Onchain Finance: Hong Kong stablecoin licenses | BBVA euro stablecoin | MetaMask tokenized markets

Onchain Finance - Edition 2: Feb 1st - 7th

Last week felt like onchain finance got its paperwork stamped. 🧾🪙

Licensing moved from drafts to deadlines, banks leaned into tokenized money, and distribution kept widening! Meanwhile, the funding tape stayed hot, pushing core compliance and infrastructure players into billion-dollar territory.

✔️ Regulated stablecoin frameworks are turning into live licensing regimes

✔️ TradFi is testing “crypto exposure inside the account you already use”

✔️ Compliance and market infrastructure are getting fresh capital and deeper integrations

Ready for the signals? 🔍

🚨 Featured Story of the Week:

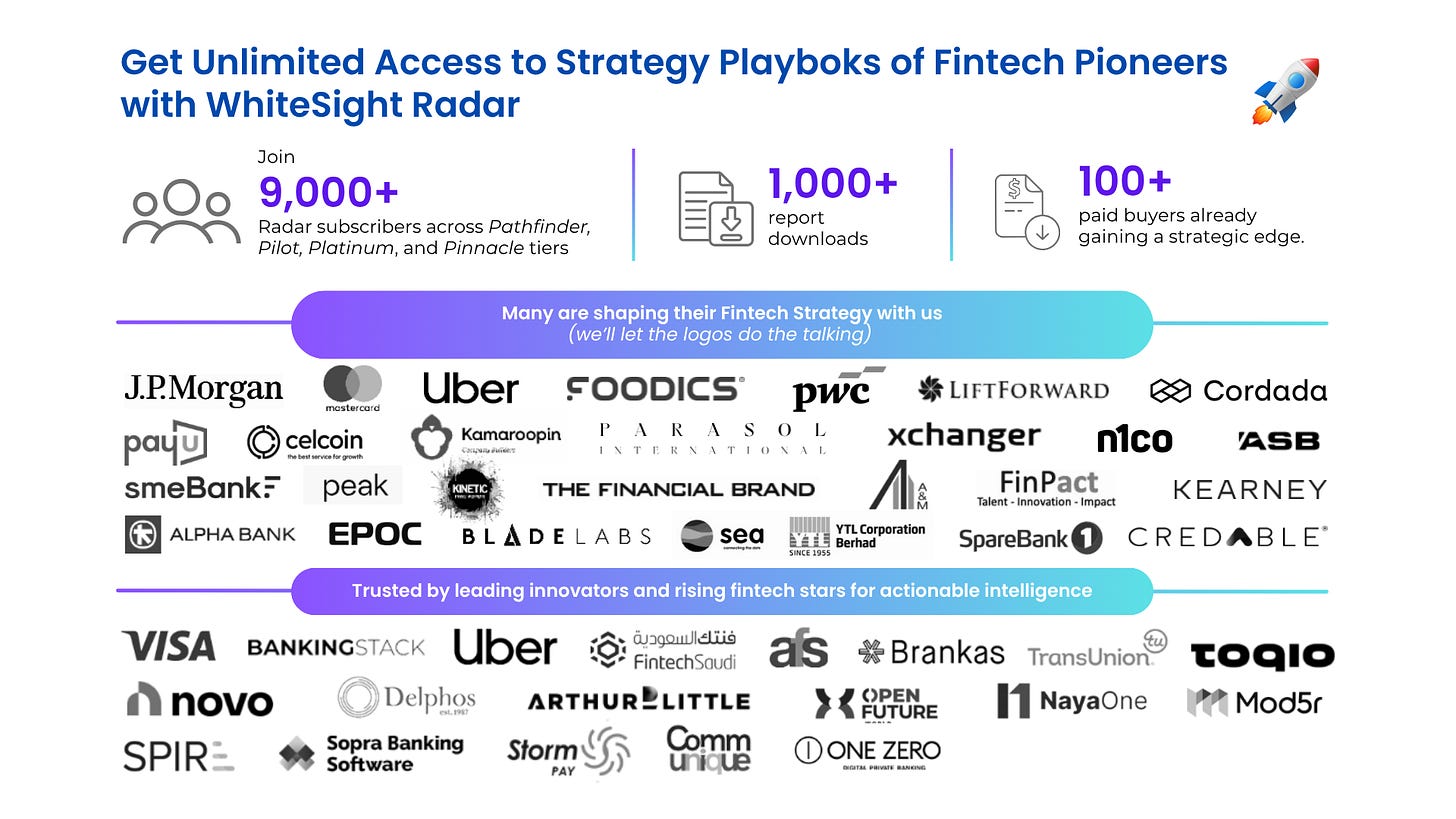

Hong Kong flips stablecoin licensing “on” in March 🏛️🪙

Hong Kong’s Monetary Authority said it expects to grant the city’s first batch of stablecoin issuer licenses in March, with only a small number approved at the start. The move signals Hong Kong is shifting from consultation to live supervision, setting a clearer runway for regulated stablecoin issuance and distribution.

What changes now

A real gate for issuers: “Issuer licenses” move stablecoins from broad policy talk to a concrete, regulated entry path - who can issue, under what controls, and with what backing expectations.

Quality filter for market participants: Starting with “very few” approvals suggests a high bar early on, likely prioritizing governance, reserves, and risk management that can stand up to scrutiny.

Faster institutional adoption path: Once licensing begins, banks, brokers, and fintechs can integrate with clearer counterparties - helpful for settlement use cases and tokenized market activity.

How HKMA set the runway last year

The rulebook went live: The Stablecoins Ordinance regime took effect on 1 Aug 2025, making fiat-referenced stablecoin issuance a licensed activity in Hong Kong - turning “planned regulation” into an operating framework.

Implementation details were published: Ahead of go-live, HKMA released the licensing approach, transitional arrangements, and supervisory expectations, giving applicants clarity on what “license-ready” looks like.

Market testing started via the sandbox: HKMA launched a stablecoin issuer sandbox (2024) and publicly named early participants (incl. Standard Chartered HK, Animoca Brands, HKT, JD Coinlink, RD InnoTech) - a signal that HKMA has been pressure-testing use cases and controls before moving to approvals.

March is Hong Kong’s “issuer go-live” moment - licenses turn stablecoins from an idea into regulated balance sheets. After that, the winners are the tokens that can clear institutional onboarding, custody controls, and settlement workflows without extra legal gymnastics.

Thanks for reading Future of FinTech Newsletter! Subscribe for free to receive new posts and support our work.

🚀 Startup Spotlight: Prometheum

Prometheum is building a U.S.-regulated broker-dealer stack for digital asset securities - focused on bringing tokenized securities trading, custody, and settlement into an SEC-aligned market structure.

Why it matters for onchain finance: if tokenized securities are going to plug into mainstream capital markets, distribution needs regulated venues that institutions can actually onboard to. Prometheum is betting that compliance-first rails can unlock wider participation once the asset classification and listing pathways solidify.

Building something interesting in onchain finance? We’d love to feature you next- drop us a note at hello@whitesight.net 👋

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the onchain menu today?

🏁 Onchain Highlights: Biggest moves across money, markets, and tokenization

🧩 ‘Byte’ Buzz: Onchain Finance updates, sorted by segment

🔗 Link Up: A curated set of reads worth your time

Sip on bite-sized onchain updates - fresh, sharp, and distilled to keep you ahead in just minutes. Subscribe now! 📨

📢 We’re always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we’d love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Edition 2 brings you the onchain finance stories that shaped how money, markets, and assets moved last week »

Last Week’s Top Onchain Tea!♨️

Regulated Stablecoin Rails

⤷ Tether invested $100M into Anchorage, tightening its link to regulated U.S. stablecoin infrastructure.

⤷ BBVA joined Qivalis to build a regulated euro stablecoin designed to compete with dollar tokens.

Crypto exposure moves into mainstream accounts

⤷ ING Deutschland enabled BTC/ETH/SOL ETPs inside ING-DiBa Direct Depot (taxed like direct BTC holding).

⤷ MetaMask added tokenized U.S. stocks/ETFs/commodities via Ondo Global Markets.

Onchain markets get settlement-grade dollars

⤷ Circle partnered with Polymarket to move settlement to native USDC.

⤷ Fireblocks integrated Stacks to give institutions access to Bitcoin DeFi lending/yield.

Trust stack gets funded and formalized

⤷ TRM Labs raised $70M at a $1B valuation to scale crypto compliance/intelligence.

⤷ Sumsub launched a Risk Intolerant Registry to spotlight crypto + fintech firms with strong security, anti-fraud, and compliance controls.

Now, for the ‘byte’-sized onchain buzz -

Onchain Money put stablecoins into more default flows last week, from YC checks to checkout buttons. Funding and payments both got faster rails.

YC enables seed checks via stablecoins

⤷ YC startups can opt to receive funding in USDC on major chains.

⤷ Implication: stablecoins are becoming a standard option for treasury ops - especially useful for cross-border founders and faster settlement.Clover POS adds “Pay with Crypto” via Lydian

⤷ Lydian launched crypto acceptance on Clover devices, while merchants can keep local-currency settlement.

⤷ Implication: POS distribution is pulling stablecoin/crypto payments into familiar checkout flows without forcing merchants into crypto balance-sheet exposure.

Onchain Assets kept tokenization inside familiar wrappers, led by regulated distribution and mainstream asset formats. More access, less friction.

DigiFT + Hines bring regulated real estate exposure on-chain

⤷ DigiFT will support tokenization and distribution of an indirect investment in a Hines-managed real estate portfolio.

⤷ Implication: tokenization is leaning into institution-friendly wrappers that prioritize compliant distribution and investor eligibility.Hang Seng launches gold ETF with Ethereum tokenized share class

⤷ A physical gold ETF debuted with tokenized units issued on Ethereum (with optional expansion to other chains).

⤷ Implication: tokenized fund units are showing up inside traditional ETF structures - helpful for secondary transfer rails while keeping conventional custody foundations.

Onchain Market turned the spotlight on custody, with new rules and bank-grade custody deals shaping market structure. Guardrails are becoming the default.

CIRO rolls out a tiered crypto custody framework

⤷ Canada’s CIRO introduced risk-based custody guidance targeting hacking, fraud, governance weaknesses, and insolvency risks.

⤷ Implication: tighter custody standards can raise baseline protections, while also setting clearer requirements for platforms courting institutional flows.VersaBank to custody Stablecorp’s QCAD (CAD stablecoin)

⤷ VersaBank signed a definitive agreement to act as custodian for QCAD’s trust assets.

⤷ Implication: regulated custody arrangements strengthen the “reserve credibility” story for CAD stablecoins, useful groundwork for broader adoption.

Onchain Infra leaned further into enterprise integrations, with sharper security coordination across the sector. Infrastructure is optimizing for institutional ops.

Cronos integrates Fireblocks for institutional trading workflows

⤷ Cronos added Fireblocks to support institutional-grade custody and operations on the network.

⤷ Implication: chains are competing on enterprise integrations that reduce operational friction for market makers and institutions.Coinbase expands automated threat intel sharing with Crypto ISAC

⤷ Continuous sharing of high-confidence threat intelligence is aimed at faster detection of sophisticated attacks.

⤷ Implication: security posture is turning into a shared industry layer, not a solo competitive advantage.

Onchain Yield gave staking new wrappers, from exchange-traded products to premium staking launches. Yield is being packaged for broader audiences.

21Shares lists JitoSOL staking ETP on Euronext

⤷ A regulated ETP gives investors exchange access to JitoSOL and its staking yield.

⤷ Implication: staking yield keeps moving into broker-native wrappers, widening access without wallet or validator management.

Tramplin launches premium staking on Solana

⤷ Tramplin publicly launched a Solana staking product backed by iTreasury Ventures.

⤷ Implication: staking products are getting more structured and segmented, with tighter positioning around savings-style outcomes.

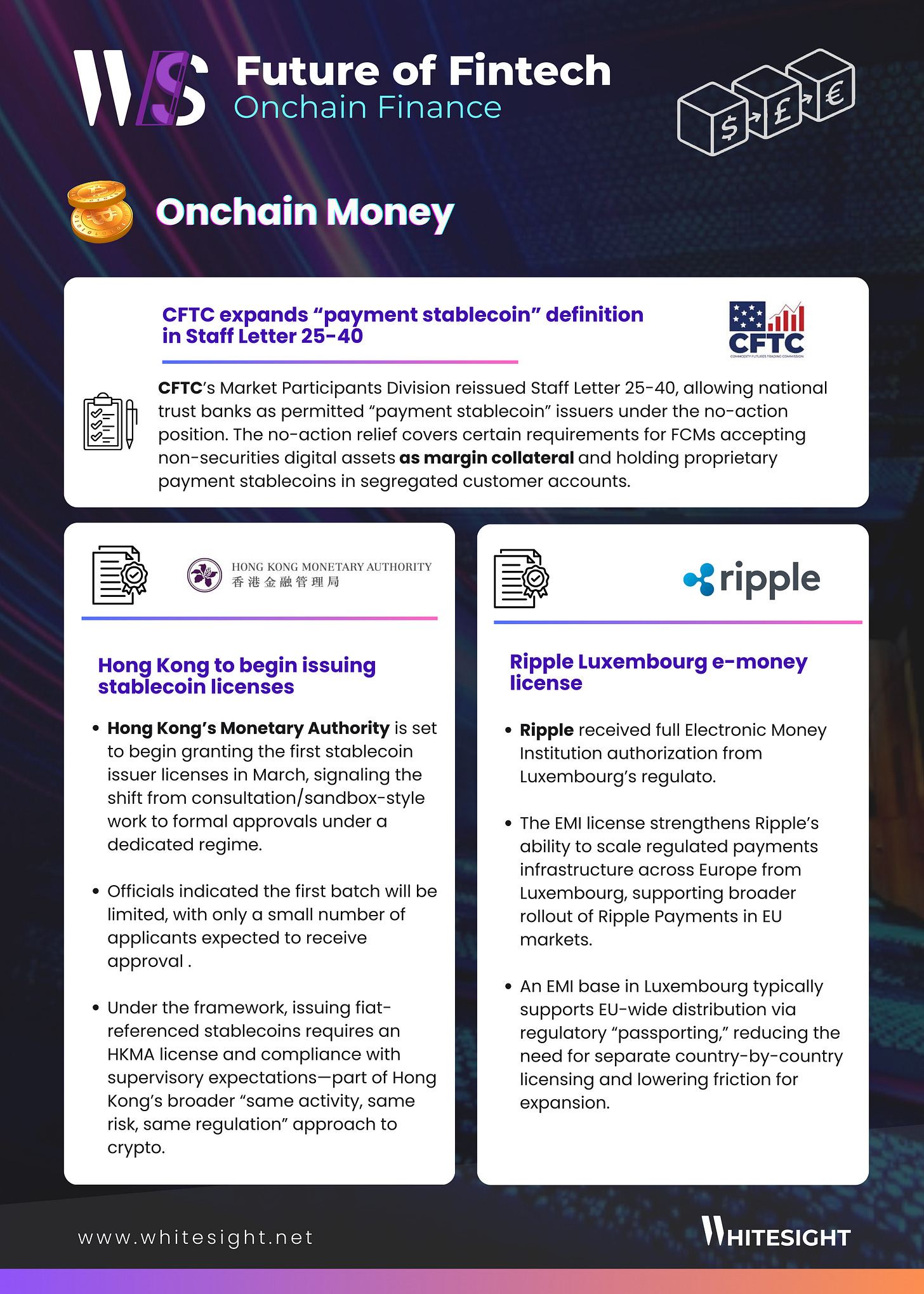

Onchain Lending saw bank credit inch toward crypto collateral while drawdowns stress-tested onchain leverage. Lending is expanding, and liquidations still set the tone.

Sberbank prepares crypto-backed loans, signals coordination with the central bank

⤷ Russia’s largest bank is moving toward loans secured by crypto collateral after a prior pilot and stated readiness to shape the regulatory framework.

⤷ Implication: crypto collateral is finding pathways into bank credit products where corporate demand and regulatory engagement line up.Crypto credit stress resurfaces after sell-off

⤷ Market drawdowns reignited scrutiny on liquidation dynamics and leverage feedback loops in crypto/DeFi credit.

⤷ Implication: resilience under stress is becoming a key adoption test for onchain lending venues and credit products.

And that’s a wrap 👋

We hope you enjoyed this edition of the Onchain Finance!

As a reward for making it this far, here’s a curated set of onchain resources to keep your curiosity (and conviction) topped up. Cheers to continuous learning!

🔗 Link Up! –

Crypto Adoption: What Consumers Told Us in 2025 Report – Deutsche Bank Research

Stablecoins Are Not Enough– Etherfuse

Charting Crypto Q1 2026: Fresh Footing – Coinbase

If you’re someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don’t be shy to show some ❤️

Thanks for reading Future of FinTech Newsletter! Subscribe for free to receive new posts and support my work.