Future of Fintech | Edition #91 – Oct 2023

Fintech Pulse: Weekly Digest (Oct 10th-16th)

Hey there, Fintech Trailblazers!

Guess what? It's another fabulous Tuesday where we serve up a sizzling hot cuppa of finance and tech fusion to supercharge your week! Last week, the spotlight was on the pulsating heart of fintech in Asia and the thriving fintech scenes down under in Australia. So, grab your virtual mug and let’s dive deep into the world where finance meets technology – where innovation simmers, ideas percolate, and the aroma of the future fills the air.☕

Before we immerse ourselves in the dynamic world of fintech innovations, let's uncover what's sizzling on Revolut's stove lately >>

In the heart of the digital finance realm stands Revolut, a UK-born sensation that's been rewriting the rules since 2015. Fast forward to today, and it's official – Revolut's global family now includes an astonishing 35 million customers! But they're just getting started. And to mark this milestone, the curtain rises on 'Revolut 10,' a game-changing update that's all about personalization. Users now have the keys to customize their financial world, from hand-picking themes that suit their style, adding widgets for their most-wanted features, and so much more! What's the magic ingredient powering Revolut's journey to success? It's their unwavering commitment to shaking up the status quo, conquering regulatory challenges, and crossing borders with ease.

Revolut's journey is nothing short of an epic saga. It kicked off as a spirited startup, driven by the adrenaline of growth, and has now matured into a 'scale-up' titan. The spotlight has shifted towards not just growth, but the pursuit of profitable expansion. Our report, "Revolut's UK Banking Quest” is an exploration of Revolut's astounding growth, the quest for a UK banking license, the formidable challenges faced, and ingenious manoeuvres turning obstacles into stepping stones.

Have a look at how it all unfolds >>

Welcome to Edition #91 of our Future of Fintech newsletter: delivering the pulse of financial technology straight to your screen!

Here's the TL;DR

Last week, the fintech scene saw some heavyweights making splashes - Nubank and Brazilian Stock Exchange B3 introduced a dividend-paying ETF, while J.P. Morgan unveiled a Tokenization Platform - Tokenized Collateral Network - enabling investors to utilize assets as collateral.

Riding the decentralized wave, Metamask crypto wallet also integrated with Stripe for enhanced Crypto On-Ramp options. At the same time, Goldman Sachs grabbed headlines for selling its lending unit Greensky to a Sixth Street-led consortium.

Collaborating to cultivate innovation and inclusivity - Fiserv and Plaid teamed on consumer bank data sharing through APIs for financial institutions. Meanwhile, UNO Digital Bank chose Collabera Digital to expand its user base through the integration of a mini application in Fintech and Lifestyle SuperApp GCash. The collaboration aims to drive financial inclusion and the growth of the digital economy in the Philippines.

Achieving targets: TrueLayer, the UK open banking fintech, processed over 1 million VRP transactions in just a month. Meanwhile, Dock Financial completed the acquisition of Paydora Finance to provide clients with a modular and turnkey solution for Embedded Finance.

Elevating user experiences: Bendigo and Adelaide Bank shifted its digital system to Google Cloud for tailored customer experience, and Australian Payments Plus (AP+) unveiled ConnectID, a digital identity solution to enhance fraud and identity theft protection for Australians.

For the longer read, let's get going –

Unlock the vault into the realm of Open Finance, where participants harness collective technological prowess through collaboration.

Pragmatic Solutions, a provider of iGaming technology for regulated markets, integrated with Zimpler Go to streamline player onboarding and accelerate growth with faster payments and financial compliance checks.

Salt Edge partnered with Access to Arabia (A2A), a banking technology provider, to support Open Finance in Jordan. Together, A2A and Salt Edge will bring opportunities in open banking by harnessing Salt Edge’s global bank connectivity and A2A’s middleware and integration expertise.

Dive into the digital frontier of Digital Finance where pioneers collaborated and upgraded last week to digitize the financial landscape.

Revolut launched Revolut 10, with a significant overhaul of the design and layout of the app. The new update gives its users a simplified and holistic view of their money in one place where they will be able to switch between accounts to easily track their money between multiple currencies, and pockets.

KakaoBank, the South Korean online-only bank, announced its plans to acquire a 10% stake in Indonesia-based Superbank. KakaoBank will be working on the development of Superbank’s products and services as well as gaining experience in the Southeast Asian market.

In the Embedded Finance arena, it was all about new launches, with new features and solutions ready to seamlessly integrate across every facet of finance!

Swedish payments group Klarna launched an AI-driven shopping feature, developed with OpenAI tech, that allows people to shop by taking a photo of products they like which then become available to buy in seconds on the company’s mobile app.

Trade Ledger launched a Beta Program for AI-enabled Working Capital solutions and has started accepting applications from banks to join the program. The solution helps banks access the $120T embedded lending market for working capital finance.

Within the dynamic sphere of Fintech Infrastructure, fintech enthusiasts joined forces in remarkable collaborations, catering to a diverse spectrum of users.

Beyon Money partnered with Ottu to launch ‘Beyon Money Checkout’ - an online payment acceptance solution for corporates and businesses in Bahrain. This collaboration with Ottu will support the expansion of the company’s services by empowering merchants in Bahrain to seamlessly integrate Beyon Money Checkout for their e-commerce channels.

UK-based Alba Bank partnered with Mambu in order to leverage the latter’s cloud banking platform to improve its SME lending. Throughout this partnership, Alba Bank will leverage Mambu’s cloud banking platform in order to manage its lending solutions, alongside its retail and business deposits.

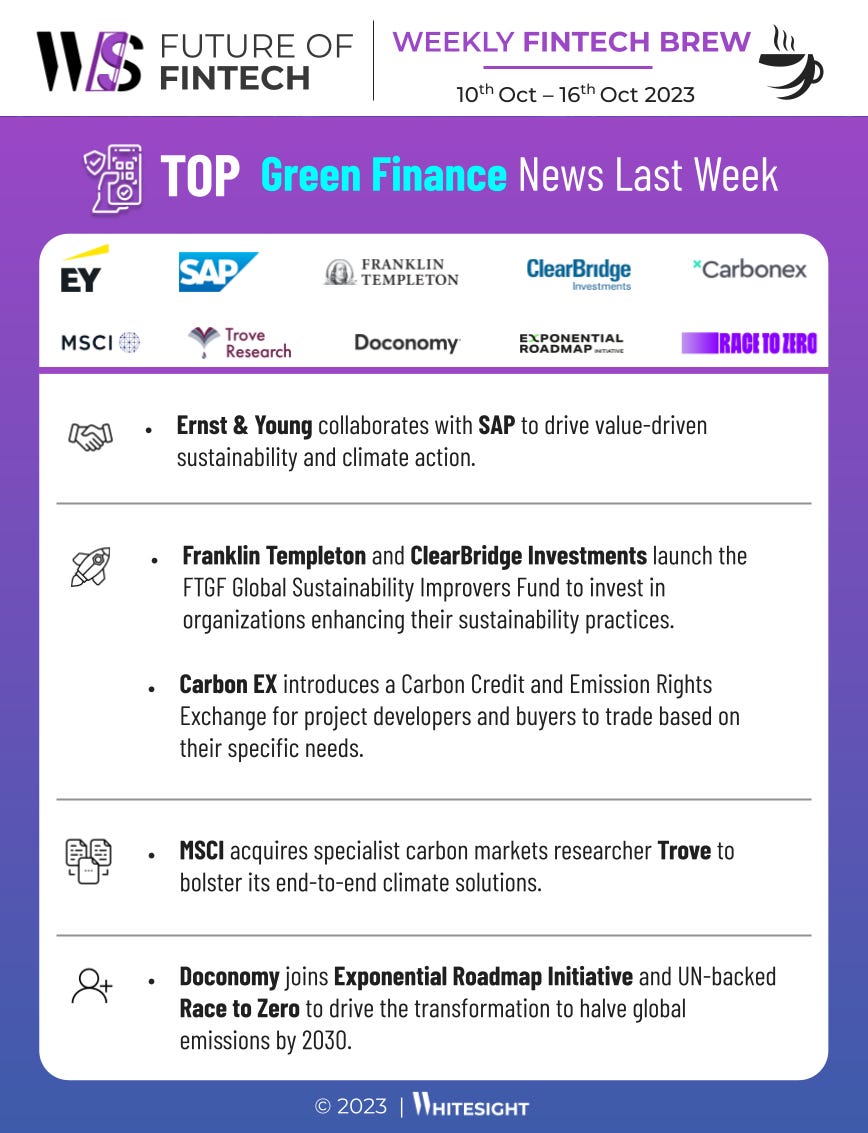

Plunge into the dynamic world of Green Finance, where trailblazers ignite sustainability through the green fields of the financial sector.

Franklin Templeton and ClearBridge Investments launched a global value equity fund - the FTGF ClearBridge Global Sustainability Improvers Fund - to facilitate investments in entities that are on a discernible path towards bettering their sustainability approaches.

Carbon EX launched a Carbon Credit and Emission Rights Exchange Service that will enable domestic and foreign project developers (sellers) and multiple buyers (buyers) to trade according to various purposes and needs and will serve as a starting point for the creation of carbon credit-related businesses.

In the past week, the DeFi community boldly ventured into newer avenues, elevating the web3 realm to new horizons!

Brazil's regulatory authority The Comissão de Valores Mobiliários (CVM) announced its plans to launch the second Tokenization Program Sandbox in 2024. CVM seeks to draw in stakeholders, including established financial institutions and startups, by providing a regulatory-light environment for innovating with tokenized assets.

Payments giant Mastercard successfully demonstrated the capabilities of a solution that enables CBDCs to be tokenized onto different blockchains. The company stated that this solution will provide consumers with a new option to participate in commerce across multiple blockchains with increased security and ease.

Some other happenings in the fintech universe 🪐

Craving for some more quick fintech nibbles to savour alongside your tea? Get ready to dig into a delectable spread of some more savory headlines!

India-based InsuranceDekho raised $60M in Series B funding, a mix of equity and debt, as the startup looks to supercharge its growth.

Stock trading API developer Alpaca raised $15M in the form of a convertible note from Japanese financial firm SBI Group to accelerate Alpaca's Asian business.

Stash, a NYC-based provider of an investing app, raised $40M in funding to accelerate growth and its business reach.

InsurTech platform Matic bagged $20M in a Series B extension round to accelerate partnership momentum, expand carrier network, and enhance product portfolio.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more fintech insights, check out some of our other work at WhiteSight.

Our latest publications include –

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️