Onchain Finance: Coinbase Agentic Wallets | Dirham stablecoin | Visa settles USDC on Ethereum

Onchain Finance - Edition 3: Feb 8th - 16th

Onchain finance had a “settlement week” - and it was busy. ⚙️🪙

UAE-style regulated issuance, enterprise stablecoin settlement, and tokenized treasuries trading/serving as collateral all pushed the stack forward, while AI agents got their own payment tools.

✔️ Stablecoin settlement moved deeper into regulated and enterprise workflows

✔️ Tokenized treasuries looked more like collateral and trading inventory

✔️ Agentic wallets + automated payments pushed crypto UX into new default surfaces

Ready for the signals? 🔍

🚨 Featured Story of the Week:

Stablecoin Cards Go Mainstream: Quantoz × Visa 💳🪙

Quantoz partnered with Visa to become a direct Visa principal member, enabling it to issue virtual Visa debit cards and act as a BIN sponsor for third-party fintechs - so customers can spend regulated e-money/stablecoin balances anywhere Visa is accepted (including Apple Pay/Google Pay).

This matters because the “stablecoin moment” is shifting into a familiar distribution channel: cards, where compliance, settlement, and acceptance already exist - and stablecoins can ride that infrastructure into everyday spend.

What changes now

Regulatory: Principal membership + BIN sponsorship puts stablecoin-linked spend inside the same governance, controls, and program standards used for mainstream card issuance.

Market structure: Stablecoin balances start behaving like a spendable account layer, while merchants still receive local currency through existing card rails.

Institutional adoption: Fintechs can launch card products faster because the “heavy lifting” (network access + issuing sponsorship) sits with regulated intermediaries like Quantoz.

How the runway was set

Visa’s card playbook: Visa already rolled out stablecoin-linked card issuance via Bridge (Stripe company), letting developers issue cards funded by stablecoin balances via API.

Mastercard’s parallel push: Mastercard positioned end-to-end stablecoin acceptance: wallet enablement, card issuing, and merchant settlement, through partners like OKX and Nuvei.

Network-level expansion: Mastercard also partnered with Fiserv to support stablecoin-linked cards and merchant settlement in FIUSD across its acceptance footprint.

Stablecoin adoption is increasingly a distribution race, and cards are becoming the fastest bridge from onchain balances to everyday spending.

Thanks for reading Future of FinTech Newsletter! Subscribe for free to receive new posts and support our work.

🚀 Startup Spotlight: STBL

STBL is building stablecoin + yield infrastructure that lets ecosystems launch their own programmable, yield-sharing stablecoins, anchored to USST (its universal over-collateralized stablecoin backed by high-quality RWAs).

This week’s OKX Ventures investment and the X Layer partnership signaled strong product–market fit: institutions want regulated, tokenized collateral + programmable settlement, and STBL is positioning itself as the infrastructure layer that packages that into deployable “ecosystem-specific” stablecoins.

Building something interesting in onchain finance? We’d love to feature you next- drop us a note at hello@whitesight.net 👋

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the onchain menu today?

🏁 Onchain Highlights: Biggest moves across money, markets, and tokenization

🧩 ‘Byte’ Buzz: Onchain Finance updates, sorted by segment

🔗 Link Up: A curated set of reads worth your time

Sip on bite-sized onchain updates - fresh, sharp, and distilled to keep you ahead in just minutes. Subscribe now! 📨

📢 We’re always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we’d love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Edition 3 brings you the onchain finance stories that shaped how money, markets, and assets moved this week »

Last Week’s Top Onchain Tea!♨️

Institution-grade settlement rails go on-chain

↳ IHC and First Abu Dhabi Bank launched the dirham-backed stablecoin DDSC on ADI Chain under UAE central bank licensing.

↳ Visa began settling USDC stablecoin transactions on Ethereum for real-world payment flows.

↳ Fiserv launched INDX to move USD 24/7/365 for digital-asset firms via a single custodial account.

Tokenized cash becomes tradable + usable as collateral

↳ BlackRock’s BUIDL tokenized MMF became tradable on Uniswap via Securitize’s compliance/whitelisting layer.

↳ Binance and Franklin Templeton activated tokenized money market funds as off-exchange collateral for institutions.

Public experiments

↳ The Bank of England teamed with Chainlink to test settling tokenized assets alongside central bank money.

↳ Robinhood launched a public testnet for Robinhood Chain, an Arbitrum-based Ethereum L2 aimed at compliant tokenized finance.

AI + agentic crypto payments stack

↳ Stripe introduced an AI-agent payment system using automated USDC payments on Base via x402.

↳ Coinbase introduced Agentic Wallets so AI agents could transact with configurable controls.

Now, for the ‘byte’-sized onchain buzz -

Onchain Money put stablecoins deeper into regulated banking rails!

OKX snags EU payments license for stablecoin rails

↳ OKX secured a Payment Institution license in Malta to expand stablecoin payments and its crypto card push across Europe.

↳ Implication: stablecoin checkout and card products are becoming “license-first” utilities as EU compliance deadlines kick in.Japan’s megabanks test stablecoins for securities settlement

↳ Nomura and Daiwa launched a PoC with MUFG, SMBC, and Mizuho to use stablecoins for securities settlement inside Japan’s FSA sandbox.

↳ Implication: stablecoins are moving toward DvP-style settlement in traditional markets, not just remittances.

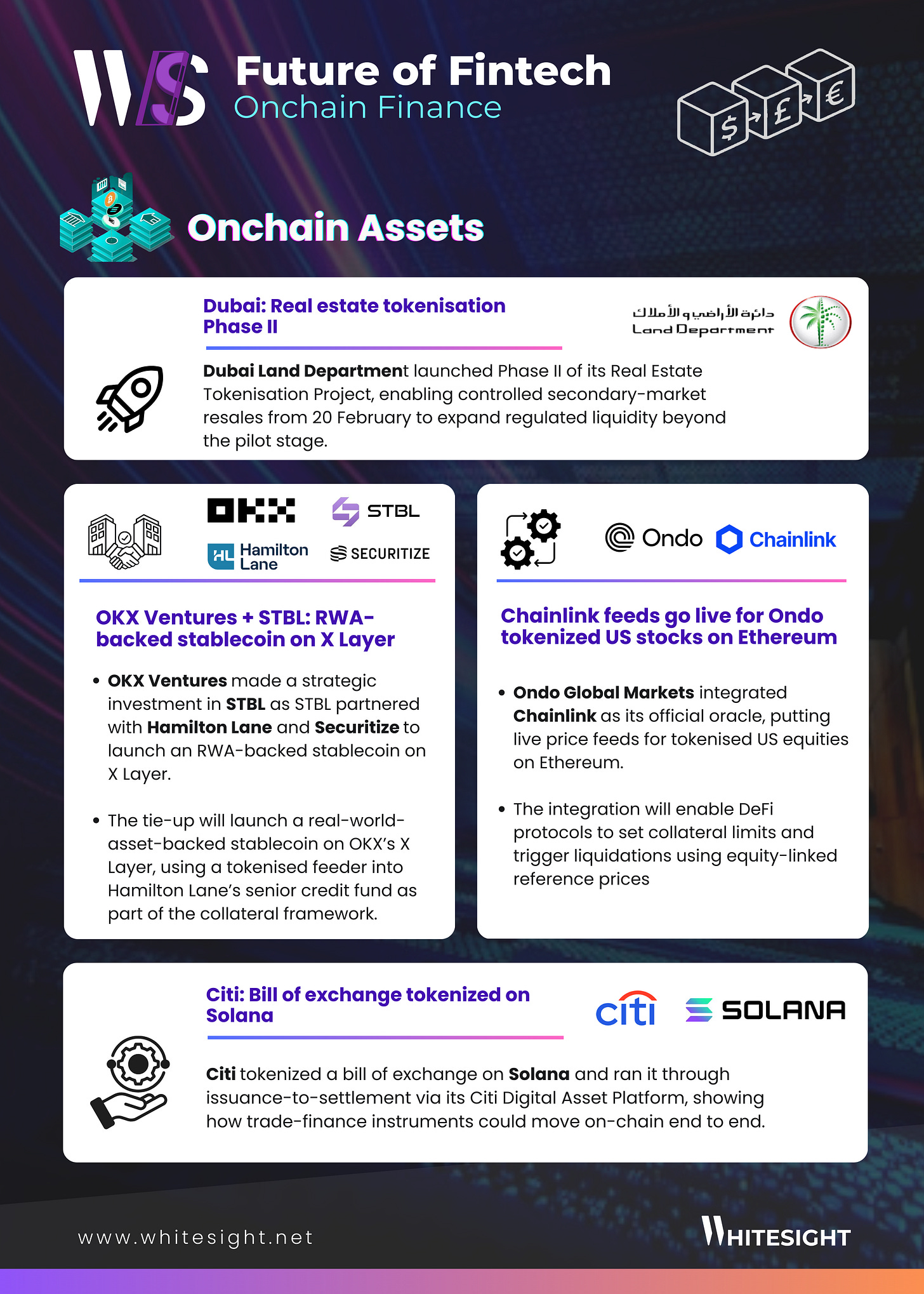

Onchain Assets kept tokenization inside familiar wrappers - sovereign-style issuance and regulated derivatives access.

UK taps HSBC Orion for tokenized gilt pilot (DIGIT)

↳ HM Treasury selected HSBC Orion to run the UK’s digital gilt pilot, testing blockchain rails for government bond issuance/settlement.

↳ Implication: tokenized sovereign debt is edging toward “real issuance,” which upgrades tokenization from demos to market infrastructure.Thailand clears crypto as underlyings for regulated derivatives

↳ Thailand approved changes to let crypto/digital assets be used as underlying assets in the regulated derivatives framework.

↳ Implication: the “regulated perimeter” expands — more crypto exposure can move into licensed venues instead of offshore products.

Onchain Markets looked more like “licensed market access” - major players getting regulatory stamps.

Blockchain.com gets FCA registration in the UK

↳ Blockchain.com was registered with the UK FCA to operate as a crypto asset business, enabling regulated brokerage/custody services in-market.

↳ Implication: UK market structure is increasingly defined by who can operate under FCA supervision - raising the bar for credible distribution.Animoca Brands secures VARA VASP license in Dubai

↳ Animoca received a VARA VASP licence to provide broker-dealer and management/investment services in/from Dubai for institutional and qualified investors.

↳ Implication: Dubai keeps pulling Web3 into a regulated hub model - licensing becomes a growth lever, not a constraint.

Onchain Infra shifted toward enterprise-grade rails - custody stacks and settlement plumbing for institutions.

Ripple upgrades institutional custody with security + staking integrations

↳ Ripple expanded Ripple Custody via partnerships with Securosys (HSM security) and Figment (staking for ETH/SOL) plus compliance integrations.

↳ Implication: custody is bundling into a “full stack” (security + compliance + yield) that banks can adopt without building it all.LSEG plans an on-chain settlement platform (DSD)

↳ LSEG announced plans for a Digital Securities Depository (DSD) to support on-chain settlement connecting traditional and digital markets.

↳ Implication: major market infrastructure is now building for multi-chain settlement workflows, not just token issuance.

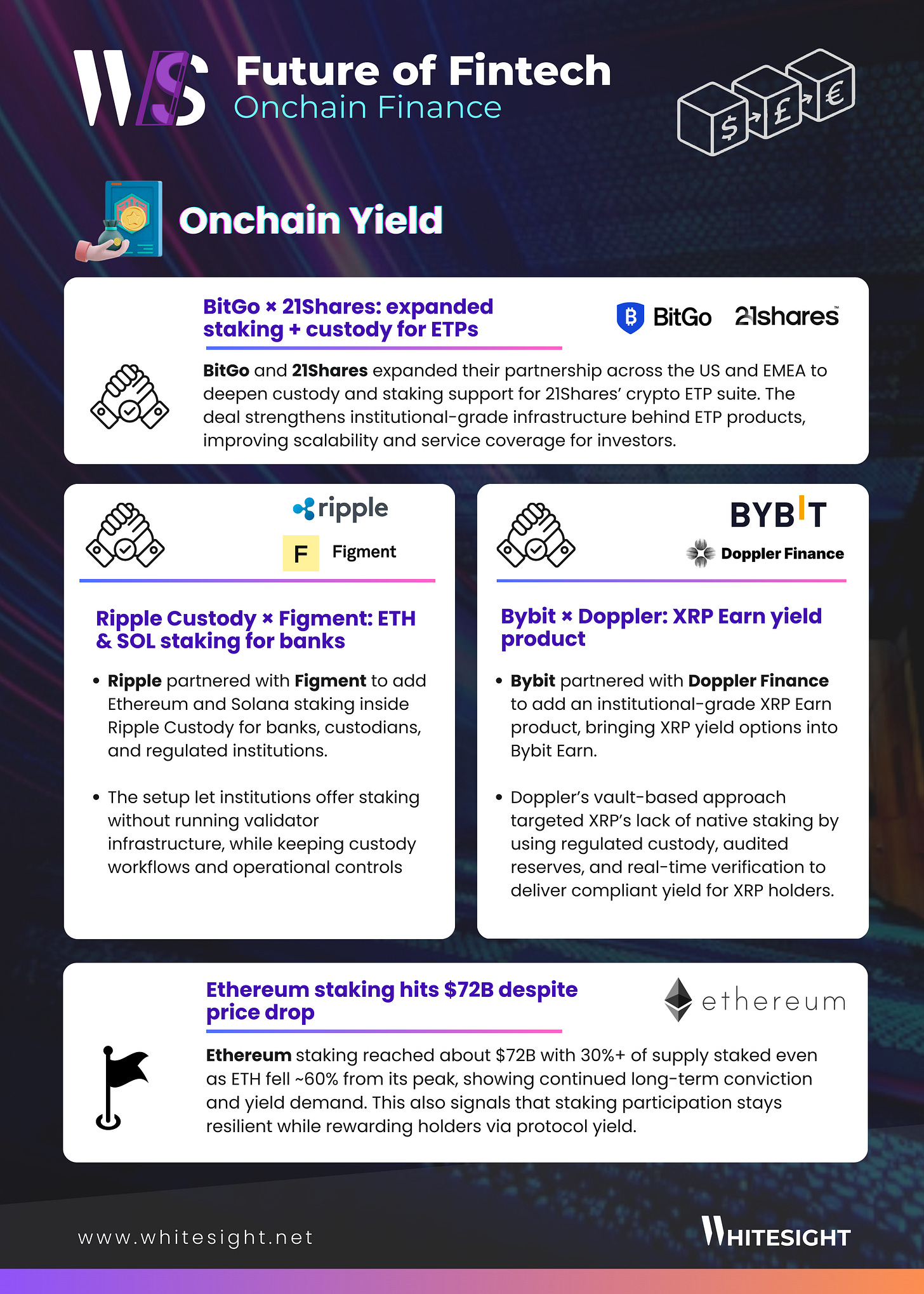

Onchain Yield packaged yield into safer wrappers!

BitGo × 21Shares deepen staking + custody for ETPs

↳ BitGo and 21Shares expanded their partnership across the US and EMEA to support custody and staking services for crypto ETP products.

↳ Implication: staking yield keeps moving into broker-native/regulatory-friendly wrappers, widening access without validators or wallets.Bybit launches an institutional-style XRP Earn with Doppler

↳ Bybit partnered with Doppler Finance to bring XRP yield products to Bybit Earn (positioned as a staking alternative since XRP has no native staking).

↳ Implication: exchanges are productizing “compliant yield” for major assets - even when the base chain doesn’t support staking.

Onchain Lending pushed institutional participation without losing custody - TradFi capital meets DeFi rails.

Morpho × Apollo: cooperation agreement around MORPHO exposure

↳ Morpho signed a cooperation agreement with Apollo, allowing Apollo affiliates to acquire up to 90M MORPHO tokens over 48 months (with restrictions).

↳ Implication: large asset managers are taking structured exposure to DeFi lending protocols - a signal that “onchain credit” is entering institutional portfolios.Anchorage × Kamino: tri-party model for borrowing against staked SOL

↳ Solana, Anchorage Digital, and Kamino launched a tri-party structure letting institutions borrow against natively staked SOL while keeping qualified custody.

↳ Implication: the “don’t move custody” constraint is getting solved - which is key for institutional-scale DeFi lending participation.

And that’s a wrap 👋

We hope you enjoyed this edition of the Onchain Finance!

If you’re someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don’t be shy to show some ❤️

Thanks for reading Future of FinTech Newsletter! Subscribe for free to receive new posts and support my work.