Hey there, Web3ers!

Happy Friday! Let's get you pumped up for the weekend by presenting another Web3 smash! Take a ride on a thrill-filled Web3 rollercoaster 🎢 and let yourself be enchanted by the dazzling symphony of five unique themes from the decentralised world. Let's ramp it up now, shall we?

JPMorgan has always been on a quest to embrace disruptive trends. Journey through the events of the goliath’s tryst with the crypto phenomenon ―

Take a look at its Web3 playbook here.

It's time for your weekly blue bird update! This time it's about the BNB smart chain pause that took place last week –

Click here to read the whole thing.

Here's the TL;DR:

The big guys hopped on the Web3 rollercoaster last week as Google partnered with Coinbase to accept crypto payments for cloud services, and Meta and Microsoft announced a partnership to integrate Workplace and Teams.

JP Morgan and Visa, too, grabbed a seat as they teamed up to streamline cross-border payments. Crossing borders was on the plate of Gemini as well since it obtained approval for registration as a Virtual Asset Service Provider (VASP) in Ireland.

While it was a regulatory blitz for Blockchain.com to secure preliminary approval from Singapore's central bank to offer Digital Payment Tokens, things were different for Yuga Labs as it came under investigation by the US SEC concerning the sale of its digital assets.

Rolling out new stuff to rev up the ecosystem was Polygon, who unveiled the public testnet of its Layer 2 zkEVM scaling solution, and BNY Mellon, who is all set to debut its crypto services.

In the Web3 multiplex, we also grabbed front seats to watch MinePlex securing $100M funding to advance global penetration of the MinePlex ecosystem and Aave DAO community voting to integrate its V3 on the Ethereum network.

Let's dig deep into the decentralised dimension –

Decentralised Assets 一 A collection of the hottest stories from the decentralised assets ecosystem, plus a bunch of noteworthy tales from the world of Crypto, DeFi and Tokenised Assets.

The Decentralised Assets segment reverberated with ecosystem players joining hands with one another. To begin with, we have:

Google seemed to be floating up above the clouds as it selected Coinbase to take cloud payments with cryptocurrencies and use its custody tool for storing and trading cryptocurrencies. Visa further spiced things up by teaming up with FTX to offer debit cards in 40 countries focusing on Latin America, Asia, and Europe.

Creating ripples in the Web3 waters, crypto payments company Ripple Labs formed new partnerships with France’s Lemonway and Sweden’s Xbaht, continuing its march into Europe despite the current winter enveloping much of the crypto industry.

Furthermore, privacy-focused cryptocurrency and payments firm MobileCoin collaborated with stablecoin platform Reserve to launch a stablecoin dubbed Electronic Dollars (eUSD).

As for the licences and regulations, crypto exchange and custodian Gemini Trust Company obtained approval for registration as a Virtual Asset Service Provider (VASP) in Ireland, allowing it to provide crypto exchanges and custodial services.

BNY Mellon hit the bulletins as it is prepared to start custody of crypto assets after receiving authorisation from New York's financial regulator DFS.

Brazil’s Rio de Janeiro also took a major step towards crypto acceptance by seeking crypto firms to operate its tax property seasoning in 2023, allowing taxpayers to use crypto alongside fiat currency to pay taxes.

Money-wise, Web3 eCommerce startup Rye raised $14M to build out the product and engineering teams and to start the decentralisation process in the Solana blockchain. Similarly, digital bank MinePlex secured $100M in funding to advance global penetration of the MinePlex ecosystem and the development of new banking technologies. That’s not all – crypto custodian Copper Technologies also raised $196M in a Series C funding round, most of which will be used for hiring and scaling.

In other news, Crypto.com chose Paris to set up its European regional headquarters and plans to invest $145.7M to support the establishment of its market operations. Further, robo-advisor Betterment launched its crypto offering after completing a private beta phase enabling customers to invest up to 5% of their Betterment balance in digital currencies like Bitcoin, Ethereum, and other popular currencies.

Decentralised Tech – The sphere hosting a party built around Blockchain, Smart Contracts, and Oracles – the perfect place to catch up on everything Web3!

There was a rain of funds last week on DLT streetー

Blockchain data infrastructure provider Nxyz raised a $40M Series A round led by crypto-focused investment firm Paradigm to hire talent, build out support for emerging use cases, and expand across different blockchains. Furthermore, Autonomous software systems developer Valory AG closed $4M in seed funding led by True Ventures to fill the gap in crypto infrastructure between decentralised Web3 apps and centralised services with the help of open-source tools.

Likewise, blockchain development platform Tatum also raised $41.5M in funding to invest in marketing, educational efforts, and community building. Blockchain startup Settlemint, too, announced a $16M Series A funding round to expand its existing presence in Belgium, Dubai, Delhi, and Singapore and set up a new office in Japan with help from Fujitsu.

We’re not done yetー native smart-contract platform Soroban also joined the party after launching the Stellar network with the support of a $100M fund, which they allocated to developers building tools and products for the Soroban ecosystem.

As for various launches, Samsung announced its plans to launch a security solution called Knox Matrix, a private blockchain system, to protect Galaxy devices, TVs, appliances, and more. Polygon also unveiled the public testnet of its Layer-2 zkEVM scaling solution that would allow DeFi protocols Uniswap and Aave to test different functions.

Not just that, but it was party time for Blockchain.com, which became the latest crypto company to secure preliminary approval from Singapore’s central bank to provide Digital Payment Token services in the city-state.

And finally, the big boys ー JPMorgan and Visa ー were the talk of the town after teaming up to streamline cross-border payments using their private blockchain networks, Liink and B2B Connect.

Virtual Assets World – Bringing you the segment where you immerse yourself in the very best of the Web3 universe featuring NFTs, Metaverse, and eXtended Reality!

Meritorious Metaverse

A surge of new launches pumped up the metaverse as Multiverse Labs launched a metaverse city known as Sharjahverse in UAE. Not just this, Dubai-based Commercial Bank International (CBI) also announced the official launch of its metaverse location.

Moving on to Europe ー PKO Bank Polski announced its new metaverse branch on the Decentraland Platform, which will be used as a laboratory “to broaden experience and to test relevant technological solutions.”

Aboitiz-led Union Bank of the Philippines made the news for partnering with The Sandbox to expand its metaverse footprint and promote innovation by engaging and empowering the Filipino Web 3.0 community.

Novel NFTs

The jingling of money keeps the segment lively and buzzing! We saw blockchain-based athlete financing platform Fantium raise $2M in a pre-seed round to develop an NFT athlete investment platform. Further, Gomu, an NFT infrastructure company, closed a whooping $5M seed round.

Adding to Web3 ocean, OpenSea launched support for Avalanche, expanding access to NFT Avalanche and enabling users to benefit from faster, low-fee transactions.

An obscure grey cloud of doubt hovered around Yuga Labs ― the creator of the Bored Ape Yacht Club NFT collection ― which came under investigation by the US Securities and Exchange Commission as to whether the sale of its digital assets violated federal law.

In other news, Emirates NBD entered the next phase of its digital partnership with Microsoft to venture into a new wave of digital and technology initiatives. GameFi platform Epic League team also made the bulletin for announcing that their strategic and private rounds have been successfully completed!

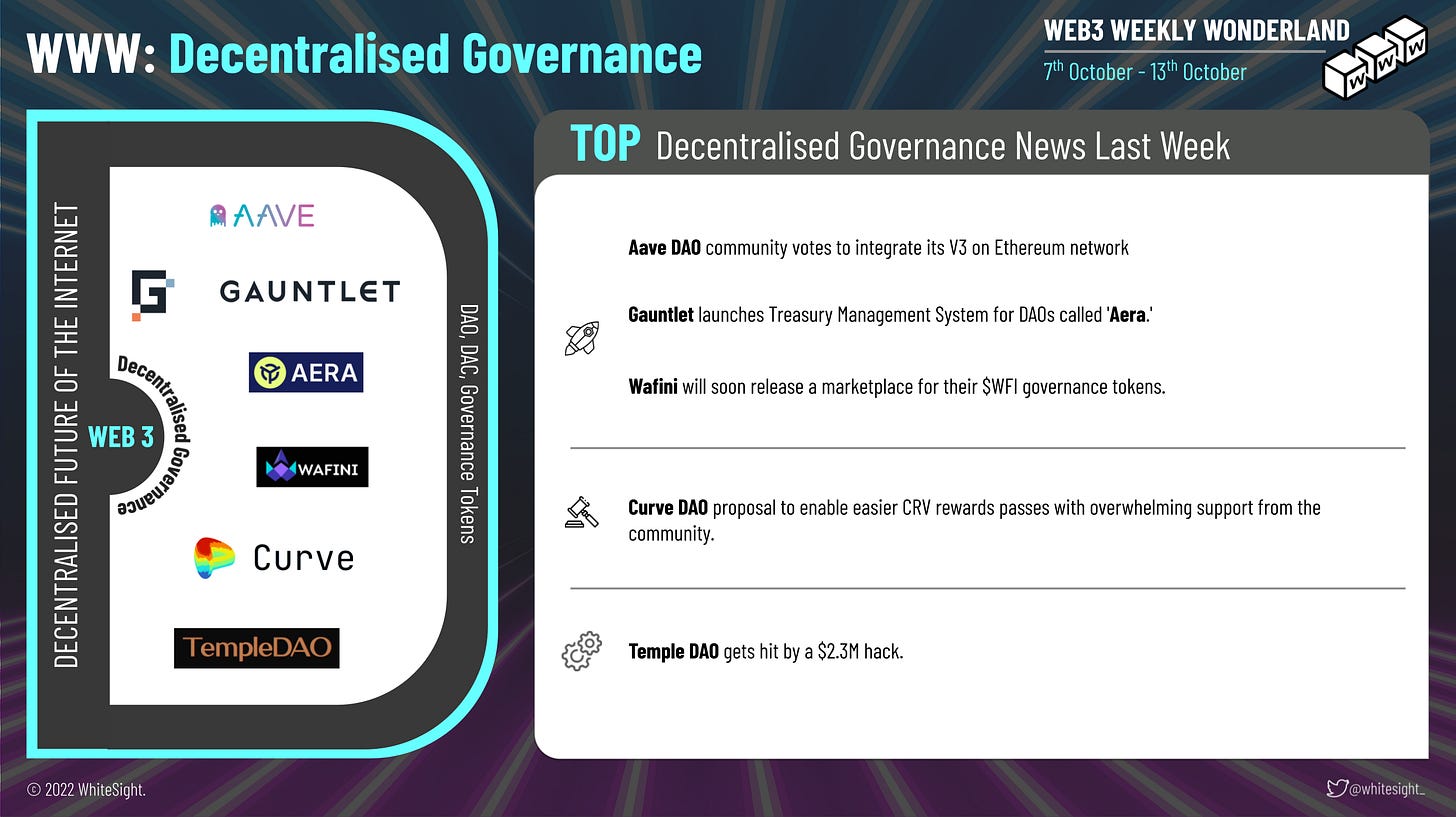

Decentralised Governance – A symphony of activities ran throughout the week, stretching across numerous events like partnerships, launches, and everything in between!

The Decentralised Governance space has been a witness to a range of product launches off late ─

While DeFi lender Aave DAO members overwhelmingly passed a vote to deploy the protocol’s latest iteration on the Ethereum blockchain, Cardano DAO-powered project Wafini released its marketplace demo as its governance token $WFI’s seed sale rages on.

Crypto data science shop Gauntlet also captured headlines after launching Aera, a rewards-based treasury management system for leaderless DAOs.

In other news, Curve DAO's proposal to enable easier CRV rewards was passed with overwhelming support, which means projects looking to offer CRV rewards to their users would no longer need to propose their requirements to Curve’s governance community.

In a turn of events, Temple DAO was hit by a $2.3M exploit. The exploiter converted all funds to Ethereum and transferred $2.34M to a fresh wallet. Yikes!

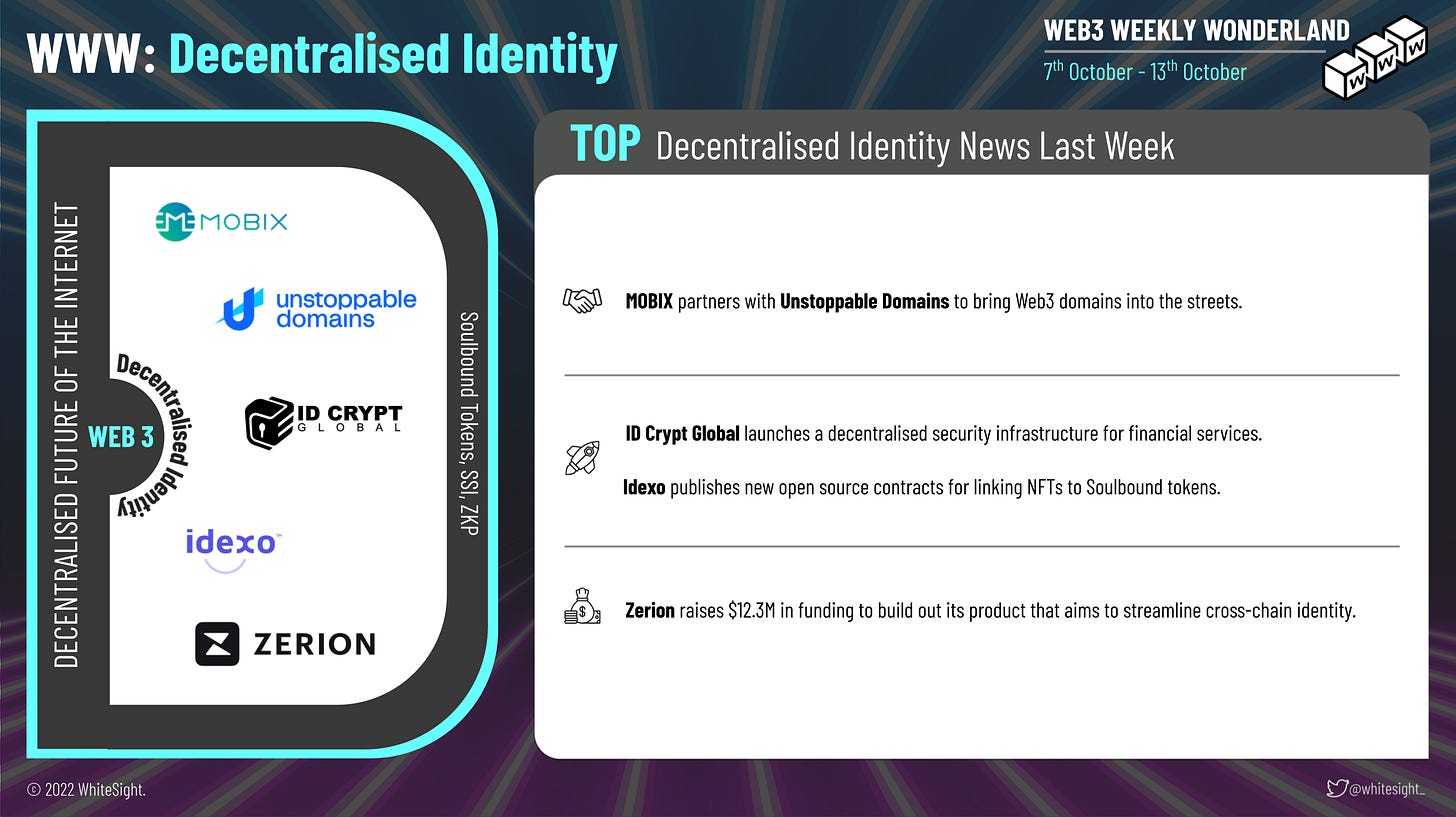

Decentralised Identity ― A buzzword in the blockchain space, the chatter around digital identity certainly grabs attention in the Web3 realm!

There was an assortment of events in the Decentralised Identity segment the past week ―

Idexo published new open-source smart contracts for linking NFTs from different smart contracts to a Soulbound Token, creating a voting contract whereby votes are cast by NFT holders, and the votes can spend tokens, and also a payments contract where the payment can be in any specified token with payments generating a consumable NFT coupon for those products.

ID Crypt Global launched a decentralised security infrastructure named DPKIps, that allows financial institutions to move away from costly Public Key Infrastructure (PKI) to a highly resilient and cheaper decentralised Public Key Infrastructure solution.

Furthermore, Web3 wallet Zerion raised $12.3M in Series B funding led by Wintermute to build out its product that aims to streamline cross-chain identity.

Wrapping up the edition is the news of Micromobility App MOBIX, which partnered with Unstoppable Domains to bring Web3 domains into the streets and to enable more easy transactions by replacing complex wallet addresses with human-readable NFT domains.

It can sometimes be overwhelming for our Web3 wanderers to get their heads around the Web3 world 🌎 with new things popping up every other day 🆕. So, let's learn more about Web3 as we wrap up. Welcome to the LearnVerse! ✨

Web3 Word Of The Week

Gas Fees: Every transaction in Ethereum must be processed and validated by miners since it is currently a proof-of-work network. For miners to perform this work, they need a reward – and that's where the gas comes in. Gas is a unit describing the number of computational work miners need. Users pay a gas fee to cover some of the costs associated with computational work and resources needed for the network.

Also, try out this Web3 tidbit 🍩 this weekend for a peek into the Web3 realm, fresh from ‘The Whitehouse’!

AAVE Whitepaper – V3 overview

That's all for now!🤘

We hope you enjoyed this edition of the Web3 Weekly Wonderland experience, and we'll see you next Friday! 💌

If you're hungry for FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include digging into Goldman's Pot of FinTech Gold: Global Investments and Bumping Up the BaaS: Banking-as-a-Service Roundup 2022

If you're someone who prefers to read think pieces, you will likely love our monthly blog Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, reach, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️