Howdy Web3 folks!

Happy Friday! We’ve got your weekend covered with another Web3 jam to get you in the mood. Feel the thrill as you journey through the Web3 rollercoaster adventure 🎢 and immerse yourself in the enchantment ⚡ of five captivating themes from the decentralised world. Let's ratchet things up, huh?

To start off the newsletter, check out this Twitter thread that you won't wanna miss out on -

Click here to read the whole thing.

Here’s the TL;DR:

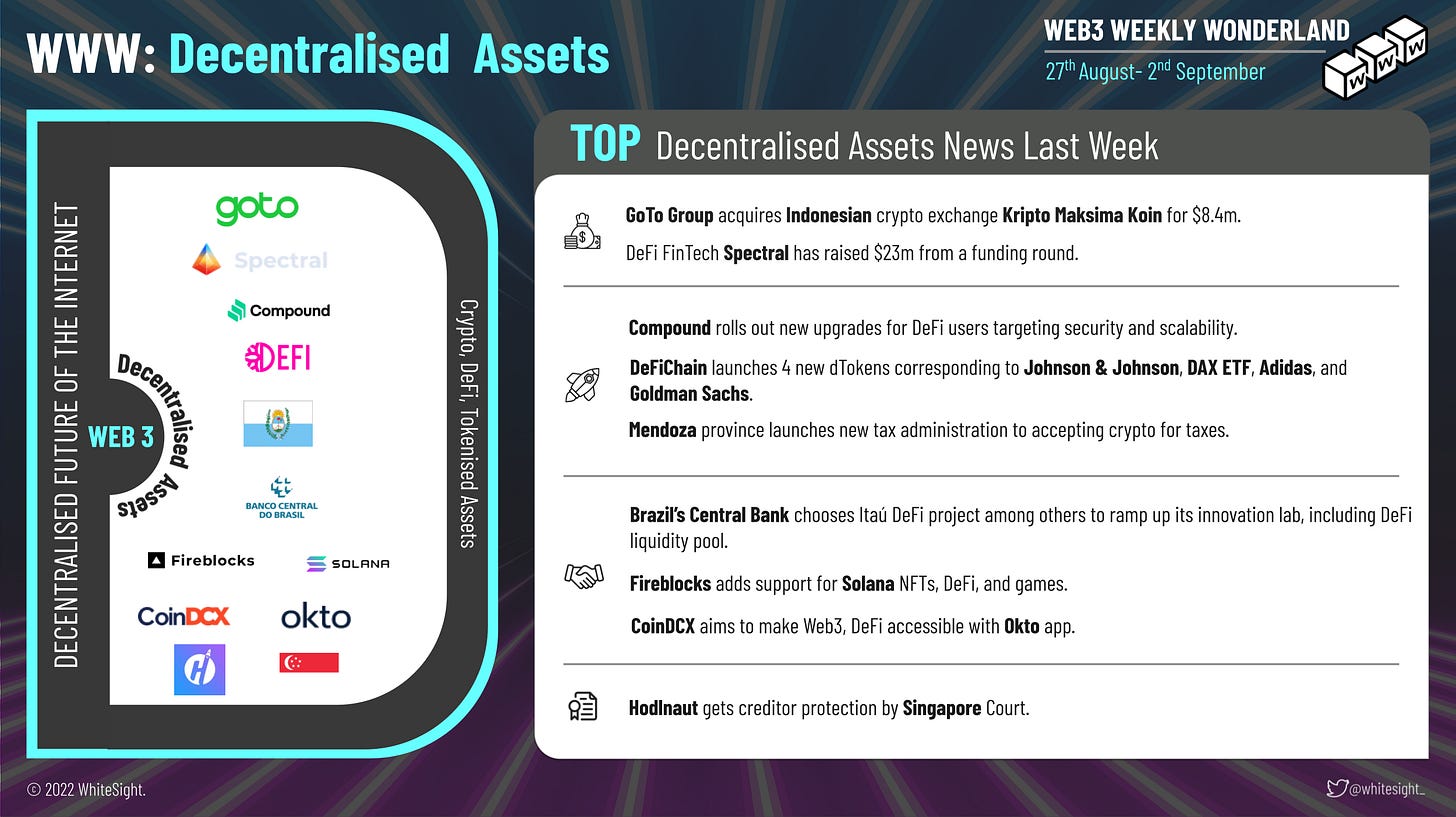

This time, we're on an adventure that involves quite a few pit stops along the way! First stop – Indonesia, where GoTo Group acquired local crypto exchange company Kripto Maksima Koin for $8.4M. To make things more tropical, we arrive at Brazil, where The Central Bank of Brazil picked proposals for eight new projects, including the DeFi liquidity pool from Itaú Unibanco, as part of financial and technological innovation.

Inputs from all regions globally is essential to get a better understanding of Web3 trends, which is why we make a stop at Stanford University, which collaborated with Input Output Global by establishing a peer-reviewed research hub worth $4.5M at the university.

To add fuel to the raging flames in the Web3 landscape, Fireblocks added support for Solana-based NFTs, DeFi, and Gaming apps, allowing Fireblocks’ customers to interact directly with Solana-based applications. It's a fireball of money for Singapore's state investment fund, too, where Temasek is leading a $100M funding round in non-fungible token (NFT) and metaverse investor Animoca Brands.

Everyone was all about upgrading the past week, with Compound launching a new version of its DeFi lending platform, Compound v3, meant to reduce the number of supported tokens available for borrowing. Taking up the challenge like a bullet, Ethereum founder Vitalik Buterin proposed an upgrade to the ENS DAO, assessing a tax on ENS Domain names to make more money.

To make things even more fabulous, Fabwelt joined hands with Polygon Studios to scale the growth of Fabwelt’s existing games and upcoming future games in the Fabwelt Ecosystem. Creating proof that NFTs are still in the game were CreatorDAO for raising $20M in a seed funding round led by a16z crypto and Initialized Capital, and NFT collective Proof for securing $50M in a Series A funding round as it gears up for the launch of its latest NFT collection.

Let's dig deep into the decentralised dimension –

Decentralised Currency ㅡ the segment brings a chock full of hot-off-the-press headlines to offer. We have devoted the space to newsworthy stories in the world of Crypto, DeFi and Tokenised Assets.

Clinkin’ Crypto Chips

Talkin’ about the tick-tacks of money ㅡ GoTo Group, the merged entity of major Indonesian tech players Gojek and Tokopedia, acquired local crypto exchange company Kripto Maksima Koin for $8.4M, and Barclays analyst Benjamin Budish initiated coverage of crypto exchange Coinbase with an equal weight rating and an $80 price target.

We now onboard the crypto train to Busan city, which signed an agreement with crypto exchange FTX to develop and promote various blockchain-focused businesses and establish the Busan Digital Asset Exchange. The next turn is to Japan, where The Financial Services Agency (FSA) proposed easing corporate tax rules for crypto assets as well as lighter levies for individual stock investors in support of Prime Minister Fumio Kishida’s efforts to reinvigorate the economy.

And lastly, we cross the tunnel to enter another country – Argentina. Here, a shift toward modernised payments occurred, as the Mendoza Province implemented a system that allows taxpayers to pay their taxes fully with cryptocurrencies. A crypto bonanza for Mendoza!

Dazzles of DeFi

Several players bombed the market with new launches ㅡ DeFiChain, who announced the additions of four new decentralised tokens to give users price exposure to their favourite stocks and ETFs without geographical restrictions. The newly added dTokens include $dJNJ – Johnson & Johnson, $dDAX – Global X DAX Germany ETF, $dADDYY – Adidas AG – ADR, and $dGS – Goldman Sachs Group Inc. Things are heating up in the DeFi world with big guns making big bangs!

Compounding the new launch activity, Compound launched a new version of its DeFi lending platform, Compound v3, to reduce the number of supported tokens that can be borrowed and collateralised on the protocol.

Money talks and business walks for DeFi FinTech Spectral, which raised $23M from a funding round to help the company fund its vision of a decentralised platform of Machine Learning models to make credit scoring open and accessible to everyone.

Keeping accessibility of DeFi on top of its plate, The Central Bank of Brazil picked proposals for eight new projects to ramp up through its innovation lab, including the DeFi liquidity pool from Itaú Unibanco, the country’s largest bank. The Central Bank chose these projects as part of financial and technological innovation.

Inching its way into the Web3 ecosystem, Mumbai-based crypto exchange CoinDCX announced during Unfold 2022, CoinDCX's Web3 event, a mobile app called 'Okto'. From dipping toes to drowning, we saw Solana-based DeFi protocol OptiFi, which accidentally closed its mainnet platform in a programming blunder, locking away $661k.

The DeFi sky was lit up by Fireblocks, a crypto asset custody and services firm, which added support for Solana-based NFTs, DeFi, and Gaming apps, allowing Fireblocks’ customers to interact directly with Solana-based applications. The DeFi atmosphere got more intense, with Synthetix proposing to cap the number of its native SNX tokens to a fixed 300 million as the protocol gains revenue from newer products.

Well, a little glimpse of the sun amongst the clouds is the news of crypto lender Hodlnaut who was placed under interim judicial management by the Singapore High Court, which allows a financially distressed company to be restructured under court supervision. All's well that ends well!

Decentralised Tech – the space springs into life with events centred around Blockchain, Smart Contracts, and Oracles ㅡ perfect for keeping the pulse on Web3!

The segment witnessed many money-making moments fueled by a bunch of funding rounds and a host of other events that piqued our interest last week!

Like a thunderbolt, the money jingles throughout the ecosystem. So, keeping the thundering light of wealth blazing, Lightnet Group announced it secured a $50M capital commitment to grow its infrastructure and operations. Contributing more to the frenetic flow of money, Contribution Labs raised $3M in an equity sale, according to a filing with the US Securities and Exchange Commission, to contribute towards its goal.

Removing blocks from its journey to success, blockchain gaming platform Xterio raised $40M in a funding round aimed at developing games and building out the platform. Amid the shower of cash, Sei also announced a $5M funding round to support the network and further accelerate the growth of over 20 dApps already building in the Sei ecosystem.

Strengthening the gears of the ecosystem anew via bigger names, we had Cardano blockchain builder Input Output Global (IOG), who funded a $4.5M blockchain hub at the one and only ㅡ Stanford University, the latest in a series of academic research outposts around the globe.

As we move forward with the money talk, DeFi oracle platform RedStone raised nearly $7M to develop a faster, cost-efficient cross-chain oracle for decentralised finance protocols.

A fortune of novel launches were seen to be propelling the Web3 jet upward:

Taking the Web3 myriad into a spout, Myria announced the release of a blockchain gaming-focused Ethereum (ETH) layer 2 (L2), a scaling solution that enables fast and efficient transactions as well as gas-fee-free gaming.

On top of that, the EOS Network Foundation kicked off a new era by forking the underlying software for EOSIO blockchains to Antelope, a new, community-led blockchain protocol pioneered by ENF members.

Integrating to interchange each other’s tech and coming up with solutions seems to be an ideal way to grow the Web3 tech! The past week saw The Graph adding Gnosis Chain to its decentralised blockchain Indexing protocol, bringing it a step closer to sunsetting its centralised "hosted" service.

Drawing the graph of integration the right way, we saw Ledger revealing that they integrated Filecoin into Ledger Live Desktop to power a decentralised internet where storage is owned and operated by its users.

To make things juicier, Singapore’s Marketnode revealed its plans to launch the blockchain-based FundNode in association with the Singapore Funds Industry Group (SFIG) in 2023. And if that wasn’t enough pulp, what makes it even better is the presence of big players affiliating with the association, namely HSBC and Citi. Blockchain building blocks of success!

In other news, Stabila, a POS blockchain focused on bank-grade stablecoins and bank-grade digital assets, made it possible for counterparties to exchange digital crypto assets instead of relying on fiat currencies.

Virtual Assets World – the one space that is obsessing over all the gizmos of the Web3 universe through NFTs, Metaverse, and eXtended Reality ㅡ Navigating, Magnifying, and Enchanting the virtual assets’ world!

Notoriety of NFTs

Nothing ever gets boring when the money keeps rolling in ㅡ NFT Genius announced a $150M value, and the funds will also be used to expand beyond sports and support significant entertainment and culture partnerships.

Japan’s NFT space is blossoming like the cherry blossoms, where Asia’s crypto games and Web3 investment powerhouse Animoca Brands see its local unit picking up $45M in financing at a $500M pre-money valuation for NFT push. Further, NFT collective Proof raised $50M in a Series A funding round as it gears up for its latest NFT collection launch.

The rollercoaster ride has reached the partnership zone with LasMeta announcing a strategic partnership with Oxalus. Taking strategic alliances one step further, Lithium Finance announced its collaboration with Cyan, which will serve as a key partner in the pursuit of optimising the process of appraising NFTs.

Magnetic Metaverse

The magnetism of the metaverse is reaching new heights, allowing brands to tie up together to enhance their appeal further. Last week, LootMogul announced that it selected DigitalBits as the first blockchain to create the MOGUL tokens. Additionally, ORIGIN Metaverse announced the addition of an affiliate partner, Vreal.mx, giving Vreal.mx a competitive edge in offering luxury real estate solutions that combine technology with first-class service.

Metaverse magic continues to spread ㅡ Jupiter Meta launched Rent-A-Meta, a multi-utility space offering Metaverse-as-a-Service in India.

This ride isn't over yet, and in fact, reaching Singapore! Singapore's state investment fund Temasek was also in the news for leading a $100M funding round in NFT and metaverse investor Animoca Brands.

Goofy GameFi

The gambles of GameFi are booming, so much so that brands are ramping up partnerships to gain a foothold. DeNet partnered with GameSol, providing GameSol with a Web3 life-needed infrastructure — decentralised storage along with secure, permanent, and fast access to it.

Unlocking the enticing world of GameFi, Unlockd partnered with Klay Guild Games, a community gathering gamers to play, learn, and share everything about blockchain games.

A little further into the ride, we saw Fabwelt joining hands with Polygon Studios to scale the growth of Fabwelt’s existing games and upcoming future games in the Fabwelt Ecosystem.

Decentralised Governance – the sphere where a karaoke of events was the main highlight, from get-togethers to a bunch of upcoming new stuff and a whole lot more!

As it turns out, coming together is the go-to way for building community ― Gamerse formed a partnership with Megaverse to unify the fragmented blockchain gaming space by creating a community-driven social ecosystem called MegaDAO.

Making its name in the meta merit list is Merit Circle DAO which announced a collaboration with Vorto to co-launch the much-anticipated multiplayer real-time strategy game Hash Rush, the version of which is expected to arrive in September 2022.

Putting all the blood, sweat, and tears into play, Sweat Economy made the news for its plans to host a Web3 token sale for its new cryptocurrency as it bids to scale its ecosystem dedicated to incentivising healthier living by rewarding people for their movement.

Marvelling at the march, Marvion launched Producer's Club with Forensic Psychologist and Tape at Club DAO, Hong Kong's member's club designed for those who are active and interested in cryptocurrencies, blockchain technology, NFTs, and the Metaverse.

Dodging all DeFiying moves in the industry, the Layer-2 solution for Dogecoin (DOGE) announced the $DC governance token launch. There will also be an airdrop accompanying the launch of the token.

Creating an aura via jiggling cash, CreatorDAO raised $20M in a seed funding round led by a16z crypto and Initialized Capital.

Upscaling at the speed of a bullet, Ethereum founder Vitalik Buterin proposed an upgrade to the ENS DAO to assess a tax on domain names based on active offers for ENS Domain names, creating revenue opportunities. We hear the ka-chink of money coming in >>

We saw a swalla moment for BLOCWARS operator Blocverse DAO, who announced the acquisition of IP creator Swagga Studio to establish the phygital fashion metaverse, SWAGGA, that combines the elements of fashion, amusement, social network and e-commerce. Tic tac toe, let's make the metaverse fashion world grow!

Community of DeFi lending and borrowing protocol Aave proposed on the ground to halt Ethereum borrowing until the launch of the Merge, as it might put utilisation risk while moving from PoW to PoS.

In a not-so-slow move, Slow Ventures hit the headlines after it raised its stakes on crypto governance with Timber sDAO.

What’s more – DEX platform Uniswap’s community voted to create a foundation that supports open-source development, improves the governance of the protocol’s community treasury, streamlines the grants process, promotes Uniswap ecosystem developers, and strengthens the community. What a power-packed move!

Decentralised Identity was shining bright like a diamond with tons of activities going on within the ecosystem that’s sprouting a vibe within the blockchain world.

Keeping up with the goal of a free circulation of data assets around the world, Encentive joined the PlatON ecosystem and received a grant from the LatticeX Foundation to apply Encentive's turn-key, multi-chain dApp building platform to use tools and interoperability development for LatticeX's PlatON network. Encentive utilising all the incentives to boost itself up!

Similarly, digital security and privacy company Avast joined the Trust Over IP Foundation (ToIP) and the FIDO Alliance to commit to identity industry standards to enable global-scale digital trust.

Rolling our way into the funding (g)rounds, EMURGO Ventures announced an investment into AID: Tech to accelerate the expansion of its Web3 products and services for a positive social impact.

We next reach Finland, where the Finnish Ministry of Finance granted the Findynet Cooperative a $3M government grant to build a pilot environment for a self-sovereign identity network to strengthen Finland's leading position in digitalisation and support the emergence of investments in new digital services.

Reaching all the way to Singapore, where GammaX announced the closure of a $4M seed round, backed by the likes of StarkWare and Dexterity Capital.

Forming bonds to bolster the foundation, VMware blockchain linked in Ethereum for the enterprise to boast its scalability.

Furthermore, Partisia blockchain foundation also integrated its Mainnet v3 into Polygon, creating a new Unified Smart Contract technology that brings multi-party, zero-knowledge computation to Polygon, enabling developers to build new blockchain-based use cases.

Solving problems of the ecosystem was healthcare blockchain platform Solve.Care, which announced the launch of Care.Labs Wallet, allowing users to access Care.Labs portal, a healthcare Imaginarium where users can create decentralised healthcare applications (dApps) without programming knowledge.

And lastly, big tech investors and Web3 communities joined Grants Round (GR) 15, resulting in the creation of new ecosystem rounds that promote infrastructure, blockchain security, and the Chinese developer ecosystem.

It can sometimes be overwhelming for our Web3 wanderers to get their heads around the Web3 world 🌎 with new things popping up every other day 🆕. So, let's learn more about Web3 as we wrap up. Come learn with us! ✨

Web3 Word Of The Week

Flash Loans: Traditional loans require you to jump through lots of hoops – You usually need collateral, for example, and your creditworthiness must be reviewed. In the case of flash loans, they are granted instantly, allowing users quick access to funds. Thanks to smart contract rules, flash loans require borrowers to pay back the loan before the transaction ends. The smart contract reverses the transaction if this condition isn't met. Despite this, cybercriminals can also exploit poorly protected protocols to carry out their crimes. In some cases, smart contracts that are not built correctly leave loopholes for hackers to exploit.

And finally, treat yourself to this Web3 delight 🍩 this weekend for a taste of Web3 World!

Merit Circle – Whitepaper

That’s all for now!🤘

We hope you enjoyed this edition of the Web3 Weekly Wonderland experience, and we'll see you next Friday! 💌

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include witnessing the evolution of Marcus’ Expedition from Wall Street to Main Street and journeying through Revolut's Playbook to Build a Global Financial SuperApp

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and research content services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️