Future of FinTech | Edition #8 – February 2022

Welcome to the weekly serving of a new edition of the Future of FinTech Newsletter! If you're new and curious, read on to find out what happened in the world of FinTech across six dynamic themes, and join 531 other FinTech nerds in receiving some fresh Weekly FinTech Brew delivered right to your inbox every Tuesday ☕️

Edition #8 was abuzz 🐝 with a plethora of partnership activities across all verticals for the week.

Here's the TL;DR

Embedded Finance once again comes out ahead as the most active theme last week.

Some interesting partnerships that stole the headlines with their collaborative efforts:

Douugh + TrueLayer for Open Banking data in Australia,

Visa + VNPAY to drive digital payments in Vietnam

Standard Chartered + IATA to launch payment platform

Opera + DeversiFi to open DeFi access, and

Kollectiff + Moss to offset carbon emissions on NFT campaigns.

Several product and platform launches were at the forefront last week, with TransUnion’s BNPL credit tool solution, Colombian neobank Plurall’s debut in the LatAm market, and the launch of Revolut’s Stock Trading feature in Australia.

Notable funding rounds – Scalapay ($497M Series B), Niyo ($100M), Pollination ($50M), Weavr ($40M Series A), MarketForce ($40M Series A)

For the longer read, let's get going –

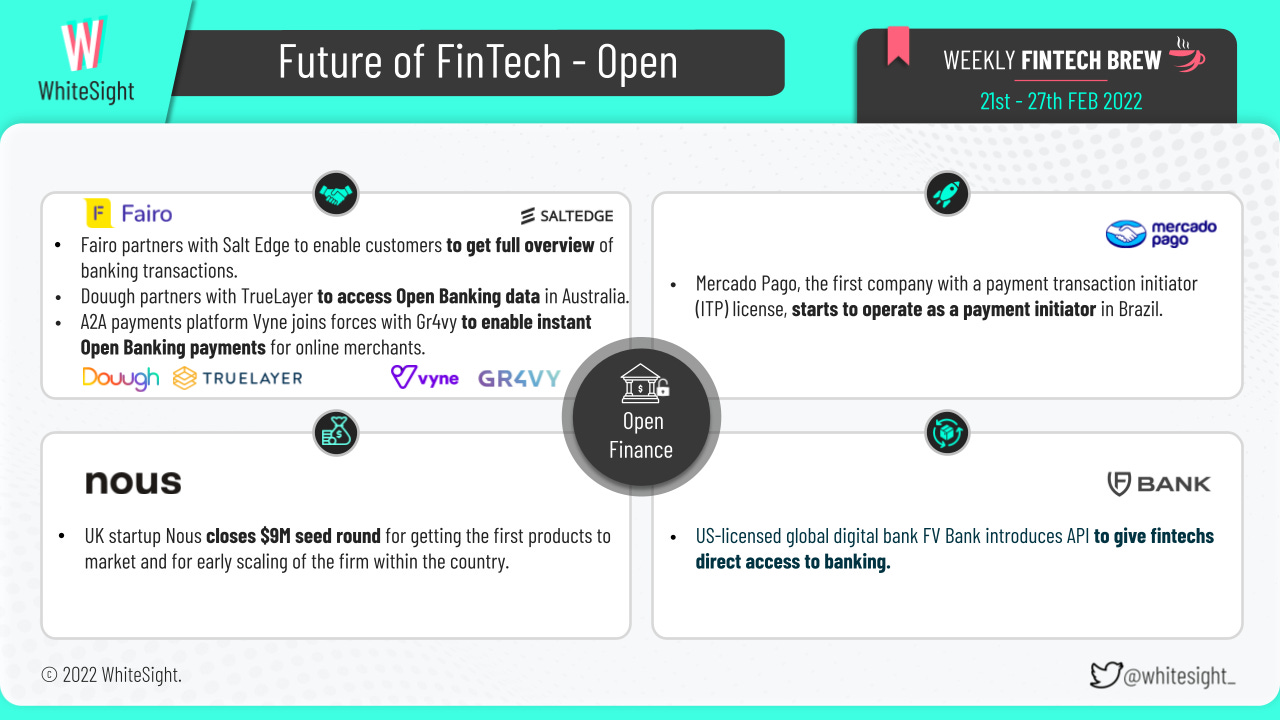

The Open Finance vertical witnessed an assorted mix of partnerships, launches and funding rounds. While neobank Douugh announced a partnership with global FinTech TrueLayer to access Open Banking in Australia, account-to-account payments platform Vyne partnered with payment orchestration platform (POP) Gr4vy to enable instant Open Banking payments for online merchants. Fairo and Salt Edge also joined forces to offer Romanian freelancers Open Banking connectivity by tracking their business banking transactions in the app as well as automating the management of administrative tasks.

Additionally, US-licensed digital bank FV Bank introduced its first API to advance bank automation and integration for its clients’ operations. Brazil observed the launch of ITP licensed Mercado Pago as a payment initiator for the region. UK startup Nous also made the headlines for raising $9M in seed round to scale up the product team and build out its savings-as-a-(subscription)-service.

The Digital Finance segment was bustling with a bountiful of events that drew our attention last week.

Emerging FinTech GreenBox POS entered a licensing partnership with Cross River to bring to fruition the launch of their first banking-as-a-service initiative, and usher GreenBox into the arena with the major financial technology-driven brands. Visa inked a strategic partnership with Vietnam’s FinTech VNPAY to enhance digital payments in Vietnam by expanding and strengthening the FinTech company's affiliate network of accepting merchants, as well as by rolling out new services. Mambu and Change Financial also joined forces to leverage an ecosystem approach, working together to deliver fast-to-market SaaS solutions to Australian and New Zealand financial institutions. Furthermore, SoFi entered a definitive merger agreement to acquire digital multi-product core banking platform Technisys for the former to pursue its ambition of providing best-of-breed products as a one-stop-shop financial services platform.

On the funding front, emerging markets neobank Canza Finance announced the completion of its $3.27M seed round. The fundraising round was led by Fenbushi Capital and will enable Canza to continue headcount growth and expand its service offering in Nigeria and other growth regions including South America and Asia. On the other hand, Indian neobanking platform Niyo raised $100M as a part of its new funding round led by Accel and Lightrock India to launch new products in the lending as well as insurance space. Even German virtual bank Penta had begun its third funding round with the goal of making it halfway to the $1 billion mark.

Speaking of virtual banks, Hong Kong’s virtual banks were in the limelight for gaining an advantage by acquiring customers with cash prizes and numberless credit cards; with ZA Bank and Mox Bank reportedly making up over two-thirds of the total deposits of the city’s eight digital banks. Capital Bank of Jordan and Codebase Technologies’ launch of digital-only neobank Blink for Jordanian customers also made it to the news for the week. Additionally, a new digital bank, Plurall, launched in Colombia to focus on the financial inclusion of LatAm’s SMEs and entrepreneurs.

Several funding rounds made up for the majority of the happenings for the Embedded Finance space.

Italy’s Scalapay became the latest BNPL unicorn on the back of a $497M Series B investment from Tencent and Willoughby Capital, with the aim to double the number of employees by the end of the year. London-based startup Weavr bagged a $40M Series A in a bid to expand its embedded finance offering to the States and across Europe. On similar lines was Kenya-based MarketForce’s $40M Series A raise, which will be used for its merchant inventory financing and expansion across Africa. Even Mashreq made the headlines for its investment in BaaS provider NymCard to help grow the booming FinTech ecosystem in the Middle East.

In terms of partnerships, Standard Chartered partnered with the International Air Transport Association (IATA) to launch a payment platform for the airline industry in India, offering a new payment option that enables participating airlines to offer instant payment options. A safe flight is an insured one, and EaseMyTrip’s recent partnership with Toffee Insurance to provide travel insurance solutions to customers ensures just that. BNPL providers Afterpay and Sezzle also took to signing healthcare-related deals – with Afterpay partnering with online eyewear retailer EyeBuyDirect, and Sezzle letting WellNow Urgent Care customers pay their medical bills in four interest-free installments.

As for other activities, Railsbank’s subsidiary Railspay secured an independent Australian financial services license (AFSL) to enable more innovative consumer brands to harness the power of embedded finance experiences. TransUnion launched a new suite of solutions designed to help BNPL users get and establish credit. African payment company Paga also became a new payment provider for Twitter’s ‘Tips’ feature in Nigeria.

The DeFi and Crypto industry was astir with eventful affairs for the week – with Opera integrating ETH Layer 2 exchange DeversiFi to provide cheaper and instant transactions; BNY Mellon partnering Chainalysis to develop cryptocurrency services for its clients; and AllianceBlock and peaq joining forces as part of their plan to accelerate into web 3. Wirex’s newsworthy addition of the Polygon blockchain to their recently launched non-custodial wallet and app was also a key highlight of the segment. Global internet finance firm Circle Internet Financial, LLC announced the launch of the new Circle Account that allows business customers to easily begin transacting with USDC and settle in and out of digital currencies.

On another front, Chinese blockchain technology and services provider OK Group is set to invest $21M in Brazilian cryptocurrency exchange Foxbit as a necessary step to continue improving the services provided to its clients. Furthermore, Multicoin Capital and Pantera Capital co-led a $3M round in Solana-based Marginfi protocol to drive community and ecosystem development and launch the protocol into a development network (DevNet). DeFi project Ref Finance’s $4.8M round led by Jump Crypto, and Australian DeFi startup Tiiik’s $5.2M in a seed round also made it to the headlines for the sphere last week.

The super app trend continues to expand over sectors and geographies far and wide, with a diverse range of players bringing the emerging sphere of web3 into the mix. African web3 super app Jambo is one such platform, whose recent $7.5M seed funding hit the headlines for introducing young Africans to web3 financial ecosystems through play-to-earn gaming and DeFi services. Pakistan-based FinTech NayaPay secured $13M in South Asia’s largest seed funding to roll out its multi-service messaging and payment app, and to build payment acceptance and financial management tools for businesses in the South Asian country.

Revolut grabbed the headlines for launching its popular Stock Trading feature to its Australian offering, enabling customers to buy and sell fractional shares listed on the New York Stock Exchange (NYSE) and NASDAQ. A few oceans away, NayaOne onboarded US-based People Data Labs (PDL) onto its FinTech marketplace to empower developers to build better and more powerful data-driven products and processes. On top of that, the Minister of Communications and Information Technology witnessed the launch of Egypt Post’s ‘Yalla’ application – which is the first super app in Egypt, the Middle East, and Africa that provides various financial and non-financial solutions in cooperation with Visa International and PaySky.

Many firms are joining the race of becoming climate-positive as the world shifts to an ambition to correct the economy’s environmental costs. Digital wallet Eco partnered with climate action organization KlimeDAO to leverage the power of blockchain technology in sharing its community-building technologies and programs. Similarly, Kollectiff’s debut ‘The Wombats’ NFT project is carbon negative thanks to an ongoing partnership with Moss. What’s more, each NFT holder will receive an AirDrop of an MCO2 token, which can offset 1 ton of CO2 from the atmosphere by burning it on the Moss platform. Furthermore, Westpac and the Clean Energy Finance Corporation (CEFC) became the latest to sign on as partners to the Australian Industry Energy Transitions Initiative, which brings together key industry and finance organizations to accelerate action towards achieving net-zero emissions in industrial supply chains by 2050. ANZ also made it on the bulletin for its $50M investment in climate finance firm Pollination to support customers in the transition to net-zero.

Alternatively, BBVA channeled 71.6% of its $96.47B sustainable financing through loans to wholesale, corporate, and individual clients. Chinese tech giant Tencent also hopped on the sustainability bandwagon by planning to achieve carbon neutrality in its operations and supply chain by the end of the decade. On a similar note was Apollo’s launch of a comprehensive sustainable investing platform, in which the firm sees the opportunity to deploy more than $100 billion by 2030 for energy transition and decarbonization of the industry.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly FinTech Brew, and we'll be back with more next week!

Till then, if you're hungry for more FinTech insights, check out some of our other work at WhiteSight. Our latest publications include an overview on Honoring the Black Voices the FinTech way and Facing the Reality of Facebook's Meta Move.

If you're someone who likes to read think pieces, you will likely love our monthly blog Fintersections where our team members analyze the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for our strategic intelligence and research content services, reach out to us at hello@whitesight.net

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter and don't be shy to show some 💛