Ahoy Web3ers!

Make the most of your weekend by grabbing the latest edition of the Web3 Newsletter! Get ready for a euphoric ride on the Web3 rollercoaster 🎢 as you discover every aspect and angle of the decentralised world in a whole new way through five distinct themes!

Whatcha waiting for?

The crypto and digital assets sector is under regulatory scrutiny across the world. Last year, we did a study on the regulatory stance of G20 countries' Crypto. While we plan to refresh the study by the end of 2022, have a look at the industry as it was at the beginning of 2022.

Here's our analysis of the crypto regulatory landscape in Dec 2021: To C or Not To C: G20's Regulatory Stance on Crypto

Let's move on to our bluebird update ㅡ Do you know Ethereum is being used to cure cancer?

Read the whole thread here to find out how!

Here's the TL;DR:

We start the Web3 journey up above in the clouds – with Microsoft working on bridging its cloud and other divisions with multiple metaverse experiences, and Google announced its plans to launch a cloud-based node engine for Ethereum projects.

It was all about the money-money last week as Cash App announced its payment infrastructure’s integration with the Bitcoin Lightning network. MakerDAO community also approved a proposal to place a deposit of a staggering $1.6B in USD coin (USDC) with Coinbase Prime as custodian and generate a yield of 1.5%.

The vehicle of payments was fueled with notable events, with Fireblocks announcing the launch of its Payments Engine, and payment giant Mastercard and BitOasis partnering to launch a series of crypto card programs in the MENA region.

Cryptochips chipped their way into the headlines, too – Western Union is set to launch crypto-related services based on several recently filed trademark applications. At the same time, crypto-friendly bank SEBA Bank added an NFT custody solution to allow customers to hold NFTs without managing private keys.

Creating new waves in the ecosystem were Ernst & Young, which is all set to provide EY wavespace experiences in the metaverse; and Equifax and Oasis Labs, who partnered to build an identity management and know-your-customer (KYC) solution for Web3.

Let's dig deep into the decentralised dimension –

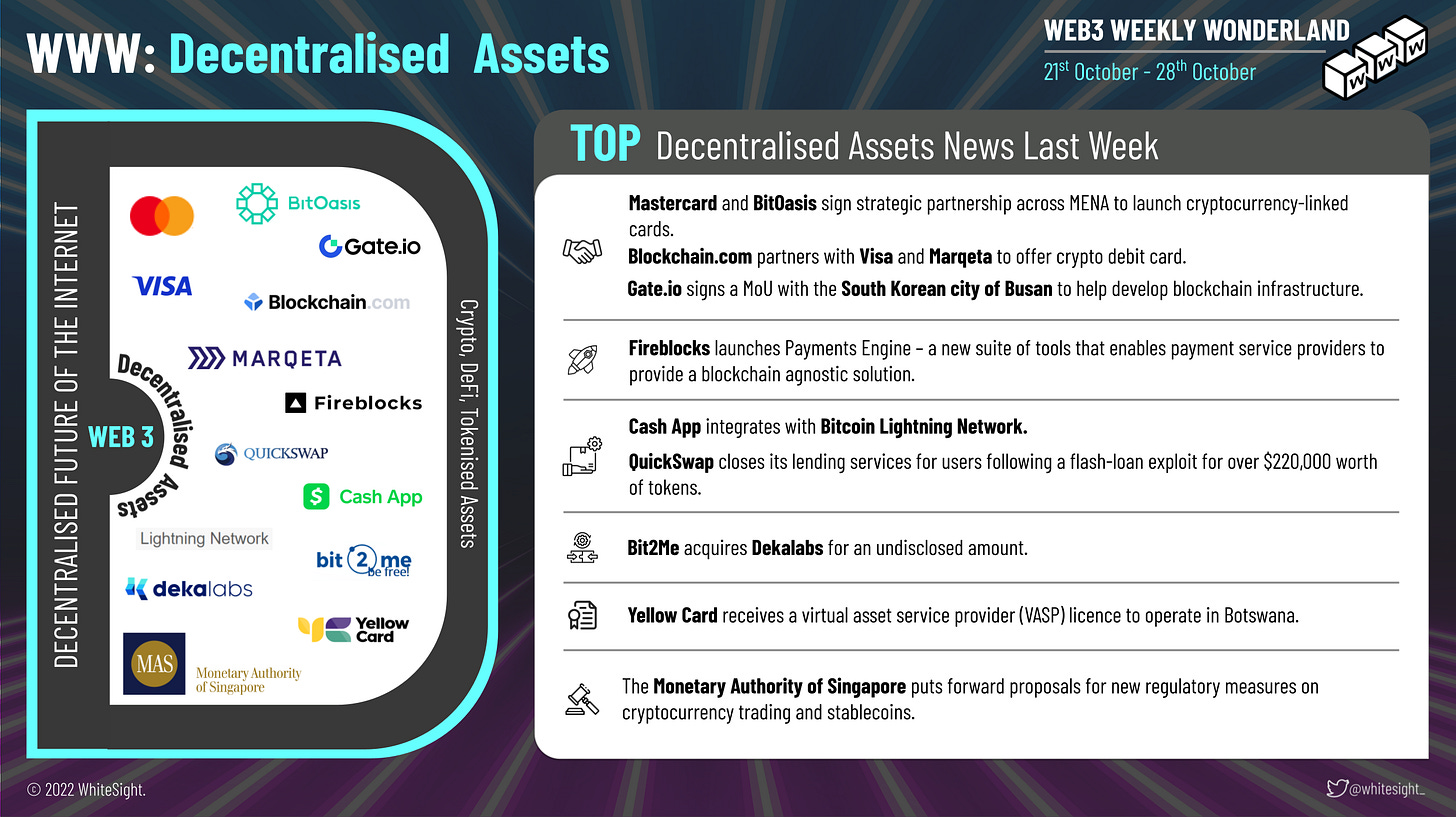

Decentralised Assets 一 Getting the gears turning for Web3 world, kickstarting with the pillars of the decentralised world ― Crypto, DeFi, and Tokenised Assets.

A mix of various events touched the Decentralised Assets segment this past week:

Mastering the art of partnership - Mastercard and crypto platform BitOasis partnered to launch a series of crypto card programs in the MENA region that will facilitate the day-to-day usage of cryptocurrencies at points of sale and across e-commerce platforms.

Crypto exchange Blockchain.com also joined the shindig by partnering with Visa to launch a crypto card, available to only US residents initially, allowing users to pay using their crypto or cash balance wherever Visa debit cards are accepted.

Moving on, crypto exchange Gate.io signed a memorandum of understanding (MoU) with the South Korean city of Busan to help develop blockchain infrastructure and operate and distribute a local stablecoin.

Ramping up the game through an acquisition- Spanish cryptocurrency exchange Bit2Me was also in the news after it bought blockchain and crypto-focused software development company Dekalabs for an undisclosed amount to enhance the former's position in helping companies and institutions build tools on cryptocurrency and blockchain protocols such as Bitcoin and Ethereum.

Exploding the Web3 realm with new launchesㅡ Cash App announced that its payment infrastructure is now integrated with the Bitcoin Lightning network, enabling users to send and receive Bitcoin at a negligible fee on a limited basis.

Heating up the launch game- Fireblocks announced the launch of its Payments Engine, which provides payment service providers (PSPs) with a blockchain-agnostic solution to accept, manage and settle digital asset payments anywhere.

Polygon-based DeFi platform QuickSwap was in the news as it closed its lending services for users following a flash-loan exploit for over $220,000 worth of tokens.

In other news, Africa-focused cryptocurrency exchange platform Yellow Card received a virtual asset service provider (VASP) licence to operate in Botswana from the country’s Non-Bank Financial Institutions Regulatory Authority, allowing the crypto exchange to bolster its operations on the continent.

What’s more - Singapore's central bank, MAS, proposed new regulatory measures on cryptocurrency trading and stablecoins to reduce the risk of consumer harm from the industry's volatility.

Decentralised Tech – You won't want to miss this section, which focuses on the best bits of the Web3 space, i.e. Blockchain, Smart Contracts, and Oracles – all cool and shiny things underpinning the web3 revolution!

Diving straight into the launches, Google announced plans to launch a cloud-based node engine for Ethereum projects ㅡ a fully managed node-hosting service that can minimise the need for node operations, meaning that Google will be responsible for monitoring node activity and restarting them during outages.

Similarly, Bybit introduced its custodial wallet offering cross-chain compatibility, private key management, and access to DeFi and NFT marketplace, among others.

Then, BNB Chain introduced a whopping $10M fund to help projects with user acquisition and growth, initially supporting 10 projects in the fourth quarter, with gas incentives of up to 800 BNB tokens a month in total.

Moving on, crypto exchange Binance announced the launch of a new data feed network, Binance Oracle, that allows blockchain smart contracts to connect with real-world data, starting with its in-house blockchain offering, BNB Chain.

Causing a wave - Singapore-based gaming blockchain Oasys fully launched on its mainnet, which will be implemented in three distinct phases designed to stabilise, integrate and enhance the overall ecosystem.

As for various product updates, global bank Santander continued exploring the benefits of blockchain technology, with a local branch implementing blockchain technology for vehicle trading and car registration.

Further, international money transfer company Western Union made headlines and appears to be preparing to offer crypto-related services based on several recently filed trademark applications.

There’s more - Digital Asset platform Exodus Movement and Polygon Technology announced adding Polygon support in Exodus’s browser-based Web3 Wallet.

On the partnerships front, RocketFuel Blockchain, a global provider of payment solutions via ACH bank transfers, Bitcoin and other cryptocurrencies, announced the launch of its loyalty program, which was developed in collaboration with its merchant processing partner, ACI Worldwide. Blockchain infrastructure company.

Blockdaemon partnered with Zero Hash to leverage the latter’s API-driven infrastructure and help Blockdaemon’s offering, Onramp, offer customers crypto and fiat funding options in a regulated way.

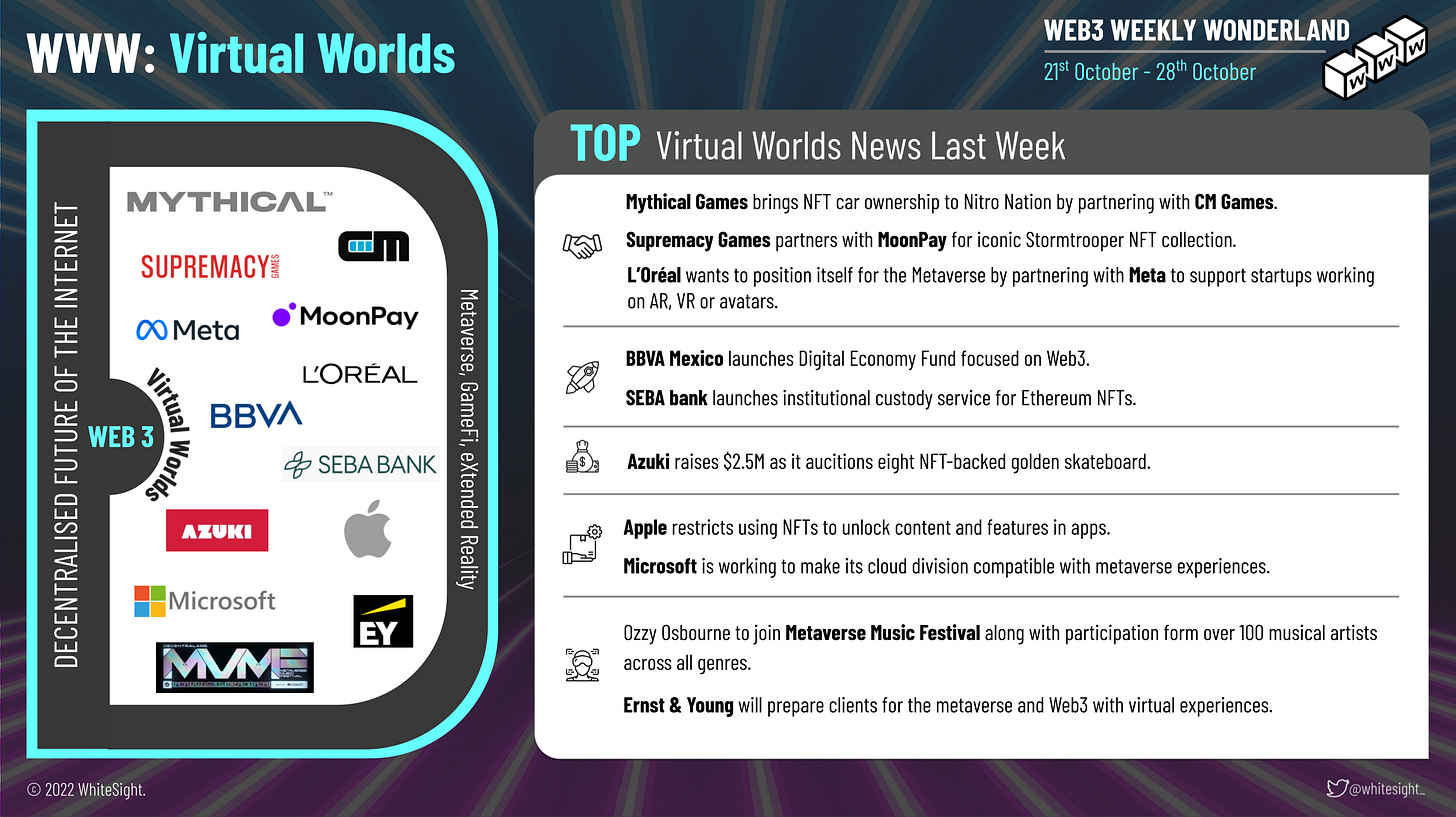

Virtual Assets World – The hub is home to the bright lights of the Web3 universe: NFTs, Metaverse, and eXtended Reality!

Metaverse Musings

Taking the musical route, Decentraland announced its Metaverse Music Festival 2022, a novel platform hosting over 100 artists, including the world’s biggest artists such as rock legend Ozzy Osbourne, the Godfather of heavy metal, rap superstar Soulja Boy, and electronic music icon Dillon Francis, among many others. Let's get our shoes tappin' to the tunes of the metaverse music festival!

Big names are taking bigger steps to hop on the metaverse ride ㅡ Microsoft announced that it is seeking to adapt part of its software service stack to the metaverse and declared that the company was working to make its cloud division compatible with metaverse experiences.

A trio of top giants ㅡ L’Oreal, Meta and HEC Paris teamed up to launch Metaverse Startup Accelerator that will support startups specialising in building products related to the metaverse.

Metaverses are clearly going corporate ㅡ Ernst & Young is all set to provide EY wavespace experiences in the metaverse to help clients prepare for Web3 and the metaverse.

On the Mexican shores, BBVA Mexico launched a“Digital Economy Fund” for clients to invest in NFT, metaverse, FinTech, and other Web3 companies.

Noteworthy NFTs

Creating a dominance- Supremacy Games and Tyranno Studios announced a collaboration with MoonPay and their NFT checkout solution that allows users to use Apple and Google Pay to purchase the recently unveiled "Original Stormtrooper" NFT collection.

CM Games, the company behind the Nitro Nation mobile games, announced a partnership with Mythical Games to make a new game in the series called Nitro Nation World Tour, which will feature NFTs.

It’s pouring money into the NFT arena - Azuki, a popular NFT project, made headlines this week with the auction of eight golden skateboard NFTs, which raised $2.5M ETH in sales volume.

In a rather peculiar turn of events, tech giant Apple released guideline updates that restrict user interaction with NFTs in its App Store to discourage NFT buyers and sellers from transacting their business in-app.

In a positive move -- SEBA bank, a crypto-friendly bank based in Switzerland, added an NFT custody solution that gives customers the ability to hold well-known NFTs without managing private keys themselves.

Decentralised Governance – Get ready for a whirlwind of events featuring everything from partnerships and launches and every little thing in between!

The Decentralised Governance landscape saw a bunch of affairs that made for quite the head-turning headlines -

It's voting time! Community members of MakerDAO voted to move forward with founder Rune Christensen’s plan to overhaul how the protocol works and break it up into smaller, allegedly more decentralised units called MetaDAOs.

Voting has taken centre stage this week - Merit Circle DAO voted to burn nearly $170M worth of its native MC tokens taking nearly 1 billion tokens out of circulation.

While Sushi DAO, the DAO behind the crypto exchange SushiSwap, approved a legal structuring by an overwhelming majority that will create 3 firms for the development of DAO, the MakerDAO community approved a proposal to place as much as $1.6B in USD coin (USDC) with Coinbase Prime, where it will yield 1.5%.

The rollercoaster ride brings in the big bucks - Upside, a Web3-focused investment DAO, raised $5M in capital to deploy in support of the best Web3 startups, with a focus on Australia. Similarly, DAO framework Origami raised $6.2M in a funding round led by Bloomberg Beta to build out their software platform, infrastructure and DAO playbook.

Furthermore, MIZU DAO and PROTOCOL announced a partnership to support the development of Web3, invest in Web3 projects all over the world, and build a Web3 ecosystem together.

Decentralised Identity – Here's where you get all the action around the emerging themes such as self-sovereign identity and soulbound tokens.

The big guy enters the realm ㅡ JPMorgan expanded its web3 strategy after its subsidiary Onyx announced plans to develop a blockchain-based identity system to enable people to store, share and view all their digital assets in one place.

It's all artsy-fartsy - ART Group announced the launch of Protocol.art, a Web3 infrastructure for the community of creators and art collectors, by integrating Ethereum Name Service (ENS), allowing members of the .ART community to go beyond their standard DNS domain and streamline their digital identity to the Web3 space.

Additionally, automated market maker Voltz made a decision to move its community on-chain, where they will be able to earn soulbound tokens through participating in on-chain activities after a series of Discord hacks plagued Web3.

Wrapping up the segment is the Asian NFT marketplace Colexion which announced a partnership with Web3 domain name provider Unstoppable Domains to launch an NFT-based fantasy game that will integrate Login with Unstoppable, to allow players and fans to log in with their Unstoppable domain and connect their Web3.0 identity to leaderboards and other achievements.

Web3 Word Of The Week

Mainnet Vs Testnet: Imagine sending millions of dollars worth of cryptocurrency without checking whether the Blockchain works, and then losing everything. Here's where Testnet comes into play. Testnets offer a testing area for developers eager to build blockchain applications or test out specific capabilities without investing real money. Whereas Mainnet processes the actual transactions, where tokens have a backend value, but in the case of a testnet, tokens do not have any value attached to them.

Don't forget to check out this Web3 delight 🍩 over the weekend for a peek into the Web3 realm, fresh from ‘The Whitehouse’!

That's all for now!🤘

We hope you enjoyed this edition of the Web3 Weekly Wonderland experience, and we'll see you next Friday! 💌

If you're hungry for FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include exploring The UK Big Banks' Bet on FinTech and dwelling into the Green Cogs in the Corporate Machine: A Business Case for Sustainability

If you're someone who prefers to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, reach, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️