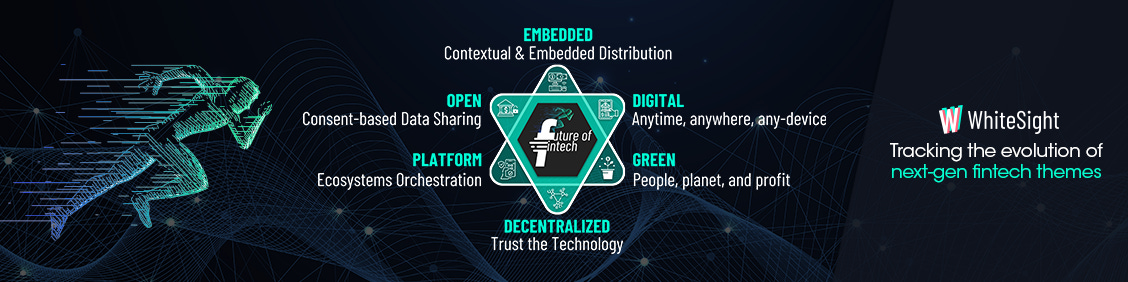

Future of FinTech | Edition #4 – January 2022

As the last week of January bids us adieu to welcome the newness of spring, it leaves no stone unturned in serving us the hot tea surrounding the FinTech world. In a close race for the theme that takes the crown this time around, Embedded Finance takes the lead from Digital Finance by just a mark. The buzz around DeFi and Platform Finance also made up for a good round of announcements. While the Open Finance and Green Finance spheres stayed comparatively low-key, their stir was enough to recharge the Weekly FinTech Brew’s refill for the week.

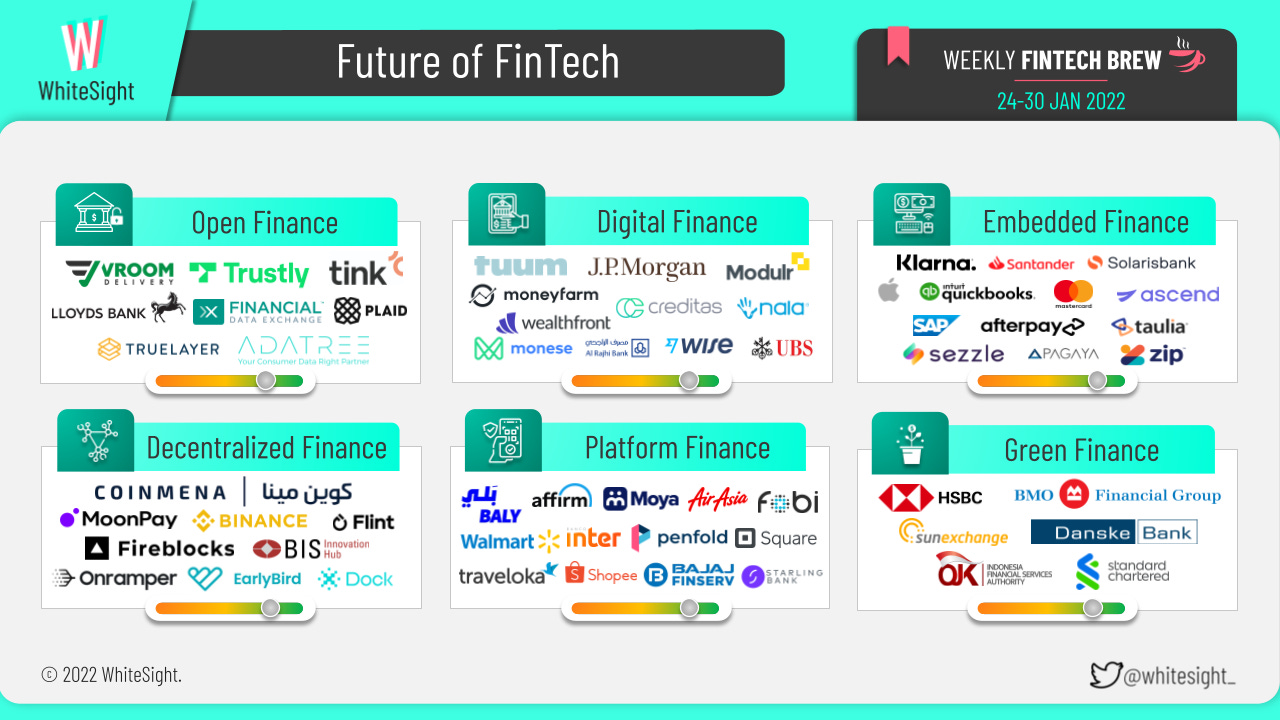

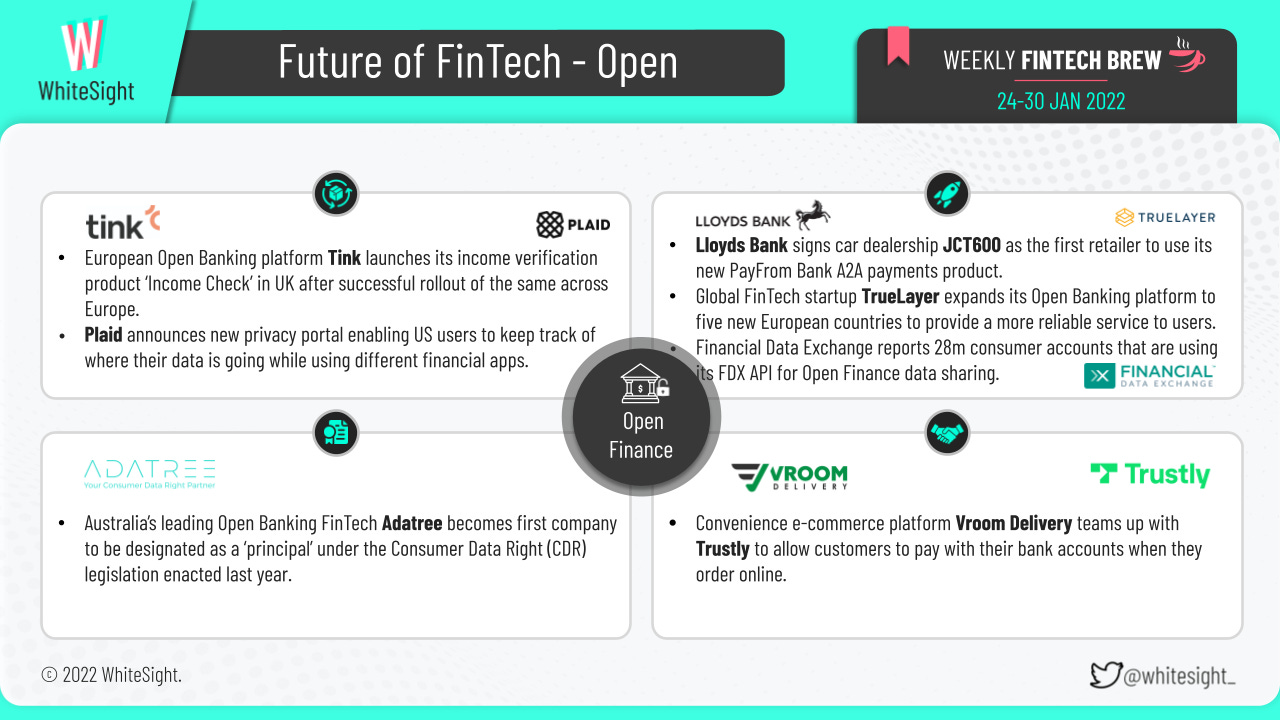

Open Finance: Consent-based Data Sharing

Open Finance saw quite the variety in terms of the activities that took place in the space last week.

Plaid was once again in the news – this time with its new privacy portal that lets US consumers view where their data is going when using a diverse range of apps to manage their finances.

In a bid to streamline income verification using Open Banking technology, Tink launched its ‘Income Check’ product in the UK, enabling banks and lenders to instantly verify a person’s income using secure and real-time data directly from their bank account.

Lloyds’ PayFrom Bank account-to-account payments product also signed its first retailer through car dealership JCT600. The new functionality forms part of JCT600’s latest ‘Buy Online’ offer, allowing customers to browse, reserve, and buy a vehicle, all totally online and without the need to visit a dealership. This is a classic case of Open Banking enabling both digital and embedded finance for consumers and non-banks.

Company milestones make up for the other affairs surrounding the segment for the fourth week. While FDX reported 28 million customers using its FDX API for Open Finance and Open Banking data sharing, TrueLayer added five new European countries as part of its expansion plan for high-quality connectivity and convenience of clients amongst markets.

Speaking of convenience, convenience industry e-commerce platform Vroom Delivery also paired up with Trustly, a partnership that allows customers to pay with their bank accounts when they order online. This will additionally benefit retailers by lowering transaction costs and reducing the risk of fraud.

On the emerging markets front, Aussie Open Banking FinTech Adatree gained a first-of-its-kind Consumer Data Right (CDR) legislation, paving the way for smaller ADIs and lenders to integrate CDR-as-a-service (a new term to add to your FinTech dictionaries) into their systems.

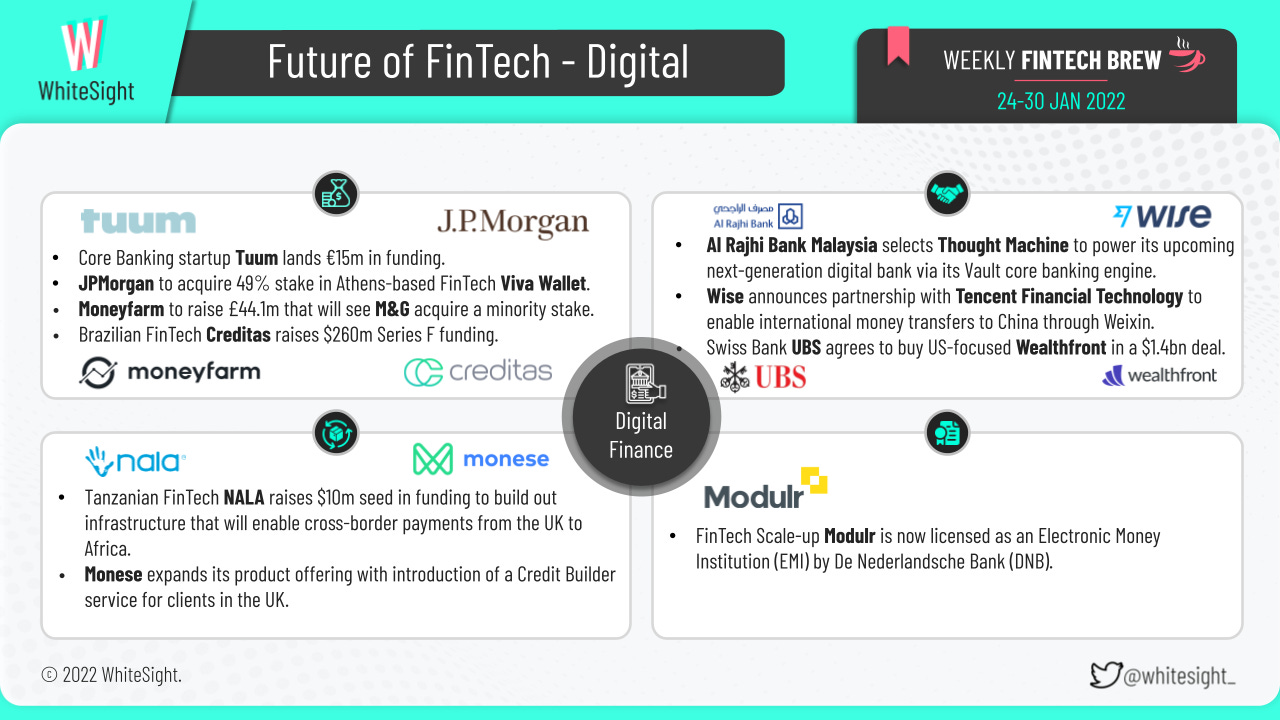

Digital Finance: Anytime, Anywhere, Any Device

A series of fundings were the highlight for Digital Finance’s Weekly Brew.

While JPMorgan agreed to take around 49% stake in cloud-based Viva Wallet for continued payments innovation in the European businesses, digital wealth manager Moneyfarm raised £44.1m through a private placement led by M&G, allowing the latter to acquire a minority stake in the company. Estonian core banking supplier Tuum also landed a €15m funding deal to expand its operations initially in the UK, followed by R&D efforts to develop its product portfolio. Brazilian FinTech Creditas jumped the funding bandwagon with its own $260m Series F funding valuing the company at $4.8bn.

Besides the same, a few noteworthy partnerships and acquisitions also made their mark in the digitized space. Online money transfer service Wise tied up with Tencent for enabling the former’s customers to send money from 11 currencies to Chinese Yuan (CNY) within minutes at the mid-market exchange rate. Al Rajhi Bank Malaysia’s selection of Thought Machine for building out a full-suite of Shariah-compliant products for its upcoming next-gen digital bank also was a head-turner, especially for the emerging trend of digital transformation and tech-modernization of Islamic banks.

UBS stepped up its US push with a $1.4bn Wealthfront purchase in a bid to broaden the firm's reach among mass-affluent investors and expand its distribution and capabilities. On a similar note was European FinTech Monese’s move to introduce the Credit Builder service, an offering that will allow clients to reliably establish their credit history and enhance their reputation with the three major UK credit firms and lenders.

The digital banking endeavor continues to reach countries far and wide, as Tanzanian FinTech NALA raised $10m in funding to support its aggressive expansion across Africa this year. Lastly, digital payments platform Modulr marked a major milestone by being granted the Dutch EMI license by DNB in order to bring fast, reliable, and embeddable payment solutions to European businesses that can overcome inefficiencies and friction in existing payment processes.

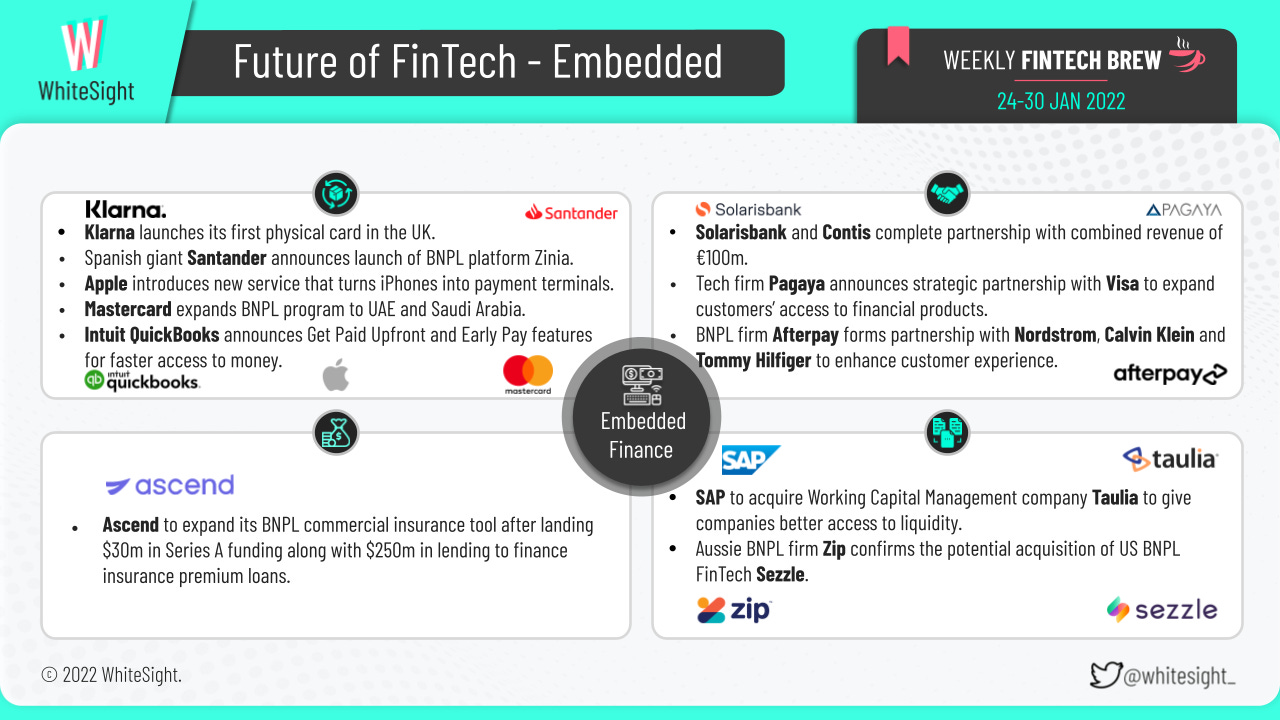

Embedded Finance: Contextual & Embedded Distribution

The last week closed with a bang for the Embedded Finance vertical with an influx of diverse products being introduced by notable industry names to the market.

Buy Now Pay Later behemoth Klarna announced the launch of its first physical card in the UK that rivals major credit card firms offering consumer loans. The card will allow consumers to delay payments for up to 30 days when used at high street shops.

Apple Inc. introduced its new payments feature that will let small businesses accept payments directly on their iPhones, turning the device itself into a payment terminal.

Spanish banking giant Santander made its BNPL debut through the launch of a new platform called Zinia, a service that offers customers the opportunity to pay in interest-free installments, both online and in-store. This move marks a shift in the financial services space, as incumbents begin to behave and act like FinTechs.

Global payments and technology company Mastercard also expanded its BNPL Mastercard Installments program to consumers in the UAE and Saudi Arabia. Mastercard is working with leading partners representing a significant market share in the region for the development of BNPL go-to-market models across sectors of mobility, retail, and marketplaces.

Intuit QuickBooks went a step further by launching not one, but two new FinTech solutions in the form of QuickBooks Get Paid Upfront and QuickBooks Early Pay. Get Paid Upfront enables eligible customers to eliminate the wait to be paid on outstanding invoices, while Early Pay provides eligible employees with the option of instant access to money between paydays.

An assortment of collaborations also made up for the bustling embedded space. Through a strategic relationship with payments firm Visa, tech firm Pagaya wants to leverage its technology and funding solutions to expand robust access to financial tools.

Solarisbank AG and Contis Group Ltd also made the news for the completion of their partnership, thereby resulting in operating as a joint entity that will cover lending and payments of both fiat and crypto-assets. BNPL firm Afterpay wasn’t far behind as it joined forces with three leading retailers—namely Nordstrom, Calvin Klein, and Tommy Hilfiger—to enable the brands to benefit from the perks of offering flexible payment options.

While Ascend’s BNPL approach through its BNPL commercial insurance tool scored it a $30m Series A funding following its seed round four months ago, Aussie BNPL firm Zip made headlines for its confirmation of taking over rival US BNPL Sezzle. SAP SE also announced its intent to acquire a majority stake of leading working capital management solutions Taulia to help improve the financial flexibility and stability of companies.

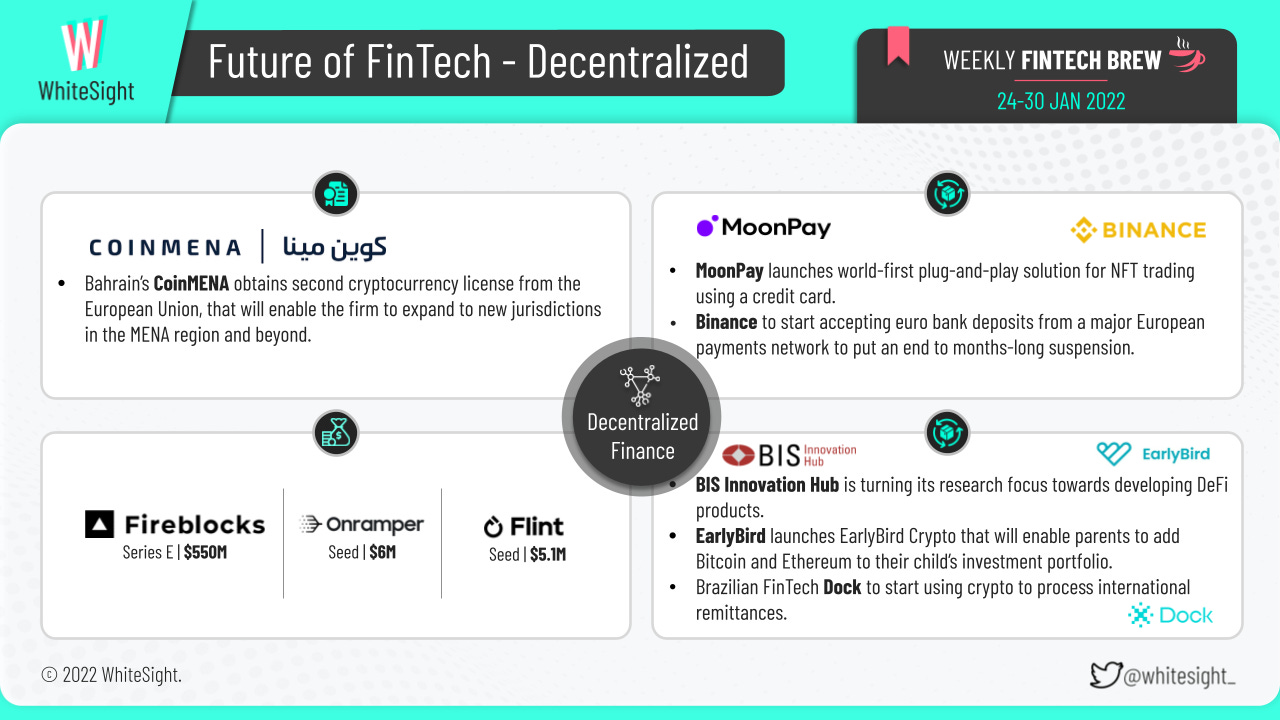

DeFi: Trust the Technology

The DeFi industry was a witness to various funding rounds and product launches across emerging geographies.

While MoonPay’s world-first NFT Checkout feature might take plug-and-play solutions to the moon, Brazilian FinTech Dock is beginning to use cryptocurrencies to process international remittances as it expands to Latin America and Europe. But the innovation does not stop there – as BIS’ Innovation Hub announced its plan to focus on CBDCs, payments, and DeFi to research and develop public goods involving the novel technology.

EarlyBird’s child-friendly finance platform introduced its industry-first EarlyBird Crypto Wallet, a digital experience enabling parents to add Bitcoin and Ethereum along with traditional assets to their children’s investment portfolios. Even Binance took a spot on the bulletin with its attempt to end a months-long freeze on deposits by resuming to take euro bank deposits from a big European payment network.

Many crypto platforms were the receivers of significant funding amounts for the week – with crypto investment platform Flint raising $5.1m seed led by Sequoia Capital India and GFC; fiat-to-crypto gateway aggregator Onramper securing $6m in seed funding led by EQT Ventures; and crypto custody platform Fireblocks’ latest $550m Series E funding round, that now values the infrastructure provider at a booming $8bn valuation. At the same time, Bahrain’s crypto assets exchange CoinMENA obtained a second cryptocurrency license from the European Union that will help it strengthen banking relationships with regional as well as global banks.

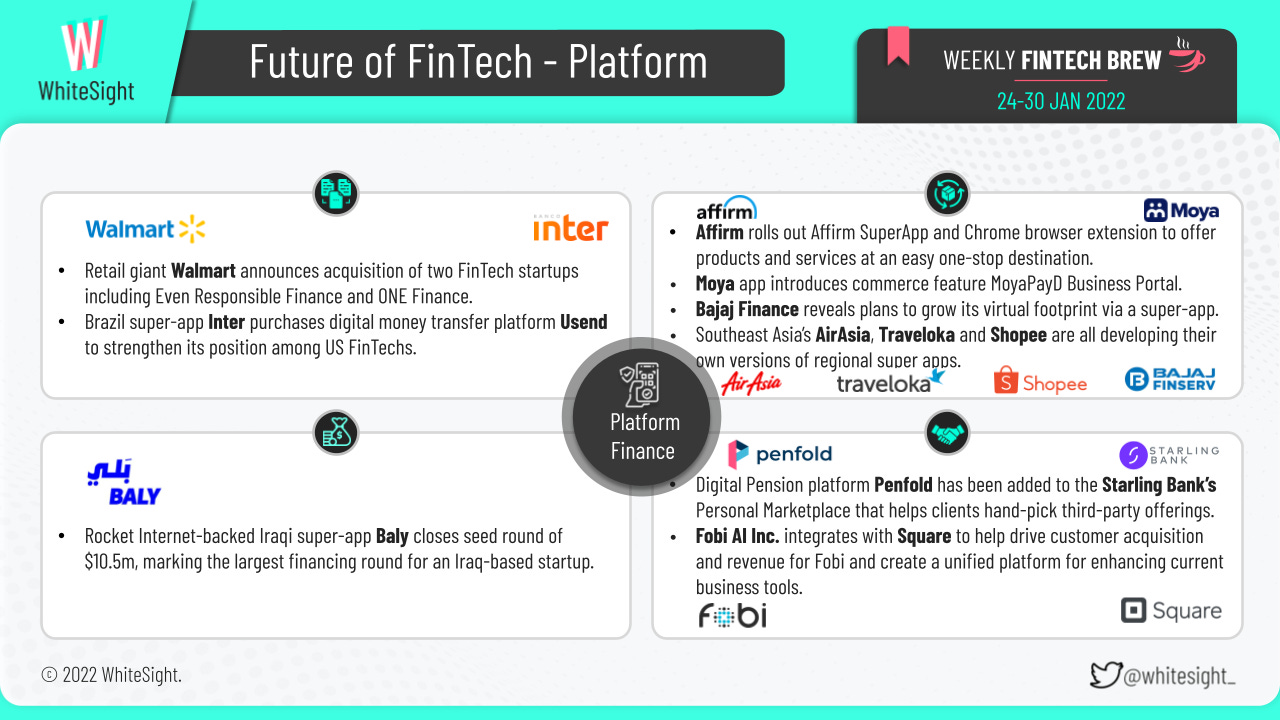

Platform Finance: Ecosystems Orchestration

The Platformification sphere was majorly swamped with the news of product launches for the last week of the month.

With the ongoing race surrounding the development of all-in-one super apps, players across industries took to introducing their own unique propositions. Affirm integrated two significant additions to its product suite via the Affirm SuperApp and Chrome browser extension – features that would enhance customer experience through more flexible and transparent checkout journeys.

Bajaj Finance is also furthering its super app ambitions, with plans to incorporate 30 services in its app across a diverse range of sectors. Data-free messenger Moya’s MoyaPayD Business Portal also grabbed the headlines as a commerce feature that will allow small businesses to send and receive money within its super app. The Southeast Asian region is equally gearing up to bring its own set of super app players, such as AirAsia, Shopee and Traveloka, that are expanding beyond their core business to offer a diverse product and service portfolio.

In terms of the acquisitions and collaborations happening within the space, AI platform Fobi integrated with global tech-provider Square to avail Fobi’s app in the Square App Marketplace for businesses of all types and sizes. Digital Pensions platform Penfold also confirmed its addition to the Starling Bank’s Personal Marketplace, enabling clients to select the pension products which work best for them and allowing them to have the visibility they need over their financial products in a single place.

Retail giant Walmart’s acquisition of two notable startups—Even Responsible Finance and ONE Finance—additionally served to turn heads towards the stir in the Platform Finance segment.

Emerging markets were also amongst those who made significant movement, with Brazil’s super app Inter acquiring US FinTech Usend to bolster and strengthen its position among US FinTechs and roll out Inter’s Super App capabilities to US clients; and Rocket Internet-backed Iraqi super-app Baly’s closing of a $10.5m seed round, marking the largest financing round for an Iraqi startup and Rocket Internet’s first foray into the country.

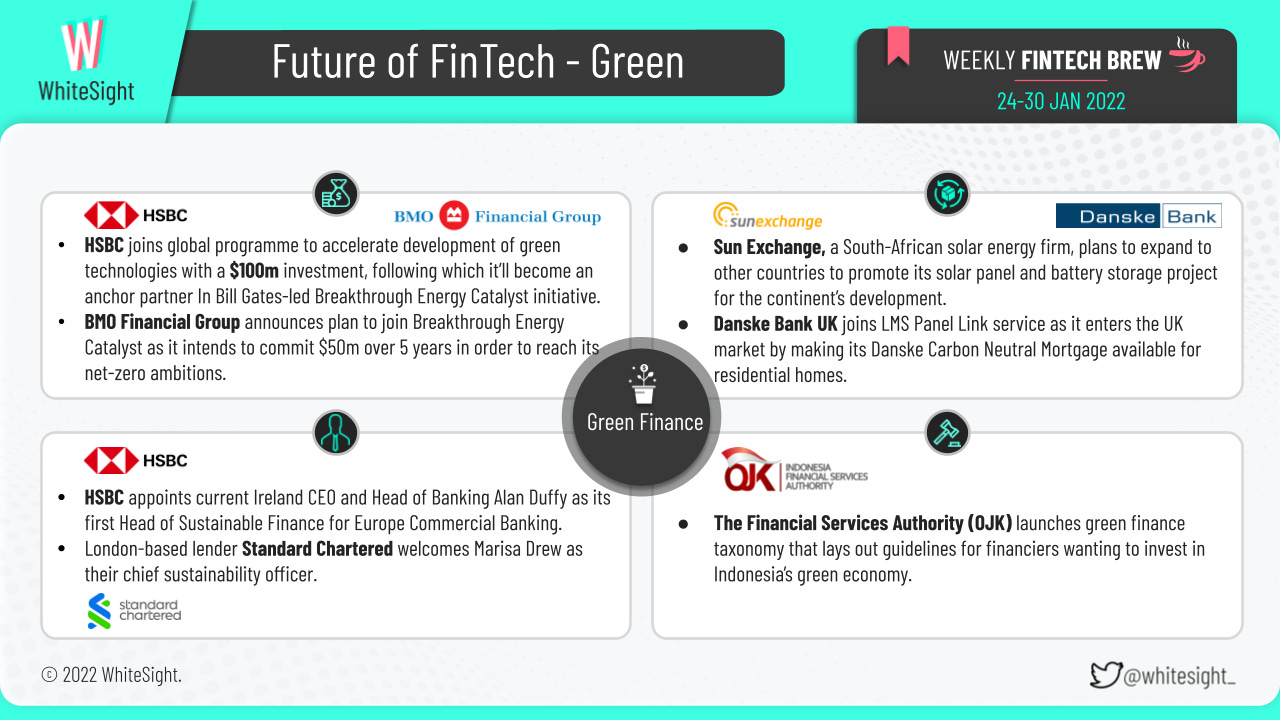

Green Finance: People, Planet, and Profit

New industry roles remained at the forefront for the Green Finance vertical in the fourth week of January.

While HSBC appointed current Ireland CEO and Head of Banking Alan Duffy as its first Head of Sustainable Finance to help business customers in Europe make the transition to net-zero carbon emissions, Standard Chartered Bank welcomed Marisa Drew from Credit Suisse as their first chief sustainability officer to lead the bank’s decarbonization drive. The former was also in the news for its $100m investment in Bill Gates-led green tech Breakthrough Energy Catalyst initiative in order to accelerate the development of green technologies.

On the other hand, South African crowd-sourcing solar energy firm Sun Exchange and Danske Bank UK hit the headlines for the expansion of their respective green product plans – with Sun Exchange looking into developing the countries within the continent with the most unreliable electricity access; and the UK Bank becoming the latest member of the IMLA to avail their carbon-neutral mortgage to homeowners and homebuyers in the South East, South West and East of England.

On the regulatory front, the Financial Service Authority (OJK) of Indonesia launched the much-awaited guidelines for financiers wanting to invest in Indonesia’s green economy, by helping them determine how environmentally damaging a business’s operations are in the nation.

That's a wrap for this week, folks! Let us know how you liked this Weekly FinTech Brew and what we can do to make it better. See you next week 👋