Future of FinTech | Edition #1 – January 2022

The opening week of the new year is already brewing with movement for the FinTech sector. Last week, we witnessed some major headlines from the DeFi space, making it the strongest brew to charge up your palate; followed by some stirring in the themes of Digital and Platform Finance. Other themes such as Open, Embedded, and Green Finance are still coming up from the new year celebrations and witnessed relatively subdued dynamics last week.

So grab yourself a warm cuppa as we indulge in the buzzing scoop of the Weekly FinTech Brew!

Open Finance was astir with some significant partnerships last week – as financial service providers made a move to integrate more digital solutions to meet the demands of the digital-savvy consumers.

While Fintech Automation’s move to add Fincity’s Open Banking network signaled the end of tedious validation methods like micro-deposits and minimization of risk, CHK’s partnership with Nordigen on their accounting solution Trigon followed a similar trajectory of allowing data to be delivered to the system directly from companies’ bank accounts, thereby streamlining and eliminating time-consuming manual tasks.

Brankas’ recent $20m raise from its Series B funding round to expand its product menu of banking-as-a-service APIs serving customers across six markets in Asia, and Judopay’s strategic Click to Pay solution in collaboration with Mastercard to improve the e-commerce experience by providing rich native components for customers to use within their mobile apps serve as the cherry on top.

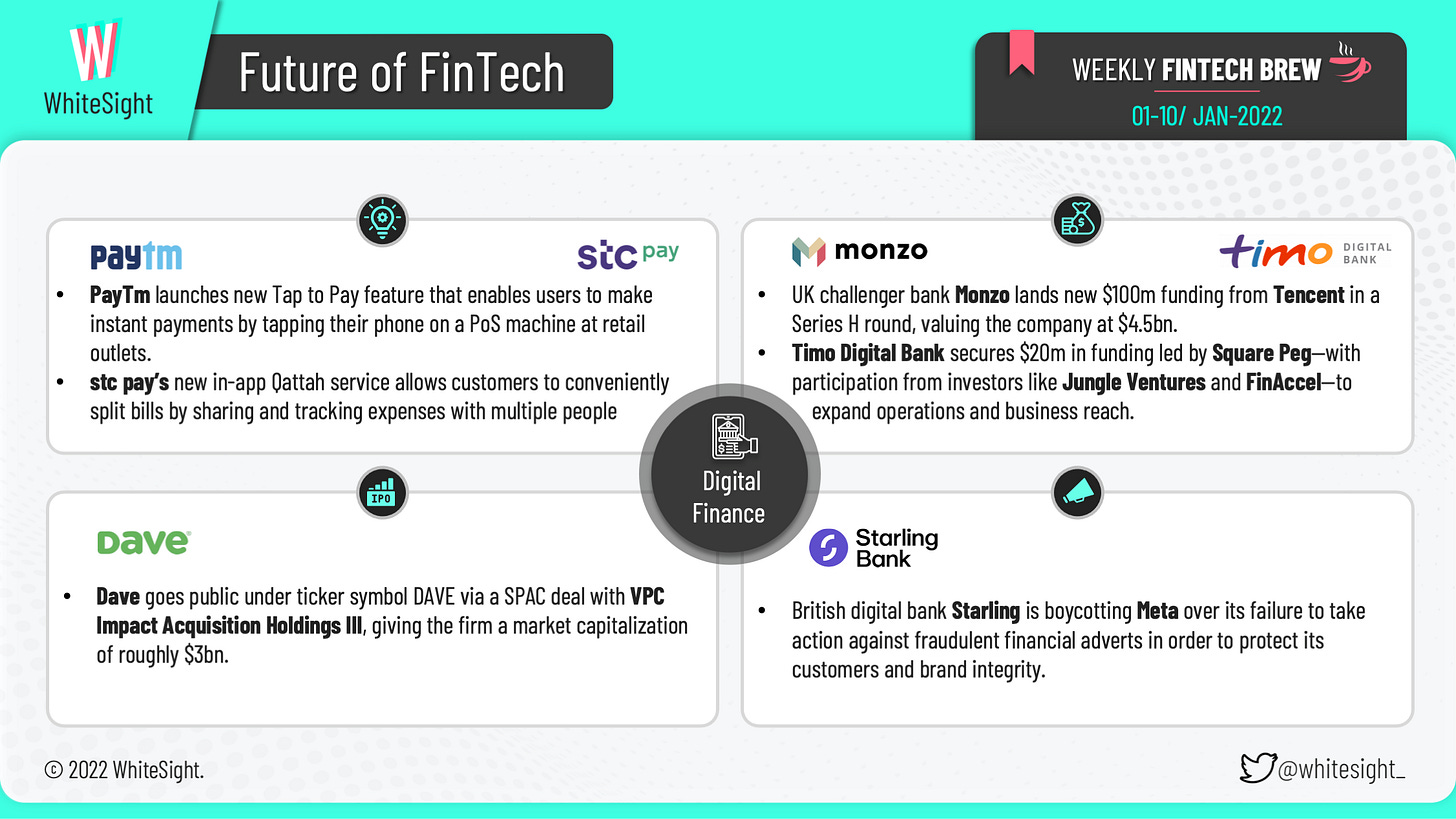

A diverse set of happenings were abuzz in the Digital Finance sphere for the opening week of this month – from the launch of features such as PayTm’s instant PoS supporting Tap to Pay and stc pay’s seamless and contactless Qattah service, to the fresh injection of fundings for both UK challenger Monzo and Vietnam-based Timo Digital Bank to accelerate their respective operations.

LA fintech Dave’s hyped public listing via SPAC merger sponsored by Victory Park Capital stole headlines for this segment. CEO Jason Wilk said in an interview that Dave —which was poised to raise as much as $3.8 billion in a public offering Thursday— will develop cryptocurrency-related services over the next 12 to 24 months with the digital asset exchange FTX, whose Alameda Research arm was one of the investors in the SPAC.

British digital bank Starling’s boycotting of Facebook parent company Meta over lack of action pertaining to fraudulent financial adverts also attracted some curious eyes.

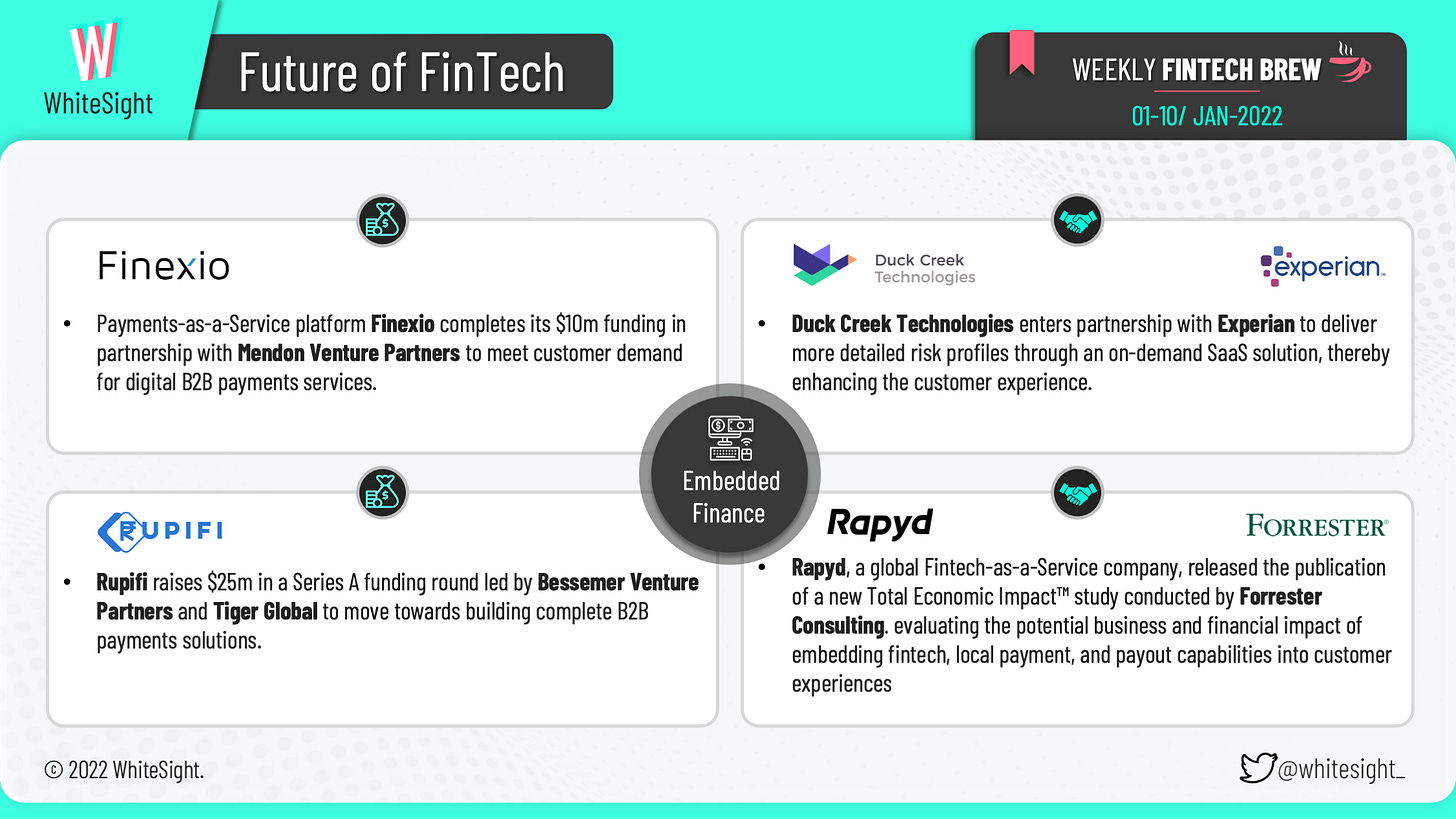

A healthy mix of fundings and partnerships accounted for the key highlights in the weekly Embedded Finance affairs. While both Finexio and Rupifi raised $10m and $25m through their respective funding rounds for building and widening their B2B payment offerings, Rapyd announced the publication of its commissioned new Total Economic Impact™ study conducted by Forrester Consulting highlighting a 196% ROI for the company’s Fintech-as-a-Service solution. Duck Creek Technologies’ unique initiative in using Experian’s iCache platform to enhance the quality of their underwriting and claims handling for delivering more detailed risk profiles through enhanced consumer data also proved to be a welcome addition.

The DeFi space took headlines by the storm with its eventful happenings for the week. With regulation being a critical subject in the field presently, venture capital firm Andreessen Horowitz (a16z) proposed its own recommendations of more transparent crypto regulations targeted at the “world leaders”, which also emphasized acknowledging disparity of the Web3 and Stablecoins. The firm was also a lead investor in Goldfinch’s Series A extension round, helping the DeFi Credit Protocol raise $25m.

Baanx received regulatory approval from the UK Financial Conduct Authority (FCA) to provide crypto asset services and is now working with Ledger on providing cryptodraft services to the Ledger community with a Q1 rollout across many key countries in the EEA and parts of the US. Several collaborations also made for eye-catching events in the segment – with Aave’s attempt to bridge the gap between DeFi and TradFi via Centrifuge partnership, and DeFi Technologies’ Preferred Partnership Agreement with SEBA to name a few.

The world of Platform Finance was busy hustling with new service additions being at the forefront last week. While Brazilian fintech giant Nubank introduced the three new categories of Pets, Travel, and Games to enhance its e-commerce product portfolio, Tinkoff Investments focused on providing more ‘here-and-now’ experiences to its consumers through the launch of an online stock gifting service with no additional paperwork and no visit to the broker’s office.

Paysend also announced its partnership with Tencent Financial Technology in a move to promote more financial inclusion through expanding its global payments network, and Southeast Asia’s super-app Grab achieved the milestone of becoming the first online transportation service to be integrated into JakLingo app to enable the creation of a robust transportation system for Jabodetabek amid the COVID-19 pandemic.

With concerns around sustainability, and the urgency surrounding climate action, many financial institutions made the news for their green initiatives. On the regulatory front, the European Commission delayed the application date of regulatory technical standards (RTS) under the Sustainable Finance Disclosure Regulation (SFDR) to 1 January 2023, leaving firms intending to make PAI disclosures with little choice but to prepare imminently to collect data in advance of the final RTS.

In other news, Saudi National Bank became the first national bank to establish a sustainable finance framework in association with HSBC. Many Qatar banks also adopted green initiatives in their business practices to help nurture a green economy. While Garanti BBVA implemented its Green Finance Specialist training course in cooperation with the Green for Growth Fund (GGF) Technical Support Facility and the Renewable Energy Academy (RENAC), Fidelity International also surged forward to newer adventures of achieving net-zero ambitions by 2030, relishing the challenge of leading the company 20 years ahead of the 2050 goal most countries and many companies have set.

That's a wrap for this week, folks! Let us know how you liked this Weekly FinTech Brew and what we can do to make it better. See you next week 👋