Future of Fintech | Edition #83 – Aug 2023

Summary of fintech news from 9th to 21st Aug

Hey there, fintech fanatics!👋

Brace yourselves for a feast of fintech flavours as we serve up the latest "Future of Fintech" newsletter! This week's fintech escapade transports us to the tech frontiers of the US and the bustling hideaways of South America.

As the fintechaverse was riding high the previous week, Adyen, the Dutch payments whiz, hit a bump that grabbed the headlines big time >>>

Adyen's Plunge: Shares Drop, Valuations Alter, and Digital Dreams Shake

At the crack of this week, Adyen’s NV plunged into stormy waters. Earnings stumbled, growth stuttered, and elusive hiring costs stole the spotlight's edge. Its tumble wasn't just a blip; it was a big shift that sent shockwaves through the financial realm, making a whopping $14.2B vanish in thin air. Unveiling the backstage chaos, Adyen, the enablers for bigwigs like Netflix, Meta, Microsoft, and Spotify, confessed that the North American groove was losing steam, and hiring costs sneakily eroded margins. Number-wise, the EBITDA margin dropped, slipping from 59% to a steady 43%, with wages taking the blame. The week was no leisurely stroll, it was a roller coaster forcing a rethink of digital dreams!

At Whitesight, we've delved deep into Adyen's strategy.

Dive in if you wish to gain a deeper insight into their business approach.

Stay tuned for the electrifying scoop in the realm of Future of Fintech – Edition #83 has just hit the scene!

Here's the TL;DR

Fintech firms focus largely on Asia - Musoni and Brankas partnered to simplify Corporate Financing in Asia. At the same time, Tonik Digital Bank unveiled shop instalment loans at FC Home Center stores for Filipinos.

Fintech yacht sails all nooks and crannies as Coinbase tapped Trustly for open banking payments in Canada. Not just that, Backbase and Valleysoft teamed to boost digital banking in the Middle East and Africa.

Catering to a diverse spectrum of users - Citizens Bank of Edmond teamed with Nymbus to launch Roger, a digital bank for military personnel. And, Fareportal partnered with Aspiration for emissions calculation and mitigation for travellers.

Dedicated to improving financial processes - ChargeAfter partnered with Wells Fargo to expand Point-of-Sale options. Also, Digital bank Tenpo tapped Dock for card processing technology.

It's launch season for finance giants as Marqeta launched Marqeta Docs AI for Enhanced Task Efficiency. At the same time, Mastercard launched a forum for crypto industry players to discuss CBDCs.

For the longer read, let's get going –

Plunge into the dynamic realm of Open Finance, where pioneers reshape the financial landscape with a splash of innovation.

Pinwheel partnered with Plaid for direct deposit switching services. The partnership will see Pinwheel provide complementary payroll data services for Plaid’s Income offering while providing Plaid users with direct deposit switching (DDS) services.

The UK Government announced its plans to implement open banking within the GOV.UK Pay system. This is part of a larger initiative to enhance current payment functionalities for government services.

Plunge into the electric world of Digital Finance, where fintech wizards conjure digital magic, pouring money on digital streets!

Digital financial services platform Klar secured a $100M credit facility from Victory Park Capital. The move will allow the Mexico City-based FinTech to expand its product offers domestically.

Brazil's Nubank reported Q2 record revenue, adding 4.6M customers bringing the total number of customers to 83.7M worldwide, a 28% YoY growth and total revenue surging 60% to $1.9B YoY.

Enter the Embedded Finance realm, where fintech pioneers explore diverse niches, spanning new geographies and industries!

ATOME Financial renewed and expanded its $100M debt facility with HSBC Singapore to include the Philippine market as well as support new consumer financing products.

Selfbook, the technology company that is modernizing hotel payments and bookings, today announced a partnership with Affirm to bring flexible payment options to hotel bookings. With this, any approved US-based hotel can drive additional direct business by adding Affirm’s monthly and biweekly payment options, with interest as low as 0%.

Welcome to the Fintech Infrastructure universe, where leading innovators collaborate to exchange and elevate the fintech innovation!

RegTech startup iDenfy partnered with Syntropy, a Web3 network software and real-time blockchain data company. iDenfy will be responsible for ensuring Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance by providing swift identity verification checks for Syntropy’s clients and partners.

US-based LoanPro announced its equity investment in TrueNorth, to enable further innovation in lending. The financing supports the development of products and delivering value to their customers in the financial services industry.

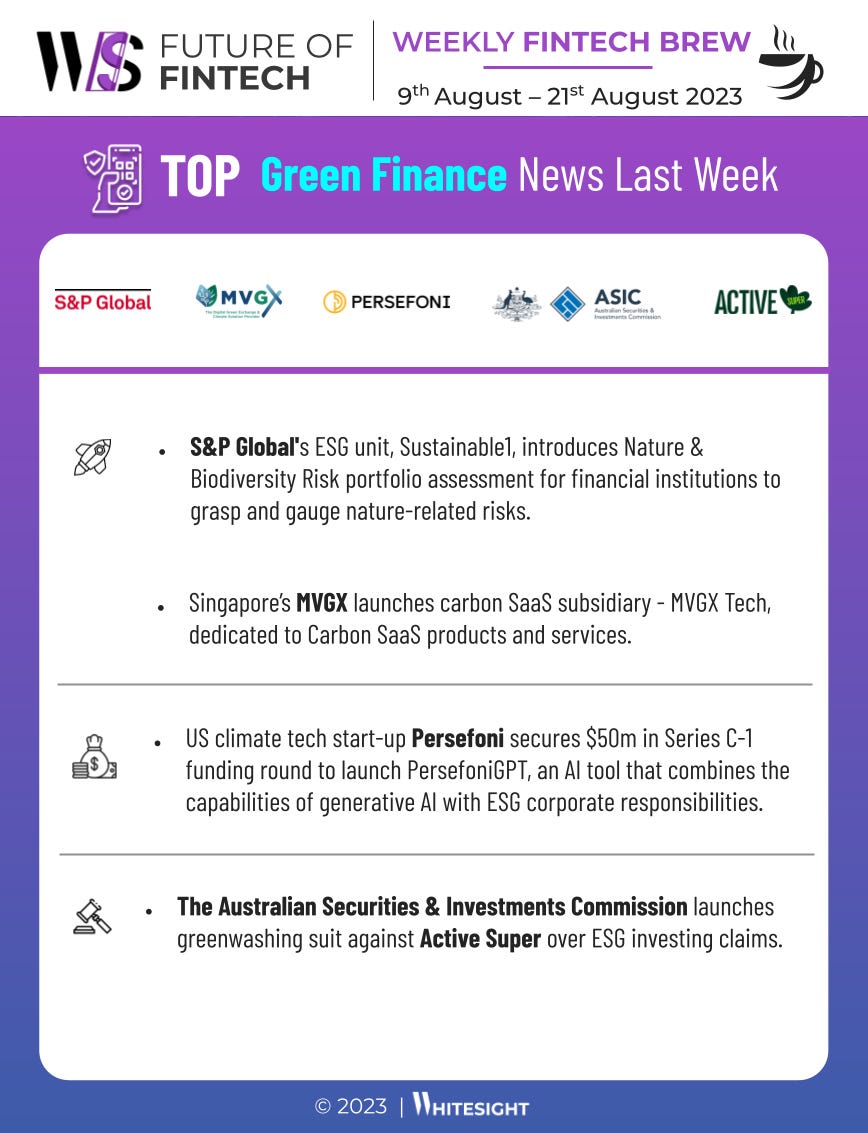

Step right into the realm of Green Finance, where the eco-savvy visionaries are on a mission to spread sustainability magic through innovative green tech!

HSBC Asset Management initiated its energy transition with its first investment in Tokyo's Tekoma Energy solar platform. Following the investment, Takoma Energy will roll out 500MW of solar PV projects by 2027, both in construction and operation.

Earthchain partnered with global payments reporting pioneer Kani enabling Kani Payments’ clients to show their customers the real-time carbon footprint associated with every purchase they make at checkout.

Hold onto your hats for an adventure in the dynamic world of DeFi! This week, the heavy hitters caused a stir by fully embracing the DFfi dynamos with open arms!

Brazil's central bank picked 16 proposals from firms including Nubank, Microsoft, Visa and SETL - for the pilot phase of its Drex CBDC project. The bank said that this use case allows testing to focus on privacy, as it promotes the exchange of information between the various platform participants, and also tests the programmability of the offered services and their interoperability.

Hardware wallet manufacturer Ledger integrated its Ledger Live software with PayPal. The integration allows U.S. residents with verified PayPal accounts to buy Bitcoin, Ether, Bitcoin Cash and Litecoin directly through Ledger Live with no extra verification.

Some other happenings in the fintech universe 🪐

Looking for some bite-sized fintech headlines to snack on with your tea? Get ready to indulge in some yummy fintech goodness!

Irish insurtech Fineos raised $26.13M in a funding round to strengthen its balance sheet and expand operations and its business reach.

Installments-as-a-service platform provider Splitit secured an investment of $50 million from private equity firm Motive Partners. The investment will be in two parts of $25 million each. The first tranche will be invested when shareholders approve the company delisting from the Australian Security Exchange (ASX) and redomiciling from Israel to the Cayman Islands, per the release. The second is upon meeting performance goals.

Nigeria’s mobility fintech company Moove announced a further $76M in funding to fuel further global expansion.

Identity management platform Veza secured $15M from Capital One and ServiceNow for product development, expanding its sales capacity and supporting its go-to-market execution.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include –

The big picture of embedded finance and how it’s taking shape in Canada

Adaptable Platforms, Strong Alliances: BaaS consolidation in action

OakNorth: A blueprint for profitable growth in digital banking

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️