Hey there, Web3ers!

Enjoy your weekend to the max by grabbing the newest issue of the Web3 Newsletter! The Web3 rollercoaster will take you on a thrilling journey 🎢 through every facet of the decentralised world as you journey through five distinct themes!

Let’s get this party started >>>>

As the financial industry witnesses a total transformation, the question of how women fit in this expanding space looms in the air. Take a look at some of the women-focused game-changers who are taking ‘DeFi’nitive Steps Forward through a blog we did earlier this year as we #breakthebias surrounding women in the Web3 space.

Now for the weekly blue bird update ㅡ A thread on the regulatory scenario of crypto:

Read the entire thread here.

Here's the TL;DR:

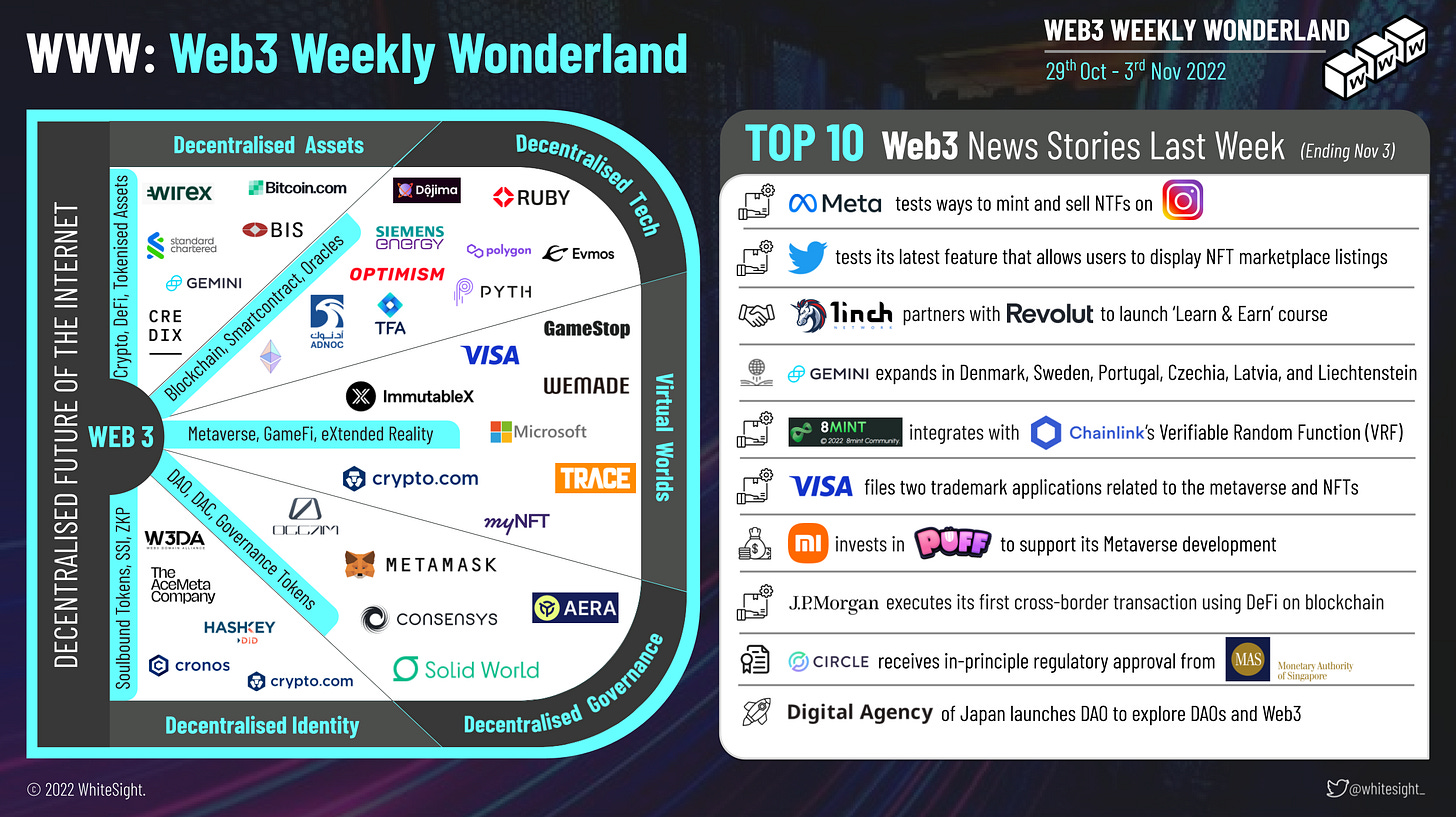

The Web3 rollercoaster was seen to be crossing borders – with J.P. Morgan executing its cross-border transaction using DeFi on a public blockchain and Gemini expanding its geographical reach by launching in Denmark, Sweden, Portugal, Czechia, Latvia, and Liechtenstein.

It was all about testing and succeeding the past week, as Twitter tested its latest feature that allows users to display NFT marketplace listings, while Meta announced that it’s testing minting and selling NFTs on Instagram.

The metaverse magic is in full swing as Visa filed two trademark applications related to the metaverse, and Xiaomi announced that it will invest in a new 3D metaverse called Puffverse.

Explore-learn-and-earn is in vogue right now, with 1inch Network teaming up with Revolut to develop a learn-and-earn crypto course and The Digital Agency of Japan launching a research DAO to investigate aspects of digital assets.

And while Circle Internet Financial received in-principle approval as a major payments Institution Licence holder from the Monetary Authority of Singapore (MAS), 8mint integrated with Chainlink’s Verifiable Random Function (VRF) on Ethereum, Polygon, and BNB Chain.

Let's dig deep into the decentralised dimension –

Decentralised Assets 一 We kick start the Web3 space with the pillars of the decentralised world ― Crypto, DeFi, and Tokenised Assets.

It’s all about the big players in the Decentralised Assets realm as J.P. Morgan executed its cross-border transaction using DeFi on a public blockchain, facilitated by the Monetary Authority of Singapore’s (MAS) Project Guardian, which was established as part of a pilot program to explore potential DeFi applications in wholesale funding markets.

Similarly, Standard Chartered led a pilot initiative to explore the issuance of tokens linked to trade finance assets aiming to digitise the trade distribution market.

Moving on, BIS Innovation Hub announced the launch of a new project designed to explore CBDCs and DeFi protocols, dubbed Project Mariana, that will intend to explore automated market makers (AMM) for the cross-border exchange of hypothetical Swiss franc, euro and Singapore dollar wholesale CBDCs.

Further, Bitcoin.com also made it to the news after it announced the public sale of the VERSE utility token that will reward participants for buying, selling, storing, using, and learning about cryptocurrency while supporting those who are seeking accessible onboarding into Bitcoin and DeFi.

New launches rained in the Web3 town – Wirex launched DUO, the dual-asset yield-generating tool, allowing their customers to earn the difference in market price from a trading pair over a certain duration, where they'll be paid out in one of the two currencies plus the yield.

Similarly, decentralised credit marketplace Credix Finance launched monetary support of up to $150M to the lending platform Clave, where the fund will serve as a credit pool that Clave will use to issue loans to businesses and private individuals across Latin America.

Meanwhile, Gemini made the bulletin for its plans to expand its geographical reach, as it announced its launch in Denmark, Sweden, Portugal, Czechia, Latvia, and Liechtenstein, enabling users from these regions to open to deposit, trade, and custody over 100 cryptocurrencies.

In other news, DEX aggregator 1inch Network teamed up with FinTech firm Revolut to develop a learn-and-earn crypto course on DeFi where users can earn $1INCH. Additionally, Circle Internet Financial received in-principle approval as a Major Payments Institution Licence holder from the Monetary Authority of Singapore (MAS), allowing Circle to offer digital payment token products, cross-border and domestic transfer services in the city-state, giving rise to a new generation of financial services and commerce applications. Circle deserves a round of applause for this!

Decentralised Tech – A section that you do not want to miss out on, featuring key elements of the Web3 space, i.e. Blockchain, Smart Contracts, and Oracles – the things driving the Web3 revolution!

Partnerships, partnerships, and just more of partnerships – that was the story last week in the DLT segment. Dojima Network formed a strategic partnership with privacy-centric Web3 data management platform Ruby Protocol to create and integrate a private data management framework.

Taking the Web3 rollercoaster across the globe, Abu Dhabi National Oil Company (ADNOC) and Siemens Energy joined forces to pilot blockchain technology to certify the carbon intensity of a range of products using smart sensor data gathered from across ADNOC’s operational chain.

Meanwhile, a Memorandum of Understanding (MOU) was signed by the Thai Fintech Association (TFA) and the Hungarian Blockchain Coalition to explore the use of blockchain technology in their countries.

While 8mint integrated Chainlink Verifiable Random Function (VRF) on Ethereum, Polygon, and BNB Chain mainnets to help power fair raffles for allowlist distribution, Pyth network announced its high-fidelity data feeds are now available on Ethereum and Optimism, a Layer 2 scaling solution for Ethereum. Through the integration, any Ethereum or Optimism program can permissionless request and directly consume any of Pyth’s 80+ data feeds for equities, commodities, foreign exchange pairs, and cryptocurrency to power their protocols.

On the other hand, Evmos chain core developer Tharsis Labs also hit the bulletins after it raised $27M in a token sale led by Polychain Capital, where the funding will go toward hiring more engineers, developing partnerships, and building out the Evmos ecosystem of interoperable dApps.

Virtual Assets World – Your gateway to the glitz and glamour of the Web3 universe: NFTs, Metaverse, and eXtended Reality!

Magnificent Metaverse

Creating a metaverse tribe, 3D and Augmented Reality (AR) platform Threedium announced a partnership with fashion platform Faith Tribe to provide web 3D tools to Faith Tribe’s ecosystem members as part of a toolkit of Web3 solutions for phygital creation of fashion items.

Strengthening the meta ecosystem, Xiaomi also announced that it will invest in a new 3D metaverse called Puffverse and will support Puffverse during its development stage.

Nascent NFTs

Every big name seemed to be jumping the NFTs bandwagon – Twitter announced a test of NFT integration in the future and announced an experimental feature that prominently displays NFT listings when users tweet a link to them.

Meta announced that it’s testing minting and selling NFTs on Instagram, while payments giant Visa is journeying to Qatar’s FIFA 2022 as the company unveiled Visa Masters of Movement, a hybrid auction that fuses Football, Art and NFTs to enhance the fan experience ahead of FIFA World Cup Qatar 2022.

From Qatar we now head to London, where Multichain NFT marketplace myNFT announced the debut of its physical NFT vending machine at this year’s NFT.London event. The vending machine will allow users to purchase an NFT without owning a digital wallet.

The NFT realm is never short of eye-grabbing events – GameStop Corp. announced the official launch of the GameStop NFT Marketplace with ImmutableX Pty Limited, which unlocks access to Web3 games and millions of world-class, NFT gaming assets to tens of millions of GameStop players.

Glory of GameFi

Getting into the heart and soul of GameFi – Soulbound integrated with a 3D gaming project which is built on the Binance Smart Chain, Ookeenga for Season 0, to offer the Ookeenga community their first opportunities to earn M-XP in the Ookeenga Discord!

Microsoft, too, made it to GameFi space, as the company invested in a Korean blockchain game company Wemade.

In other news, Visa is all set to immigrate into Web3 as it filed two trademark applications related to the metaverse: non-fungible tokens and digital currency wallets.

Further, establishing its trace into the decentralised world was Play-To-Earn NFT Metaverse project Trace, which raised over $3M in a closed round of seed investments in order to develop the metaverse, work on marketing and acquisitions, as well as brand development.

Decentralised Governance – Prepare yourself for a full-on frenzy of events featuring everything from partnerships to launches and beyond!

Occam DAO announced it would integrate Humanode.io following a stake-based voting round by the Occam DAO community, giving them a new ecosystem to help build from the ground up and the Humanode team its expertise and strength as an incubation layer for Humanode’s incredible network.

Solidifying its presence in Web3, Solid World DAO announced a new partnership with derivatives platform Neural Protocol that will support its mission to allow liquidity of forward carbon credits.

Furthermore, the reward-oriented management platform Aera joined Polygon to connect DeFi with DAO treasury management.

As for the launch vertical, blockchain technology firm ConsenSys announced it would spend $2.4M annually to fund its newly launched MetaMask Grants DAO aimed at driving further development of the Web3 ecosystem.

What’s more – The Digital Agency of Japan launched a research DAO in an effort to investigate aspects of digital assets and DAOs that could potentially be used for cross-border crimes that exploit blockchain technology and threaten user protection.

Decentralised Identity – Here's where you can catch all the buzz-worthy stories around self-sovereign identity and soulbound tokens.

Diving into the Decentralised Identity domain with various launches, Cromos chain’s identity protocol Cronos ID was in the news twice – first as it announced the upcoming minting and public launch of 500M Cronos ID native governance tokens, $CROID, which will offer utility to users of the Cronos ID social protocol; and second, as Cronos ID partnered with Crypto.com’s DeFi Wallet to enable sending and receiving crypto tokens using “.cro” domains.

But wait, there’s more! A new member-led coalition called Web3 Domain Alliance, meant to promote the technological advancement and interoperability of Web3 domain registries and improve the experience of Web3 users, went live.

Additionally, HashKey DID collaborated with The AceMeta Company, an AceMetaverse Enabler and IP Connector, to facilitate the creation of decentralised digital identities in the AceMetaverse, further bolstering the respective ecosystems of both AceMeta and HashKey DID.

Wrapping up the edition, we have Notebook Labs, which closed its $3.3M seed round led by Bain Capital Crypto to enable the company to further expand its development team and scale its technological infrastructure.

Web3 Word Of The Week

Wrapped Tokens: Wrapped crypto tokens are cryptocurrencies that are tied to another original crypto or assets like gold, stocks, shares, and real estate, which can be leveraged with DeFi platforms. The original asset is ‘wrapped’ into a digital vault, and a newly minted token is created to transact on other platforms. Wrapped tokens allow non-native assets to be used on any blockchain, build bridges between networks, and implement interoperability in the cryptocurrency space.

Don't forget to check out this Web3 delight 🍩 over the weekend for a peek into the Web3 realm, fresh from ‘The Whitehouse’!

That's all for now!🤘

We hope you enjoyed this edition of the Web3 Weekly Wonderland experience, and we'll see you next Friday! 💌

If you're hungry for FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include diving into A SEA of Transformation: Southeast Asia’s Digital Banking Landscape and exploring The UK Big Banks' Bet on FinTech

If you're someone who prefers to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, reach, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️