Visa’ Launches VIP Pass to Security 🛡️

Future of Fintech - Edition #175 (05 - 11 Aug‘ 25)

Espresso yourself in fintech! The pot’s been on all week, and what’s brewing now is a rich mix of payment smoothness and digital asset crema topping it off. From fresh cross-border flows to sharper fraud defences and crypto slipping into daily spend, the week’s blend packs a punch!

✔️ Smooth payment pours across markets and industries

✔️ Security shots brewed to perfection

✔️ Crypto blends stirred into everyday transactions

Your table’s ready - let’s serve the week’s finest pours. ☕

🚨 Featured Story of the Week:

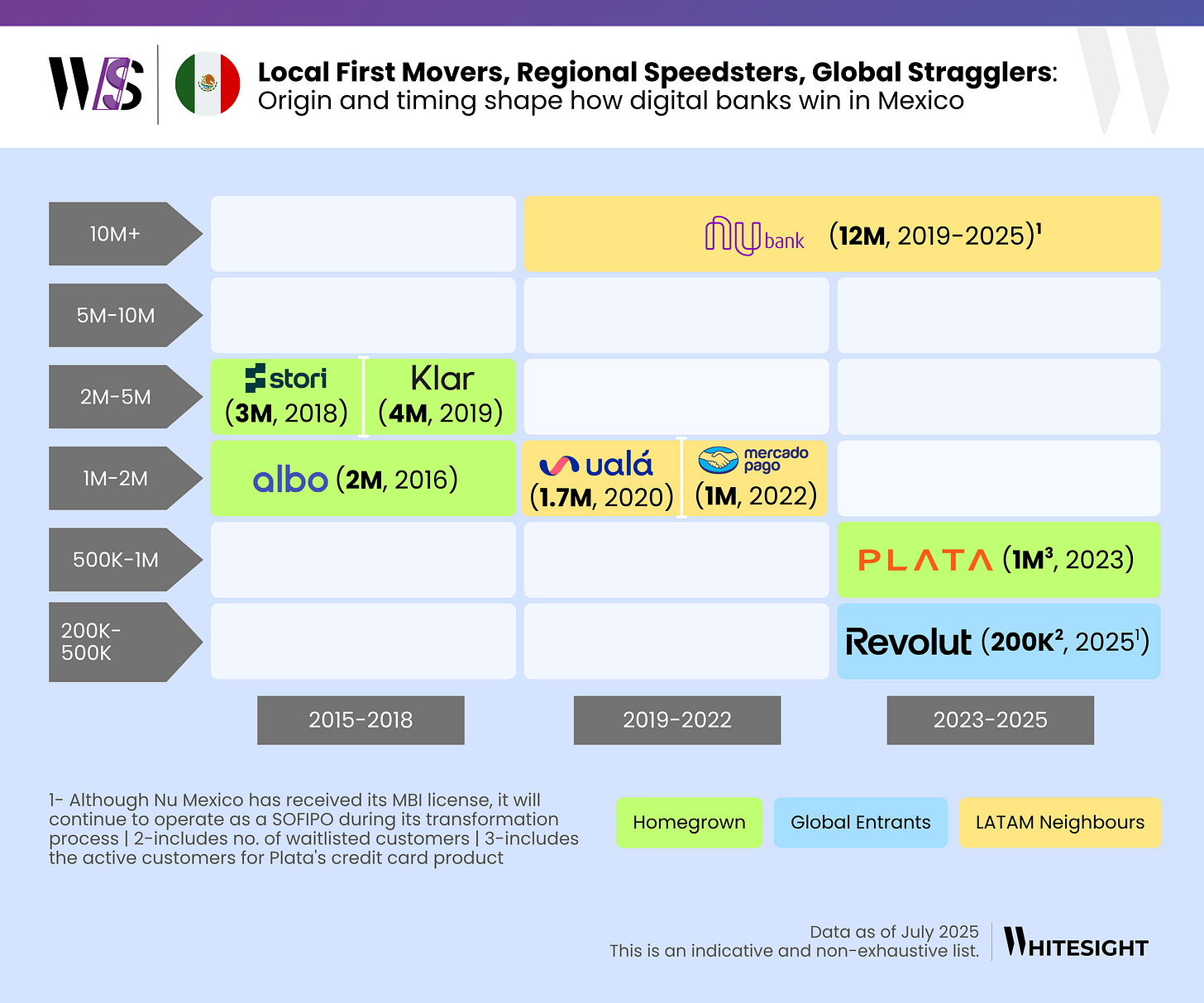

Mexico’s Digital Banking Boom - What’s Fueling it? 🇲🇽

Mexico’s financial sector is moving fast, and digital banking is at the centre of the action. New players are drawing millions with fresh approaches, while established institutions are adapting to keep pace. The result is a market buzzing with innovation, shifting consumer habits, and new competitive dynamics.

This week’s featured infographic from WhiteSight explores the trends shaping Mexico’s digital banking surge and why the momentum is building now.

💥 Key drivers shaping the market:

📱 Mobile-first challengers offering seamless onboarding and lifestyle-focused features

💸 Expanded access to credit, savings, and payments for underserved communities

⚖️ Regulation that encourages innovation while safeguarding customers

🤝 Partnerships bridging fintech agility with established networks

Mexico’s transformation is setting the tone for digital finance in Latin America, with lessons that could echo far beyond its borders.

👉 Check out the full story here.

Pledge your access to fintech analysis and exclusive insights ⚡

What’s on the fintech menu today?

🌟 Fintech Fiesta: The Week's Hot 10!

🌐 ‘Byte’ Buzz: Fintech highlights, sorted by segment!

🔗 Link Up: Your gateway to resourceful links!

Sip on bite-sized updates every week—fresh, hot, and brewed to keep you in the loop in just minutes. Subscribe now! 📨

📢 We're always seeking innovative voices in fintech to be our next guest feature!

With a community of 2100+ fintech enthusiasts, we'd love to amplify your insights. Reach out to us for features, sponsorships, or collaborations!

Get Unlimited Access to Strategy Playbooks of Fintech Pioneers with WhiteSight Radar! 🚀

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, Banco Inter, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Nubank, Grab, Wise, Shopify, Affirm, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Buzzed, bold, and brimming with ideas – Edition #175 pours out cross-border sprints, embedded sparks, and token tales for your fintech fix.

The Week's Hot 10!♨️🔟

Frictionless Payments for Diverse Needs

⤷ dLocal introduced SmartPix, a tokenized Pix-on-file solution enabling Brazilian merchants to process recurring and on-demand Pix payments.

⤷ PayPoint introduced open banking rent payments for Thirteen Group, enabling real-time, card-free transactions for tenants in England and Wales.

Global Accounts, Local Reach

⤷ Revolut launched 2 plans in Australia – Plus for individuals with enhanced perks and Basic Business for sole traders/startups with multi-currency accounts, cards, and expense tools.

⤷ TransferMate secured in-principle MAS approval to expand its MPI license in Singapore, adding account issuance, domestic transfers, and e-money services.

Building Scale Through Customer & Card Reach

⤷ Monzo surpassed 13 million UK customers, fueled by growth and rising business adoption, with FY2025 revenue up 48% to £1.2 bn.

⤷ Marqeta acquired TransactPay, enhancing BIN sponsorship and EMI capabilities for smoother card-program expansion across the UK and EU.

Bringing Crypto Into Mainstream Payments

⤷ Ripple to acquire stablecoin payments platform Rail for $200M, gaining virtual accounts and cross-border stablecoin payment capabilities.

⤷ Binance launched a Mastercard-powered “Buy & Sell” feature in Europe, letting users instantly convert crypto to fiat and withdraw to eligible Mastercard accounts.

Security Gets Smarter

⤷ Visa launched Cybersecurity Advisory Practice, risk analysis, maturity assessments, and training to help businesses counter threats and payment fraud.

⤷ Finmo rolled out Confirmation of Payee in Australia, verifying account details before payment to curb fraud, scams, and misrouted transfers.

Now, for the ‘byte’-sized fintech buzz –

Embedded finance is sneaking into everyday moments, turning everything from a cart checkout to an insurance buy into a smooth, in-flow money move.

Klarna announced that it can now auto-enable its flexible payment options for thousands of WooCommerce stores using the Stripe plugin - boosting checkout speed, reducing cart abandonment, and bringing modern payment choices directly into partners’ checkout flows.

Shory, a UAE digital insurance platform, partnered with Wio Bank to embed car-insurance purchase and financing directly into the Wio Personal app - allowing users to buy insurance with monthly installment options (3–48 months).

Open finance is shifting into high gear, zipping through instant checks and cross-market links that make every transaction feel effortlessly smart.

iDenfy introduced a Secretary of State (SOS) lookup tool, enabling the automated verification of business registration and status across all 50 U.S. states using official state records, thereby enhancing onboarding accuracy and compliance.

Tarabut received in-principle approval from the Central Bank of the UAE under the country’s new Open Finance regulation, enabling embedded finance and data services across the region.l.

Digital finance is slipping into your lifestyle, blending payments, credit, and perks right into the apps and services you can’t live without.

AEON Bank entered a B2B partnership with foodpanda Malaysia to enhance financial inclusion for customers, riders, and merchants. The MoU includes digital financing, microloans for devices/motorcycles, financial literacy programs, and financing for merchant inventory and campaigns.

GCash launched Tap to Pay for Android users - an NFC-powered e-wallet feature - enabling quick and secure contactless payments at any Mastercard-accepting POS terminal, both locally and internationally.

Fintech infrastructure is wiring up a faster world, where cross-border payments and turbo-charged back-ends keep money in constant motion.

Airtel Money Africa expanded its partnership with pawaPay, enabling licensed international money transfer operators (IMTOs) to deliver real-time inbound remittances directly to Airtel Money mobile wallets across several African markets.

Blink Payment teamed up with Cashflows as its acquiring partner, leveraging Cashflows' infrastructure to enhance payment acceptance, onboarding speed, and reconciliation capabilities across sectors such as finance, legal, trade, and beyond.

Digital assets are sliding into everyday finance, becoming less about speculation and more about secure, instant movement of value.

Spanish bank BBVA began serving as an independent custodian for select Binance users, holding client assets in U.S.-Treasury–backed accounts off the exchange to reduce counterparty risk and enhance investor trust.

Crypto.com partnered with Plaid to offer its U.S. users instant asset transfers via Plaid’s “Investments Move” product - allowing transfers of brokerage assets without the need to sell and potentially incur taxes.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

As a reward for making it this far, enjoy a curated list of awesome fintech resources to keep your curiosity cuppa full to the brim. Cheers to continuous learning!

🔗 Link Up! –

Your card, their wallet: Increasing debit card usage Report- Pulsate

The future of AI in the insurance industry Report - McKinsey

What is an acceptable level of fraud? Blog - Chris Skinner

Liquidity Management in the Age of Real-Time Payments Blog- Finacle

Mexico’s Digital Banking Surge: A Market in Motion Blog - WhiteSight

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️