Future of Fintech | Edition #84 – Aug 2023

Summary of fintech news from 22nd to 28th Aug

Welcome, fintech aficionados, to another exhilarating edition of our Future of Fintech Newsletter! Just like the satisfying aroma of a freshly brewed cuppa, we're here to serve you the most delicious blend of the week's hottest fintech headlines. So grab your digital mug, cozy up, and get ready to sip on innovation, disruption, and all things fintech! ☕

Now, before we take a merry sip from the frothy goodness of fintech headlines, let's tease your taste buds by quickly tapping into the buzz around Apple’s Tap to Pay >>>

Apple Revolutionizes Transactions: Tap to Pay makes UK debut, J.P. Morgan Joins the Fray, and SumUp Gets in on the Action!

After Apple rocked the boat with its Tap to Pay feature on iPhones in the UK this July—letting merchants easily and securely accept Apple Pay, contactless credit and debit cards, as well as other digital wallets through their iPhones and a partner-enabled iOS app—everyone's getting in on the action! J.P. Morgan is taking the plunge in the US with beauty mogul Sephora as the first retailer for a stylish start. Meanwhile, SumUp is turning on the Tap to Pay charm for UK and Netherlands merchants. The fintech arena seems primed for a dazzling transformation, all thanks to the magic of touch-and-go payments! 📲

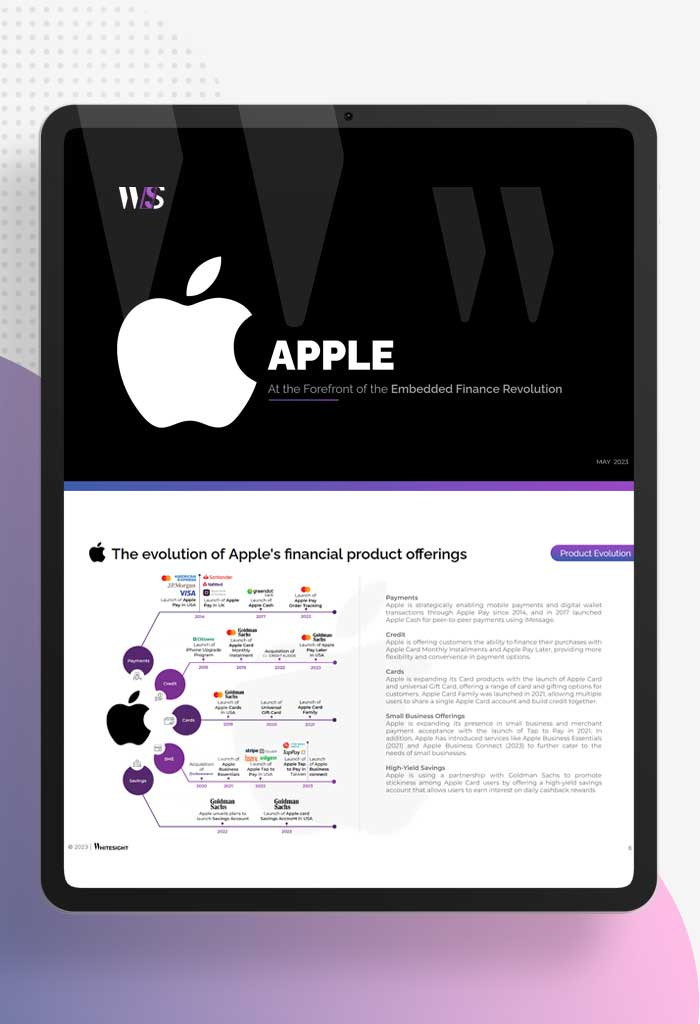

We recently dissected Apple’s strategic maneuvers in acquiring payment licenses and launching high-yield financial services, showcasing their deepening dedication to embedded finance.

Delve into our exclusive report and unveil the hidden gems of Apple’s Embedded Finance Playbook! 🍎

Get ready to sip on the sizzling Future of Fintech blend – Edition #84 is now brewing with all the latest buzz!

Here's the TL;DR

Docking at our first fintech partnership of the week, Brazil-based Dock partnered with Feedzai to bring a native behavioral biometrics module that will provide companies of all sizes with digital footprints of consumers conducting transactions. Meanwhile, Salt Edge and TreasurUp teamed up to enable a first-rate experience in account aggregation and Open Banking compliance for UK- and EU-based financial institutions.

Another partnership in Europe that grabbed headlines – BackBase joined forces with SavvyMoney to enable community banks and credit unions to provide access to real-time credit scores from their banking application. Not only that, but Klarna also reached over 100 million European users on its platform, achieving a 14% year-on-year GMV growth in the second quarter in Europe and a GMV growth of 26% in the UK.

Speaking of millions, Solana Pay, a peer-to-peer payments protocol built on Solana, became available to millions of businesses as an approved app integration with Shopify. The protocol empowers merchants with instant access to funds and enhanced control over finances. It wasn’t just Solana that was all about the integration game – PayPal and Ledger announced an on-ramp integration allowing users to explore crypto in a convenient, simple and secure way via the Ledger Live companion app.

Fiserv and Akoya also collaborated to enable secure data sharing among financial institutions, their customers, and the third parties with which they do business. At the same time, Marqeta lined up Giftbit, Vivian and Whistle as customers of its embedded finance services, seeking to develop innovative payment offerings with the new ties.

Riding on the wave of a digital-first mindset, Mastercard teamed up with UAE-based Qashio to launch corporate credit cards, enabling businesses with virtual issuance capabilities across the region. Colendi also made the news for securing regulatory approval to launch a digital deposit bank in Turkey, where the new bank will lean heavily on its proprietary AI technology for personalised services.

For the longer read, let's get going –

Dive headfirst into the vibrant world of Open Finance, where trailblazers are revolutionizing payments, boosting automation, and giving fraud a run for its money!

Plaid upgraded its income verification suite to improve automation while minimising fraud risk, implementing several updates to its product to provide users with access to accurate real-time data.

Guavapay joined forces with Yapily with the aim to enhance the user experience of its newly launched payment app MyGuava, providing customers with secure access to and direct transfer of funds from their preferred financial institutions.

Step into the vibrant universe of Digital Finance, where digital players are on a quest to make lending more accessible to consumers.

Cross River and Current together launched a new credit-building product, providing access to building credit history for previously underserved communities while empowering individuals to improve their financial well-being through the new secured charge card.

Zopa re-entered the peer-to-peer lending market post selling its P2P subsidiary in 2022, at a time when people in the UK are navigating through the cost-of-living crisis and rising interest rates.

Collaborations were the name of the game in the Embedded Finance arena the past week, with fintech providers teaming up to deliver even more innovation in the space.

Liberty Bank, N.A. partnered with Treasury Prime to create new channels for end users to interact and consume its comprehensive suite of financial services, including Deposit Accounts, ACH, and Wires.

Yeeld joined forces with Airwallex as the company looks to expand further into the fintech and payments space, with the aim to boost international payments.

The theme of identity verification took centre stage in the Fintech Infrastructure arena last week, with innovators deploying advanced digital verification technologies to streamline the process.

Beyond the Pines Productions incorporated iDenfy’s identity verification solution into its rental checkout process, with the objective of enabling a remote onboarding process for its equipment rental customers that ensures a secure and seamless experience.

Truiloo announced new Workflow Studio capabilities to accelerate person matching worldwide, providing an alternative that streamlines the verification of good users through intelligent transaction routing and improves match rates, helping businesses accelerate customer onboarding.

Take a look at the green landscapes of Green Finance, lush with the latest green moves to encourage more effective climate action.

Indian Finance Minister Nirmala Sitharaman launched HSBC India’s strategic partnerships to enable innovation projects that will help prioritize green hydrogen as a strategic alternative fuel, partnering with the Indian Institute of Technology, Bombay and Shakti Sustainable Energy Foundation (SSEF).

NatWest, in partnership with Cogo, implemented a new “feedback and cues” feature in its carbon tracker, bringing carbon insights directly into customers’ transactions.

In a week of DeFi dazzle, ecosystem players were seen ‘DeFi’ying all odds as they came together to enable more web3-based experiences.

Nubank connected its infrastructure to the blockchain network of Banco Central do Brasil to initiate testing with Drex, the Brazilian digital currency.

Komainu, the cryptocurrency custody joint venture of Nomura, Ledger and CoinShares, received an operating license from the Virtual Asset Regulatory Authority (VARA) in Dubai, offering its full range of custody services to clients in the emirate.

Some other happenings in the fintech universe 🪐

Craving for some more quick fintech nibble to savor alongside your tea? Get ready to dig into a delectable spread of tantalizing headlines!

Ramp announced $300M in new funding to accelerate expansion, hiring, and product roadmap.

Brazil fintech Nomad raises $61M in an investment round led by Tiger Global Management.

Koverly raises $7.6M for B2B BNPL.

Momnt raises $15M to expand lending platform.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include –

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️