Stablecoins Land a Seat in Visa’s Treasury Playbook 💳

Future of Fintech - Edition #181 (Sept 30 - 6th Oct‘ 25)

This week in fintech feels like a crossroads. 🚦 Youth step into credit, banks test BNPL with tech giants, and networks tinker with stablecoins. Different moves, one clear story: money is changing its form and flow.

✔️ New credit models taking shape

✔️ Embedded finance across platforms and payments

✔️ Stablecoins piloted for faster transfers

Want to see where the signals point? 🔥

🚨 Featured Story of the Week:

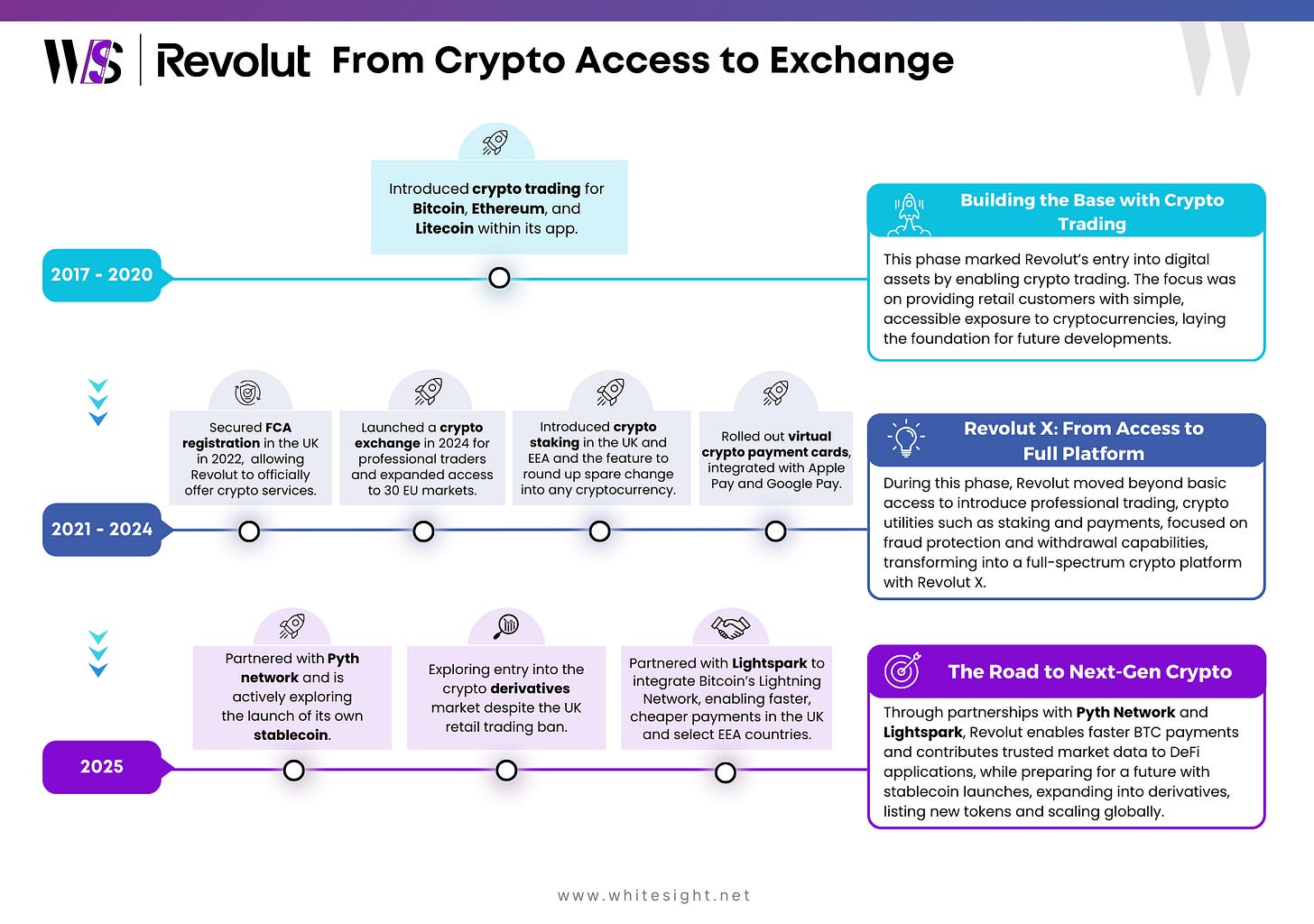

From Access to Exchange 🔐➡️💹

Revolut’s crypto journey has been a steady climb - from simply offering retail users Bitcoin and Ethereum trading to evolving into a full-spectrum platform with staking, virtual cards, and a professional-grade exchange. What started as a toe-dip into digital assets has now turned into a long-term play to integrate crypto across payments, wealth, and utilities.

This week’s featured deep dive from WhiteSight traces Revolut’s path through three distinct phases: building a base with simple trading, scaling into Revolut X with staking and pro exchange tools, and now moving towards next-gen crypto with stablecoins, Lightning Network payments, and derivatives.

Key milestones in focus:

⚡ Early crypto trading for BTC, ETH, and LTC

💳 Virtual crypto cards integrated with Apple & Google Pay

📈 Launch of Revolut X crypto exchange for EU traders

🔗 Partnerships with Pyth Network & Lightspark for stablecoins and Lightning

🚀 Preparing for derivatives, new tokens, and global scaling

Revolut’s crypto roadmap shows how a mainstream fintech can transform from access-provider into a full-fledged exchange and infrastructure player—bridging today’s retail needs with tomorrow’s decentralized future.

👉 Check out the full story here

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Sip on bite-sized updates every week—fresh, hot, and brewed to keep you in the loop in just minutes. Subscribe now! 📨

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Edition 181 brings you the stories driving finance’s evolution this week.

The Week's Hot 10!♨️🔟

Youth & Everyday Finance

⤷ Nubank launched a teen credit card in Brazil with limits to promote responsible credit use.

⤷ Revolut introduced a U.S. high-yield savings account offering to attract new customers.

Broadening the Financial Rails

⤷ Mastercard rolled out a digital media network to deliver personalized advertising across its owned channels.

⤷ MoneyGram and Plaid expanded their pay-by-bank open banking solution into European markets.

Finance Woven In

⤷ Worldpay launched an Embedded Finance Engine for easy platform integration of lending, banking, and cards.

⤷ Banco Santander launched its BNPL product Zinia in Spain with Amazon, enabling installment payments.

Global Expansion Moves

⤷ Airwallex enabled Nordic and Polish currencies for EU card users to cut FX costs.

⤷ Unlimit gained Visa and Mastercard principal membership in Peru to issue cards and grow in LATAM.

Stablecoin Integration Push

⤷ Visa started a stablecoin pilot prefunding in Visa Direct to improve cross-border liquidity and speed.

⤷ Coinbase added peer-to-peer USDC payments in its app to drive mainstream adoption of stablecoins.

Now, for the ‘byte’-sized fintech buzz –

Embedded finance is widening its reach, tucking payments and coverage into the very platforms where businesses already operate.

Mastercard partnered with insurtech Hillcroft (mTek) to embed insurance solutions directly into Mastercard’s consumer and SME card experiences across East Africa, to drive greater insurance access and financial inclusion.

Zycus introduced Zycus Pay, in partnership with TransferMate, embedding global B2B payments capabilities into its Source-to-Pay (S2P) platform so clients can execute payments natively in the workflow.

Open finance is layering intelligence onto connectivity, turning raw transaction data into richer insights and smoother customer journeys.

Ecommpay launched open banking services targeting the UK and EEA, connecting merchants with over 48 UK banks to allow customers to initiate payments directly from their bank accounts via API integrations. This move positions Ecommpay to compete in real-time bank transfers and reduce reliance on card rails in the UK/European markets.

PortX entered a strategic partnership with Bud Financial to provide advanced transaction data enrichment and customer engagement tools for banks and credit unions. This integration combines PortX’s connectivity and orchestration with Bud’s intelligence layer to speed up product launches and analytics capabilities for financial institutions.

Digital finance is stretching its boundaries, blending local market rules with global ambitions to redefine what a “bank” can offer.

N26 launched a French PEA in partnership with Upvest, enabling French users to invest in European equities with tax benefits, thereby completing its all-in-one banking platform offering in France.

Nubank applied for a U.S. national bank charter with the Office of the Comptroller of the Currency, a move intended to allow it to expand its product suite (deposits, credit cards, loans, digital assets) and scale operations into the U.S. market.

Fintech infrastructure is rewiring global pipes, stacking new collection tools and faster rails onto familiar cross-border systems.

Thunes to offer banks to use of existing SWIFT connectivity to deliver faster cross-border payments to bank accounts, essentially embedding newer rails over legacy infrastructure. This allows banks to modernise payment flows without ripping out their core SWIFT setups, improving speed and efficiency.

Nium launched Global Collections, enabling banks to issue customer-named local currency accounts in key markets (EUR, SGD, USD, GBP initially) to collect funds locally, convert/settle, and reclaim FX margins - effectively giving banks the same cross-border collection tools fintechs have.

Digital assets are moving from fringe to function, with stablecoins slipping directly into corporate cards and treasury operations.

Brex introduced stablecoin payment capability for its global corporate card product, enabling corporations to pay suppliers or partners in stablecoin, thereby bridging traditional corporate payments with crypto rails.

Visa’s Visa Direct service is piloting stablecoin prefunding, letting businesses use stablecoins to pre-fund cross-border payments - intended to modernise treasury operations, improve liquidity management, and reduce delays associated with traditional payout systems.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Banking on Digital Assets: How Traditional Finance is Investing in Blockchain Report- Ripple

The Journey Towards Frictionless Cross-Border Payments in APAC Report - LexisNexis

The integration of human and machine intelligence Blog - Chris Skinner

Brits’ ‘fear of fraud’ cost UK SMEs £6.15bn in the last financial year Blog- Tink

Revolut: From UK Challenger to Global Superapp Report - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️