GFTN Digital Assets Survey (SFF 2025 Launch)

Future of Finance - Edition #173 (22nd - 28th July‘ 25)

Fintech’s serving a plot twist this week! ⚡ When credit stops playing by old rules, payments slip into everyday life like they’ve always been there, and crypto ditches the hype for hard utility - you can feel the stack levelling up. The week’s signals are sharp and sizzling:

✔️ Credit gets a glow‑up and a fresh playbook

✔️ Embedded rails blur the line between product and experience

✔️ Tokens take a victory lap into real‑world money moves

Buckle up, this week doesn’t just move the needle, it rewires the compass. Let’s dig in. 🔥

⏳Shape the Future of Digital Assets – 2025 GFTN Survey

WhiteSight’s founder, Sanjeev Kumar, has joined forces with Arthur D. Little and the Global Finance & Technology Network (GFTN) on a comprehensive global study on Digital Assets.

We are seeking insights from private players, regulators, and standard-setting bodies across 12 key jurisdictions: US, Brazil, EU, UK, Switzerland, Qatar, Saudi Arabia, UAE, India, Hong Kong, Singapore, Japan.

📌 Why participate?

Influence policy recommendations in one of the most authoritative industry reports.

Benchmark your insights against peers across the globe.

Be part of the conversation that will shape the next phase of digital assets.

📅 Report Launch: Singapore FinTech Festival (SFF) 2025

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Sip on bite-sized updates every week—fresh, hot, and brewed to keep you in the loop in just minutes. Subscribe now! 📨

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

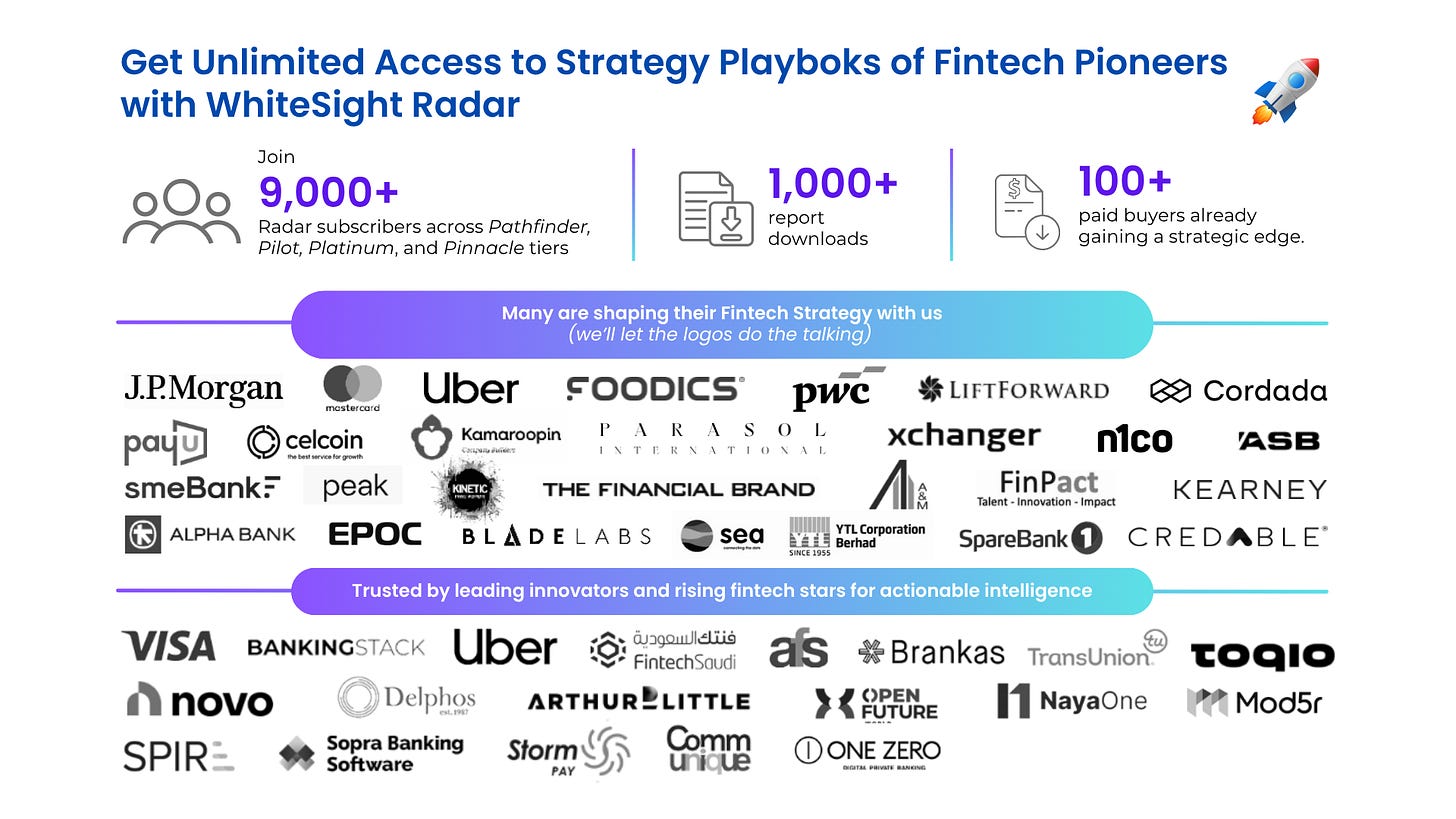

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Poured, pressed, and popping – Edition #173 stirs up fresh embedded upgrades, smooth open finance pours, and a bold shot of digital currency spice.

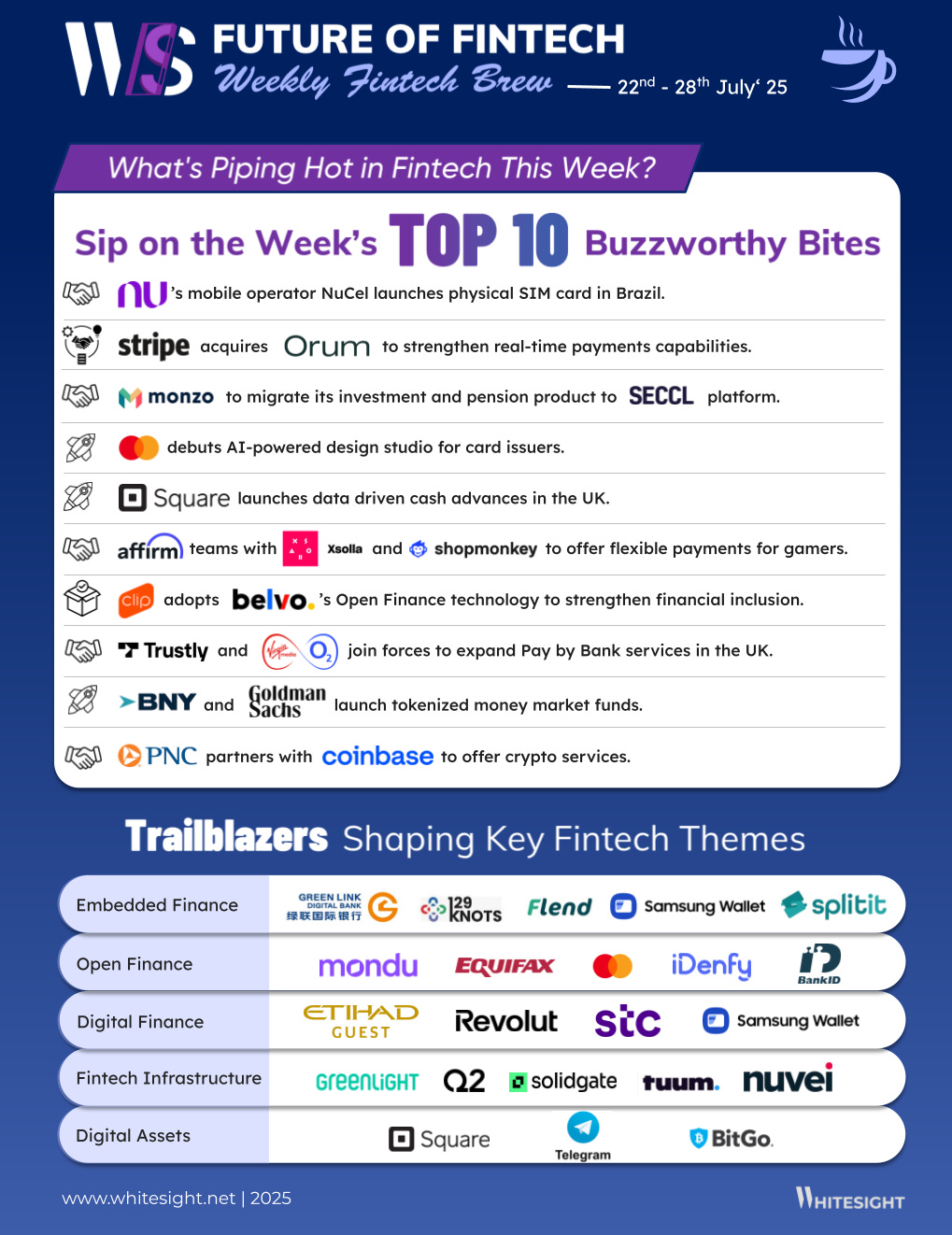

The Week's Hot 10!♨️🔟

Frictions Fade in Payments

⤷ Affirm teamed up with Xsolla to let gamers split in‑game payments into installments, and separately partnered with Shopmonkey to embed flexible BNPL for auto‑repair payments.

⤷ Trustly partnered with Virgin Media O2 to bring Pay by Bank to telecom users, advancing Open Banking with direct debits and one-off payment.

Credit Access Reimagined

⤷ Square launched its merchant cash advance service in the UK so that qualifying SMEs can receive up-front funding and repay via a percentage of future card sales - no interest, only a fixed funding cost.

⤷ Clip fully integrated Belvo’s Open Finance platform into its PrestaClip service to power automated payroll‑level credit decisions, A2A payments, and employment-data insights for users with no credit history.

Infrastructure Behind the Curtain

⤷ Stripe acquired payments orchestration firm Orum to embed real‑time bank payment and instant account verification capabilities.

⤷ Mastercard launched its AI Card Design Studio, enabling issuers in North America, Europe, and Australia to generate customized card designs instantly using logos and brand assets.

Digital to Tangible Bridges

⤷ Nubank’s mobile operator NuCel to offer a physical SIM card in Brazil, available to order via the app for free, complementing its existing eSIM offering.

⤷ Monzo to migrate its investment and pension product lines to Seccl to handle custody, admin and servicing of investment and pension accounts.

Digital Assets on New Rails

⤷ BNY Mellon and Goldman Sachs are launching tokenized money market funds on blockchain, allowing near-instant settlement and digital record-keeping.

⤷ PNC Bank partnered with Coinbase to let retail and institutional clients buy, hold, and sell cryptocurrencies directly through PNC's interface.

Now, for the ‘byte’-sized fintech buzz –

Embedded finance is sneaking into everyday moments, turning split payments and built-in cover into effortless, “of course it’s there” features.

Samsung Wallet integrated with Splitit, enabling U.S. users to split in-store purchases (Visa/Mastercard) into 6‑ or 9‑installment plans with no credit checks or new accounts.

OMRON Healthcare Singapore partnered with Bolttech and QBE to launch an embedded health solution - Premium Care - in Singapore. Underwritten by QBE, the plan includes device coverage, step-up insurance protection, and customised health reports.

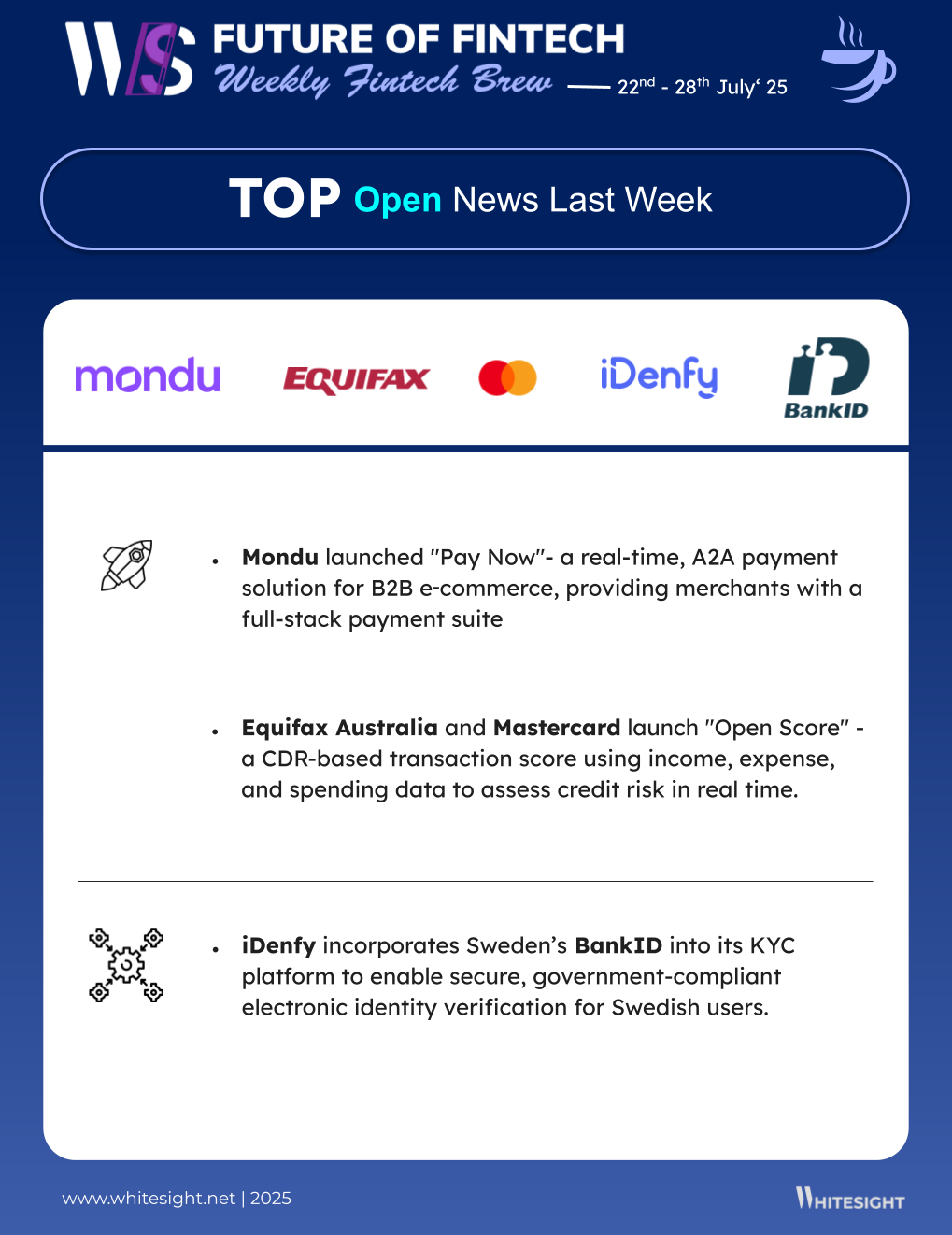

Open finance is getting sharper, where instant IDs and smarter scores are rewriting what trust and access look like behind the scenes.

iDenfy incorporated Sweden’s BankID into its KYC platform to enable secure, government-compliant electronic identity verification for Swedish users.

Equifax Australia and Mastercard launched "Open Score"- a CDR-based transaction score using income, expense, and spending data to assess credit risk in real time.

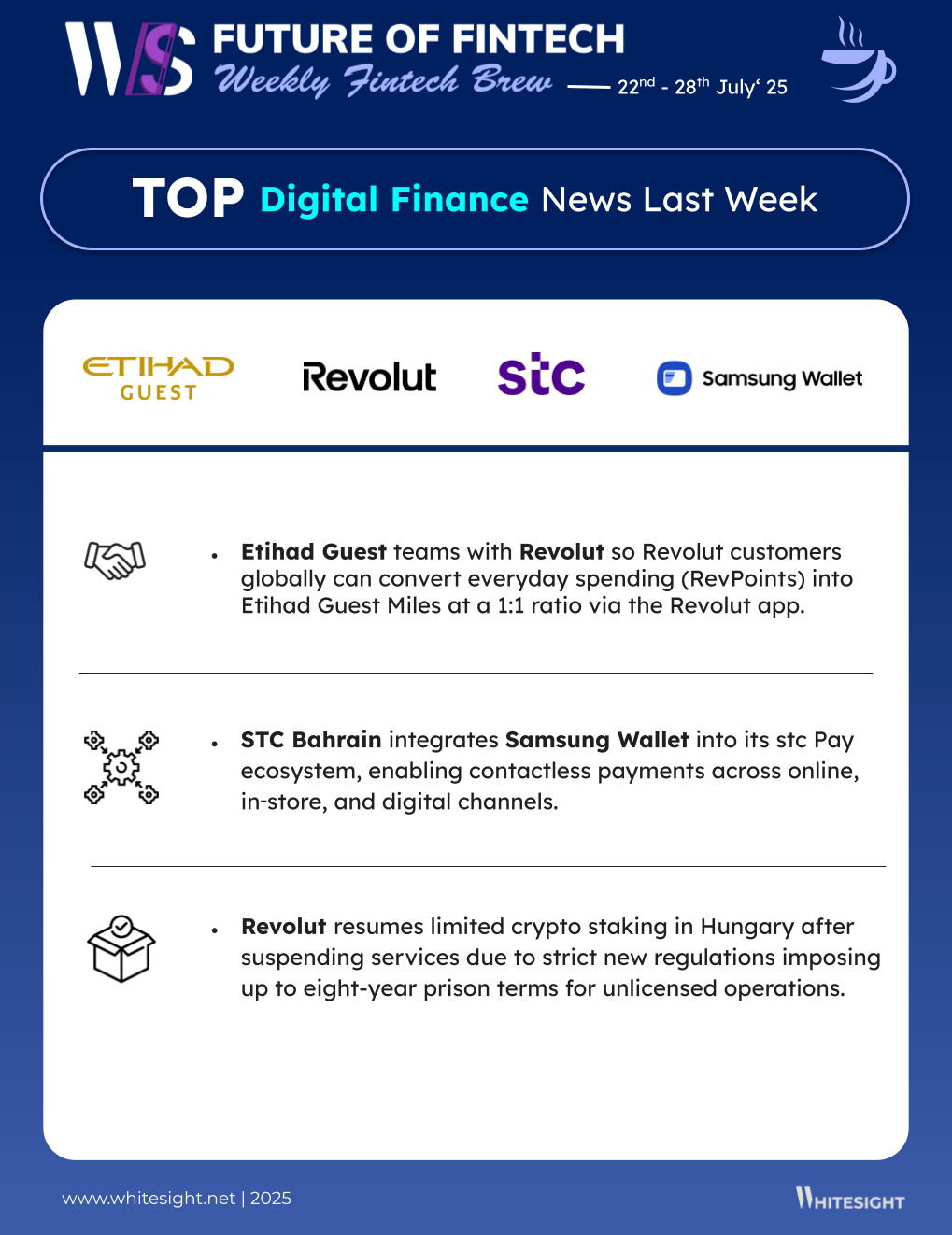

Digital finance is blurring the lines between loyalty and checkout, turning every tap and swipe into a value play on autopilot.

Etihad Guest partnered with Revolut so that Revolut customers globally can convert everyday spending (RevPoints) into Etihad Guest Miles at a 1:1 ratio via the Revolut app.

STC Bahrain integrated Samsung Wallet into its STC Pay ecosystem, enabling contactless payments across online, in‑store, and digital channels.

Fintech infrastructure is cranking up the rails, making fast moves and borderless flows feel less like upgrades and more like the new baseline.

Nuvei added PINless debit and Least Cost Routing to its Authorisation Optimisation suite, boosting merchant authorisation rates by up to 3.5 percentage points.

PayPal unveiled PayPal World, a global platform connecting PayPal/Venmo with domestic wallets like UPI (India), Tenpay (China), Mercado Pago (Latin America) and more.

Digital assets are ditching the hype for hands-on utility, bridging crypto and cash to make everyday transactions actually click.

Square started enabling select merchants to accept Bitcoin payments via the Lightning Network directly through its existing POS systems.

Bitget Wallet integrated with MoonPay to enable users to convert USDT and USDC into fiat currencies across 25+ currencies via in-app withdrawals.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Charting the Future of Payments Report- PYMNTS

The APAC State of Open Banking and Open Finance Report - University of Cambridge

5 Blockchains Lead The Market: Which L1 is Most Active? Blog - Binance

The frontlines of fraud: How Brazil is becoming a global testbed for financial crime prevention Blog- QED Investors

Embedded, Expanding, Evolving: BNPL’s Role in Mexico’s Financial Future Blog - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️