Future of Fintech | Edition #79 – July 2023

Summary of fintech news from 18th to 24th July

Hola, fintech fanatics!👋

The freshest edition of our Future of Fintech newsletter has just been brewed and is chock full of all the latest fintech goodies you crave. This week, we're dishing out the hottest trends straight from the tech frontiers of Europe and the vibrant shores of LATAM!

Before we dive into the thrilling fintech trends from last week, we've got some major stories unfolding in the US fintech and crypto market. Here are the two big ones from the good ol' US of A:

Big Moves in the US: Instant Payments and Crypto Oversight

FedNow: Shaking Up US Payments

Heads up, folks! The US Federal Reserve has finally rolled out FedNow, and it’s about to turn the US payment system on its head. This nifty service lets you send and receive cash instantly, any time, any day. No more waiting around for transfers to go through! It’s been a long time coming since 2019, but now the US is catching up with countries like the UK, India, and Brazil that have had similar services for years. Launching with 41 banks and 15 service providers, including big shots like JPMorgan Chase and Bank of New York Mellon, FedNow is set to make life a whole lot easier for consumers and small businesses.

U.S. House Republicans Drop a Crypto Bill

In a move to keep crypto investors safe, U.S. House Republicans have dropped a fresh digital assets oversight bill. The snappily named Financial Innovation and Technology for the 21st Century Act is all about setting up rules that protect folks while keeping the US at the forefront of the digital asset game. The bill could even let crypto exchanges register with the big dogs at the U.S. Securities and Exchange Commission (SEC), meaning they could trade digital securities, commodities, and stablecoins all under one roof. But, some crypto gurus are warning that the bill might stir up confusion and lead to some heavy-handed regulation of certain assets in the decentralized finance (DeFi) world.

Indulge your fintech taste buds with a perfectly brewed blend of innovation and fintech delights in Edition #79!

Here's the TL;DR

Increasing fintech's role in e-commerce - Nuvei and Plaid expanded their partnership to new regions and eCommerce verticals. And, Atome partnered with TikTok Shop to drive e-commerce growth in Malaysia.

Aiming to expand the fintechaverse far and wide, 10 Egyptian fintechs partnered with Fintech Galaxy for MENA market expansion. At the same time, Airwallex partnered with Brex to support its global expansion.

Focusing on Europe - Bunq hit 9M users in Europe, doubling deposits to $5.01B in 4 months. Also, Tymit teamed with Visa for the adoption of instalment credit in Europe.

Banking innovations were infused by Fintech players as Canadian Tire Bank moved to Temenos Banking Cloud for faster banking services and customer personalisation. Not just that, ecolytiq and Mambu partnered to offer banks embedded climate engagement for customers.

Licenses and compliances were also hot topics last week - Societe Generale's crypto unit, Forge, obtained France's crypto licence. And, Starling Bank selected Napier’s Intelligence Compliance Platform to combat financial crime.

For the longer read, let's get going –

Step into the realm of Open Finance, where fintech wizards expand financial opportunities while providing seamless payment experiences.

Real-time payments software provider ACI Worldwide partnered with Brazil-based fintech infrastructure provider Dock to launch new services in Brazil. The partnership between the two companies will result in an Acquiring as a Service solution for the Brazilian market.

Payments automation platform Primer partnered with real-time payments gateway Volt. The collaboration will leverage Open Banking technology to make payments increasingly simple for merchants and customers, enabling Primer’s customers' access to instant bank payments.

Last week in the thrilling domain of Digital Finance, the currents of cash surged and dazzling new services emerged.

Southeast Asian tech major Grab made a $104M capital infusion into its digital banking subsidiary GXS Bank, according to regulatory filings.

K bank launched web firm banking services involving a range of financial products and services to meet the unique needs of each company. K bank plans to increase the number of corporate partners relying on the bank's firm banking services and become a leader in the market.

The Embedded Finance realm last week witnessed collaborations meant to revitalize payments and spending.

B2B payments company Mondu partnered with payments specialists Acquired.com.This strategic collaboration will bring together Mondu’s flexible payment solutions, which include net terms and instalments for online, in-person and telesales, with Acquired’s platform that meets all payment needs.

Klarna announced a partnership with the Money Adviser Network to help its consumers access free and impartial debt advice quickly, as part of wider efforts to promote healthy spending.

Welcome to the cutting-edge realm of Fintech Infrastructure, where fintech trailblazers forge alliances to redefine the fintechverse.

Grow Finance partnered with Pismo to issue new Mastercard credit cards for SMBs in Australia. The Grow Mastercard credit card, available in the market from September, will give business owners better cash flow, management and capital to help them improve their businesses.

Fiserv showed its support for transaction activity with financial institutions on the Federal Reserve’s newly launched FedNow Service. Using Fiserv, financial institutions will be able to connect to FedNow and other real-time payment networks from a single, straightforward interface, making it easier to meet the needs of their consumers and small business customers, with use cases ranging from instant refunds to bill payments in real-time.

Step into the electrifying world of Green Finance, where mighty titans invest in green projects that ignite our planet's greener future.

Global bank ING and the European Investment Bank (EIB) launched a sustainable finance program aimed at providing $665M in new loans to small and medium-sized enterprises in Belgium, the Netherlands and Luxembourg to enable investments with a positive climate and environmental impact.

AXA Group’s alternative investments business AXA IM Alts invested $49M in carbon removal start-up Mombak’s Brazilian Amazon rainforest restoration projects. The investment is part of AXA IM Alt’s natural capital and impact investing strategy.

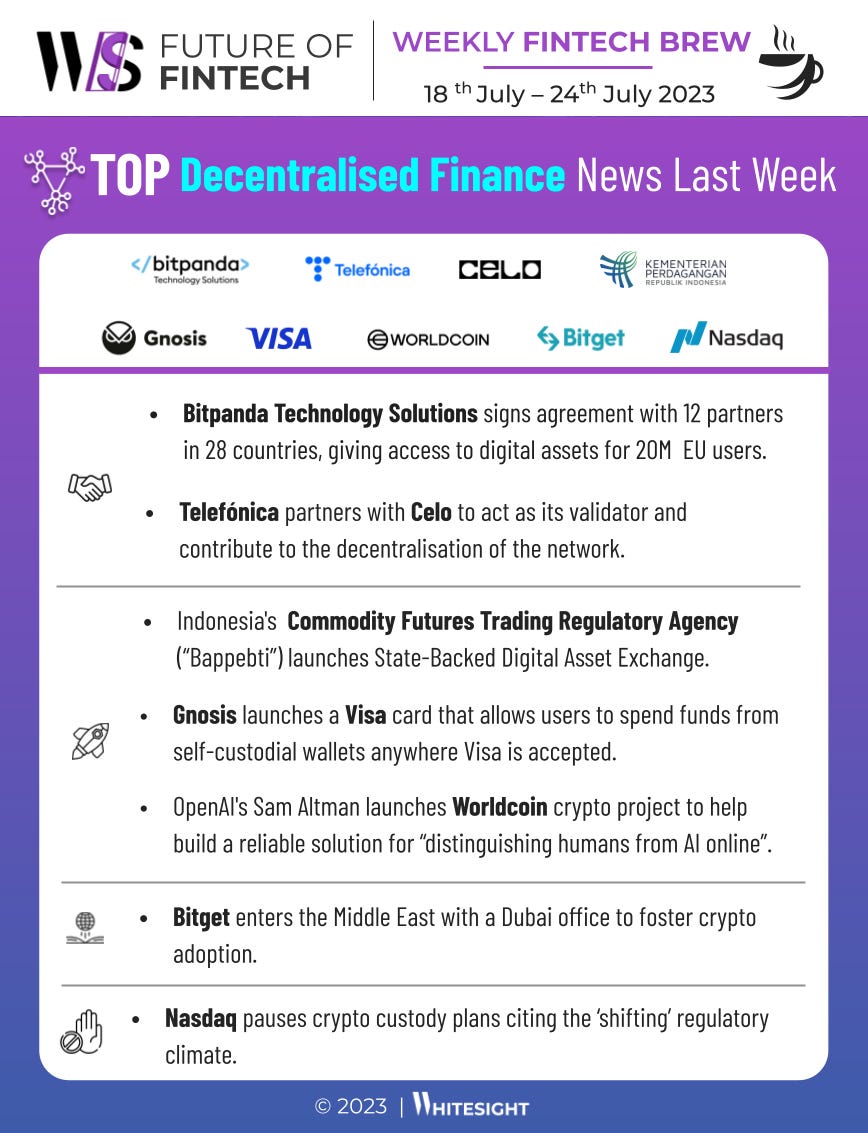

Enter the captivating realm of DeFi, where players join forces to amplify the ecosystem and unveil groundbreaking user-centric innovations.

Gnosis launched a Visa card that allows users to spend their funds from self-custodial wallets anywhere the payment method is accepted. The card will be initially available in the UK and the EU, with plans to expand to Brazil, Mexico, Singapore, and Hong Kong in the future.

Ripple struck a partnership deal with Super How to build ‘Axiology’, a crypto project together. The partnership aims to become a catalyst for testing and issuing digital assets, which include stablecoins and CBDCs and bolster the confidence of regulators when it comes to the security and safety of these assets.

Some other happenings in the fintech universe 🪐

Looking for some bite-sized fintech headlines to snack on with your tea? Get ready to indulge in some yummy fintech goodness!

Karat Financial raised a $70M Series B to upgrade its creator credit card business.

Thunes extended its Series C fundraising to include new investors, including Visa, bringing the total funding to $72M.

Small business lending fintech Lumi raised $15M, allowing it to continue to broaden and institutionalise its register.

German embedded insurtech platform Hepster raised $11M Series B as it looks to expand to new markets and work towards profitability.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include –

Adaptable Platforms, Strong Alliances: BaaS Consolidation in action

OakNorth: A blueprint for profitable growth in digital banking

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️