Future of Fintech | Edition #89 – Sept 2023

Summary of fintech news from 26th Sept to 2nd Oct

Greetings, fellow fintech enthusiasts!

It's that day of the week – Tuesday – when we brew up some fintech magic, curating the hottest headlines from the crossroads of finance and technology to electrify your week! So, get ahold of your favourite cuppa and let's embark on a journey into the future of fintech, one bite-sized update at a time. Last week, the fintech spotlight shone brightly on the tech hubs of Europe! So, let's plunge headfirst into the thrilling world of innovation and all things fintech! ☕

Before we dive into the fintech buzz, let's uncover the enigmatic empire that Apple is silently crafting in the world of finance>>

Unveiling Apple's Finance Game Plan: Open Banking and Beyond

Apple is making bold moves in the world of finance!

Apple's acquisition of Credit Kudos in March 2022 demonstrated its strategic interest in open banking technology. Now, 18 months later, Apple is further solidifying its commitment to this investment by introducing open banking-led data access in the UK. In a soft launch, Apple has integrated open banking capabilities into its iPhone Wallet in the UK, enabling users to access and manage their financial accounts seamlessly.

This move indicates a shift towards promoting financial wellness, likely aimed at gaining consumer trust during challenging times. It also suggests the possibility of a wave of embedded financial products coming to the UK through the iPhone, similar to the trend observed in the US.

Check out WhiteSight’s Apple’s Embedded Finance Playbook report to dive deeper into Apple's innovative strategies.

Hold onto your hats as we prepare to rocket through Future of Fintech - Edition #89, where the most blazing innovations are set to ignite your imagination!

Here's the TL;DR

It's all about the BaaS - Brankas and Konsentus teamed to launch The Brankas Open Finance Suite (OFS) – a BaaS platform to fast-track open finance. Codebase Technologies also joined forces with Network International to launch a comprehensive BaaS solution in the Levant, set to accelerate the pace of digital banking transformation throughout the region.

Fintech giants globalize the game as Visa partnered with ABHI and YellowPepper to launch A2A payments in the UAE. At the same time, Nubank secured a $265M loan from the International Finance Corporation to expand its operations in Colombia.

Addressing the financial requirements across industries, Credibly partnered with Green Dot to add small business banking services to its offering. Meanwhile, Helvetia chose Qover as its insurtech partner to power pan-European automotive insurance.

Industry leaders teamed up to harness each other's tech prowess – Tonik extended its core banking partnership with Finastra to accelerate growth. Not just that, but XYB also teamed with Google Cloud to bring generative AI within its coreless banking platform.

In the DeFi world, while Crypto.com teamed up with PayPal and Paxos to establish Crypto.com as a preferred PayPal USD exchange, ANZ Bank partnered with Chainlink for cross-chain interoperability protocol.

For the longer read, let's get going –

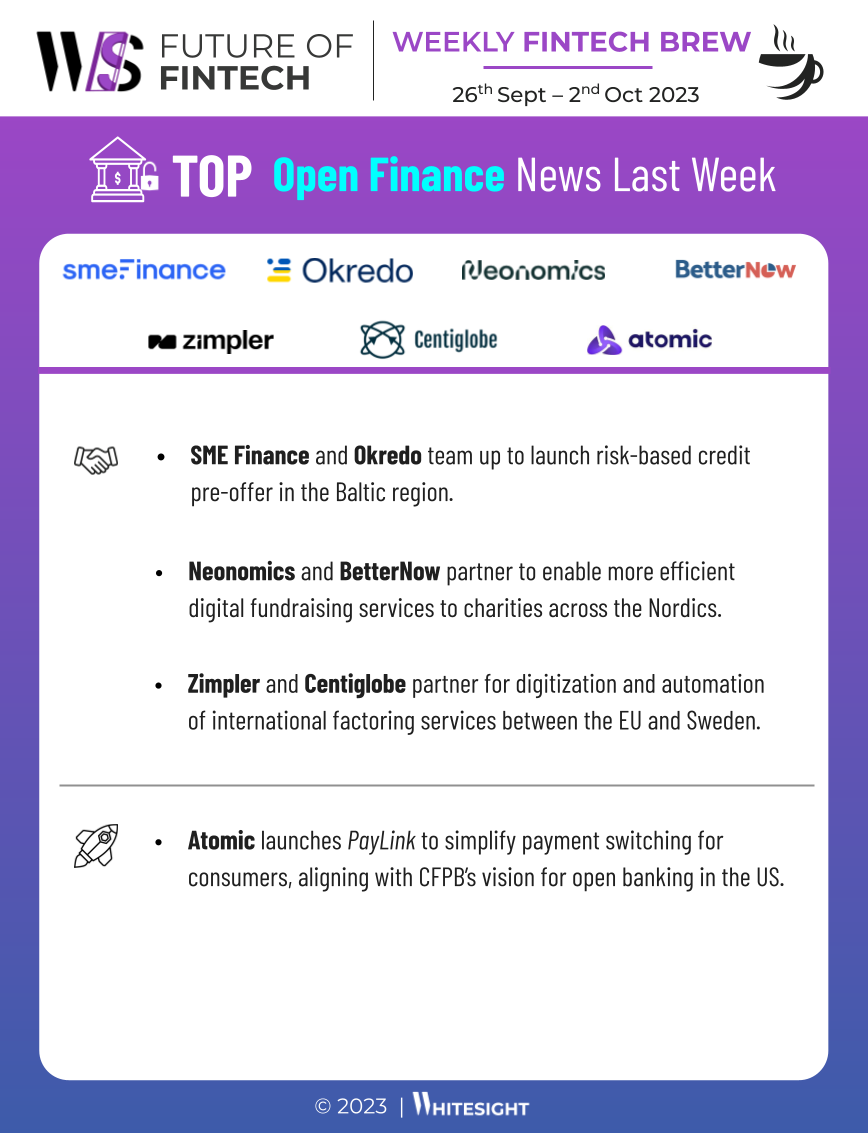

Prepare for an electrifying voyage through the realm of Open Finance, where trailblazers are turbocharging their efforts to deliver open services worldwide!

Atomic launched the open banking tool PayLink to simplify payment switching for consumers, aligning with the CFPB’s vision for open banking in the US. PayLink is a solution suite that streamlines payment switching, facilitating consumers to switch their primary banking relationships.

A2A payment solutions provider Zimpler and Centiglobe partnered for the digitization and automation of international factoring services between the EU and Sweden. The partnership will enable unique solutions to specific segments, such as cross-border factoring, as well as broader innovative cross-border payment capabilities.

Fasten your seatbelts for an exhilarating journey through the Digital Finance frontier, where financial players captured headlines with their bold moves!

JPMorgan’s UK digital bank Chase UK blocked customers in the UK from purchasing crypto assets. The company said it was taking the step because fraudsters are increasingly using crypto assets to steal large sums of money from people.

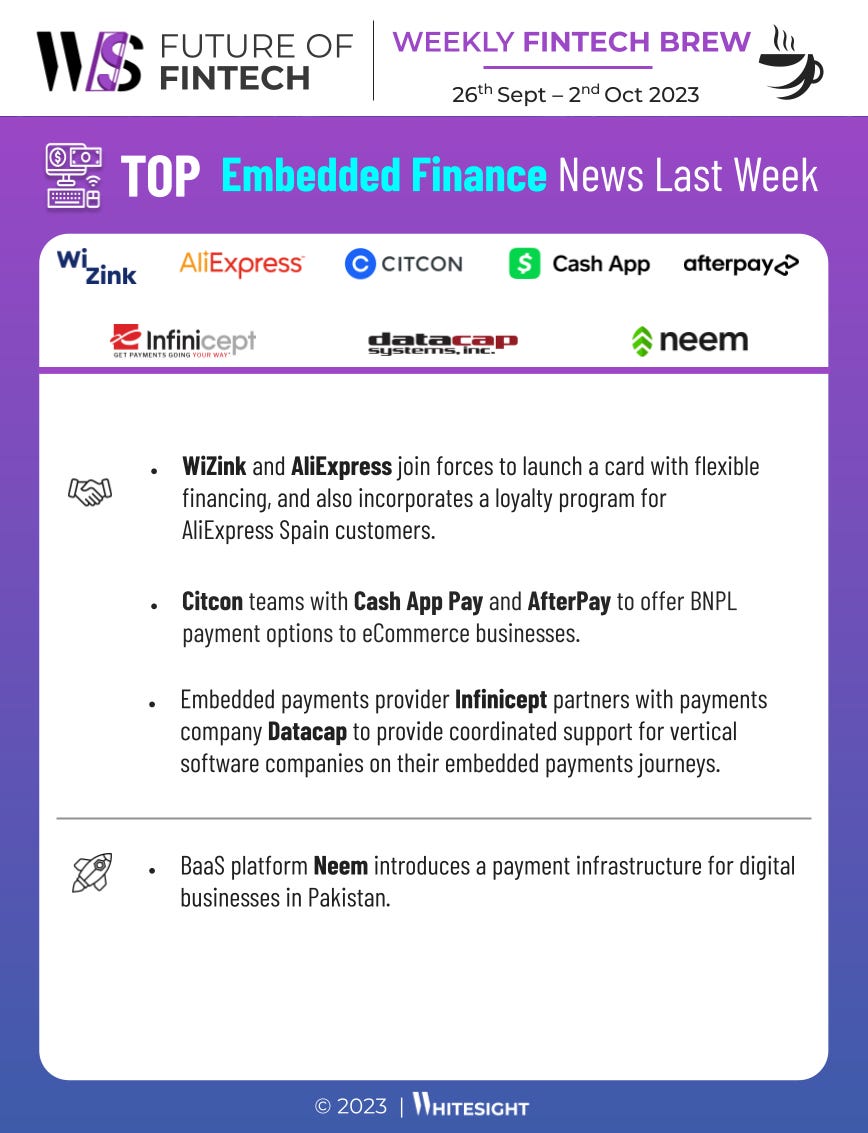

In the dynamic realm of Embedded Finance last week, the players worked hard to make payments a breeze for both consumers and merchants!

WiZink and AliExpress joined forces to launch a card with flexible financing, and also incorporated a loyalty program for AliExpress Spain customers. AliExpress chose WiZink as a partner and card issuer due to its experience in digital financing and payment solutions.

Citco, the global provider of digital payments, teamed up with Cash App Pay and AfterPay to offer BNPL payment options to eCommerce businesses. By leveraging both Cash App Pay and Afterpay’s popular “Buy Now, Pay Later” service, merchants will be able to deliver a streamlined experience that caters to modern consumer preferences for more payment options

In the pulsating realm of Fintech Infrastructure, juggernauts of the industry united to bolster and propel the financial world.

Tuum partnered with AMLYZE, an anti-financial crime solution provider, to extend its next-generation core banking offering with specialist anti-financial crime solutions. The partnership is intended to enable banks and financial institutions to leverage out-of-the-box compliance. This is achieved through the integration of Tuum's core banking, payment, and card modules with AMLYZE's comprehensive compliance solution.

Philippines’ Cebuana Lhuillier Bank joined forces with Temenos to update its core banking platform and revolutionize financial services for Filipinos. Through Temenos’ core banking platform, Cebuana Lhuillier Bank can oversee customer accounts with efficiency and introduce accessible lending products, giving clients a seamless banking experience.

Immerse in the Green Finance realm, where industry players ride the wave of eco-conscious commitment, transforming finance for a greener world.

Tokyo Stock Exchange announced the launch of carbon credit trading – starting on 11 October, 2023 – to tackle climate change. Via the new market, registered members can trade the existing carbon credit (known as J-Credit) on the TSE, a unit of Japan Exchange Group Inc.

Atom Bank partnered with climate tech company Kamma to assess climate impact on mortgages. Kamma will further provide analytics on Atom’s financed emissions, improved PCAF scoring, and climate credentials on pools of assets for the purposes of securitization.

In the past week, the DeFi scene ignited with regulatory shifts and groundbreaking partnerships, embracing the true essence of decentralized finance.

UK fintech Ramp partnered with cryptocurrency wallet MetaMask to offer seamless crypto purchases to MetaMask’s users. The collaboration will see MetaMask directly integrate with Ramp’s on-ramp services, allowing customers to convert fiat into crypto from within their MetaMask wallet.

Taiwan’s Financial Supervisory Commission (FSC) unveiled a set of guidelines for virtual asset service providers (VASPs), emphasizing increased oversight and customer protection. Another critical change mandates that offshore exchanges seeking to operate in Taiwan must now register with the FSC.

Some other happenings in the fintech universe 🪐

Craving for some more quick fintech nibbles to savour alongside your tea? Get ready to dig into a delectable spread of tantalizing headlines!

Mexico-based neobank albo raised $40M in a Series C investment round in order to accelerate its development process.

Paris-based KYC solution Ondorse raised $3.9M in Seed funding to expand its team and European market reach.

B2B payment platform Slope announced a $30M investment round to fuel product development and expansion.

PortX, a US-based technology company offering integration software for the financial services industry, clinched $16.5M in Series B investment to expand operations and its business reach.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include –

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️