Mastercard Moves All In ♟️- Borders Down, Coins Up, Rails On

Future of Fintech - Edition #177 (Aug 26th - 1st Sept‘ 25)

If money had a soundtrack this week, it’d be fast, loud, and relentless. 💸 Borders don’t matter, compliance is biting back, kids are stacking savings, and digital coins are finally being taken seriously.

✔️ Payment rails cranked to max speed

✔️ Credit reshaped by data and youth

✔️ Stablecoins sliding into settlement lanes

Let’s dive into the week where finance flexed hard. 🔥

🚨 Featured Story of the Week:

Ethereum at 10: A Decade of Decentralised Evolution 🔗🔥

From powering the first wave of ICOs to anchoring today’s DeFi, NFT, and stablecoin ecosystems, Ethereum has been the bedrock of blockchain innovation. In just a decade, it’s transformed from an experimental smart contract chain into the backbone of a trillion-dollar digital economy.

This week’s featured infographic from WhiteSight traces Ethereum’s journey - unpacking its breakthroughs, the hurdles it has faced, and what the next decade could hold for the world’s most influential programmable blockchain.

💥 Key shifts across the decade:

⚡ The birth of smart contracts and decentralised apps

🌍 The rise of DeFi and NFTs as global movements

🔐 Major upgrades like Proof-of-Stake and scalability drives

🚀 Growing role as settlement layer for stablecoins and tokenized assets

Ethereum’s story is about how open infrastructure can rewire global finance, culture, and technology at once.

👉 Check out the full story here

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Sip on bite-sized updates every week—fresh, hot, and brewed to keep you in the loop in just minutes. Subscribe now! 📨

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Edition #177 runs Clear, Connected, and Cross-border – where wallets, banks, and blockchains finally speak the same language.

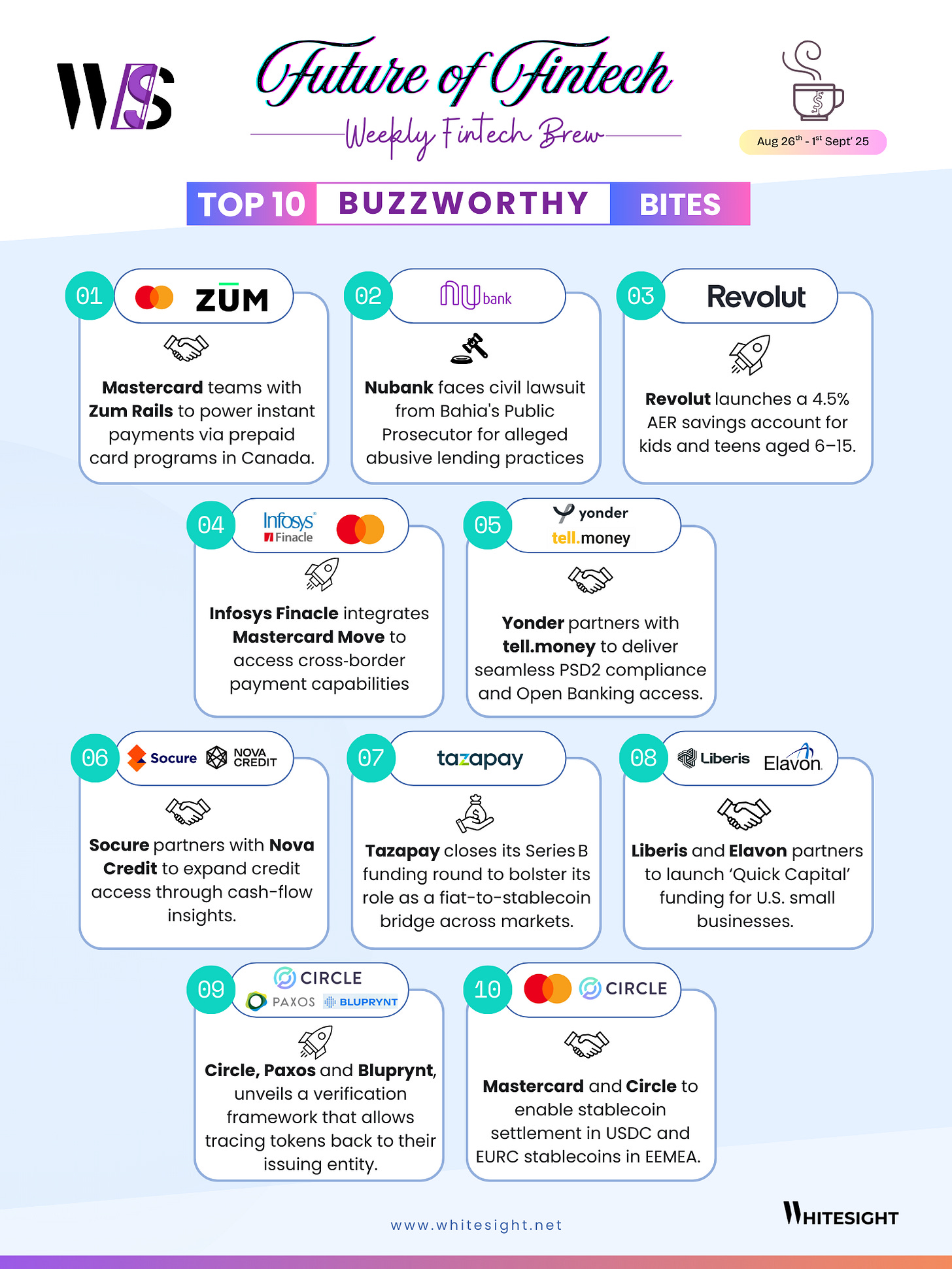

The Week's Hot 10!♨️🔟

Money on Turbo Mode

⤷ Mastercard teamed with Zum Rails to power instant payments via prepaid card programs in Canada.

⤷ Infosys Finacle integrated with Mastercard Move to access cross-border payment capabilities.

Rules Bite Back

⤷ Nubank faced civil lawsuit from Bahia’s Public Prosecutor for alleged abusive lending practices.

⤷ Yonder partnered with tell.money to deliver seamless PSD2 compliance and Open Banking access.

Financial Access for New Group

⤷ Revolut launched a 4.5% AER savings account for kids and teens aged 6–15.

⤷ Socure partnered with Nova Credit to expand credit access through cash-flow insights.

Cash, Right When Needed

⤷ Liberis and Elavon partnered to launch ‘Quick Capital’ funding for U.S. small businesses.

⤷ Tazapay closed its Series B funding round to bolster its role as a fiat-to-stablecoin bridge across markets.

Stablecoins Take the Stage

⤷ Circle, Paxos and Bluprynt unveil a verification framework that allows tracking tokens back to their issuing entity.

⤷ Mastercard and Circle to enable stablecoin settlement in USDC and EURC stablecoins in EEMEA.

Now, for the ‘byte’-sized fintech buzz –

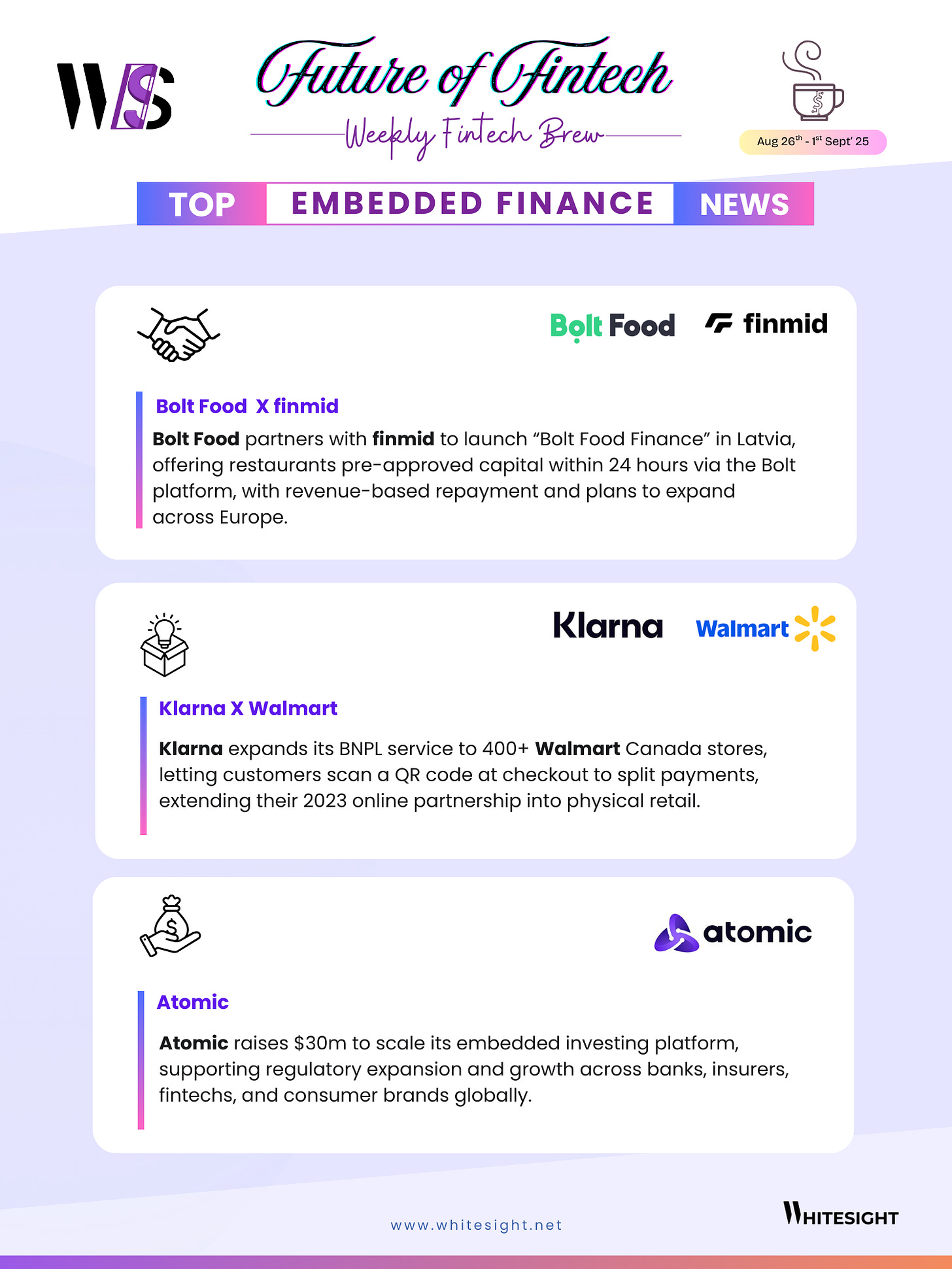

Embedded finance is moving deeper into business workflows, from SME treasuries to restaurant platforms, making money management faster and more accessible.

Pleo and lemon.markets partnered to launch the ‘Pleo Investment Account’ for German SMEs. The embedded treasury product allows businesses to invest surplus funds in money market funds directly via Pleo, with next-day liquidity.

Bolt Food partnered with finmid to provide embedded financing for restaurants, starting in Latvia. “Bolt Food Finance” gives restaurants rapid, pre-approved capital within 24 hours directly through the Bolt platform.

Open finance is sharpening its edge with smarter onboarding and fraud controls, pushing toward smoother, safer access at scale.

Plaid extended its instant onboarding experience (Layer) beyond tens of millions, enabling seamless autofill for a vastly larger user base, which helps businesses improve conversion and engagement during sign-up.

iDenfy partnered with Ping Proxies to integrate its AI-powered KYC solution, enhancing secure identity verification and reducing fraud for scalable user onboarding.

Digital finance is breaking borders, blending wallets and blockchain rails to make global payments instant and card-free.

SoFi partnered with Lightspark to launch a blockchain-powered international money transfer service using Bitcoin’s Lightning Network.

Rappi partnered with AstroPay to launch Latin America’ super app wallet integration, letting users pay directly from AstroPay wallets for cardless payments.

Fintech infrastructure is flexing its muscle with next-gen cards and interoperable standards that keep money moving across systems and geographies.

BPC launched Visa Flex in Vietnam, letting cardholders switch between debit, credit, installments, rewards, and BNPL on one card - advancing the country’s digital payments.

Ant International, Standard Chartered, and SWIFT began live trials of an ISO 20022 bank-to-wallet solution, enabling direct transfers from bank accounts to e-wallets via Alipay+ with SWIFT’s network.

Digital assets are stepping into the mainstream, powering funding rounds and bank rails as stablecoins become a trusted settlement layer.

Rain raised $58M in a Series B led by Sapphire Ventures to scale its stablecoin infrastructure across cards, wallets, and cross-border payouts, aiming to reduce reliance on legacy rails.

Circle and Finastra partnered to integrate stablecoin settlement into Finastra’s payment hub. Banks can initiate fiat payment instructions but settle cross-border flows in USDC.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Singapore SME Banking: Democratizing API Access Report- Fintech Nation

Rise of agentic AI Report - Capgemini

Banking is what we do … but technology is how we do it Blog - Chris Skinner

The conversion paradox: 3DS trends in regulated markets Blog- Stripe

Nubank Deep Dive Report Blog - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️