Worldwide Web3 Wonderland | Edition #37 – Sept 2023

Summary of news from 1st to 15th Sept 2023

Hello, fellow adventurers of the web3 realm!

Get ready to embark on an exciting journey into the ever-evolving world of web3! Join us this weekend as we unveil the latest updates in our Worldwide Web3 Wonderland, where visionaries and innovators come together to explore the enchanting realms of the web3 landscape. 📰

Before we fully immerse ourselves in the realm of web3, we have an exciting surprise in store: our blog on The Unbundling of Finance for SMEs: A Fintech Revolution!

In the ever-evolving finance landscape, fintech is revolutionising the game, especially for small and medium enterprises (SMEs).

From payments and banking to financing and insurance, fintech is reshaping SME finance. But wait, there's more! We're delving deep into how fintech is supercharging small businesses with cash management, value-added perks, and tech wizardry!

Curious to learn more?

Dive into the full story now, where we take a deeper look at how fintechs are unbundling SME finance!

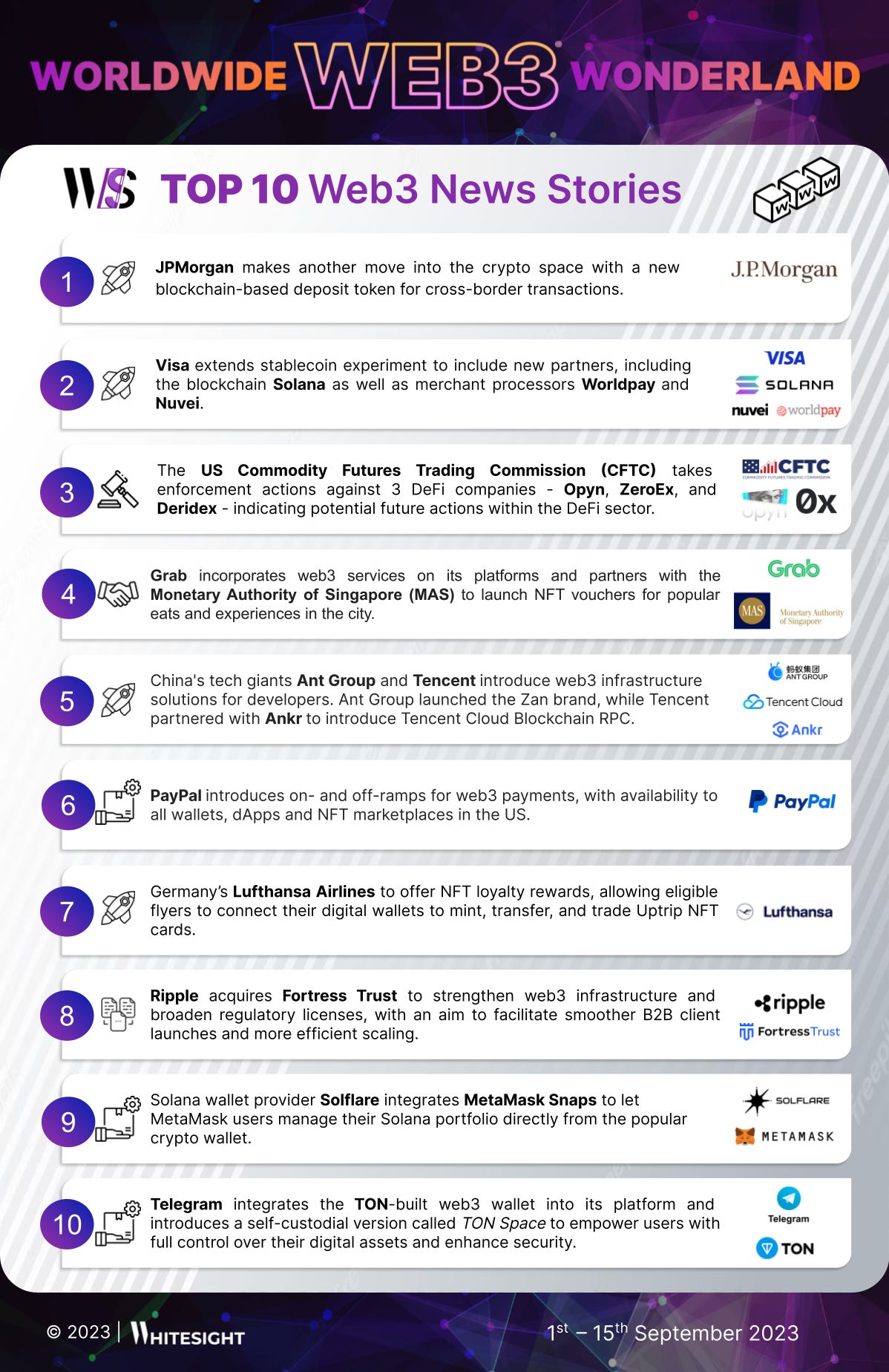

Here are the top headlines from this past fortnight of the web3 cosmos:

PayPal introduced on- and off-ramps for web3 payments, making it easier to buy and sell supported crypto in the US through PayPal integration. This benefits web3 merchants by expanding their user base, providing fast payments, and enhancing security. Previously live on Metamask and Ledger, the service is now available to all wallets, dApps and NFT marketplaces.

Telegram integrated TON's web3 wallet into its platform, marking a significant web3/web2 partnership. It's also introducing a self-custodial version called "TON Space," allowing users full control over their digital assets and enhancing security.

Solflare integrated MetaMask Snaps into its Solana wallet, simplifying portfolio management on the Solana blockchain which allows users to seamlessly interact with Solana's dApps through the popular crypto wallet.

Visa extended its stablecoin experiment to include new partners, including the blockchain Solana as well as merchant processors Worldpay and Nuvei. It has already tapped the Solana blockchain, along with its prior partner Ethereum, to settle millions of USD Coins in fiat currencies via its VisaNet cross-border system.

Financial giant JP Morgan also grabbed headlines as it moved into the crypto space with a new blockchain-based deposit token for cross-border transactions which will be first launched for corporate clients to speed up payments and settlements. The solution contrasts with stablecoins, which are usually issued by a non-bank private entity.

Chinese tech giants Ant Group and Tencent Cloud went head to head as both introduced blockchain solutions for web3 developers. Tencent Cloud Blockchain RPC, jointly developed with Ankr, aims to deliver reliable web3 infrastructure, along with developer services to web3 builders. On the other hand, Ant Group launched a sub-brand called Zan, offering a suite of blockchain application development products and services to help web3 developers.

Southeast Asian super-app Grab grabbed a spot in the web3 space, introducing a web3 wallet and blockchain-based rewards like NFTs. It also partnered with the Monetary Authority of Singapore (MAS) for a pilot study, where it is offering NFT vouchers for popular eats and experiences in the city.

Speaking of NFTs, Lufthansa is launching a loyalty program called 'Uptrip', allowing flyers to collect rewards in the form of NFTs, which will be based on the eco-friendly Polygon blockchain.

Moreover, Ripple acquired Fortress Trust, a licensed financial institution that specializes in web3 technology. Given its run-ins with the SEC, the purchase of Fortress Trust and its Nevada trust license also adds to a pool of regulatory permits that the company has recently amassed, which includes 30 state money-transmitter licenses and a New York BitLicense.

On the regulatory tangent, the US Commodity Futures Trading Commission (CFTC) took action against three DeFi companies – Opyn, ZeroEx, and Deridex – for illegally allowing US customers to trade digital-asset derivatives without registering. They were ordered to cease and desist and required to pay civil penalties. Consequently, the US government has increasingly set its sights on decentralized finance, signalling that more may be coming.

That's all for now!🤘

We hope you enjoyed this edition of the Worldwide web3 Wonderland!

If you're hungry for more fintech insights, check out some of our other work at WhiteSight.

Our latest publications include –

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️