We’re back with a new edition of the Future of Crypto Newsletter! If you're new and curious, read on to satisfy your curious taste buds and join other crypto nerds in receiving some fresh Weekly Crypto Cuppa brewing with headlines from the bustling Cryptosphere, delivered right to your inbox every Saturday! ☕️

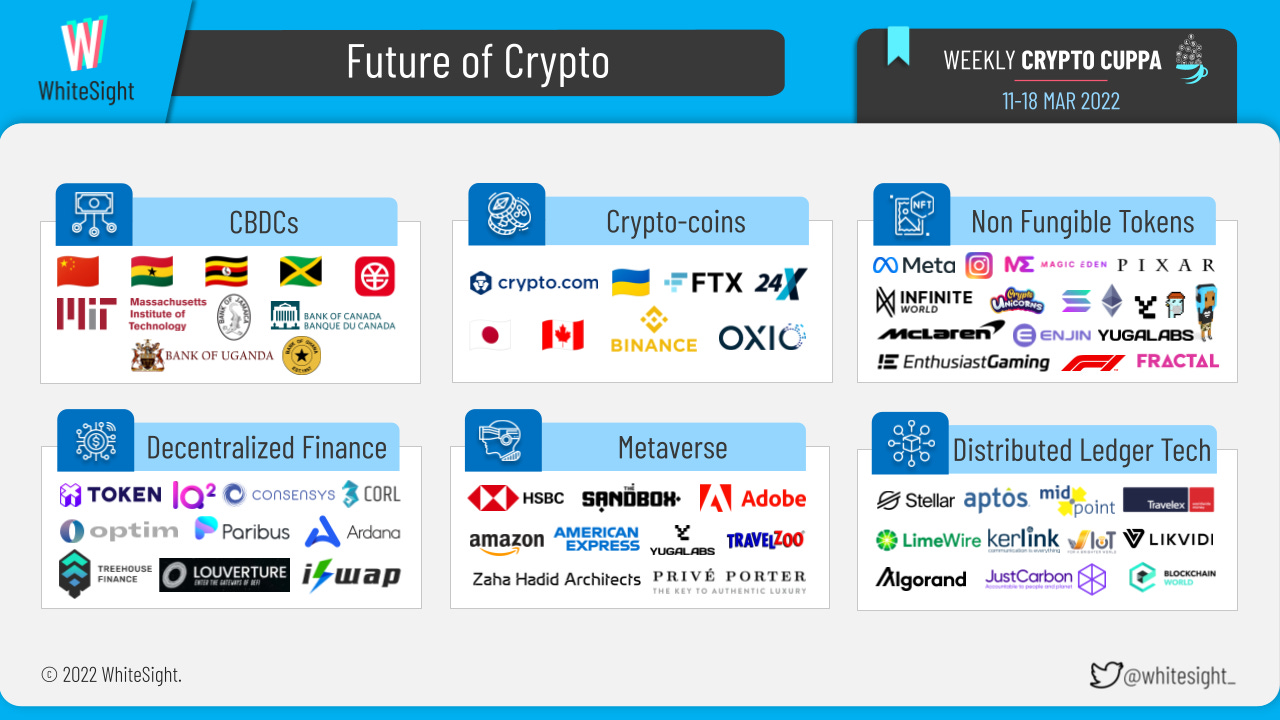

With Edition #6’s eventful stir, a diverse range of trailblazing product launches and market expansions were observed to be disrupting the digital landscape. The avant-garde NFT segment came out on top as the most active segment yet again.

Here’s the TL;DR:

Amazon launches metaverse-like game to train people how to use AWS

HSBC becomes the first global financial services provider to enter The Sandbox.

Meta to add NFTs to Instagram soon.

McLaren partners with InfiniteWorld to mint NFTs of luxury supercars.

Pixar launched the NFT series ‘Pixar Pals’ featuring characters from its movies.

For the longer read, let's get going –

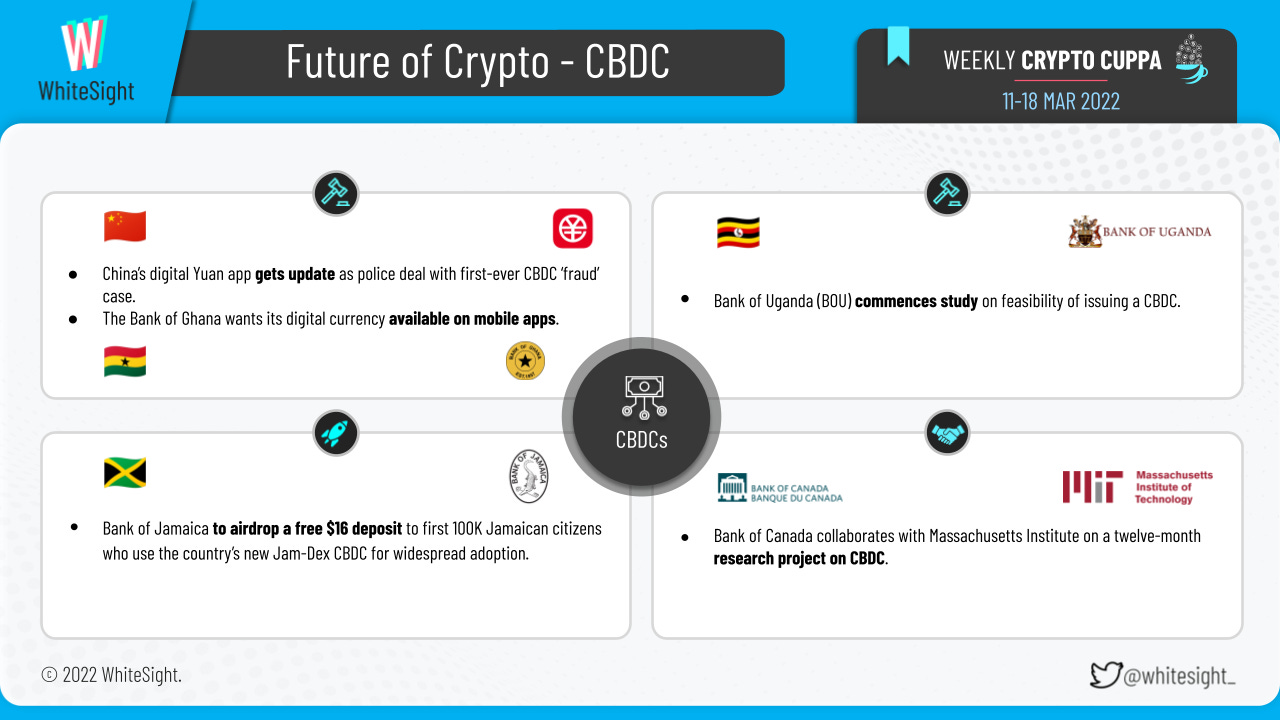

Countries around the globe are experimenting on their respective CBDC prospects.

While Bank of Ghana was in the news for its plans to make eCedi, its digital currency, available on popular payment platforms operated by mobile-phone service providers to make its use more intuitive and improve financial inclusion, Bank of Jamaica hit the headlines for its plans to deposit $16 to the first 100,000 Jamaican citizens to use the country’s new CBDC, Jam-Dex, hoping to promote widespread adoption. The Bank of Uganda (BOU) commenced a study that explores the feasibility of issuing a digital currency, and plans to revise the country’s financial laws, enabling the BOU to formally adopt the CBDC. The Bank of Canada collaborated with MIT media lab’s Digital Currency Initiative on a twelve-month research project on CBDC.

In Asia, China’s digital yuan app got updated as police deal with citizens trying to commit crimes using the new token, and have attempted to use it to launder money. In other news, a new report by Deloitte stated that Bitcoin has the potential for becoming the backbone for CBDC by helping it in five key areas — speed, security, efficiency, cross-border payments, and collaboration with other participants.

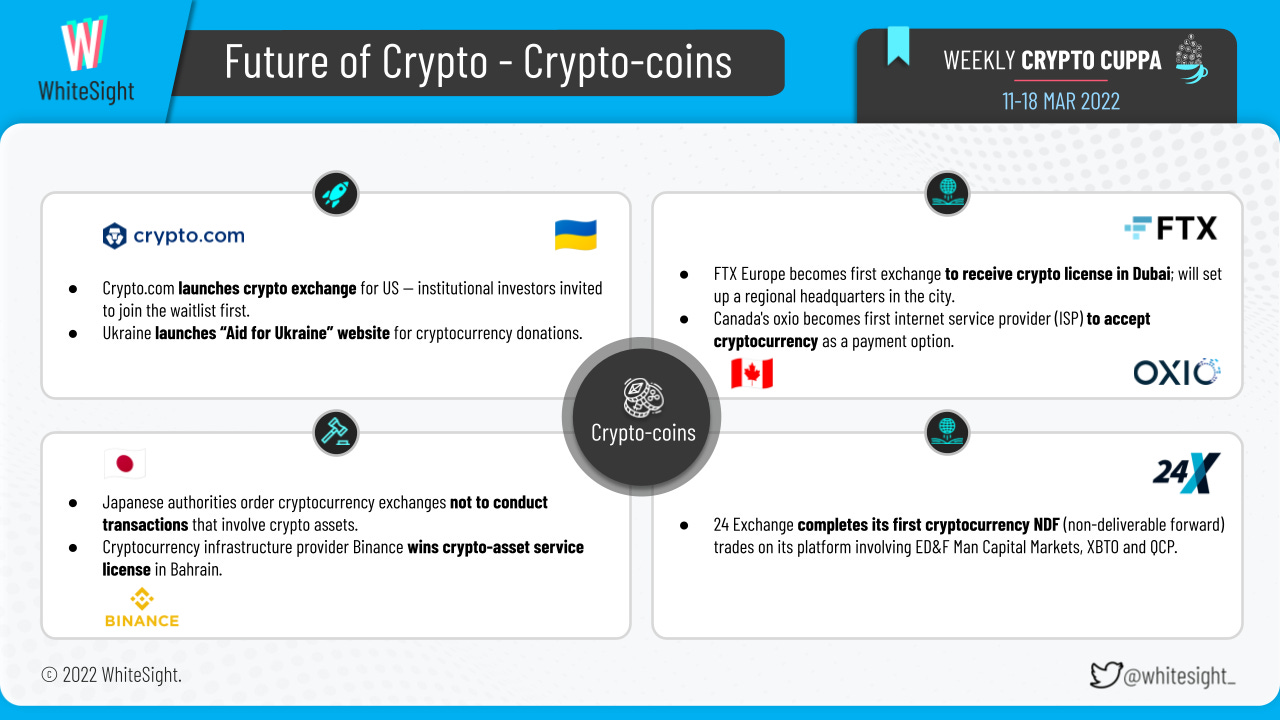

The Crypto-coins vertical has been a witness to several market expansions, with companies worldwide embracing various cryptocurrencies within their current portfolios.

While FTX Europe became the first firm to receive a license to operate a crypto exchange and trading house in Dubai, Canada’s internet service provider (ISP) Oxio started accepting payments in crypto through Coinbase Commerce platform. Multi-asset trading platform 24 Exchange also made it to the headlines after completing its first cryptocurrency NDF (non-deliverable forward) trades on its platform involving ED&F Man Capital Markets, XBTO and QCP in February.

On the regulatory front, Binance blockchain was granted a crypto-asset service license by the Central Bank of Bahrain (CBB). In Japan, the authorities have asked cryptocurrency exchanges not to conduct crypto assets transactions that are subject to asset-freeze penalties imposed on Russia and Belarus as a result of the Ukraine conflict. Additionally, the European Union rejected a proposed rule that could have banned Bitcoin across the bloc, and instead set new draft rules to protect consumers and make mining more sustainable.

Furthermore, the Ukrainian government launched a website in partnership with crypto-firms FTX and Everstake that will funnel donations to Ukraine's central bank amidst war. Digital currency exchange Crypto.com was also in the news for launching a crypto exchange for the US — where institutional investors were granted access first.

As for the crypto market, Bitcoin was trading 0.69 per cent higher at $41,124.58, taking its seven-day gains to 0.8 per cent. Ethereum surged 2.9 per cent in the last 24 hours to $2,769. The second-largest cryptocurrency by market value rose to 3.9 per cent in the last one week. Tether, the third-largest, was almost flat at $1 and so was USD Coin, which was flat at $0.99. BNB added 1.19 per cent, XRP gained 2.01 per cent, but Terra fell 2.12 per cent.

The stablecoins segment has been witnessing a series of roller-coaster events as of late. Hedge fund Fir Tree Capital Management grabbed headlines as it made a short wager against stablecoin Tether so as to minimize downside risk and maintain a high payoff potential.

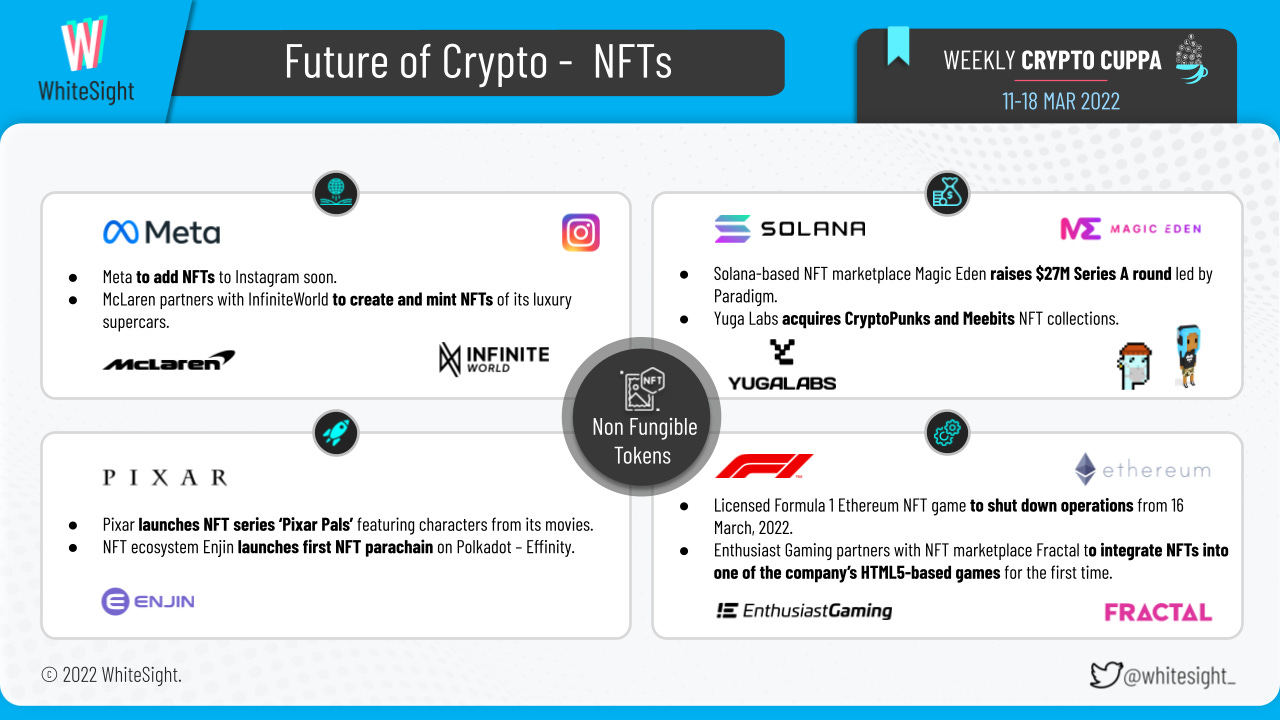

A number of launches surrounding the NFT space created quite the buzz that turned our heads last week, with significant players making their entrance into the emerging sphere.

Pixar Animation Studios released Pixar Pals NFT collection, featuring characters from movies like Toy Story, Monsters, Inc, Cars, Coco, Ratatouille, and many more. Popular NFT ecosystem Enjin launched the first NFT parachain on Polkadot – Effinity – in a bid to support CryptoBlades and its users. Similarly, Ukraine made the list for its plans to launch an NFT museum that would depict events from war with Russia.

On the other hand, Mark Zuckerberg announced that Meta would add NFTs to Instagram within the next few months. While McLaren Automotive was in the news for its plans to create and mint NFTs of its luxury supercars in partnership with metaverse infrastructure platform InfiniteWorld, popular polygon-based NFT collection Crypto Unicorns closed a $26M token sale ahead of its play-to-earn NFT game launch.

In other news, BAYC backer Yuga Labs acquired CryptoPunks and Meebits NFT collections, with plans to grant the commercial rights to all CryptoPunk and Meebit images to their respective owners. Additionally, Solana-Based NFT Marketplace Magic Eden raised $27M Series A led by Paradigm, which also included contributions from Sequoia and Solana Ventures. Integrated gaming company Enthusiast Gaming joined forces with NFT marketplace Fractal to integrate NFTs into one of the company’s HTML5-based games for the first time.

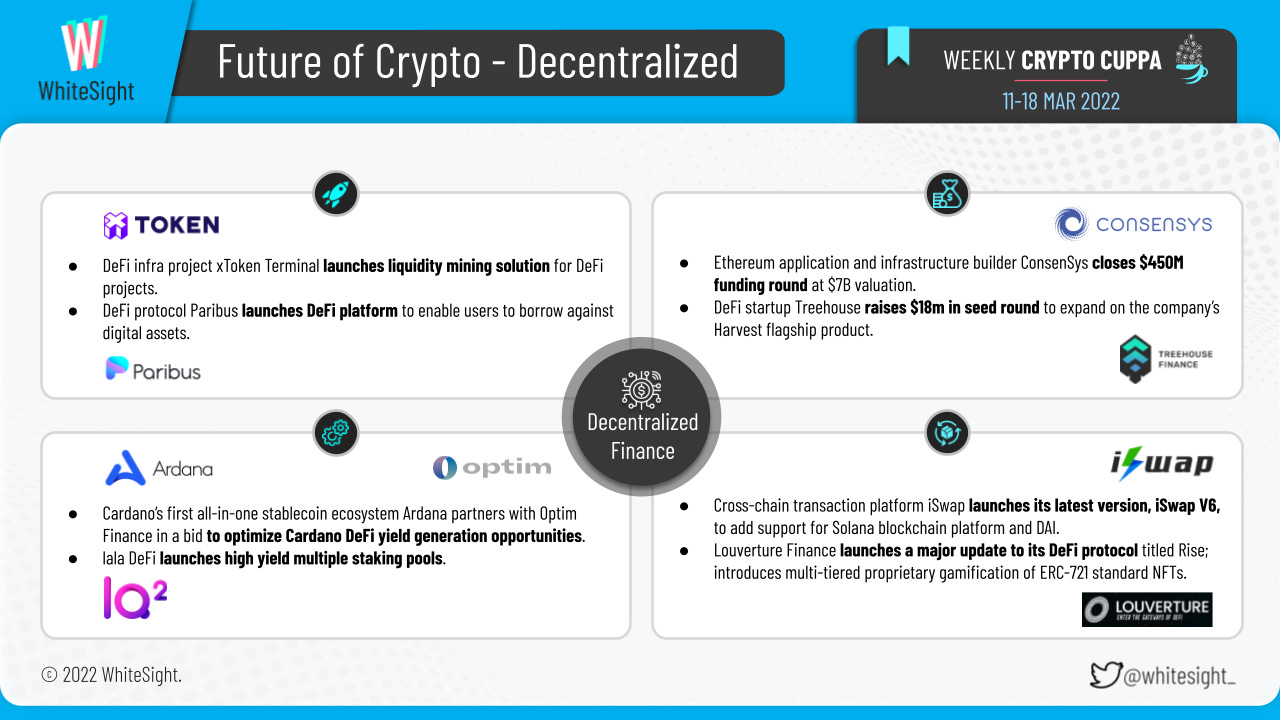

A plethora of funding rounds and launches were the key highlights for the DeFi space.

Ethereum application and infrastructure builder ConsenSys closed a $450M in Series D funding round led by ParaFi Capital at a $7B valuation. Similarly, Singapore-based web 3 DeFi startup Treehouse raised $18M in a seed funding round led by an undisclosed large FinTech investor. Corl Financial Investments Inc. also hit the headlines for securing $20M in USD stablecoin from a DeFi cryptocurrency investment company, Naos Finance.

When it comes to the various launches, DeFi infra project xToken launched a capital markets platform – xToken Terminal for web 3 – that will offer DeFi and NFT projects seamless access to financial primitives like liquidity mining, token offerings and collateralized lending. DeFi protocol Paribus launched a DeFi-based borrowing platform, allowing users to borrow against previously stagnant assets like NFTs to be used as collateral for loans. Blockchain-based DeFi project lala Finance also officially launched its DeFi staking protocol – adding farming, staking, and liquidity providing functions in the near future for users; thus allowing them to earn lucrative APY against their holdings.

Furthermore, cross-chain transaction platform iSwap launched iSwap V6, its latest version, with upgrades adding support for the Solana blockchain platform and stablecoin DAI. Similarly, Avalanche blockchain’s compounding protocol Louverture launched a major update to its DeFi protocol titled Rise, introducing multi-tiered proprietary gamification of ERC-721 standard NFTs.

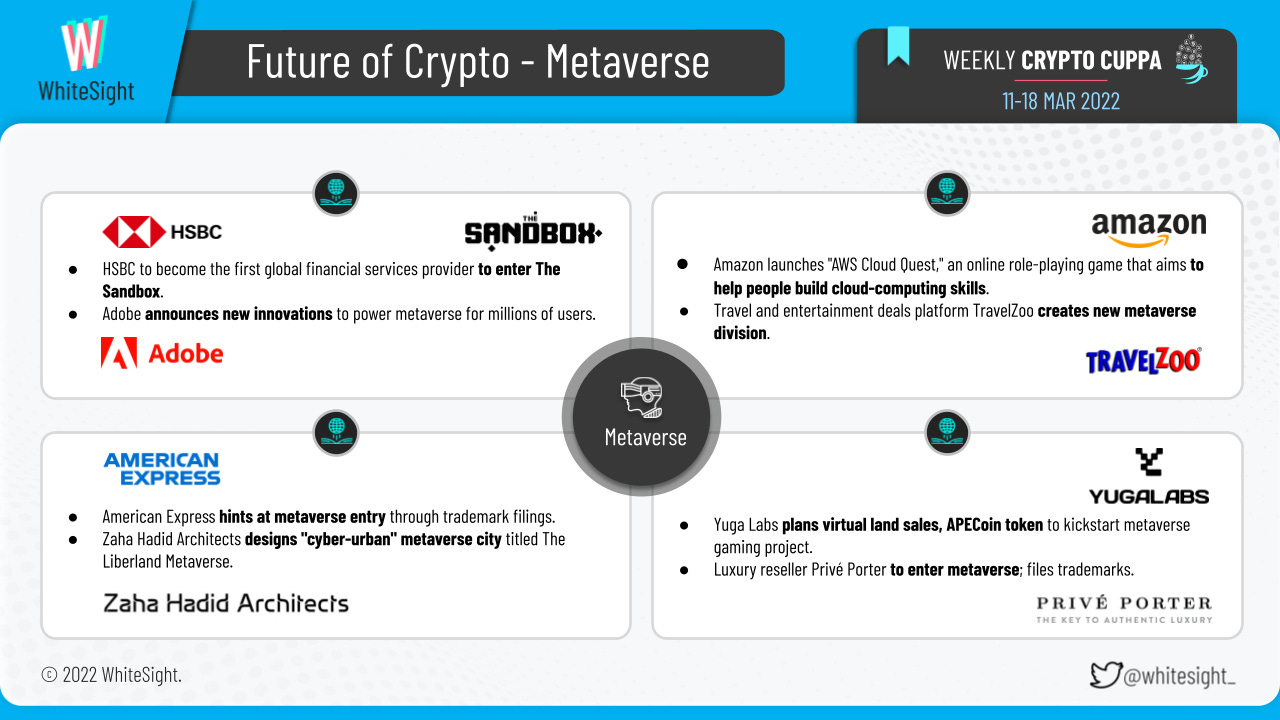

The world of metaverse has been gaining traction from a diverse range of industries. A variety of market expansions played their part in furthering the trending metaverse realm:

Amazon launched "AWS Cloud Quest," an online role-playing game that aims to help people build cloud-computing skills.

American Express hinted at a metaverse entry through multiple trademark filing for its logos and items including the Centurion black card and “Shop Small” program.

HSBC became the first global financial services provider to enter The Sandbox by acquiring a plot of LAND and developing it to engage and connect with sports, esports and gaming enthusiasts.

Luxury reseller Privé Porter announced its plans to enter metaverse, having filed trademarks.

Zaha Hadid Architects made the bulletin for designing a "cyber-urban" metaverse city titled The Liberland Metaverse, where residents can buy vacant plots centered around a curated urban core, and access them as avatars.

Yuga Labs was also in the news for its plans for virtual land sales and APECoin token in order to kickstart a metaverse gaming project.

Additionally, Adobe announced new innovations to power the metaverse for millions of users.

What’s more – travel deals platform TravelZoo created a metaverse division that will provide members with exclusive access to the latest and best Metaverse travel experiences.

On the fundings front, Blockchain game development studio Metaverse Game Studios raised $10M in a funding round co-led by Pantera Capital, Animoca Brands, Solana Ventures and Everyrealm.

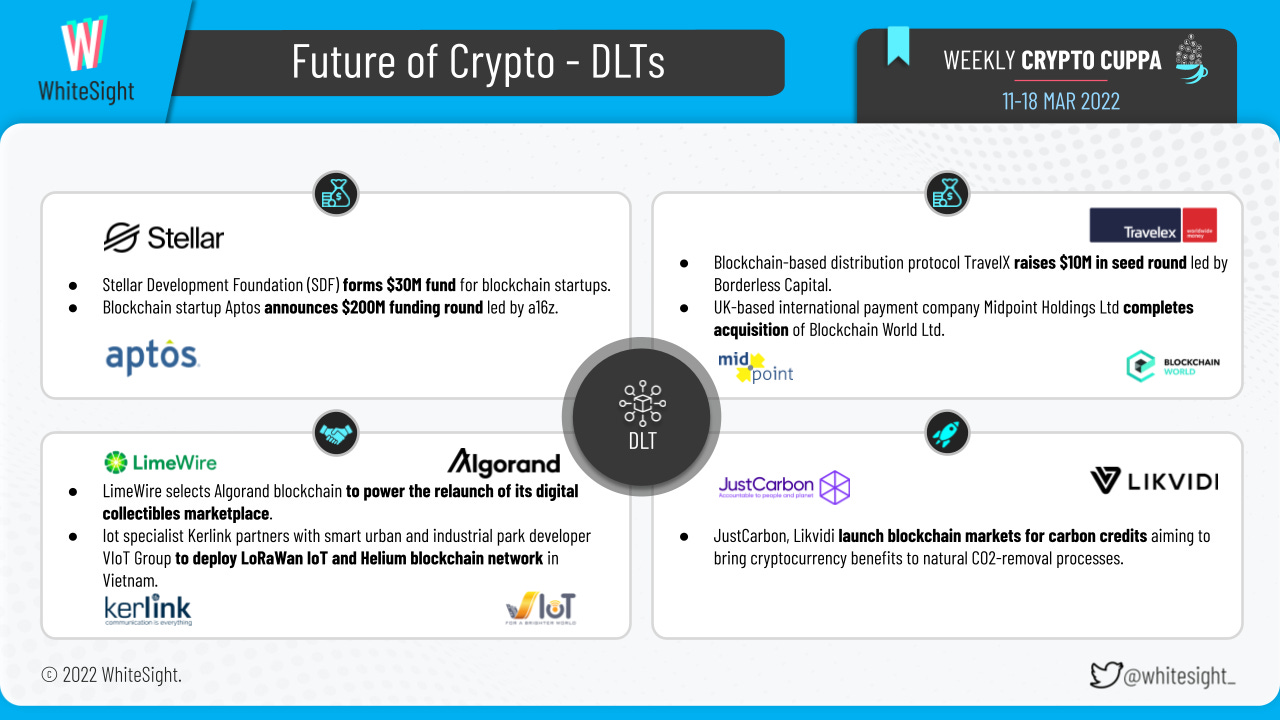

An assorted mix of fundings and partnerships made up for most of the brew in the DLT vertical.

Aptos, a team helmed by former Facebook coders bringing Diem blockchain to life, confirmed a $200M raise in a funding round led by a16z. While the Stellar Development Foundation (SDF) established a new $30M matching fund to provide more early-stage blockchain projects access to funding, blockchain-based distribution protocol TravelX raised $10M in seed funding that was led by Borderless Capital. UK-based international payments and peer-to-peer foreign exchange service company Midpoint Holdings Ltd also grabbed the headlines after completing the acquisition of B2C blockchain company, Blockchain World Limited, with the latter's founder Domenic Carosa joining as non-executive director of Midpoint’s board.

As for the partnerships, software company LimeWire selected the Algorand blockchain to power energy-efficient NFTs on the platform, along with a token launch later in 2022. Iot specialist Kerlink partnered with smart urban and industrial park developer VIoT Group to deploy LoRaWan IoT and Helium blockchain network in Vietnam by the end of May, 2022.

In other news, carbon offset marketplaces JustCarbon and Likvidi announced the start of trading platforms for tokenized carbon credits, giving participants the ability to trade greenhouse-gas emissions and lower their carbon footprints.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Crypto Cuppa, and we'll be back with more next week!

Till then, if you're hungry for more FinTech insights, check out some of our other work at WhiteSight. Our latest publication takes a closer look at Open Banking and Emerging Opportunities in MENA in partnership with Mod5r.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for our strategic intelligence and research content services, reach out to us at hello@whitesight.net

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter and don't be shy to show some ❤️