GENIUS. Clarity. Anti-CBDC. Crypto gets its page 📜

Future of Finance - Edition #172 (15th - 21st July‘ 25)

Fintech’s sharpening its edge this week! 🔥 When savings go age-specific, insurance flexes mid-policy, and payments run smoother behind the curtain — you know the tools are finally catching up to the needs. The week’s signals are crisp and calculated:

✔️ Credit scoring breaks out of the old mould

✔️ Finance tools get life-stage aware

✔️ Crypto takes a step toward the mainstream

Ready to see how the week reshaped the stack? Let’s get into it. ⚡

🚨 Featured Story of the Week:

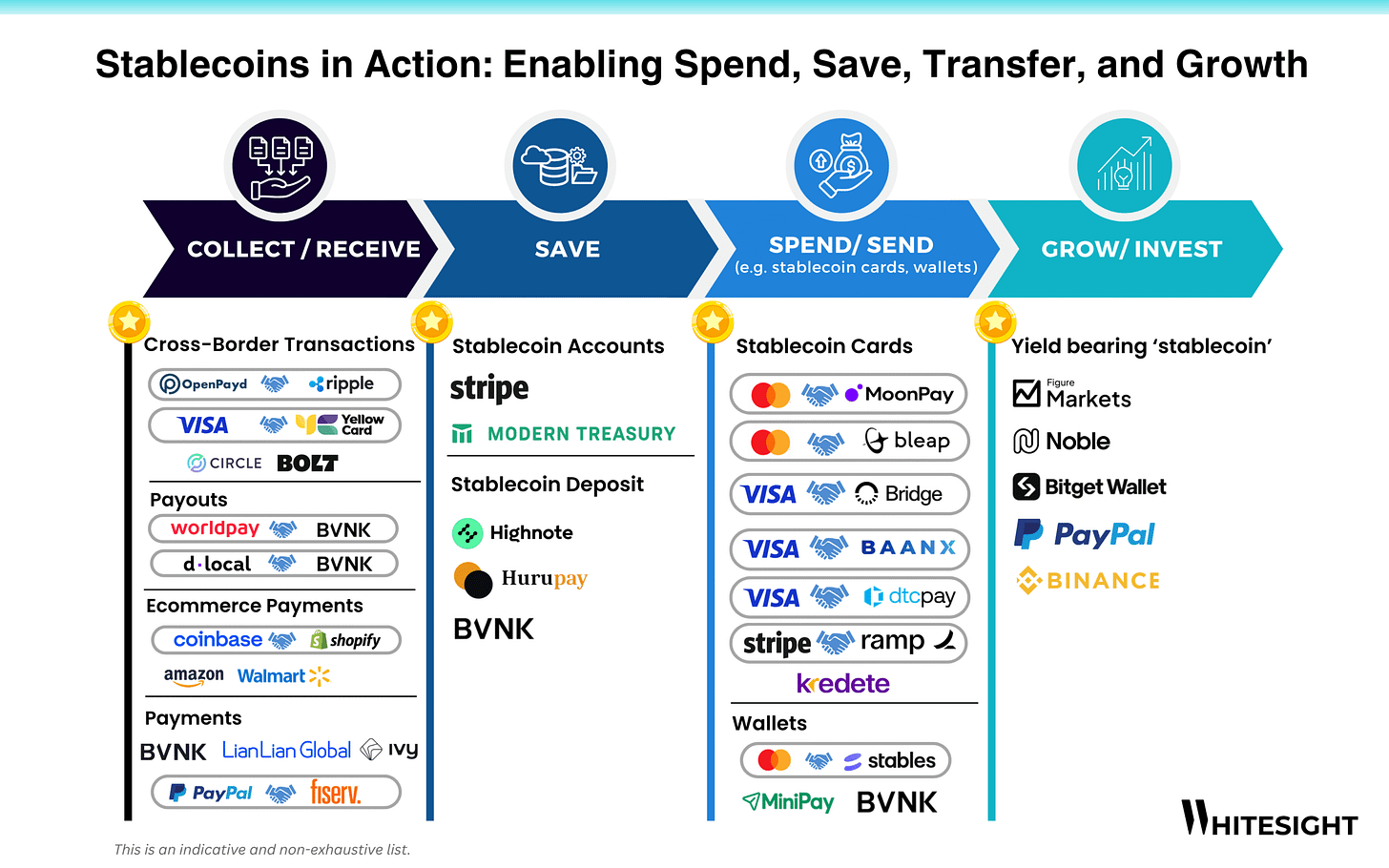

From Saving to Spending - Stablecoins Are Powering It All 🔄

From faster payouts to smarter savings, stablecoins are stepping out of the crypto corner and reshaping how money flows for people, platforms, and businesses alike. This week’s featured infographic from WhiteSight charts out just how deep this transformation goes.

💥 What’s cooking in the stablecoin world?

💼 Cross-border remittances are getting smoother with direct rails powered by stable-value assets

🛒 Commerce giants and fintechs are experimenting with on-chain checkout and programmable payments

💳 Card networks and wallets are supporting stablecoin rails for spending like it’s just another currency

🏦 Deposits, accounts, and investments are now being reimagined with yield-bearing stablecoins and tokenized flows

Whether it’s collecting funds, saving, spending, or growing capital, stablecoins are showing up in every corner of the money stack. And the players? From payments to platforms, they’re more diverse than ever.

👉 Check out the full story here.

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Sip on bite-sized updates every week—fresh, hot, and brewed to keep you in the loop in just minutes. Subscribe now! 📨

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

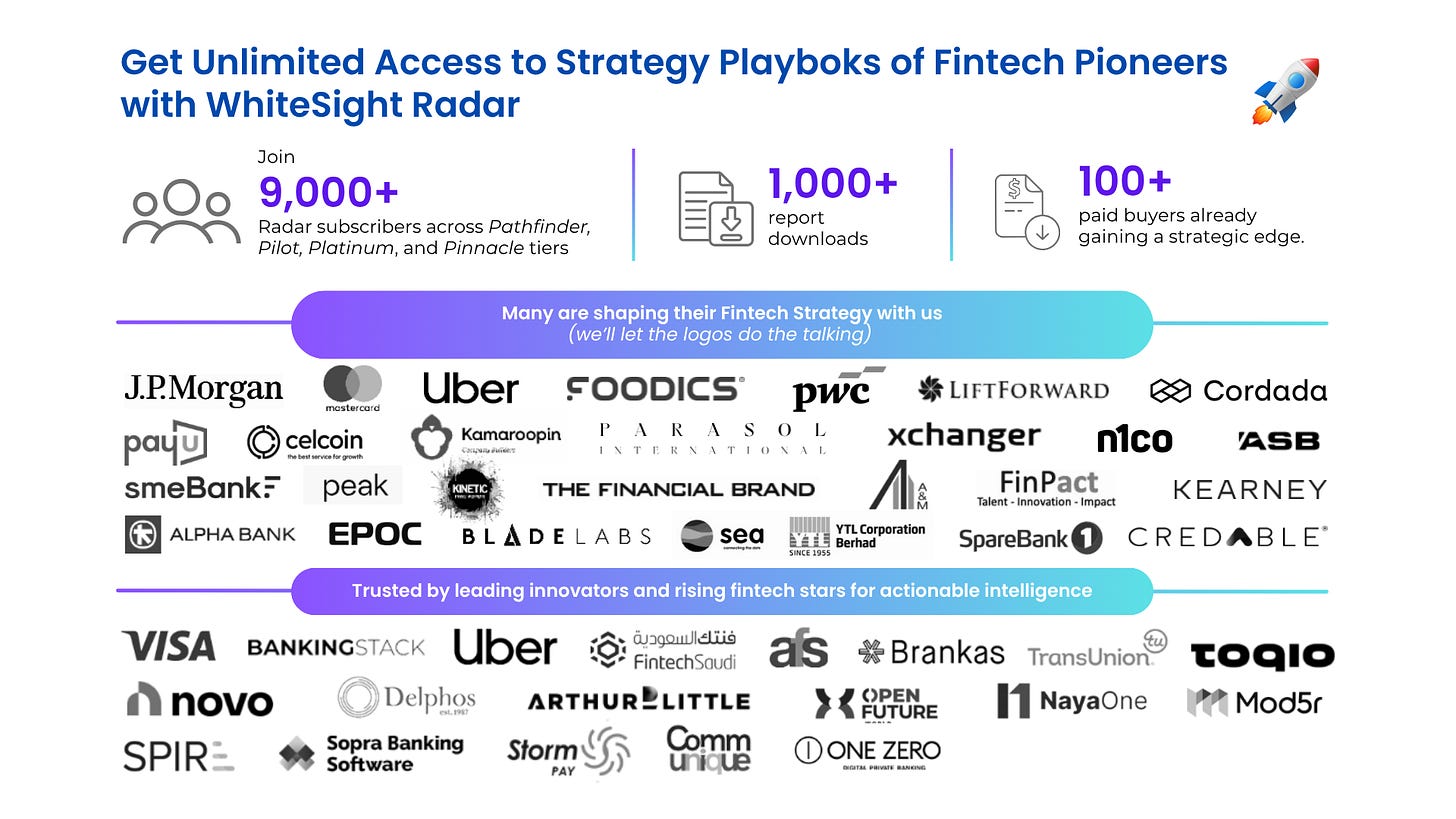

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Sliced, stacked, and served - Edition #172 is a crunchy bite of embedded upgrades, smooth open finance swirls, and a tangy shot of crypto clarity.

The Week's Hot 10!♨️🔟

Financial access beyond traditional scores.

⤷ Equifax and Mastercard launched a transaction-based credit score to support thin-file consumers in Australia.

⤷ ClearScore introduced credit-matching tools inside external platforms to surface loan offers contextually.

Tailored savings and investment tools

⤷ NatWest and Saga launched fixed-rate savings accounts designed for customers aged 50 and above.

⤷ GXS debuted a micro-investing product with free accident insurance to help users build wealth from S$1.

Crypto Gets Going

⤷ The U.S. House of Representatives passed a trio of crypto bills - GENIUS Act, the Digital Asset Market Clarity Act, and the Anti‑CBDC Surveillance State Act - to clarify oversight and block central bank digital currencies.

⤷ Standard Chartered bank launched Bitcoin and Ether spot trading for institutional clients with USD settlement.

Under-the-Hood Payment Upgrades

⤷ Cashflows partnered with GoCardless to enable faster and lower-cost business disbursements via A2A rails.

⤷ Worldline launched AI-driven payment routing to boost merchant authorisation rates and reduce declines.

Everyday Finance, Elevated

⤷ Monzo introduced flexible home insurance with mid-term edits and digital policy management via its app.

⤷ Checkout.com expanded into Canada with direct acquiring and performance tools for merchant control.

Now, for the ‘byte’-sized fintech buzz –

Embedded finance is growing roots inside core systems, making on-demand pay and real-time cards feel like native features, not add-ons.

Highnote, an embedded finance and card-issuance platform, launched “Instant Payments,” enabling near-real‑time payouts from Highnote‑issued cards to eligible external debit and prepaid cards via Mastercard Move and Visa Direct.

Rain, a provider of earned wage access solutions, launched a fully embedded on-demand pay integration within Workday. This integration enables Workday customers to enable Rain, providing their employees with immediate access to earned wages through a native Workday experience.

Open finance is doubling down on smarter backends, where seamless syncing and richer insights are becoming table stakes for better decision-making.

Xero partnered with Plaid to triple high-quality bank feed connections for its U.S. customer base, improving small business financial visibility and streamlining account syncing.

EDGE and MX Technologies partnered to integrate MX’s account aggregation and verification services into EDGE’s cash-flow analytics platform, aiming to help U.S. lenders make faster, more accurate credit decisions.

Digital finance is pushing into the mainstream, linking bold expansion bets with secure tap-to-pay tech for users who expect more, faster.

Starling Bank to evaluate a potential IPO on a U.S. exchange, aligning with plans to expand its operations in the United States - possibly including the acquisition of a U.S. bank - to access higher valuation and investor depth.

Curve collaborated with Thales to secure Curve Pay on iOS, enabling NFC-enabled contactless payments through its own app (via Thales D1 cloud platform). This marks a major step in securing mobile wallet transactions.

Fintech infrastructure is powering fast funds movement and compliant cross-border builds for the next wave of financial services.

Cashflows and GoCardless (via its subsidiary Nuapay) entered a partnership to streamline business disbursements, bringing the ease and speed of account-to-account payments to payouts.

Thredd and Payblr partnered to enable compliant USD card programs, accelerating fintech expansion in the gig economy, disbursements, and cross-border services across Latin America and the Caribbean.

Digital assets are leaning into utility, making it easier for enterprises and users alike to move value across systems without missing a beat.

BVNK and Bitwave teamed up to enable enterprise finance teams to send and receive stablecoin-based invoice payments with end‑to‑end security, compliance, automated GAAP/IFRS reporting, and faster settlement.

OKX integrated PayPal across the EEA, allowing users to fund crypto purchases instantly with PayPal balance, linked bank accounts, debit/credit cards, with a one-month fee‑free promotion.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Navigating the U.S. Payments Evolution Report- Deluxe

Stablecoins and CBDCs Report Coindesk

The GENIUS Act Passed — Here’s What It Means for USDC and Stablecoin Adoption Blog - Coinbase

How to find the launderers … or not Blog- Chris Skinner

Mexico’s Digital Banking Surge: A Market in Motion Blog - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️