Future of Fintech | Edition #81 – Aug 2023

Summary of fintech news from 1st to 7th Aug

Hello, fintech geeks!👋

Time to get your fintech taste buds tingling with the newest serving of our "Future of Fintech" newsletter! This week, we're your hosts to the fintech tales, straight from the exotic lands of MENA and the techy peaks of Europe.

Surfing through last week's thrilling fintech waves, a giant tech player sparked a wave of cash in the financial haven>>>

Apple's Whopping $10 Billion Splash: From Tech Titan to Finance Trailblazer! 📱

Apple's not just ruling tech, but also acing the finance game! Its big bet on financial services is minting gold, with an eye-popping $10B in deposits rolling in like a boss within months of launch. This ain't your regular piggy bank - it's a high-yield savings account tied to the Apple Card, treating users to daily cashback and an impressive 4.15% APY. Apple's knack for pampering users and ensuring their involvement knows no bounds – and pulling off a billion-dollar miracle like this? Quite a cash-filled trip through the fintech world, isn't it?

Keep reading to find out more about the exciting developments in Future of Fintech - Edition #81!

Here's the TL;DR

The fintech ship navigates the globe as Arab Financial Services partnered with CRIF for Open Banking use cases in the MENA region. And, Nuvei teamed with 888 to help improve the payment experience in the US.

Creating a strong presence in APAC - The Australian Competition and Consumer Commission launched a CDR developer portal for technical guidance. Also, Capital A and UnionDigital Bank joined hands to enable digital banking in the Philippines.

Taking steps to strengthen the payments process - Bluevine launched accounts payable offering to simplify business payments management. At the same time, Rapyd acquired PayU for $610M to expand its global payment network.

The US digital assets scene gained traction as PayPal launched U.S. dollar-denominated stablecoin, PayPal USD. On the flip side, Revolut suspended US crypto services, citing the evolving regulatory environment.

Fintech players bonded to innovate - Crédit Agricole Italia teamed with Blockinvest for the tokenisation of bonds. And, HSBC partnered with Tradeshift to launch an embedded finance business.

For the longer read, let's get going –

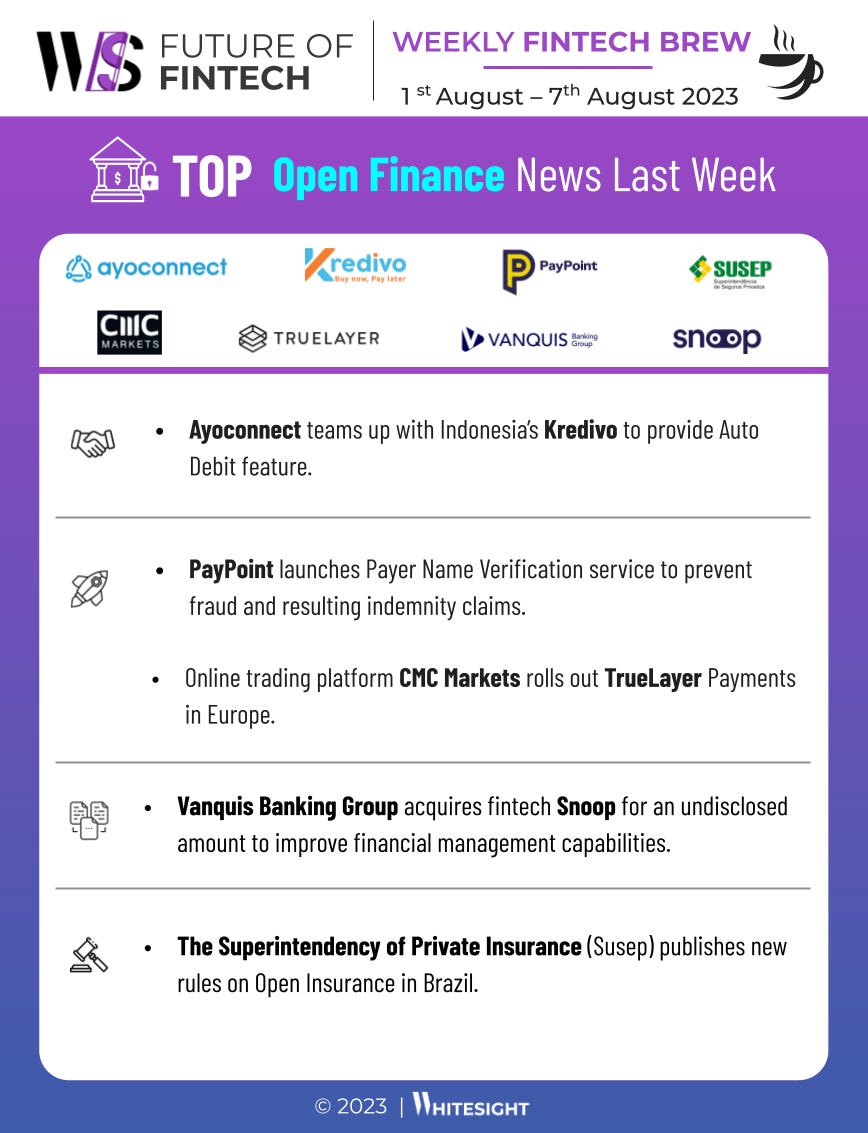

Welcome to the enchanting realm of Open Finance, where fintech superheroes join forces to create a dazzling symphony of financial wonders!

Ayoconnect teamed up with Indonesia’s Kredivo to provide an Auto Debit feature. Integrating Kredivo’s services with Ayoconnect Direct Debit API aims to create a more seamless and secure loan payment experience for users.

Online trading platform CMC Markets rolled out TrueLayer Payments in Europe. CMC Markets users in the UK and Europe can now benefit from smooth, secure and fast payments using TrueLayer’s open banking technology compared to traditional methods such as debit, credit cards or manual bank transfers.

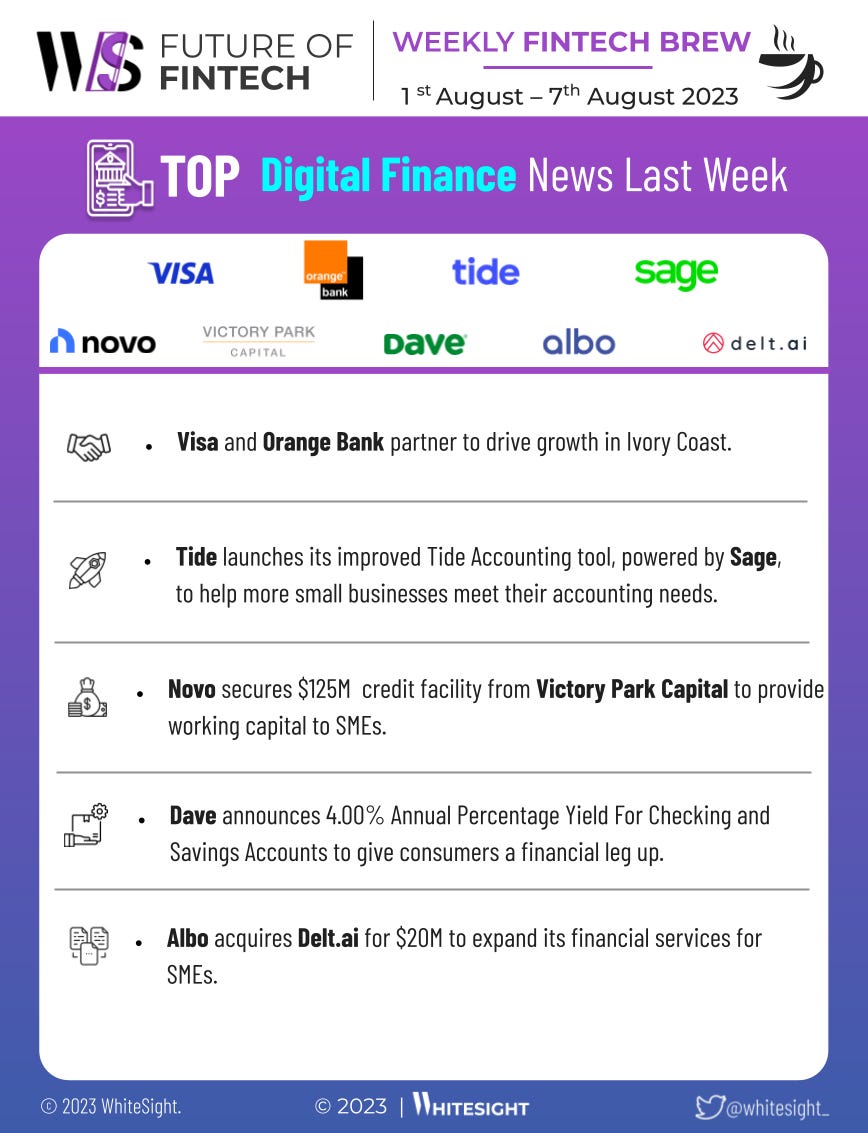

Enter the dynamic universe of Digital Finance, where fintech wizards wield their digital magic, turning every corner of the globe into a playground of financial opportunity!

Novo secured a $125M credit facility from Victory Park Capital to provide working capital to SMEs through the launch of its new offering Novo Funding. With the introduction of Novo Funding, the company offers a streamlined and instant way for small businesses to access up to $75,000 in working capital.

Visa and Orange Bank partnered to drive growth in Ivory Coast. The Partnership for Growth in Côte d'Ivoire will focus on developing innovative digital payment solutions, including cash management tools, flexible financing options and online payment solutions. secure line.

In the realm of Embedded Finance, finance giants united in bold alliances to unleash the soaring potential of the BNPL!

The end-to-end platform for online learning products Thinkific launched BNPL functionality. Powered by Stripe, this functionality enables Thinkific Creators to offer credit at checkout options, thereby increasing the accessibility of their products to wider audiences and driving increased sales.

Mastercard partnered with Lipa Later to accelerate BNPL payment services in Africa. The partnership is expected to unlock new opportunities for consumers and merchants by providing tailored BNPL solutions and enhanced payment capabilities.

Explore the Fintech Infrastructure wonderland, where fintech pioneers unite to supercharge the financial realm, in tandem with regulation and safety!

Treasury Prime teamed with Academy Bank to expand BaaS offerings. The objective of this partnership is to provide businesses with seamless access to Academy Bank’s deposit services, enabling them to offer FDIC-insured accounts to their customers while staying fully compliant with regulatory requirements.

DocuSign teamed up with Onfido for selfie-based ID verification on its signing platform. Using Liveness Detection for ID Verification, businesses will securely and remotely prevent the use of fake documents and the use of deep fakes or pre-recordings, as well as prevent identity spoofing.

Welcome to the enchanting realm of Green Finance, where bigwigs rally together to promote sustainability.

Standard Chartered and Ant Group partner to drive green and inclusive finance, global fund management and sustainable development. Under the expanded cooperation framework, Standard Chartered will support Ant Group to build its global liquidity and foreign exchange management structure, and further strengthen their collaboration in ESG, digital innovation and inclusive finance.

Thames Technology plans to eliminate virgin PVC from all its card production. The company has already been manufacturing 100% of its non-financial cards, such as gift, loyalty, and membership cards, virgin plastic-free using either paperboard or recycled PVC (rPVC), depending on the intended use and lifecycle of the cards.

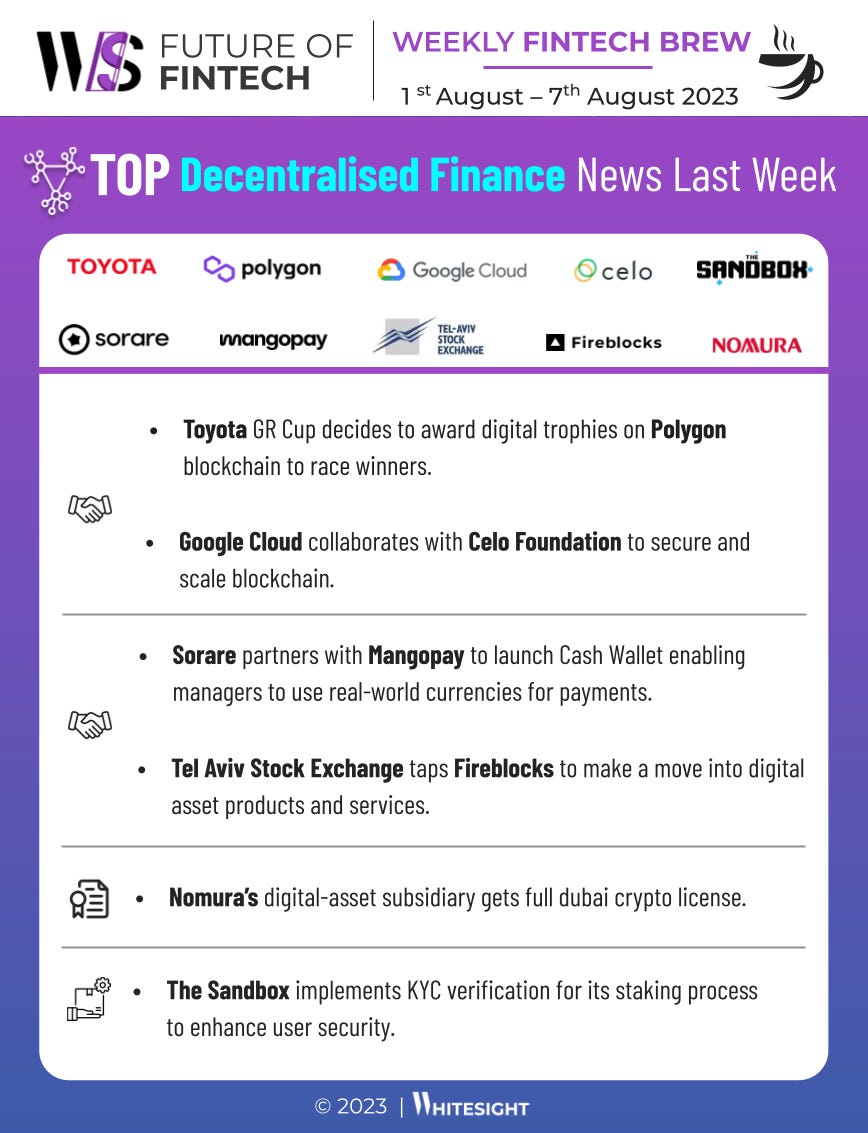

Brace yourself for an exhilarating journey into the DeFi, where savvy players gear up with licenses and embark on a mission to explore the Web3 revolution!

Nomura’s digital-asset subsidiary gets a full Dubai crypto license. The approval will allow Nomura to innovate in the asset class and come up with products that suit the institutions in the virtual asset space.

Gazoo Racing’s Toyota motorsport division expanded its presence in the digital space by creating digital trophies on the Polygon Blockchain for the GR Cup Series in North America. The personalized digital trophies deployed on the polygon blockchain would give insights into driver statistics, podium finishes, finishing positions, and lap times.

Some other happenings in the fintech universe 🪐

Looking for some bite-sized fintech headlines to snack on with your tea? Get ready to indulge in some yummy fintech goodness!

Credit card and fintech company Petal closed a $200M debt facility from Victory Park Capital. It also secured a new term loan facility with Trinity Capital for up to $20M, along with $20M in new equity funding, providing fuel to grow.

US insurtech Lula raised $35.5M in a Series B funding round to transform Insurance Industry and expand into new markets.

London-based Pockit scooped $10M in a growth round; aims to continue expanding its customer base and diversifying its product suite.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include –

Adaptable Platforms, Strong Alliances: BaaS consolidation in action

OakNorth: A blueprint for profitable growth in digital banking

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️