PayPal Goes dGlobal 🌍

Future of Fintech - Edition #163 (6th - 12th May, 2025)

Fintech is cooking with serious heat this week! 🔥 From borderless spend flows to AI pulling strings in the back office, the industry's evolving not just fast, but smart. The lines between tech stacks and everyday tools are officially blurred.

✔️ AI brains plugging into banking ops

✔️ Crypto rails built for the big leagues

✔️ Payments syncing across platforms and borders

Curious where money’s really heading? Let’s dig in. 🚀

Before we jump back into the fintech frontier—

Let’s talk rollups. Not the snack. The scaling kind.

This thread explains why zero-knowledge rollups are quietly becoming the endgame for Layer 2s—no matter how they start.

Whether you’re crypto-curious or deep in the weeds, this one’s for you.

👉 Dive into the full breakdown here.

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

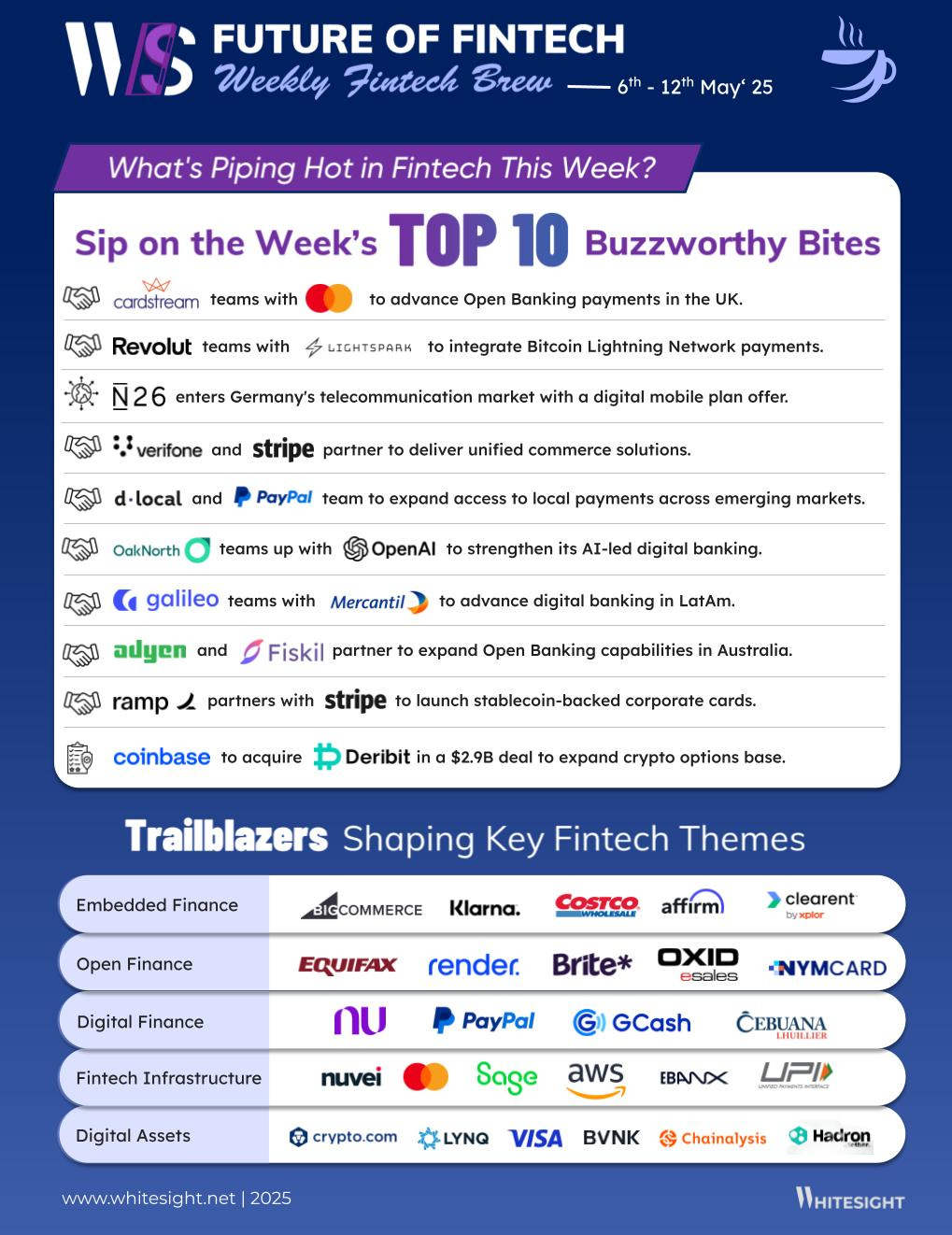

Tapped, poured, and piping with product drops and power plays. ☕

The Week's Hot 10!♨️🔟

Tech Meets Everyday Life

⤷ N26 expanded into the telecommunications sector with eSIM-based mobile plans, allowing users to activate phone services directly through its banking app.

⤷ Verifone and Stripe integrated commerce tools into point-of-sale devices, enabling flexible retail transactions in-store and online.

Local Moves, Global Vision

⤷ Galileo and Mercantil Banco joined forces to modernize digital banking in Latin America, aiming to boost innovation and customer experience across the region.

⤷ dLocal and PayPal broadened access to local payments in over 40 new emerging markets, bringing international commerce closer to underserved geographies.

No Delays, Just Pay

⤷ Revolut collaborated with Lightspark to enable faster, low-cost Bitcoin transactions by integrating the Lightning Network and Universal Money Address for real-time crypto payments.

⤷ Ramp and Stripe teamed to launch stablecoin-backed corporate cards, offering faster settlements and reduced FX friction for global business spend.

Smarts Behind the Scenes

⤷ Adyen teamed up with Fiskil to enhance onboarding and account verification by unlocking real-time financial data, helping platforms make sharper decisions from the start.

⤷ OakNorth partnered with OpenAI to embed generative AI into its operations, aiming to improve personalization, speed, and decision-making for lower middle-market businesses.

Scaling the Crypto Stack

⤷ Coinbase agreed to acquire Deribit for $2.9B, strengthening its global position in the crypto derivatives market.

⤷ Cardstream and Mastercard teamed to enable Open Banking payment options for merchants, aligning with broader crypto-to-fiat infrastructure playbooks.

Now, for the ‘byte’-sized fintech buzz –

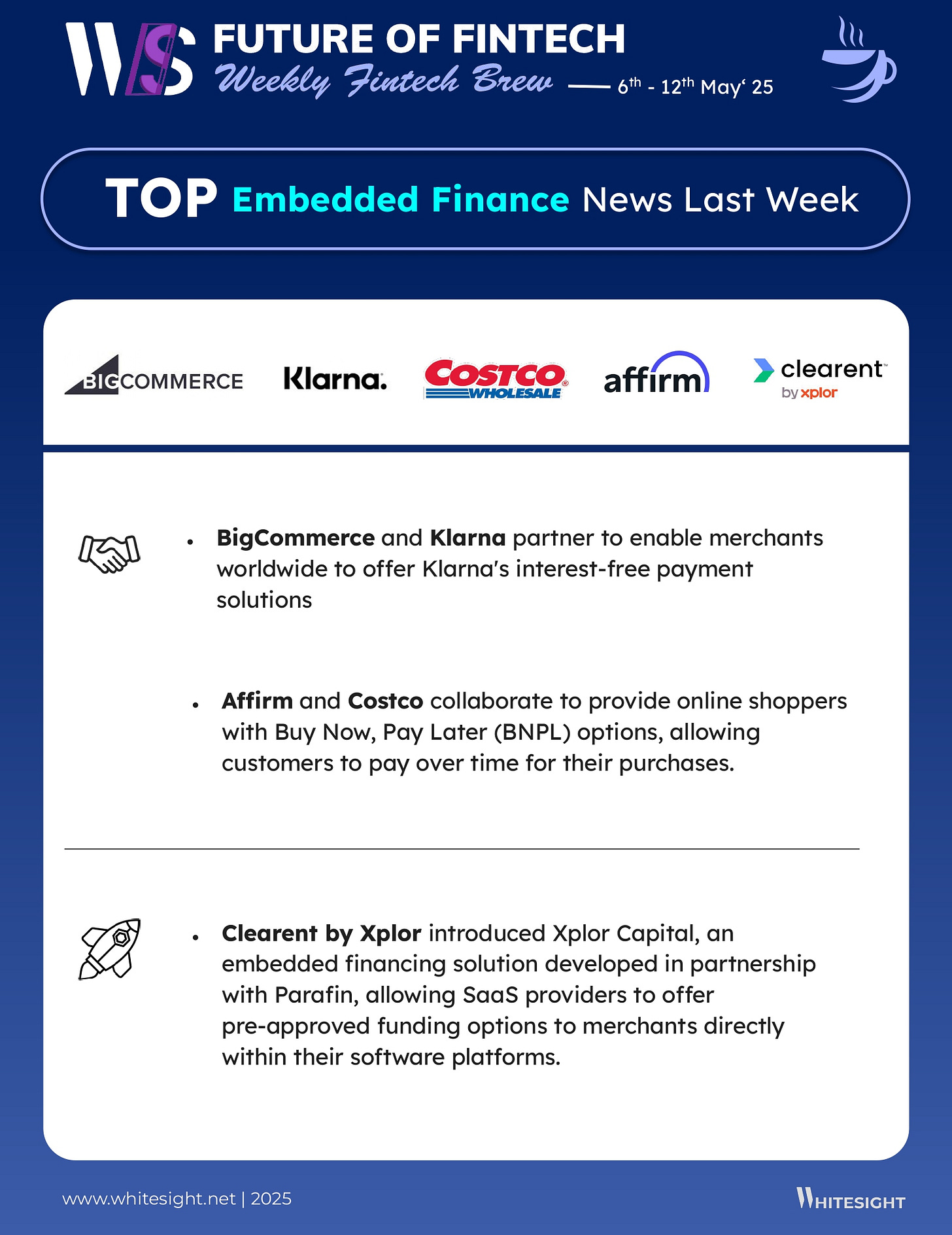

Embedded Finance is crossing borders and breaking delays—turning payments into smooth, stable, real-time rides.

BigCommerce designated Klarna as its global preferred payments partner, enabling merchants worldwide to offer Klarna's interest-free payment solutions, enhancing the shopping experience and driving growth.

Ramp expanded its partnership with Stripe to introduce stablecoin-backed corporate cards designed to facilitate cross-border transactions, offering businesses faster settlements and protection from currency volatility.

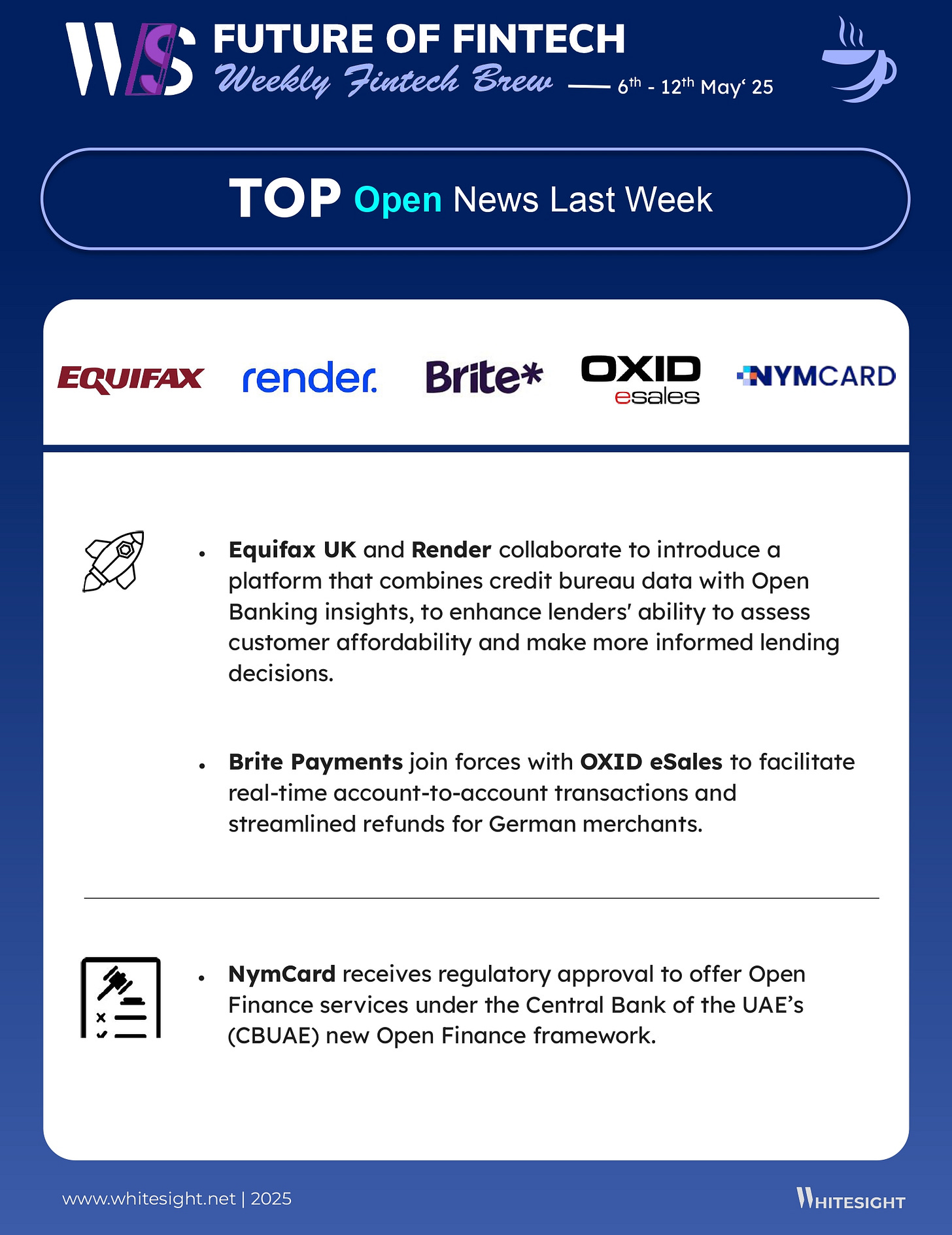

Open Finance is plugging into the real world—less theory, more tap-to-pay and smarter credit calls.

Equifax UK and Render collaborated to introduce a platform that combines credit bureau data with Open Banking insights, aiming to enhance lenders' ability to assess customer affordability and make more informed lending decisions.

Brite Payments joined forces with OXID eSales to integrate Brite's Instant Payments and Instant Payouts into OXID's e-commerce platform, facilitating real-time account-to-account transactions and streamlined refunds for German merchants.

Digital Finance is making money moves local—bridging gaps with tools built for daily life.

Allica Bank provided a £5.85M bridging loan to support the acquisition of a prime London property, marking a record month for its bridging finance operations.

GCash users in the Philippines can now open an eC-Savings account by Cebuana Lhuillier Bank through the GSave feature, offering high interest rates and financial inclusion for underserved communities.

Fintech Infrastructure is speeding things up—cutting out the clunky bits for smoother, smarter flows.

Nuvei collaborated with Mastercard to enable near-instantaneous payout capabilities for Canadian businesses, utilising Mastercard Move to facilitate rapid fund transfers to Debit Mastercard and Reloadable Mastercard Prepaid cards.

Adyen chose Fiskil as its data-sharing partner to improve the onboarding and account verification experience for merchants in the Australian market, streamlining the connection of financial data and ensuring a secure process.

Digital Assets are getting business-ready—blending crypto ease with real-world rails and rules.

Visa, through its venture arm Visa Ventures, made a strategic investment in BVNK, a London-based startup focusing on stablecoin payment infrastructure, to enhance global payment solutions.

Crypto.com partnered with Lynq to launch a real-time, yield-bearing settlement network for digital assets, aiming to provide efficient and scalable settlement solutions for institutional clients.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Future-Proofing Digital Assets Custody Report- Kapronasia

Building Inclusive Central Banking Fit for the Digital Africa Report- Agpaytech

It ain’t what you do, it’s the way that you #revolut it Blog- Chris Skinner

SuperApps: The Future of Fintech and Digital Convenience Blog- MobiFin

Nubank’s Secured Lending Portfolio Blog- WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️

Bankers