Worldpay? That’ll Be $24 Billion, Thanks.

Future of Fintech - Edition #161 (15th - 21st April, 2025)

Hola fintech nerds — distribution is no longer the flex it used to be.

This week was about skipping layers, collapsing stacks, and getting closer to the money. This week -

✔️ Pay-by-bank eats the checkout middle

✔️ Governments outscale fintechs at infra

✔️ Institutional rails meet tokenised assets

Let’s decode the moves flattening finance »

Before we dive deeper into the stack...

Something unusual is happening in the world of payments.

It’s not coming from Big Tech or fintech unicorns, but from state-backed infrastructure.

Government-run rails like UPI and Pix are moving billions, not just because they’re cheap, but because they’re trusted, fast, and built for scale.

Even Saudi Arabia is now quietly entering that league. Every bill paid, every taxi taken, every marketplace settled- feeds the loop. Unlike card networks, they don’t rely on brand loyalty or merchant incentives.

They grow because they’re useful, invisible, and frictionless at the edge.

And once adoption tips, it's not just consumers, businesses, banks, and platforms that plug in, too. That’s how national infrastructure becomes everyday behaviour.

We broke down what’s powering this rise- and why it matters.

👉 Dive into the full thing here »»

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Brewed fresh from the fintech café - bold moves in every sip. ☕

The Week's Hot 10!♨️🔟

Cross-Industry Payment Innovation

⤷ Klarna partnered with Clover to auto-enable its flexible payment options across over 100,000 merchant locations in the U.S.

⤷ eBay partnered with Checkout.com to enhance its global payment platform capabilities, aiming to provide a more seamless commerce experience for its users.

Financial Data Connectivity

⤷ MoneyGram partnered with Plaid to offer Pay by Bank services in the US, enabling users to authenticate their bank accounts for funding both domestic and cross-border payments.

⤷ Thinslices and Salt Edge collaborated to streamline financial data aggregation and enable account-to-account payments for businesses across industries.

Consumer Financial Empowerment

⤷ Wise unveiled a new feature, Spend with Others, allowing customers to create groups and share transaction visibility for managing joint expenses like bills or vacations.

⤷ Nubank introduced NuScore, a feature to help users understand and monitor their creditworthiness, complete with actionable tips for improving their credit score.

Strategic Market Expansion

⤷ Global Payments to acquire Worldpay for $24.25B and to sell its Issuer Solutions business to FIS for $13.5B. This strategic move aims to position Global Payments as a leading merchant solutions provider with expanded global reach and capabilities.

⤷ Engine by Starling, the SaaS arm of Starling Bank, established its first overseas subsidiary in the US to expand its presence in the North American market, focusing on providing modern banking infrastructure.

TradFi-Crypto Convergence

⤷ Standard Chartered and OKX launched a collateral mirroring programme allowing institutional clients to use cryptocurrencies and tokenised money market funds as off-exchange collateral for trading.

⤷ Visa became the first traditional finance company to join the Global Dollar Network (USDG), a stablecoin consortium led by Paxos and including members like Robinhood, Kraken, and Galaxy Digital.

Now, for the ‘byte’-sized fintech buzz –

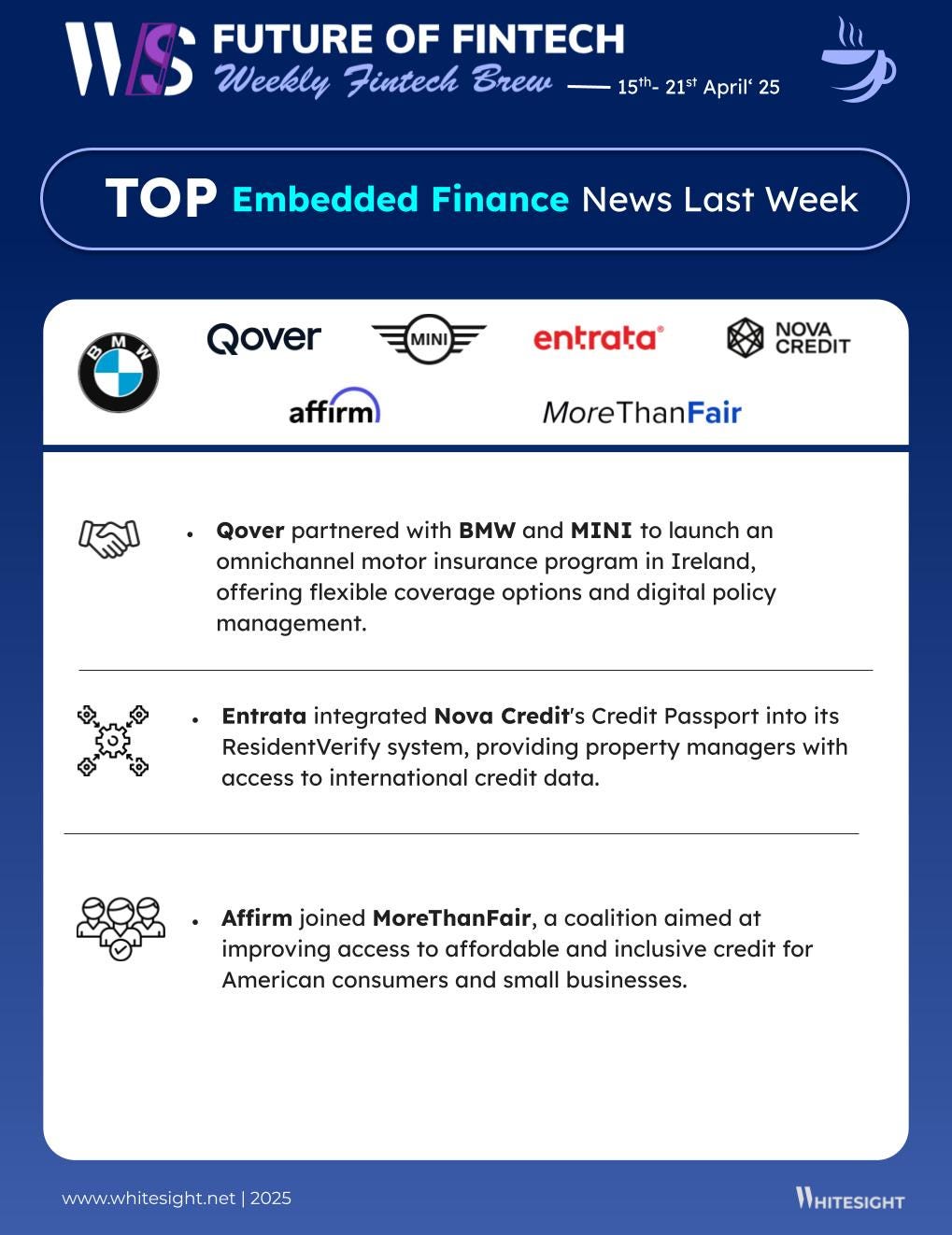

Embedded finance is building deeper layers—pairing utility with seamless digital access across borders and sectors.

Qover partnered with BMW and MINI to launch an omnichannel motor insurance program in Ireland, offering flexible coverage options and digital policy management. This initiative marks one of the first embedded insurance solutions for premium automotive brands in the Irish market.

Weavr integrated B4B Payments into its platform, enabling clients to access Visa and Mastercard schemes, localised IBANS, and multi-currency support across the UK and Europe. This move strengthens Weavr's embedded finance capabilities and supports its expansion into key European markets.

Open finance is tightening the loop, turning once-fragmented verification and claims into clean, connected workflows.

Sumsub partnered with Volt to enhance its 'Penny Drop Verification' process, utilising Volt's Open Banking capabilities to streamline identity verification across European markets. This collaboration aims to improve onboarding processes and combat rising fraud rates by leveraging real-time account information services.

CRIF and Crawford formed a partnership to streamline insurance claims processing for UK businesses by integrating Open Banking technology, aiming to reduce manual processing times by 30%. This initiative seeks to enhance efficiency and accuracy in the claims management process.

Digital finance is stepping up as a financial fixer, bridging support, access, and expansion with a smarter edge.

Nubank launched Recomeço, a campaign offering support to financially distressed customers with a history of good credit behavior by helping them renegotiate overdue debts.

Dutch neobank bunq completed the first step of its US expansion by filing for a broker-dealer licence as part of its dual-phase strategy to establish investment and banking services in the country.

Fintech infrastructure is scaling its backbone, raising the bar for enterprise-grade tools and smoother operations.

Toku raised $48 million in Series A funding to enhance its accounts receivable automation platform in Latin America. The company aims to streamline payment collections for mid-to-large enterprises by automating payment processes and integrating with ERP systems.

UST FinX and Thought Machine formed a strategic partnership to provide enterprise-grade banking technology to financial institutions of all sizes, initially focusing on mid-tier US banks and credit unions.

DeFi is shedding its crypto-only shell - tapping into card rails and compliance routes to unlock the next user wave.

Bleap partnered with Mastercard to launch a non-custodial debit card enabling users to spend stablecoins at over 150 million merchants worldwide. This initiative bridges the gap between digital assets and traditional financial systems, promoting wider adoption of stablecoins.

South Korea's Financial Services Commission requested Apple to block domestic access to 14 apps from unregistered foreign crypto exchanges, including KuCoin and MEXC. This action is part of the country's crackdown on unreported virtual asset operators to enforce compliance with local regulations.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Key trends for European payments in 2025 Report- Capco

Revolutionizing Cross-Border Transactions with Permissioned DeFi Report- Fireblocks

What are the implications of Pay by Bank on different players? Blog- Sam Boboev

Unlocking growth in SaaS: The critical role of payments in driving subscription revenue Blog- Adyen

Beyond Barriers: Embedded Lending Helps SMEs Thrive Blog- WhiteSight

Nubank Deep Dive Report- WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️