Morgan Stanley Powers Into Crypto

Future of Fintech - Edition #180 (23rd - 30th Sept‘ 25)

The fintech compass is spinning wildly. 🧭 One minute it’s youth banking and SME lending, the next it’s cross-border expansion and stablecoins finding their footing. Everywhere you look, the rules of money are being re-written.

✔️ Banking reshaped for new generations

✔️ Smarter lending at your fingertips

✔️ Crypto settling into the system

Ready to trace the forces? 🔥

🚨 Featured Story of the Week:

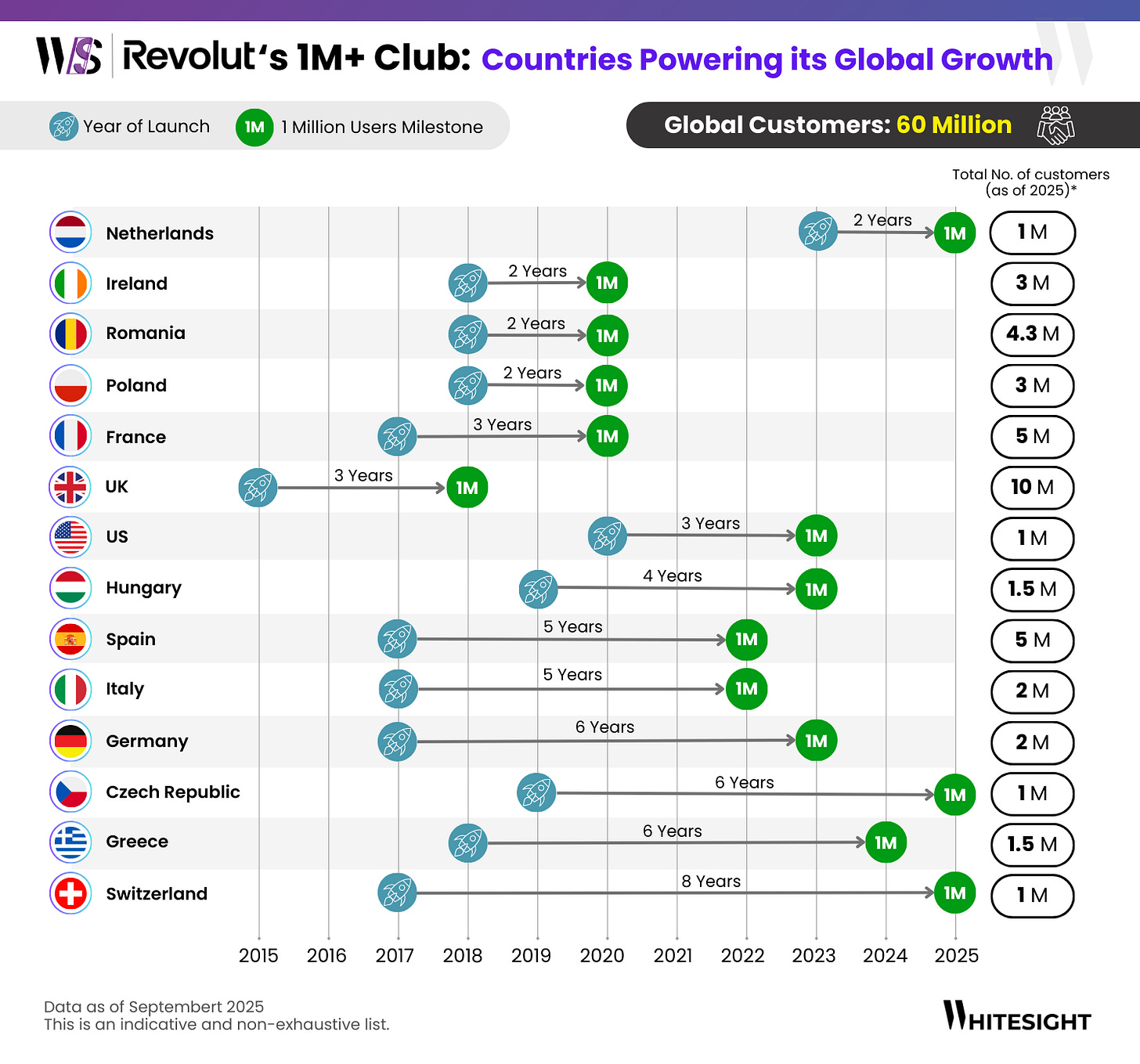

Speed, Scale, and 60 Million 🌍📈

Revolut’s playbook has been nothing short of relentless—racing into new markets, hitting million-user milestones faster than ever, and cementing itself as one of the few fintechs with true global gravity. From the UK to the US, from Poland to Spain, the superapp’s momentum shows how local DNA and speed to market fuel worldwide dominance.

This week’s featured deep dive from WhiteSight unpacks Revolut’s global customer journey, mapping out how it built a 60-million strong base through expansion bets, product breadth, and hyper-scalable growth strategy.

Key growth drivers in focus:

⚡ Rapid market launches hitting 1M milestones

💳 Layering payments, credit, and insurance services

🌐 Expanding into crypto, wealth, and trading

🚀 Scaling into a one-stop financial and lifestyle hub

Revolut’s path to 60 million customers is a masterclass in turning local wins into global leadership.

👉 Check out the full story here

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Sip on bite-sized updates every week—fresh, hot, and brewed to keep you in the loop in just minutes. Subscribe now! 📨

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

From stablecoins to smart credit, Edition 180 captures the moves steering finance into its next phase.

The Week's Hot 10!♨️🔟

Milestone Moment

⤷ Klarna’s U.S. debit-first card hit over 1 million sign-ups in just 11 weeks since launch.

⤷ ZA Bank in Hong Kong surpassed 1 million users, marking a milestone in Hong Kong’s virtual banking adoption.

Banking for the Next Gen

⤷ ABN AMRO to leverage Mambu to support Buut, a neobank for youth, in modernizing its banking infrastructure.

⤷ Revolut committed USD 13 billion to global expansion and is exploring acquiring a U.S. bank as part of its growth push.

Smarter Credit Access

⤷ NextGen launched an Open Banking-powered Automated Income Verification tool to replace manual payslip checks and speed up lending decisions.

⤷ Saudi National Bank (SNB) launched a POS lending platform for SMEs in partnership with Tarabut and Geidea, enabling financing at point-of-sale.

Cross-Border Ambitions

⤷ Solidgate joined forces with EBANX to accelerate expansion in Latin America and emerging markets, giving merchants access to local payment rails via one API.

⤷ Airwallex obtained approvals in UAE, launched a Saudi entity and partnered with Tabby to enable BNPL and fintech services in the Middle East.

Wall Street Meets Web3

⤷ Morgan Stanley to offer cryptocurrency trading (Bitcoin, Ether, Solana) through its ETrade platform beginning early 2026.

⤷ Ripple, in collaboration with Securitize, enabled holders of BlackRock and VanEck tokenized fund shares to redeem their positions into Ripple’s stablecoin (RLUSD).

Now, for the ‘byte’-sized fintech buzz –

Embedded finance is slipping deeper into the everyday, turning ordinary services into instant gateways for credit and payments.

Affirm partnered with ServiceTitan to integrate BNPL into home service payments. This makes ServiceTitan’s first step into offering flexible financing options for its customers.

Pleo launched an embedded finance solution for businesses. It enables them to integrate payments, credit, and other financial services directly into their own platforms.

Open finance is cashing in on momentum, fueling fresh funding that supercharges data-driven access to money.

TRIVER secured up to £114 million in funding to expand its AI-driven cash-flow finance platform. The company will use Open Banking data to provide UK SMEs with faster and more flexible invoice financing.

Argyle raised $40 million to accelerate its open finance and employment data connectivity platform. The funding will support global expansion and the development of new use cases.

Digital finance is breaking new ground, mixing money smarts with AI-driven rails to change how people pay and learn.

Starling Bank teamed with Arsenal to launch a financial literacy campaign aimed at educating fans on smart money habits. The partnership uses Arsenal’s platform to deliver content and tools to increase financial awareness across the UK.

Ant International partnered with Google to co-develop an Agent Payments Protocol (AP2), a system for AI agents to execute financial transactions on users’ behalf. The collaboration aims to embed payments into generative AI workflows while ensuring security and compliance.

Fintech infrastructure is cranking up the voltage, plugging local systems into global grids for faster, smarter flows.

Paymentology signed an MoU with Enjaz to advance next-generation digital payments in Saudi Arabia, combining their tech and network strengths. The partnership aims to drive innovation in card processing, payment rails, and fintech adoption.

Ebury acquired ArcaPay and rebranded as Ebury Partners Lithuania, expanding its payments and FX capabilities in the Baltics. This move strengthens Ebury’s cross-border payments reach in Europe.

Digital assets are turning up the heat, pushing stablecoins and staking into the core of mainstream finance.

PayPal teamed up with DeFi protocol Spark to boost liquidity for its stablecoin PYUSD, targeting $1 billion in deposits to integrate more deeply with on-chain markets.

Bunq launched EU-wide flexible crypto staking (no lockups) for users, allowing them to earn yield yet maintain full withdrawal flexibility across Europe.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Banking on Digital Assets: How Traditional Finance is Investing in Blockchain Report- Ripple

The end of inertia: Agentic AI’s disruption of retail and SME banking Report - McKinsey

Why you should not compare SWIFT and blockchains Blog - Chris Skinner

Unlocking Africa’s digital future: the rise of real-time payments Blog- Mastercard

Revolut: From UK Challenger to Global Superapp Report - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️