Stripe Unlocks Aussie SMB Cash 🚀

Future of Fintech - Edition #178 (9th - 15th Sept‘ 25)

If money had a soundtrack this week, it’d be sharp, global, and unpredictable. 🌐 Financing is embedding deeper into platforms, open banking is widening access, and AI is reshaping how payments and compliance get done.

✔️ Capital flowing through platforms old and new

✔️ Open banking spreading from bills to direct pay

✔️ AI and assets powering the next rails

Let’s dive into the week where fintech fused intelligence with infrastructure. 🎶

🚨 Featured Story of the Week:

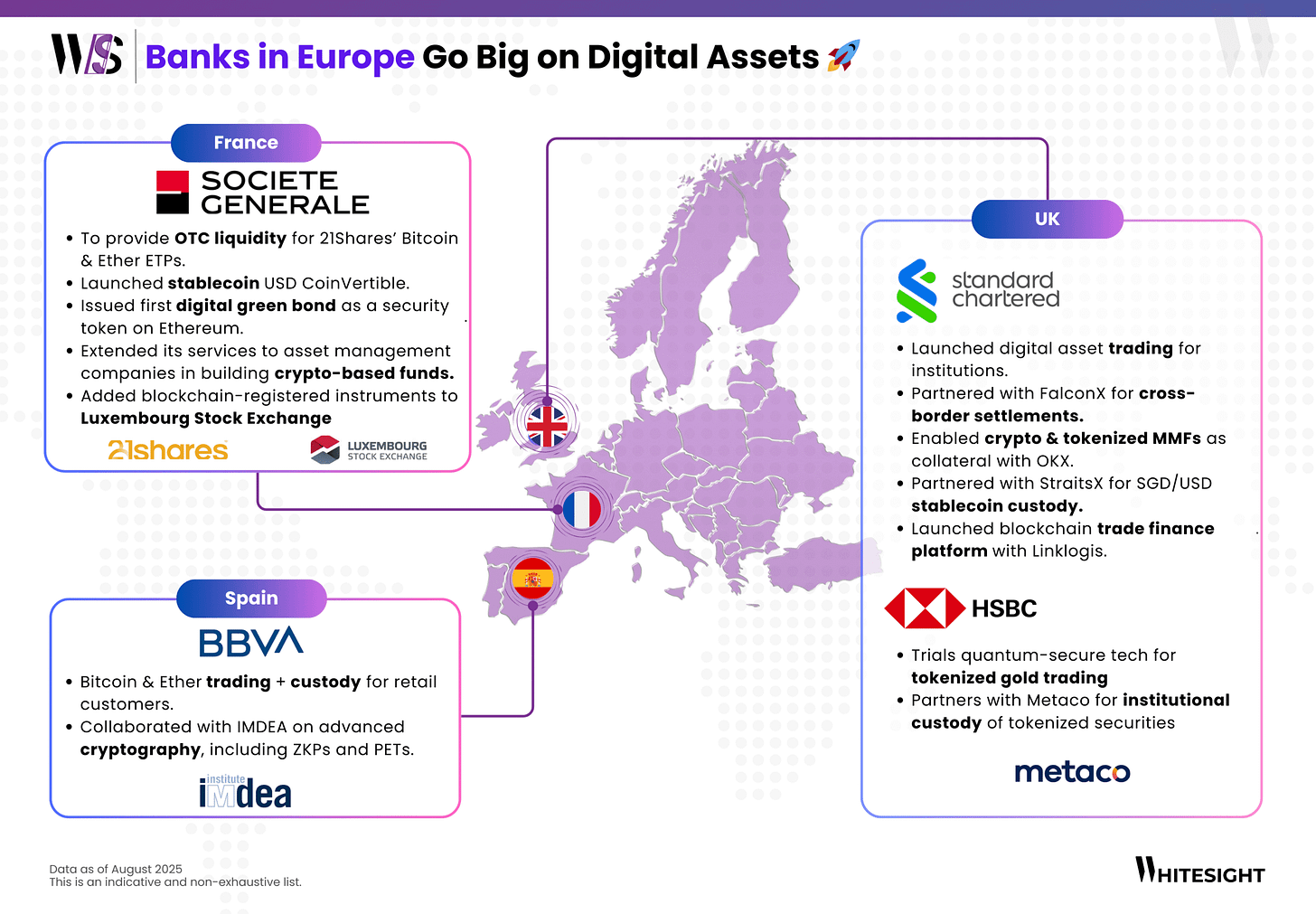

Banks in Europe Go Big on Digital Assets 🚀💶

From Paris to London, Madrid to Luxembourg, leading banks are moving digital assets from pilot projects to the core of their strategies. Stablecoins, tokenized bonds, crypto trading, and blockchain-based custody are no longer side experiments - they’re shaping how institutions build the next chapter of finance.

This week’s featured infographic from WhiteSight maps out how Europe’s biggest players are stepping into the digital asset game, highlighting use cases, collaborations, and the new rails being built across the region.

Key moves shaping the landscape:

⚡ Stablecoin launches and custody offerings

🌍 Tokenized funds, bonds, and gold trading

🔐 Institutional-grade infrastructure for security and compliance

🚀 Digital asset rails spanning cross-border payments to trade finance

Europe’s story is one of banks scaling blockchain adoption in ways that could redefine institutional finance across the continent.

👉 Check out the full story here

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Sip on bite-sized updates every week—fresh, hot, and brewed to keep you in the loop in just minutes. Subscribe now! 📨

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Edition #178 runs bold, borderless, and bankless – where finance flows without cards, branches, or barriers.

The Week's Hot 10!♨️🔟

Capital on Tap

⤷ Stripe rolled out its business financing product in Australia. This will give SMBs quicker access to capital and help them manage growth and cash flow.

⤷ Uber launched a restaurant industry-focused partnership with fintech Pipe. The partnership lets eligible U.S. restaurants access Pipe Capital via the Uber Eats Manager platform

Banking Without Cards

⤷ Mastercard and Paytently launched an open banking option for direct bank payments.

⤷ Worldline introduced New Zealand’s first open banking solution for recurring bill payments.

Expanding Horizons

⤷ Revolut gained in-principle approval to launch payment services in the UAE.

⤷ Walmart-backed OnePay launched a $35/month unlimited 5G mobile plan on AT&T’s network.

Intelligence in Action

⤷ Mastercard introduced AI-powered developer tools and services to enable agentic payments.

⤷ Binance and Franklin Templeton teamed up to create innovative digital asset products.

Big Names, Bigger Bets

⤷ dLocal partnered with Western Union to strengthen digital payment options in Latin America.

⤷ BBVA tapped Ripple’s custody tech to enable crypto custody for its retail clients in Spain.

Now, for the ‘byte’-sized fintech buzz –

Embedded finance is branching out beyond dashboards, turning cars into wallets and logistics into savings tools.

Volvo, with Mastercard and the NC Turnpike Authority, launched in-vehicle toll payments in North Carolina. This will accelerate the adoption of embedded car payments for tolls, fuel, and charging.

UPS and American Express launched offers aimed at helping small and medium-sized businesses (SMBs). Merchants can access exclusive savings from UPS via American Express’ Business Savings Suite, covering UPS air, ground and international shipping.

Open finance is sliding under the hood, wiring itself into back-office systems and digital journeys to make data flow where it’s needed most.

US digital banking platform Narmi partnered Ninth Wave to deliver open finance capabilities to community banks and credit unions. Through this partnership, financial institutions on Narmi’s platform can offer their business customers a direct connection to their accounting and enterprise planning systems.

Plumery partnered with Ozone API to embed standards-based open banking in digital journeys. This integration empowers banks and financial institutions to rapidly deploy customer-centric mobile and web applications that incorporate open banking capabilities without compromising on compliance or security.

Digital finance is stepping into everyday life, mixing trading feeds with fresh neobank launches to reimagine how people bank and invest.

Robinhood added “Robinhood Social,” where users can follow other traders, swap strategies, see verified live trades, and track moves by public figures.

Snappi, Greece’s first ECB-licensed neobank, gets launched for Greek tax residents on iOS and Android. The app offers local IBAN accounts, SEPA payments, and debit cards, aiming to modernise everyday banking in Greece.

Fintech infrastructure is stepping up its game with smarter platforms and sharper intelligence, powering everything from restaurant checkouts to AI-driven risk labs.

Global Payments rolled out its Genius platform in the UK, offering a full suite for quick-service and fast casual restaurants including POS, kitchen, back-office, payments, drive-through, digital signage and more. It aims to support speed, configurability, and seamless operations at scale.

Equifax opened a new international AI innovation lab in Wexford, Ireland to push forward R&D in credit risk, fraud detection, data analytics and decision-making tools. The initiative will build on its decades of AI work and expand its global talent footprint.

Digital assets are doubling down on rails and returns, from stablecoin payments to high-yield wallets.

dLocal joined Fireblocks Network for payments to strengthen fiat-stablecoin rails in emerging markets. Institutions gain faster on- and off-ramps, lower costs, and access to 40+ markets and 900+ local payment methods.

Bitget Wallet partnered with Aave to launch “Stablecoin Earn Plus,” offering ~10% APY on USDC deposits with flexible access and high yield compared to many self-custodial wallets.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

2025 Trends: Data-Driven Insights Into the Crypto Market Report- Gemini

How agentic AI can change the way banks fight financial crime Report - McKinsey

The cost of doing bare minimum in digital banking Blog - Backbase

Future of payments: What the UK’s new payments stack means for Pay By Bank Blog- Truelayer

Revolut: From UK Challenger to Global Superapp Report - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️