Future of Fintech | Edition #85 – Sept 2023

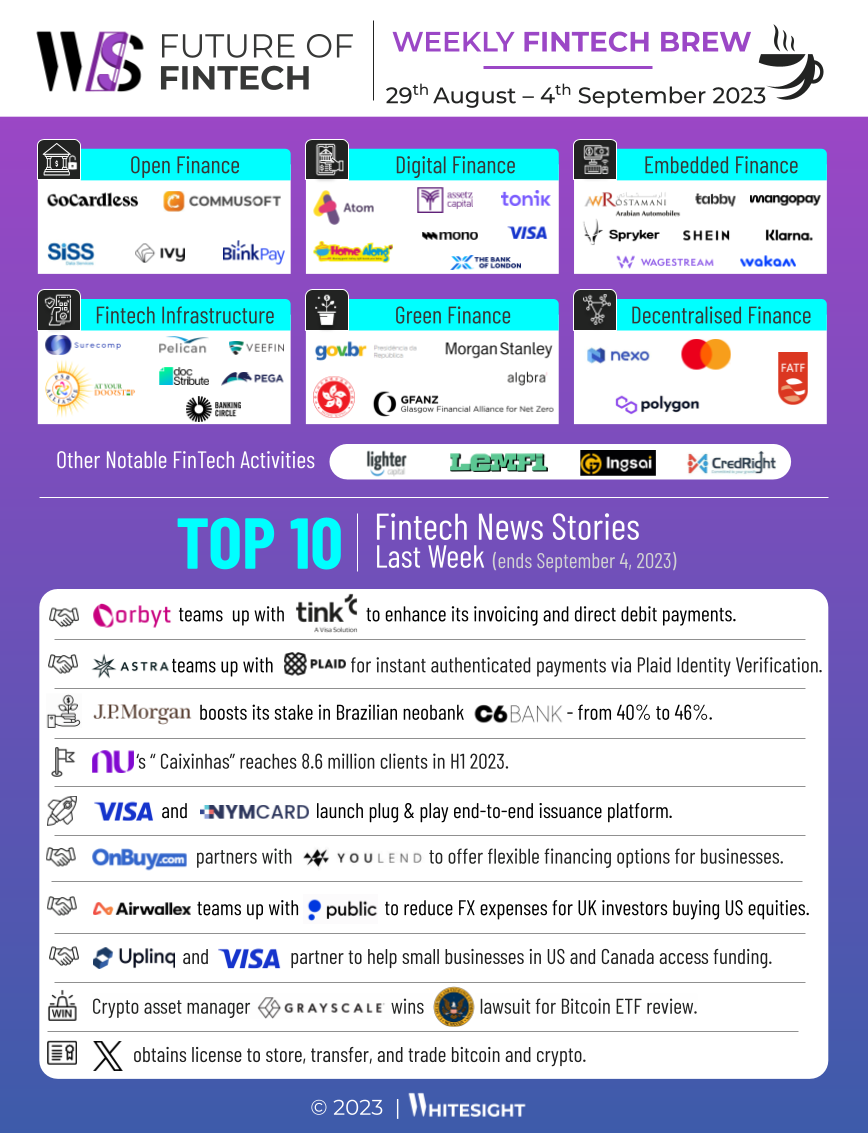

Summary of fintech news from 29th Aug to 4th Sept

Good day, fintech aficionados and digital money mavens!

It's that time of the week again when we serve up the freshest and hottest slices of fintech tidbits straight off the press! Just like the enticing scent of freshly brewed coffee, we're here to serve you the week's hottest fintech-infused news. This week, fintech excitement emanates from the vibrant landscapes of Australia and the peaks of the UK! So, grab your cuppa, curl up, and prepare to indulge in innovation and all things fintech! ☕

Before we indulge in the delicious world of fintech headlines, let's take a quick peek at the intricate web of regulations shaping the realm of BaaS>>>

Navigating BaaS Waters: Regulators Setting Sail ⚓

As Banking-as-a-Service (BaaS) charts its course toward widespread adoption, regulatory seas are growing stormier. Over the past years, bank-fintech partnerships and the BaaS landscape have squarely caught regulators' attention. While the BaaS wave is still building momentum in the US, it faces headwinds like fluctuating interest rates, looming recessions, and the ever-watchful eye of regulatory bodies. A significant development unfolded when Goldman Sachs' transaction banking arm had to pull anchor on riskier fintech clients following a stern warning from the US Federal Reserve about compliance and risk management. It's clear that as BaaS sets sail, it must navigate regulatory waters with vigilance and precision.

Prepare to savour the scorching blend of the Future of Fintech - Edition #85 is simmering with the hottest buzz! ♨️

Here's the TL;DR

Boosting fintechaverse through improved payment methods 一 Orbyt teamed with Tink to enhance its invoicing and direct debit payments. At the same time, Astra teamed with Plaid to provide instant authenticated payments via Plaid Identity Verification.

Players boosted their presence in the financial world as J.P. Morgan raised its stake in Brazilian neobank C6 from 40% to 46%, and X obtained a licence to store, transfer, and trade bitcoin and crypto.

Winning was the name of the game last week 一 while crypto asset manager Grayscale Investments won the SEC lawsuit for Bitcoin ETF review, Nubank’s “Caixinhas” reached 8.6 million clients in H1 2023.

Visa caused quite a stir in the fintech world when it unveiled a plug-and-play end-to-end issuance platform in collaboration with NymCard. Additionally, Uplinq joined forces with Visa to assist small businesses in the United States and Canada in gaining access to funding.

Innovative fintech collaborations grabbed headlines as Airwallex partnered with Public to minimize FX costs for UK investors that purchase US-based equities. And, OnBuy partnered with YouLend to offer fast and flexible financing options for businesses.

For the longer read, let's get going –

Dive headfirst into the universe of Open Finance, where trailblazers are igniting a revolution, teaming up, and achieving feats to make open banking a household sensation!

In July, open banking payments in the UK surged, reaching over 11 million transactions, marking a 9.3% increase from the prior month.

SISS Data Services launched ACSISS Adviser to allow accountants, bookkeepers, and other trusted advisers to securely receive financial transaction data from their clients. This platform is in open beta, allowing the accounting community to experience an industry-defining improvement in efficiency, security, and convenience for client bank data extraction.

Aggregation and broking group My Local Broker collaborated with personal financial management (PFM) company diñeiro to launch a white-labelled version of diñeiro’s open banking app, offering broker clients a comprehensive financial overview.

Take a leap into the dynamic universe of Digital Finance, where digital visionaries embark on a thrilling quest to digitize every facet of the financial realm!

LHV Bank partnered with Raisin UK to enter the personal savings market. The partnership will offer a 12-month fixed term, 95-day notice and easy access to savings accounts, and forms part of LHV Bank’s planned launch of a direct-to-consumer savings product next year.

Colombian neobank Nequi launched a customizable policy where each insured individual may choose up to two insurances in their name.

Another Colombian neobank – Mono – collaborated with Visa to launch its corporate card in Colombia that doesn’t require a credit review. The Mono Visa business card will offer enhanced expense-tracking capabilities.

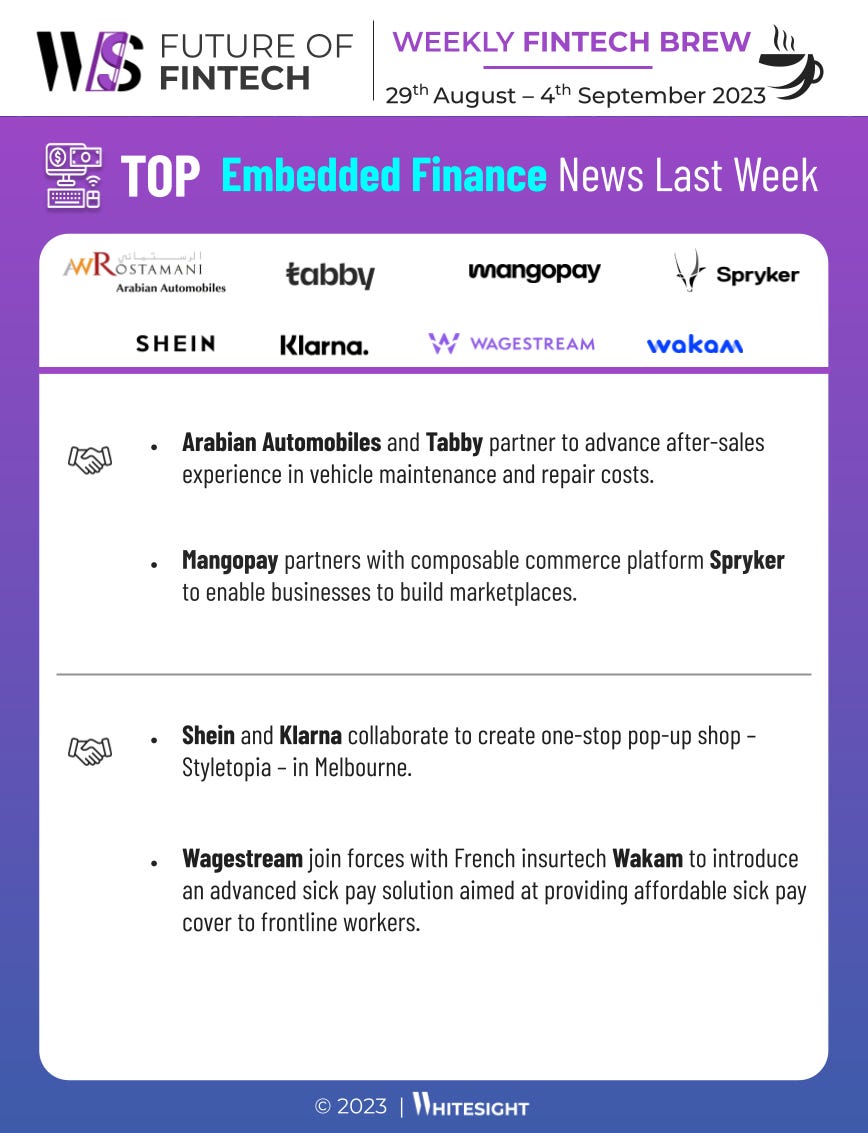

Last week in Embedded Finance, collaborations stole the spotlight as players lit up the embedding game across diverse industries, from fashion to healthcare and beyond!

Arabian Automobiles and Tabby partnered to advance after-sales experience in vehicle maintenance and repair costs. Customers will also have the option to split their payments into four interest-free instalments, allowing them to manage their budgets without straining their wallets.

Shein and Klarna collaborated to create a one-stop pop-up shop – Styletopia – in Melbourne. The pop-up will showcase SHEIN’s clothing and accessories for all genders and ages, as well as some of SHEIN’s newest collections.

Wagestream joined forces with French insurtech Wakam to introduce an advanced sick pay solution aimed at providing affordable sick pay cover to frontline workers. Wagestream users can now proactively set aside funds in the Wagestream app, tailored to their income levels.

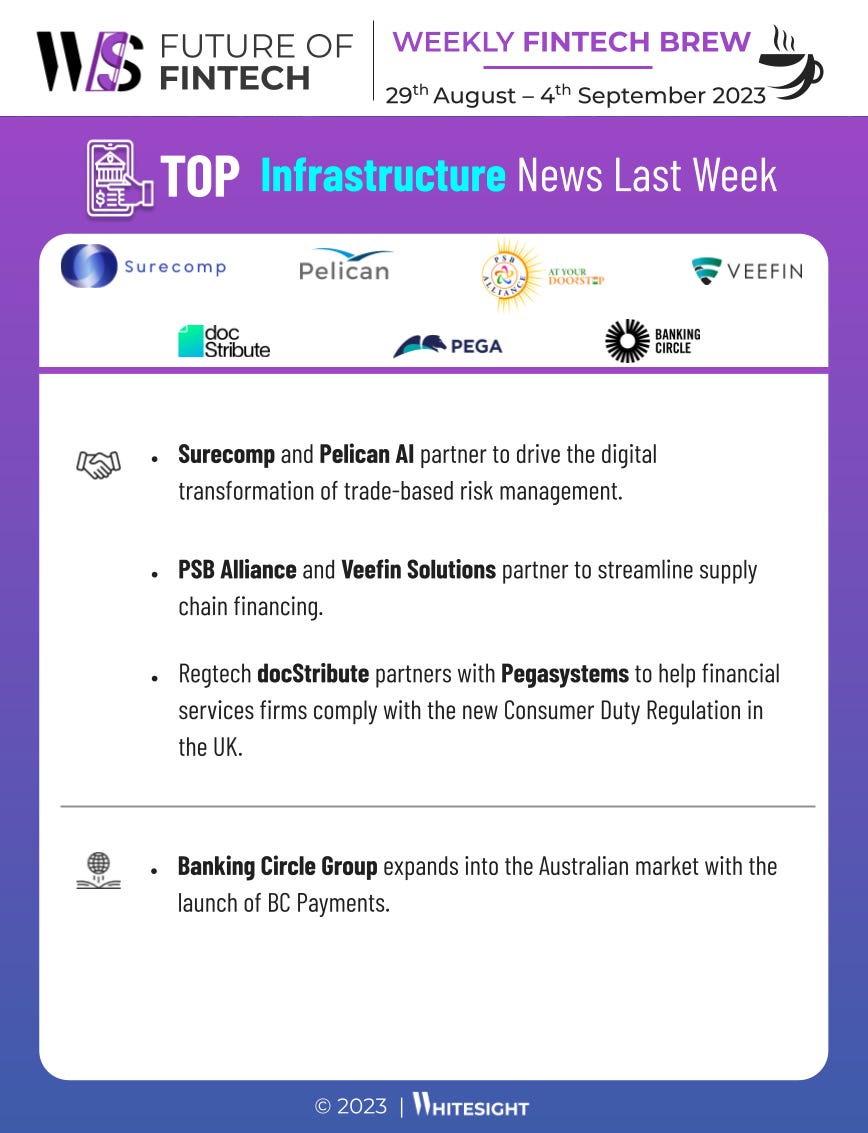

In the ever-evolving realm of Fintech Infrastructure, players teamed up with ferocity, determined to spearhead a revolution in the payments and regulations space!

Regtech docStribute partnered with Pegasystems to help financial services firms comply with the new Consumer Duty Regulation in the UK. The partnership between docStribute and Pegasystems will leverage the strengths of both companies to help firms stay compliant with the new regulations.

Paymentology partnered with Moneythor to offer banks data-driven personalization and improved engagement. By leveraging Paymentology's global payments platform alongside Moneythor's advanced personalization and engagement engine, banks and their customers can offer more relevant personal finance assistance.

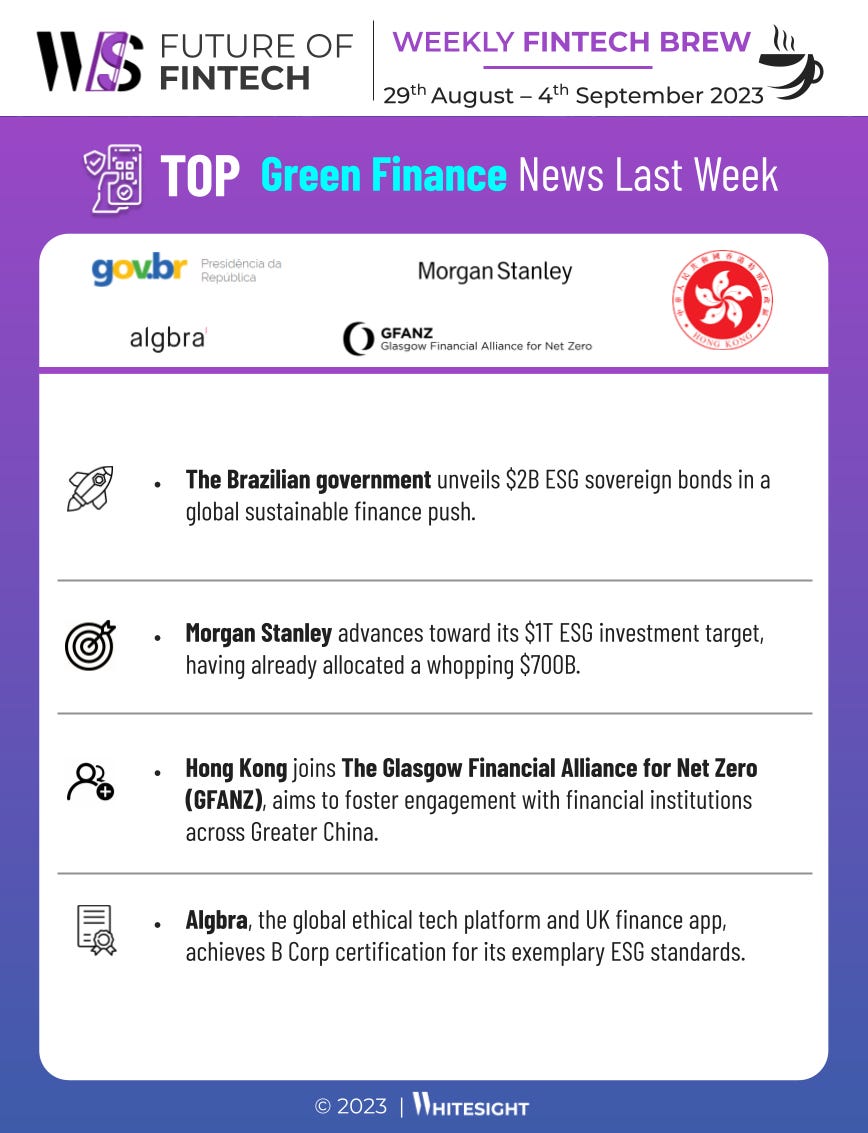

Delve into the realm of Green Finance, where visionary initiatives are fueling meaningful climate action.

Investment data and research provider MSCI and Google Cloud teamed to develop a series of generative AI solutions for the investment industry, including tools that enable investors to assess portfolio climate risk and identify low-carbon investment opportunities.

Algbra, the global ethical tech platform and UK finance app, achieved B Corp certification for its exemplary ESG standards. This accomplishment positions Algbra as one of the select financial institutions in the UK with this status, and it stands out as an FCA-authorized payments firm and a global leader in ethical, sustainable, and Sharia-compliant fintech to achieve this recognition.

Get ready for a wild ride in the DeFi universe! Last week, Asia hopped on the DeFi train, while the UK securely fastened its seat belts on more decentralized initiatives.

ZA Bank became HashKey Exchange’s settlement bank to offer fiat-currency deposit and withdrawal services. As part of its “Banking for Web3” ambition, ZA Bank will provide the necessary infrastructure to facilitate HashKey Exchange to process and settle fiat-currency transactions in a timely manner.

The Financial Action Task Force (FATF) crypto travel rule came into effect in the UK. The rule represents a global attempt to apply anti-money laundering and counter-terrorist financing regulations to on-chain activities.

Some other happenings in the fintech universe 🪐

Craving for some more quick fintech nibbles to savour alongside your tea? Get ready to dig into a delectable spread of tantalizing headlines!

Revenue-based financing fintech Lighter Capital secured a $130M credit facility to fuel revenue-based financing for startups.

Canada-based fintech platform LemFi raised $33M in Series A to streamline cross-border transactions

Ingsai Finance secured an $80M strategic investment from Grong Capital to expand its server capabilities for automated trading.

CredRight secured $9.7M in funding to bridge the credit needs of MSMEs.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include –

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️