Future of Fintech | Edition #92 – Oct 2023

Fintech Pulse: Weekly Digest (Oct 17th-23rd)

Hey, Fintech Rockstars!

Guess who's back, ready to zap those Tuesday blues with a jolt of fintech fabulousness? Last week, we ventured into the beating heart of European fintech and cruised through the bustling fintech landscapes of the Middle East. So, grab your virtual coffee mug, make yourself comfy, and join us as we plunge headfirst into the electrifying world where finance and technology come together, where innovation is always simmering, ideas are bubbling, and the scent of a brighter future wafts through the air. ☕

Before we take the plunge into the electrifying realm of fintech innovations, let's peel back the curtain on what set the US financial stage on fire just last week>>

The CFPB's Open Banking Marvel Unleashed!

In the heart-pounding arena of American open banking, the spotlight's blazing on the Consumer Financial Protection Bureau as they unveil their bold "Personal Financial Data Rights" rule. This audacious move plans to formally hand over the keys to consumers, allowing them to be in complete control of who gets access to their data, for what purpose and for how long, while also tightening the screws on companies mishandling consumers’ confidential financial secrets. This time, the CFPB steals the show, championing fierce competition, unwavering consumer protection, choice, and epic industry standards. It's a show that spans across financial domains like credit cards, checking accounts, prepaid cards, and digital wallets, leaving the audience in awe. So, gear up because the journey into US open banking has officially begun, and the race for customer-centric innovation and consumer protection is on! 🚀

Strap in and let's rock and roll into the Future of Fintech - Edition #92. Get ready for a wild ride of innovations that will take your imagination to uncharted realms!

Here's the TL;DR

Regulators worldwide were laser-focused on the paramount concerns of transparency and security last week – the Consumer Financial Protection Bureau (CFPB) proposed the Personal Financial Data Rights rule to accelerate open banking via new protections for consumers against companies misusing their data, while the MENA Fintech Association established the Digital Assets Working Group to champion for a transparent regulatory framework for the adoption and use of digital assets across MENA.

While on the topic of regulation, Coinbase chose Ireland (and not one of the big EU countries) as its main operational and regulatory hub in the European Union, having submitted its application for a license under the EU’s new Markets in Crypto-Assets (MiCA) regulation (set to come into force by December 2024).

Another firm that put the spotlight on consumer protection was Revolut, as it doubled the headcount for its Financial Crime (FinCrime) division to counteract the increasing menace of financial fraud. They seem to be getting their house in order in their quest to placate the regulators in the UK and elsewhere.

Speaking of consumer needs, Amazon Pay introduced EMI on RuPay credit cards to provide customers with increased flexibility and affordability to shop during the festive period. Taking the credit game forward, Galileo Financial Technologies launched the Galileo Corporate Credit solution that consolidates credit limits to help streamline B2B expense management for fintechs and non-financial brands.

Europe's payments arena stole quite the headlines the past week – Stripe embedded A2A payments in checkout with TrueLayer to allow European customers to access open banking linked transactions, and Juni enabled its cross-border payments capabilities, facilitating transactions to the US and mainland China for its customers across Europe.

Fintech players showcased a shared purpose of economic empowerment, with Block acquiring musician-focused fintech start-up Hifi to help artists thrive, and Backbase partnering with Atomic to deliver direct deposit and income verification solutions to community banks and credit unions.

For the longer read, let's get going –

Embark on an exciting adventure through the world of Open Finance, where collaborative partnerships unlock the full potential of cutting-edge technology.

Advanced API Management company Sensedia and fintech provider Mambu partnered at Money20/20 event, to enhance financial service and app connectivity. This partnership enables banks and other financial service providers to offer new, innovative products and services to their customers more swiftly and efficiently.

TotallyMoney, a personal finance app, partnered with Bud Financial to launch an open banking tool aimed at empowering underserved adults in the UK. The tool will help customers track past and upcoming payments, to avoid any missed payments, and inform them of any bills that might negatively or positively impact their credit report.

Plunge headfirst into the boundless digital landscape of Digital Finance, where global fintech pioneers strive to empower users' financial well-being!

Brazilian fintech Nubank's Mexico arm requested a banking license from local regulators. Obtaining a banking license will enable Nubank to expand its financial product and service offerings, including diverse investment opportunities like shares in Mexico's primary stock index.

Philippine-based digital bank Tonik partnered with Sun Life Grepa Financial to offer insurance services. The focal point of this collaboration is the introduction of Payhinga, an inclusive bundle service designed to offer customers financial security.

In the realm of Embedded Finance last week, innovators raced to deliver features and solutions for seamless integration across every financial facet.

Fiserv introduced a set of APIs that aim to offer financial institutions Embedded Finance capabilities. The company will provide accessibility to capabilities from its merchant acceptance, banking, and card-issuing businesses to customers via a curated set of APIs.

Card issuing platform Marqeta partnered with BNPL provider Scalapay to deliver BNPL across Europe. Marqeta and Scalapay signed a five-year exclusive contract, where Marqeta will issue virtual cards for online and in-person transactions, creating a more seamless payment experience for both merchants and consumers.

Within the vibrant Fintech Infrastructure sphere, fintech enthusiasts forged alliances and sealed acquisitions to cater to a diverse global user base.

Core banking technology provider Tumm and Plumery, the digital banking platform, collaborated to offer banks and fintechs access to a fully integrated core banking platform. The solution will combine Plumery’s library of ‘headless’ digital banking capabilities, with Tuum’s cloud-native, modular core to enable launching businesses to get to market faster than ever before.

Airwallex announced a deal to acquire MexPago, a Mexico-based payment service provider. This acquisition marks Airwallex’s entry into the Latin American market, unlocking opportunities for businesses in Mexico to operate globally and for international companies to establish a presence in Mexico.

Step into the captivating realm of Green Finance, where national banks and regulators are at the forefront, driving the transformation of the financial ecosystem towards sustainability!

National Australia Bank partnered with portfolio company Greener. Under the partnership, NAB will promote to its small business clients the Greener for Business tool, which provides guidance on how to develop an action plan to reduce energy and waste, as well as improve electrification, packaging and logistics emissions.

The Monetary Authority of Singapore issued a set of consultation papers with proposed guidelines on net zero transition planning for financial institutions. MAS' guidelines establish supervisory expectations for financial institutions to facilitate a robust transition planning process for effective climate change mitigation, adaptation, and managing the shift to a net-zero economy and climate-related impacts.

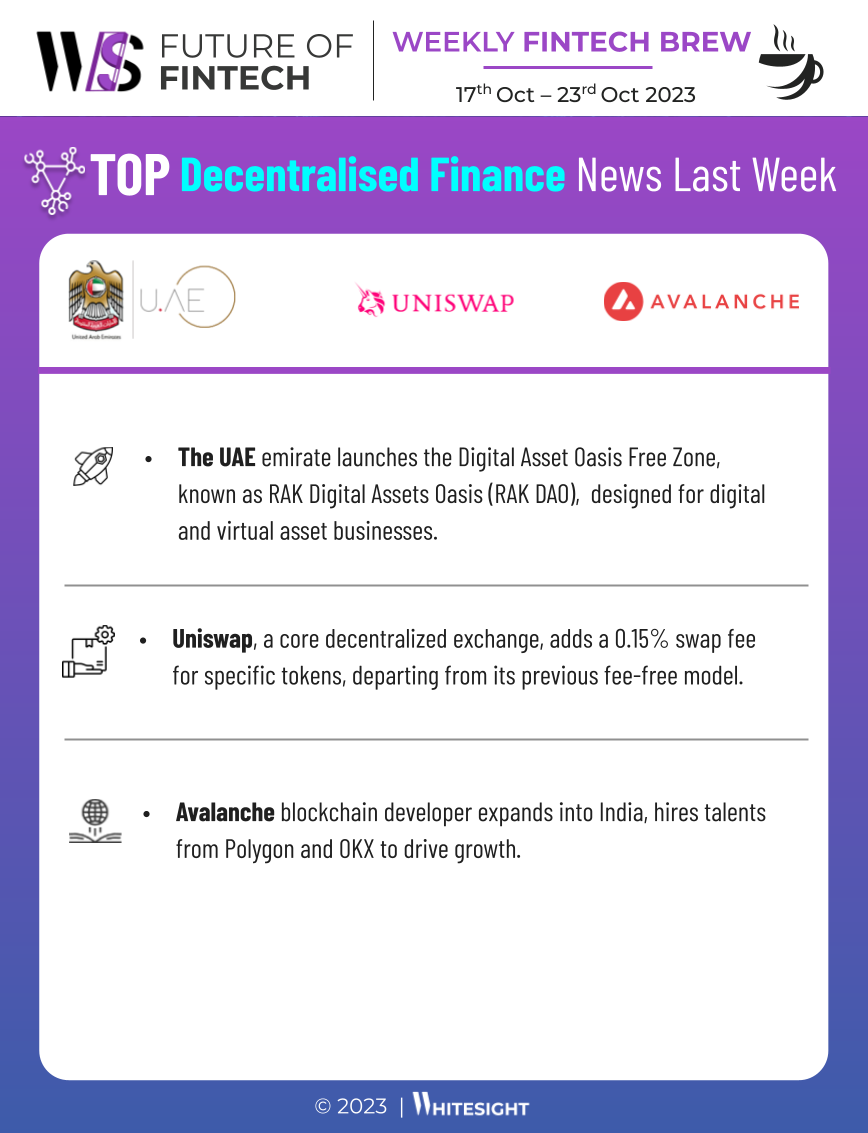

Over the past week, the DeFi community fearlessly explored fresh horizons, propelling the web3 world to unprecedented heights!

Avalanche blockchain developer announced its expansion into India and hired talents from Polygon and OKX to drive growth. Ava Labs plans to target sectors such as ticketing, certification, and supply chain in India.

The UAE emirate launched the Digital Asset Oasis Free Zone, known as RAK Digital Assets Oasis (RAK DAO), designed for digital and virtual asset businesses. The entrepreneurs in the free zone will have complete ownership over their businesses where they can establish their own tax rules and regulatory frameworks but have to adhere to the existing criminal laws of the United Arab Emirates.

Some other happenings in the fintech universe 🪐

Craving for some more quick fintech nibbles to savour alongside your tea? Get ready to dig into a delectable spread of tantalising headlines!

Fintech iwoca received a $243.9M funding line from Barclays and Värde Partners to meet the growing demand for SME lending.

Stitch, a South African fintech startup, raised $25M in a Series A extension round to extend its end-to-end payment solutions and enter new markets.

Moroccan Fintech CashPlus raised $60.4M to expand its fintech-driven branch network within the country.

Neobank Albo secured $40M in series-C round to expand SME products.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more fintech insights, check out some of our other work at WhiteSight.

Our latest publications include –

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️