customers and key information to brokers.

Additionally, Green Dot Corporation made the news by partnering with payment authentication gateway Plaid to expand financial services solutions to Green Dot’s GO2bank customers. Ecospend teamed up with Anglian Water to offer its new ‘pay-by-bank’ technology to enable the latter to receive instant account-to-account payments, which will reduce the utility provider’s processing costs. Volume, the one-click checkout startup, partnered with Yapily to remove hidden and unnecessary fees at online checkouts.

Furthermore, Open Banking FinTech Nordigen hit not one but three headlines for its various collaboration efforts. Firstly, Mallard Finance picked Nordigen as their Account Information Service Provider (AISP) to generate a more comprehensive application procedure. Next, PFM app Saveengs selected Nordigen for Open Banking data. Lastly, Ebitly joined forces with Nordigen to enable its clients to securely link up their business bank accounts to the accounting platform.

On the other hand, open finance startup Upswing drew $4M from QED Investors and other angel investors. The funding will be used to build plug-and-play platforms for open finance, and help fintech and consumer tech players offer financial services seamlessly. On the regulatory front, marking the beginning of evolution to a more open ecosystem, Australia's Treasury Department commenced consultation on expanding its flagship competition policy, the Consumer Data Right (CDR), to open finance.

The Digital Finance sphere lit up with stirring affairs that made for some attention-grabbing scoop for the week.

When it comes to the partnerships, UK-based Together selected Thought Machine to modernize its core systems via the latter’s cloud-native platform, Vault, acting as the foundation layer for Together’s new technology stack. While CloudPay and Visa partnered to reduce payroll payment cycles from 2-3 days to a few seconds, neobank Rebellion Pay tapped Sentinels to enhance its anti-money laundering and risk profiling capabilities. Aazzur and Treezor also entered into a Banking-as-a-Service partnership to allow both companies to expand their customer base and strengthen their BaaS offering. Square announced its collaboration with CodeBase to provide entrepreneurs with access to Square’s payment ecosystem and APIs. Additionally, Brazilian bank Banco Itaú acquired 30% stakes in Uruguayan FinTechs Prex and Paigo.

Moreover, UK FinTech ClearBank raised $230M from Apax to expand into Europe and the US. Kyash, a Tokyo-based challenger bank, raised a $41.2M Series D from investors, one of which was Block (formerly Square). Africa’s 4G Capital closed $18.5M in a Series C funding round to increase its finance and enterprise training solutions to small businesses. Regional lender Cross River Bank was also in the news for its plans to close a deal to raise more than $600M, giving the company a valuation of more than $3B.

As for the various launches, startup banking service Mercury rolled out a new venture debt offering for its customers in a bid to take on Silicon Valley Bank. Jumio announced the launch of a Middle Eastern solutions portfolio and its KYX platform to accelerate digital transformation for the Middle East and North Africa region. BayaniPay also tied up with East West Bank to launch a pioneering neobank that will cater to the banking needs of Filipinos based in the United States.

Many brands teamed up to integrate cutting-edge solutions for seamless experiences in the Embedded Finance space.

Caxton, a leading UK FinTech payments provider, announced a significant partnership with Banking-as-a-Service provider OpenPayd to offer customers a simplified payments experience. IRIS partnered with UNIPaaS to bring its embedded finance solutions platform to SMEs. Payments firm 2C2P also announced its regional partnership with Singapore’s BNPL provider hoolah to integrate its BNPL offering for merchants. At the same time, Mastercard beefed up its BNPL partner network to include BNPL specialists and the latest brands to further expand its unique BNPL Mastercard Installments program. Klarna and BigCommerce also extended their successful global partnership to New Zealand, where Kiwi retailers will now have the ability to integrate Klarna’s flexible payment options into their New Zealand customer offerings. Additionally, Currencycloud and US-based Moov partnered to boost customers’ international and domestic payment capabilities.

On the fundings front, London-based Playter raised $1.7M in a seed funding round to bring BNPL to the B2B space. Moove, an African mobility FinTech, also raised $105M in a new Series A2 financing to scale across its present markets and move into new markets outside Africa. Bazaar, a startup attempting to digitize Pakistan’s retail with e-commerce, FinTech, and last-mile supply chain solutions, similarly secured a $70M Series B funding from Dragoneer Investment Group and Tiger Global. Global embedded finance technology platform Alviere grabbed the headlines for announcing AutoPayPlus, an automated loan payment service provider, to be the former’s first automotive industry client. Parpera and Railspay further launched Australia’s first embedded financial business debit card for sole traders to better manage their business payments.

A diverse set of innovative launches made up for most of the buzz surrounding the DeFi and Crypto segment:

Meta Bank Defi, a Photorealistic Metaverse crypto project, grabbed headlines for its plans to create a new platform to leverage the unique advantages of decentralized finance for creating simple and dependable digital banking procedures.

DEX protocol Litedex (LDX) is now available for trading on LBank Exchange. The protocol aims to adopt popular blockchains including BSC, ETH, HECO, Polygon, Tron, Polkadot, and Solana and provide products and services such as Swap, Staking, Farming, Analytics, Lending, Borrowing, NFT, and Bridge.

Quadrata group launched their first main product, a low code web three passport for DeFi KYC that offers entry natively on the general public blockchain.

DeFi Platform Aave launched Aave v3 featuring a range of new functionalities and mechanisms designed to improve user experience, risk management, and capital efficiency.

Derify, a fully on-chain, non-custodial derivative DEX, was launched to allow traders to trade derivatives fairly, safely, and cost-effectively.

In other news, RegTech business Tintra PLC announced its plan to develop a web 3 banking platform, expanding its technology to launch an innovative and fully functional metaverse bank.

Want to fill your curious cups with more buzz surrounding the Cryptosphere? 🧐 Well, you need to get yourself a weekly cuppa of the Future of Crypto newsletter!

The race to become a ‘super app’ continues for the Platform Finance vertical, as players from industries far and wide launch their one-stop shops to maximize customer convenience.

Parallel Finance, a decentralized money market protocol, launched a DeFi super app for the Polkadot crypto ecosystem. Payment services provider Mollie was in the news for the launch of its new Connect for Platforms product, designed for SaaS and Marketplace platforms to integrate payments, onboard customers, and accept and route payments. Super app for small businesses, Entack, also made the bulletin for entering the Philippines market.

What’s more – Indonesian super app GoTo made the news for its plans to raise $1.3B at an estimated valuation of $29B in an IPO on the Indonesian Stock Exchange. Even Starbucks forged a regional partnership with Grab in six markets across Southeast Asia to allow customers to get their Starbucks orders delivered throughout Grab’s delivery network and obtain Starbucks Rewards for purchases.

The Green Finance segment witnessed an assorted mix of activities across various sectors.

On the partnerships front, leading Swedish FinTech Zimpler partnered with Norwegian climate-tech company CHOOSE to offset their carbon emissions. Blockchain carbon marketplace JustCarbon and NFT Design Works partnered to enable NFTs to benefit from carbon offsetting. With the environmental impact of cryptocurrencies being one of the flashpoints among regulators, demand for transparency around the carbon footprint of individual blockchains has increased. Elk Finance and SavePlanetEarth joined forces to offer a first-of-its-kind Carbon Negative cross-chain bridge protocol to address the same.

Furthermore, Climate Impact X (CIX), a global carbon exchange and marketplace, announced the launch of its digital Project Marketplace platform for businesses and carbon project suppliers to list, discover, compare, buy and retire quality carbon credits. UK impact neobank Novus made the news for being selected for FCA’s ongoing ‘Green FinTech Challenge’ initiative to continue developing innovative products and services that will aid the transition to a net-zero economy. Garanti BBVA also completed the first ESG-related repo transaction indexed to sustainability performance. In other news, the International Organization of Securities Commissions (IOSCO) adopted a far-reaching 2022 work plan to develop sustainable finance and strengthen the organization’s commitment to increasing transparency and mitigating greenwashing. Bank of America also hit the list for its aim to double its underwriting of green bond deals in China, beefing up its business to capture the fast-growing market.

Some other happenings in the FinTech universe 🪐

Several other head-turning headlines beyond these six dynamic themes caught our attention – with

Indonesia-based Wagely raising $8.3M in pre-Series A funding to fuel its expansion in Bangladesh,

Oakbrook Finance scored $187M in funding from JPMorgan and Atalaya Capital Management,

DailyPay securing $300M credit facility from Barclays in a landmark deal for the on-demand pay industry,

Novel Capital launching with $115M in equity and debt funding,

Payrails emerging from stealth with $6.4M led by a16z to build the OS for payments,

Indian FinTech unicorn Razorpay acquiring payments tech firm IZealiant Technologies,

Chargebee launching the industry’s first e-invoicing service for SaaS and subscription-model businesses, and

Catch announcing the launch of free automated tax routing, alongside a new brand identity.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include taking a closer look at Open Banking Innovation in Saudi Arabia in partnership with Mod5r, and entering the immersive universe of Gamification—Into The Metaverse.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for our strategic intelligence and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter and don't be shy to show some 💛