JPMorgan’s Token Era Begins: JPMD 🪙

Future of Finance - Edition #168 (10th - 16th June‘ 25)

This week’s fintech is loud in all the right places! Systems are learning. Payments are predicted. Tokens are working behind the curtain. If you blink, you’ll miss the new layer forming under everything.

✔️ Predictable flows get rebuilt

✔️ AI plugs into the core

✔️ Stablecoins step into the frame

Let’s get into the guts of it »

Deep Dive Ahead:

🌍 The SME Bank Map Just Got a Major Update

A silent banking revolution is unfolding—and it’s all about the underbanked engine of the global economy: small businesses. Our latest research in collaboration with Zasu spotlights a new class of digital banks reshaping SME finance, not just with better UX, but with entirely new infrastructure.

From Lagos to London, SME-focused neobanks are embedding credit, invoicing, and analytics into daily business tools

Workflow-native design is outpacing legacy core systems

Emerging markets aren’t playing catch-up—they’re leading the rethink

🧭 With digital players mapped across the globe, this is the most comprehensive look at where SME banking is heading—and why the next big financial shift might come from the smallest clients.

➡️ Explore the full report below and see how this momentum is reshaping the global financial stack: Reimagining Digital Banking for SMEs

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Sip on bite-sized updates every week—fresh, hot, and brewed to keep you in the loop in just minutes. Subscribe now! 📨

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Edition #168 is here — smooth like tokenised cash, sharp like open data, and fully loaded with global flex.

The Week's Hot 10!♨️🔟

Stablecoins Find Scale

⤷ Coinbase launched Coinbase Payments, enabling merchants and PSPs to accept USDC stablecoin payments.

⤷ Revolut is reportedly working on its own stablecoin to expand its crypto suite, aiming to compete in the growing regulated stablecoin market.

Experian Was Busy

⤷ Experian signed a strategic cloud deal with AWS to power over 100 generative-AI use cases across credit analytics and operations.

⤷ Experian added Monzo to its Support Hub, helping users share accessibility preferences once across multiple businesses for a more inclusive experience.

Local Focus, Global Play

⤷ Stripe rolled out 15 new features to boost France’s digital economy, many of which leverage AI and stablecoins.

⤷ Klarna entered the mobile service space via MVNO as part of its push to broaden services and deepen its U.S. footprint.

Building for Builders

⤷ Toqio integrated Adyen’s payment capabilities into its orchestration layer, enabling companies to launch tailored financial solutions quickly and with full brand control.

⤷ Salt Edge partners with RiseUp to help institutions monetise Open Banking data and drive customer engagement, behavior modeling, and monetisation.

Smarter Money Loops

⤷ Belvo launched Pix Automático using Open Finance to automate recurring payments and improve collection success for businesses operating recurring revenue models.

⤷ JPMorgan launched JPMD Deposit Token on Coinbase’s Base Blockchain to support predictable, programmable financial interactions.

Now, for the ‘byte’-sized fintech buzz –

Embedded Finance is stepping up its style game, quietly turning everyday moments into seamless financial touchpoints.

Alipay+ introduced a global e‑wallet payment via smart glasses in Hong Kong, showcasing QR-coded, voice-command-enabled transactions—pioneering wearable payment tech for AR devices.

Australian insurer TAL partnered with insurtech Cover Genius to introduce "backed by TAL," a digital embedded life, income, and illness protection product integrated directly into payroll and HR platforms, offering no underwriting, fully digital claims and targeting underinsured Australians.

Open Finance is doing more than opening doors—it’s rewriting the blueprint for how underserved users get in.

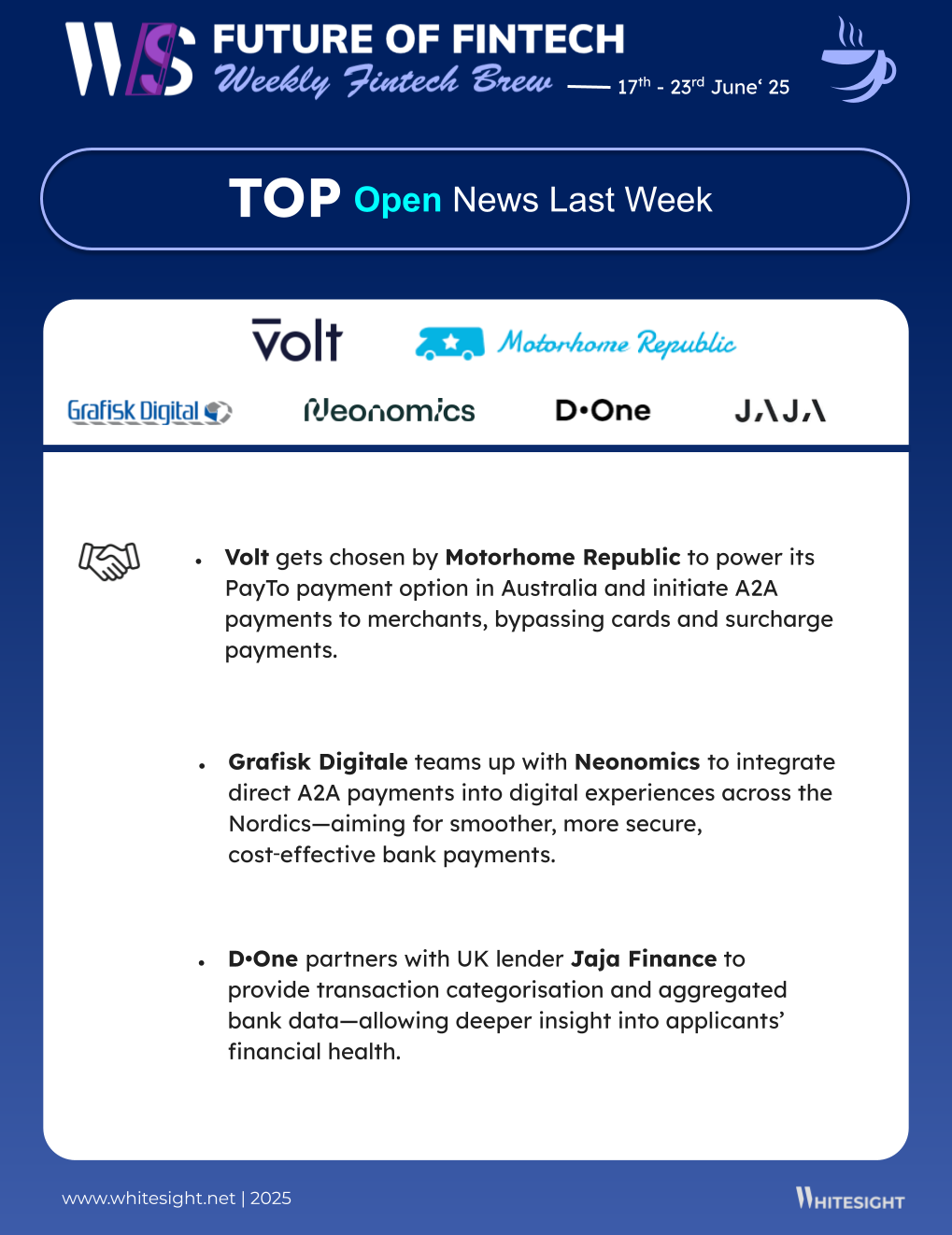

Volt, a global real‑time payments platform, will enable Motorhome Republic to offer PayTo account‑to‑account checkout in Australia, reducing card fees and improving payment speed, with a planned expansion into the UK/Europe.

MTN and its digital arm Chenosis, in collaboration with TransUnion Africa, introduced a new credit scoring system using mobile call data records. The “Telco Data Score” targets South Africans lacking formal credit histories, expanding access to financial services.

Digital Finance is getting personal and going places, shaping itself around how we live, spend, and swipe on the go.

Openbank surpassed 110,000 Mexican customers within four months of its February 2025 launch, gathering over €60 million in deposits and signalling strong demand for digital banking.

Revolut is piloting an AI‑powered financial assistant, designed to provide personalised insights, budgeting help, and improved money management—currently in the testing phase.

Fintech Infrastructure is ditching the lag, building faster brains and smoother rails to power next-gen money moves.

dtcpay partnered with Mastercard Move to leverage its global payment rails, enabling fast, cost-effective, and transparent cross-border transfers across 49+ corridors to destinations including China, UAE, EU nations, and Southeast Asia.

Light Frame teamed up with Mambu to deliver a cloud‑native, integrated core-banking solution for private banks and wealth managers, offering agility, scalability, and compliance for modern wealth operations.

Digital Assets are checking all the boxes, locking in licenses and lining up to play big in the regulated arena.

Coinbase obtained a Markets in Crypto-Assets (MiCA) license from Luxembourg’s CSSF, allowing it to establish an EU headquarters there and operate across all 27 EU member states.

Visa expanded its USDC settlement capabilities across Central & Eastern Europe, the Middle East, and Africa (CEMEA), and partnered with Yellow Card in Africa to streamline cross-border and treasury payments.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Crypto Wallet Use Cases Report- Bitget

The State of Real-Time Payments in Australia Report- Westpac

Demystifying payment authentication across Latin America and North America Blog- Mastercard

What Makes Reconciliation in Banking-as-a-Service Unique? Blog- Synctera

Inside Nubank’s Playbook for Cost-Efficient Hypergrowth Blog - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️

Puma?