Future of Fintech | Edition #90 – Oct 2023

Summary of fintech news from 3rd to 9th Oct

Hey there, Fintech Aficionados!

It's Tuesday, the day we whip up some brew-worthy headlines from the fusion of finance and technology to supercharge your week! Grab your go-to cuppa, and let's dive into the future of fintech, one tasty update at a time. Last week, the fintech stage was set ablaze in the tech hubs of Europe and the tech-savvy shores of Australia! So, without further ado, let's dive headlong into the exhilarating realm of innovation and all things fintech! ☕

Before we plunge into the world of fintech excitement, let's uncover why the fintech landscape in Canada has been making waves lately>>

Canada's Open Banking Awakening: A Late Arrival to the Fintech Frontier

In the grand arena of global finance, Canada often stands shoulder-to-shoulder with illustrious counterparts like Australia, Japan, and the United Kingdom. Yet, it's a different story when we delve into the world of open banking. While countries around the globe are boldly embracing fintech innovation and reshaping their financial policies, Canada, it seems, has been lingering in the shadows. Surprisingly, it stands as the lone G7 nation that has yet to take the plunge into the waters of mandated open banking. This year witnessed remarkable developments, epitomized by the urgent call from Open Finance Network Canada (OFNC) to establish a "definitive deadline" and roadmap for open banking. Simultaneously, a rallying cry of "Choose More" echoes across the nation as Canadian fintechs galvanize public support for government action in the domains of open banking and payments modernization. As we cautiously approach 2024, a glimmer of hope emerges on the horizon, hinting at Canada's long-awaited entry into the thrilling open banking revolution.

Meanwhile, Canada's embedded finance landscape is a thrilling canvas of innovation. Picture this: embedded finance is making waves in supermarkets and lifestyle chains, setting the stage for something big. In a country like Canada, with its robust banking culture, strong economy, and regulatory intricacies, the journey ahead is promising.

Curious about the exciting developments waiting to unfold in this space? Our latest blog, "The big picture of embedded finance and how it’s taking shape in Canada," unveils the secrets behind Canada's unique embedded finance landscape. From booming retail sectors to stringent financial regulations, we dissect it all!

Buckle up and get ready to soar through Future of Fintech - Edition #90, where the hottest innovations are about to take your imagination to new heights!

Here's the TL;DR

Fintech trailblazers expand their horizons across the globe as Salt Edge partnered with SeaPay to offer pen Banking solutions in Saudi Arabia, and Experian launched a digital checking account and debit card for US consumers.

Harmonizing transactions and payments, NatWest launched a transaction categorization service, Enriched Transactions, for businesses to integrate with their apps and digital platforms. Not just that, but Ripple also secured a payments license from the Monetary Authority of Singapore to provide regulated digital payment services.

Last week was a fintech fusion frenzy! Fintech unicorn Slice made waves by merging with North East Small Finance Bank, making its entry into the banking sector. Meanwhile, Modern Treasury joined J.P. Morgan's Payments Partner Network to serve up cutting-edge solutions for corporate clients.

With a focus on delighting customers – Lydia partnered with insurtech Qover to offer premium travel insurance. Additionally, Klarna launched "conscious" shopping tools for access to sustainable products and experiences.

Last week was all about small businesses stealing the show. Galileo and Mastercard joined forces to supercharge BNPL offerings for SMEs, while FullCircl and nCino joined forces to revolutionize financial services for small enterprises.

For the longer read, let's get going –

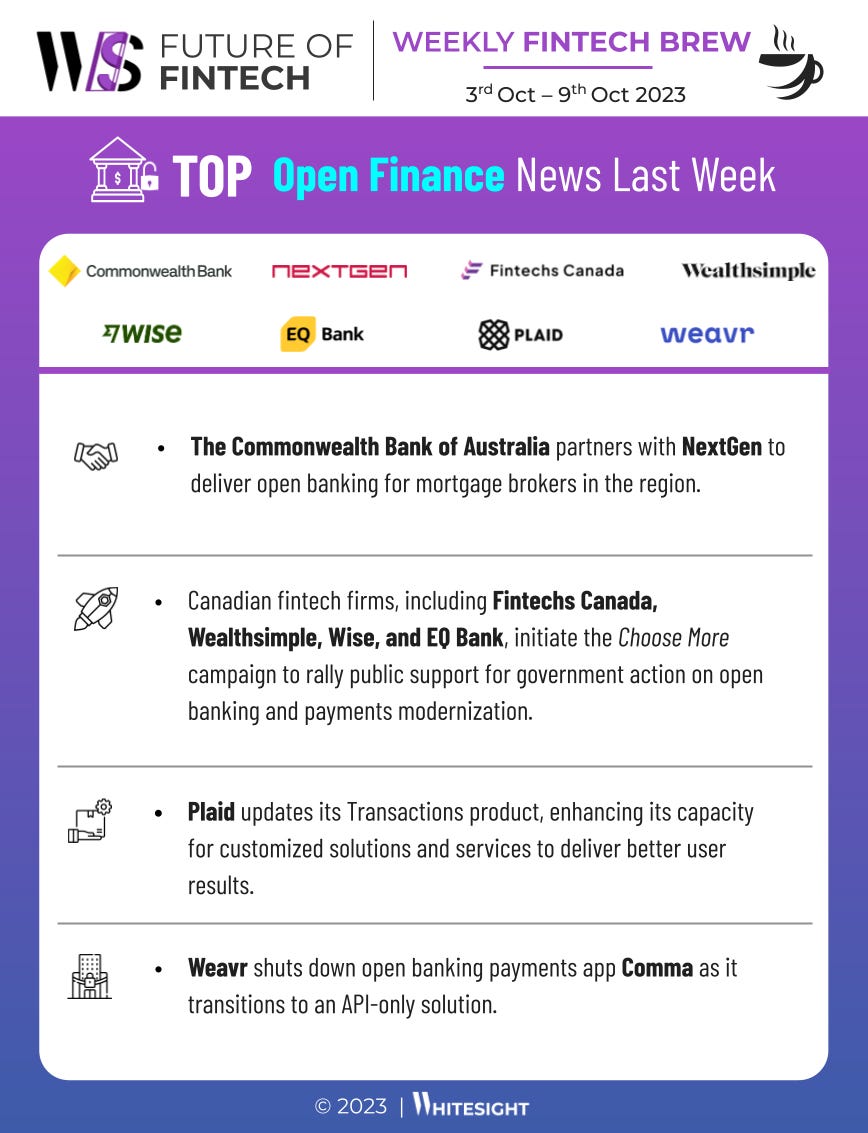

Get ready for an electrifying journey into the realm of Open Finance, where pioneers revved up their efforts to bring open services to every corner of the world.

National Australia Bank partnered with Trovata, an automated cash management platform to launch NAB Liquidity+, an AI-enabled cash management, analytics, and forecasting platform. NAB Liquidity+ will allow corporate customers to bring together their critical banking data, providing comprehensive and real-time visibility of their cash positions and delivering cash insights and precision forecasting.

Canada’s fintech companies launched a public action campaign — The Choose More campaign — coordinated by Fintechs Canada, Wealthsimple, EQ Bank, and more to push the federal government to move faster on open banking and payments modernization.

Buckle up for a thrilling ride through the Digital Finance frontier! Last week, a slew of traditional banks unveiled their digital-only offerings, aiming to digitize the financial landscape.

Brazil's Itaú entered the neobanking sector in Chile through the launch of “Itu,” a digital banking venture, initially offering a virtual account and a Mastercard debit card. This move echoes the trend of traditional banks venturing into the digital realm in response to mounting competition from digital-only financial providers.

Axis Bank launched its digital bank proposition – ‘open by Axis Bank’. The launch is a culmination of the bank’s multiyear effort to launch a digital bank within the bank, which is focused on delivering a personalized, intuitive, and hassle-free digital banking experience.

In the dynamic world of Embedded Finance, players united to effortlessly blend finance into various sectors, making finance a breeze!

Cross River Bank and Paymints.io, a B2B payment platform for real estate, teamed up to expand real-time payments in real estate. The collaboration — an extension of an existing partnership between the companies — lets Paymints.io customers in the real estate space make real-time payments using The Clearing House’s RTP network.

Indian travel booking site EaseMyTrip teamed up with Cover Genius to offer global travellers convenient and flexible embedded protection. EaseMyTrip customers will now be able to purchase optional cancel for any reason (CFAR) travel insurance as part of the standard ticket booking process.

In the buzzing realm of Fintech Infrastructure, fintech players engaged in notable collaborations to enhance and safeguard the fintech ecosystem.

The Maldives Monetary Authority (MMA) signed an agreement with Tieto Latvia, a subsidiary of TietoEVRY, to implement an Instant Payment System in the country. Initiated under the Maldives Payment System Development Project, the Instant Payment System will enable users to make and receive payments in real time, irrespective of the island they live on or where they bank.

TransUnion partnered with London-based fintech company Tymit for enhanced credit card fraud safety. The offering is Tymit’s response to providing an alternative to traditional credit cards and BNPL offerings, and TransUnion will offer an additional layer of protection against the most prevalent cases of credit card fraud such as ID theft and impersonation.

Dive headfirst into the world of Green Finance, where trailblazers ride the eco-conscious waves in sync with green regulations, reshaping finance for a greener world.

Sustainability technology platform Clarity AI launched a sustainable investment index and ETF methodology, which aligns with the Sustainable Finance Disclosure Regulation (SFDR).

The Green Technical Advisory Group (GTAG) issued its final advice to the UK Government on the creation of a UK Green Taxonomy centred on establishing a long-term "institutional home" for the taxonomy.

Over the past week, digital players across regions wholeheartedly embraced the very essence of the DeFi cosmos.

Komainu, a digital asset platform for institutions, got registered with the UK Financial Conduct Authority (FCA) to provide a custodial wallet service for clients. Komainu will offer crypto-custody services in the UK, including collateral management services via its Komainu Connect platform.

The UK government announced plans to launch a second crypto sandbox in 2024 to enable firms to test and adopt digital securities across financial markets. The move is part of a series of measures to make the UK a global hub for cryptoasset technology and investment.

Some other happenings in the fintech universe 🪐

Craving for some more quick fintech nibbles to savour alongside your tea? Get ready to dig into a delectable spread of tantalising headlines!

Indonesian fintech startup Investree raised $231M in Series D funding to set up a Joint Venture In Qatar. The joint venture will serve as a hub for Investree's Middle East operations and provide digital lending services such as AI-powered credit scoring for small and medium-sized companies in the region.

Brite Payments - an instant bank payments fintech - announced a $60M fundraising to accelerate its geographic expansion, strengthen its presence in existing markets, and invest further in the development of its products.

Kafene, a point-of-sale financing platform, announced the extension of its Series B funding round, successfully securing an additional $12.6M in new equity capital which will be used to bolster its overarching commercial operations.

South African fintech startup Stitch announced a $25M Series A extension which will be used to continue building out its end-to-end payment solutions and expand to additional markets.

Atlanta-based Rainforest, a payments-as-a-service platform (PaaS), raised $8.5M in seed funding to invest in product development and help software businesses generate revenue, improve customer retention, and enable seamless payment acceptance.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include –

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️