Future of Fintech | Edition #96 – Nov 2023

Fintech Pulse: Weekly Digest (Nov 21st-27th)

Ahoy, Fintech Trailblazers!

As we embark on the next thrilling fintech odyssey, let's rewind and savour the mesmerizing financial tales of the past week. The fintech stars were seen aligning at the pinnacle of the European financial galaxy. So, grab your espresso, rev up your digital companions, and brace yourselves for an electrifying journey into the beating heart of the financial cosmos - for the intersection of financial wizardry and innovation invites us to a captivating adventure! ☕✨

Before we plunge into the world of fintech wonders, let's unravel a thrilling update that came from the Canadian financial frontier just last week>>>

Canada Set To Embrace The Open Banking Revolution in 2024

In the realm of Canadian fintech, the open banking wave has been making some serious noise, stirring up excitement and anticipation. After a symphony of rallying cries echoing through the corridors of power, Canada has finally decided to take the plunge into the open banking universe. So, what's the latest scoop?

Ottawa is gearing up to shake the banking world with an exciting announcement: open banking legislation is coming in 2024! The federal government is planning to introduce legislation in the 2024 federal budget to establish a framework for open banking that will regulate access to financial data.

Flashback to June 2022 - the Department of Finance had promised to present an open banking model by 2023. Skip ahead to the present day, where, after feeling the heat from fintech innovators and opposition rebels, the Liberal government dropped plans for open banking legislation – introducing the eagerly awaited "consumer-driven banking implementation" set to take centre stage in next year's budget. Canada - get ready to take control of your financial destiny and embrace the power of open banking!

Eager to unravel the financial tales of the Great White North? Dive into our blog, "The Big Picture of Embedded Finance: Canada's Unique Perspective," where we dissect Canada's distinctive factors and unveil the thrilling developments shaping its financial landscape. Uncover the secrets of Canada's embedded finance scene today! 🍁

Prepare yourself for a turbo-charged expedition into the heart of fintech with Edition #96. Seatbelts up, an exhilarating adventure awaits!

Here's the TL;DR

Financial giants grabbed quite a few headlines last week, with e-Boks and Mastercard joining forces on invoice payment solutions with open banking, and Mashreq forging a partnership with Visa and Ecolytiq to introduce a personal banking platform that provides insights into carbon emissions.

In a regulatory whirlwind, the Financial Conduct Authority handed out some serious nods: Klarna snagged the FCA's approval for regulated payments and credit services across the UK. Meanwhile, in another corner of approval paradise, the UK gave the thumbs up for the tokenization of FCA-authorised investment funds.

Flexing their collaborative prowess to supercharge a diverse range of users, Funding Circle and Atom Bank teamed up to strengthen UK small businesses. Meanwhile, in the realm of entertainment, Nubank and Sympla joined forces, offering exclusive features for concert ticket purchases online.

Zooming in on the European fintech scene, Nexi and Microsoft expanded their collaboration to digitize the payments landscape across the region. Meanwhile, Marqeta and Credi2 joined forces, unveiling an end-to-end instalment platform catered to European banks.

Collaborating to amplify innovation, Endava teamed up with Salt Edge, unlocking the boundless potential of open banking solutions. And that's not all – the dynamic duo of Cover Genius and Scandinavia's airline SAS joined forces to unveil an exclusive travel protection program.

For the longer read, let's get going –

Dive into the dynamic world of Open Finance, where fintech trailblazers from all around the world are turning open banking into a global sensation!

Real-time payments platform Volt announced its expansion into Australia following a period of growth and a successful Series B funding round. The platform integrated its technology with Megatix, an Australia-based ticketing platform, allowing customers to make instant bank transfers as a payment option.

Swiss mortgage bank Hypothekarbank Lenzburg AG partnered with ndgit to introduce multi-banking services for clients. The collaboration involves utilising ndgit's open finance platform, providing the bank with the necessary technology to offer open APIs for accounts, payments, and banking operations in the future.

Step into the dynamic arena of Digital Finance, where fintech pioneers seamlessly harness new tech to serve previously untapped segments!

Filipino digital bank GoTyme and payment gateway PayMongo teamed up to enhance financial access for SMEs by making business loans more accessible to thousands of SMEs under PayMongo’s merchant ecosystem.

Revolut announced its plan to launch fixed-income trading to customers based in the European Economic Area by early 2024. This strategic move is designed to enhance accessibility for retail investors by significantly lowering the minimum investment requirement from the typical $100,000 to a more attainable ~$109.5 (€100).

In the dynamic world of Embedded Finance, collaboration emerged as the ultimate game-changer, conducting a symphony of convenience for holiday shoppers!

Digital payment platform Sezzle and Sportsman’s Warehouse partnered to enable Sezzle’s alternative payment platform for outdoor sporting goods purchases in time for the holidays. Starting immediately, customers can make instant purchases while conveniently breaking down their total into four interest-free payments.

South African retailer Makro partnered with PayJustNow to enable Buy Now, Pay Later (BNPL) in-store payments for customers ahead of the peak shopping season. Makro's partnership with PayJustNow will allow consumers to use BNPL to pay for their must-have and big-ticket items at all of the retailer's 22 warehouse stores across the country.

In the thrilling arena of Fintech Infrastructure, global titans teamed up to fuse their tech superpowers, while a few others celebrated milestones on the regulatory rollercoaster!

The investment arm of Capital Bank of Jordan, Capital Investments, launched a digital onboarding service powered by Codebase Technologies’ Digibanc platform. This partnership led to the successful launch of the neobank Blink and Capital Bank of Jordan's new mobile banking app, both of which operate on the Digibanc platform.

Payment infrastructure provider Transfeera received authorisation from Brazil’s Central Bank to operate as a payment institution (PI) in the mode of electronic currency issuer. With authorisation from the BC, the company will begin to operate with autonomy and agility and will help client companies scale their operations based on management, intelligence and payment processing, being able to connect the entire Brazilian Payment System (SPB).

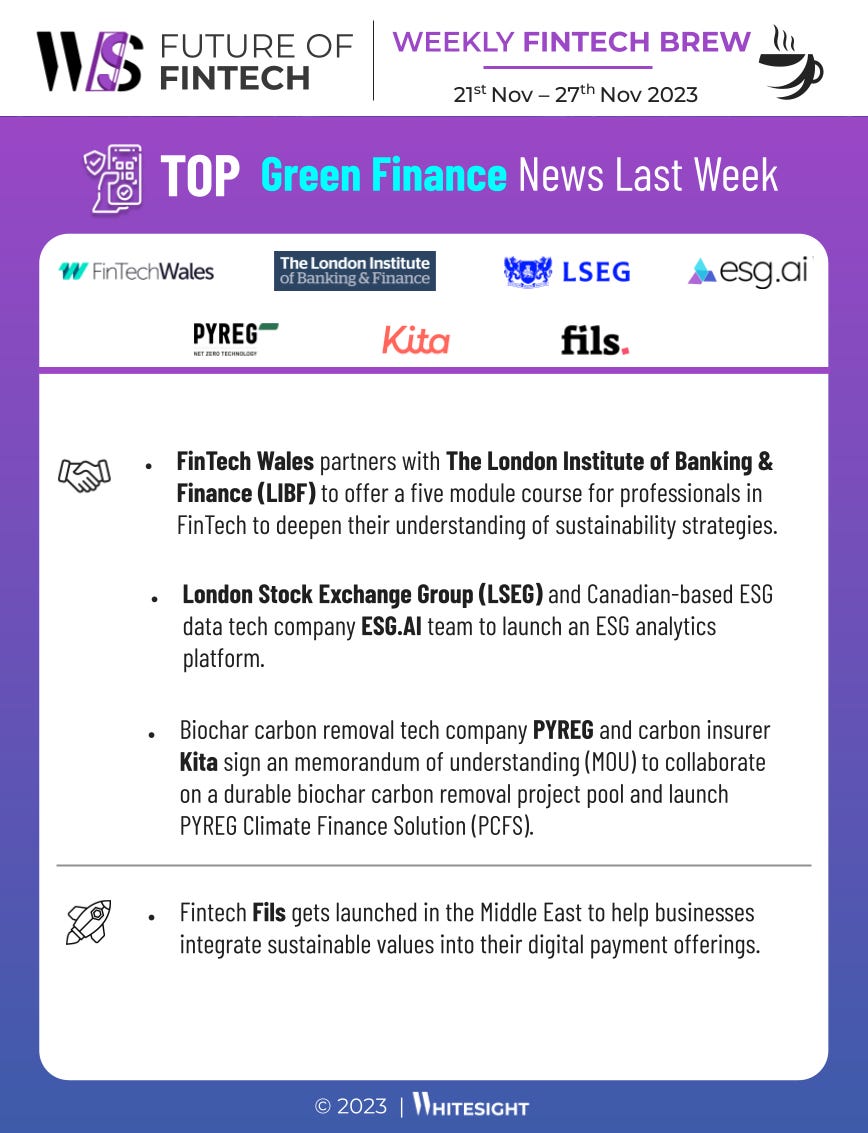

Dive into the dynamic world of Green Finance, where players are charting a sustainable course with innovation and positive impact!

London Stock Exchange Group and Canadian-based ESG data tech company ESG.AI teamed up to launch an ESG analytics platform. The new partnership will bring together LSEG’s expansive financial markets dataset with ESG.AI’s platforms, which enable users to capture real-time ESG data, calculate up-to-the-minute ESG scores, receive guidance based on planned improvements, and estimate the impact of ESG initiatives.

Biochar carbon removal tech company PYREG and carbon insurer Kita signed a memorandum of understanding (MOU) to collaborate on a durable biochar carbon removal project pool and launch PYREG Climate Finance Solution (PCFS). PYREG will launch their service, PYREG Climate Finance Solution (PCFS), in Q4 2023 with the mission to permanently remove over four million tonnes of carbon dioxide by 2050.

In the realm of DeFi, Switzerland took centre stage last week as the go-to destination for all DeFi players aiming to revolutionise the scene in the region.

Santander launched trading services for Bitcoin and Ether in Switzerland. This specialised trading option is specifically tailored for high-wealth clients with Swiss accounts, subject to predefined criteria to ensure a strategic and discerning approach to cryptocurrency involvement.

BBVA Switzerland expanded its partnership with Metaco to accelerate digital asset offerings. As part of the deal, BBVA Switzerland migrated its digital assets operations to Metaco’s Harmonize platform to facilitate enhanced speed, operational efficiency, and elevated governance standards within the bank’s digital assets ecosystem.

Some other happenings in the fintech universe 🪐

Craving for some more quick fintech nibbles to savour alongside your tea? Get ready to dig into a delectable spread of tantalising headlines!

Indian fintech startup Kiwi raised $13M in a Series A funding round anchored by Omidyar Network India. Kiwi will use the fresh capital to expand its offerings in the Indian market.

Pineapple, a South African insurtech startup, raised $21.3M in Series B funding to boost its growth.

Colombian fintech RapiCredit raised $7M in a deal with Almavest, where RapiCredit sold a portion of its loan portfolio. The funds will be used to expand microcredit offerings.

Fintech startup Scapia raised $23M in its Series A round. The company plans to use the funds to grow its customer base, add more banking partners, and enhance its product offerings.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more fintech insights, check out some of our other work at WhiteSight.

Our latest publications include –

2023 Roundup: SMB Financing Gets a Makeover with Embedded Finance

2023 Roundup: The Twists and Turns of Embedded Insurance in Travel

2023 Roundup: Embedded Insurance as the Gig Economy’s Safety Harness

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of fintech with the world.

Fintech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything fintech and web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️