Future of Fintech | Edition #78 – July 2023

Summary of fintech news from 11th to 17th July

Hey there, fintech fanatics!👋

Brace yourselves for the latest edition of our Future of Fintech newsletter, freshly brewed and served just for you. This week, we're bringing you the hottest trends straight from the tech frontiers of Europe and the USA.

Before we dive into last week's fintech trends, here's an interesting topic from fintechaverse to explore this week -

SMEs and Fintechs: A Revolution in making

In the constantly changing finance world, fintech has become a real game-changer, especially for small and medium enterprises (SMEs). Fintech companies are doing more than just helping SMEs handle their finances better and get access to a wider range of financial products. They're also finding their own special place in the industry, where they can be profitable and unique. In, The Unbundling of Finance for SMEs: A Fintech Revolution, we take a closer look at how fintech is changing the way SMEs do finance.

Join us as we explore this exciting revolution! 🚀

And with this, we welcome you to Edition #78 of the newsletter, featuring fintech and innovation in one dose.

Here's the TL;DR

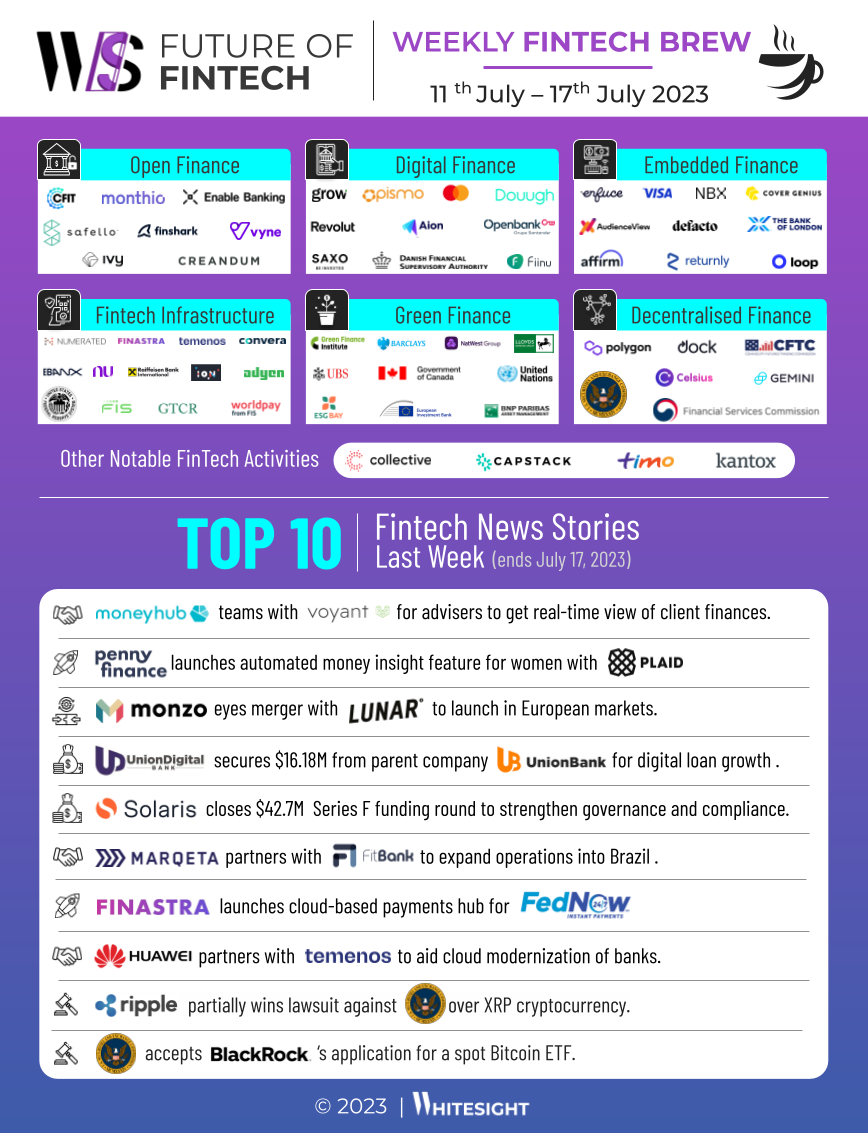

Dedicated to strengthening the fintech ecosystem - Moneyhub partnered with Voyant for advisers to get a real-time view of client finances. And, Solaris closed a $42.7M Series F funding round to strengthen governance and compliance.

The consolidation buzz in fintech reaches far and wide as Monzo seeks a merger with Lunar to launch in European markets. Not just that, Marqeta partnered with Fitbank to expand operations Into Brazil.

Taking automation to the next level - Penny Finance launched an automated money insight feature for women with Plaid. Also, UnionDigital Bank secured $16.18M for digital loan growth.

Fintechverse reaches the clouds - Finastra launches a cloud-based payments hub for FedNow. Meanwhile, Huawei partnered with Temenos to aid the cloud modernization of banks.

SEC made waves in the DeFi world when Ripple partially won a lawsuit against it over XRP cryptocurrency. At the same time, SEC accepted BlackRock’s Bitcoin ETF application.

For the longer read, let's get going –

Immerse yourself in the world of Open Finance, where fintech maestros unite their powers to make open finance into a force sweeping across the globe.

Denmark-based credit decisioning solution Monthio partnered with Open Banking connectivity provider Enable Banking to facilitate loan approval procedures in Spain. By joining forces with Enable Banking, Monthio aims to assist Spanish banks and loan providers in delivering augmented customer experiences through quicker and more informed credit decisions.

Safello, a cryptocurrency exchange in the Nordics, entered into an agreement with Finshark, a Swedish open banking company, to provide Safello with payment initiation services for instant payments and payouts.

The Digital Finance realm last week was an exhilarating playground, where fresh ideas merged and fintech players harmonized to unleash an explosion of innovation on every front.

Revolut launched ‘Experiences’ – an in-app marketplace for tours, activities, and attractions, giving users the opportunity to book their travel experiences directly in the Revolut app and receive cashback with no booking fees charged.

Nubank signed an agreement with Fireblocks to expand its crypto services, Nubank Cripto. Nubank will be using Fireblocks’ settlement of purchases and sales for Nubank Cripto.

Last week saw incredible feats of Embedded Finance, where visionaries chase their dreams, collaborate relentlessly, and secure funds to deliver unparalleled experiences to users.

Enfuce was chosen by Norwegian crypto exchange NBX to issue a Visa-branded credit card offering Bitcoin cashback on purchases. The NBX Visa credit card is designed to give users from 0.5% to 4% Bitcoin cashback on purchases when using the card and opens the door for NBX to attract customers looking to become crypto enthusiasts.

French B2B lender Defacto secured up to $187.4M in debt funding provided via Citi and Viola Credit. Defacto aims to use the capital to fuel additional growth as the company sets up a lending capacity of up to €1 billion.

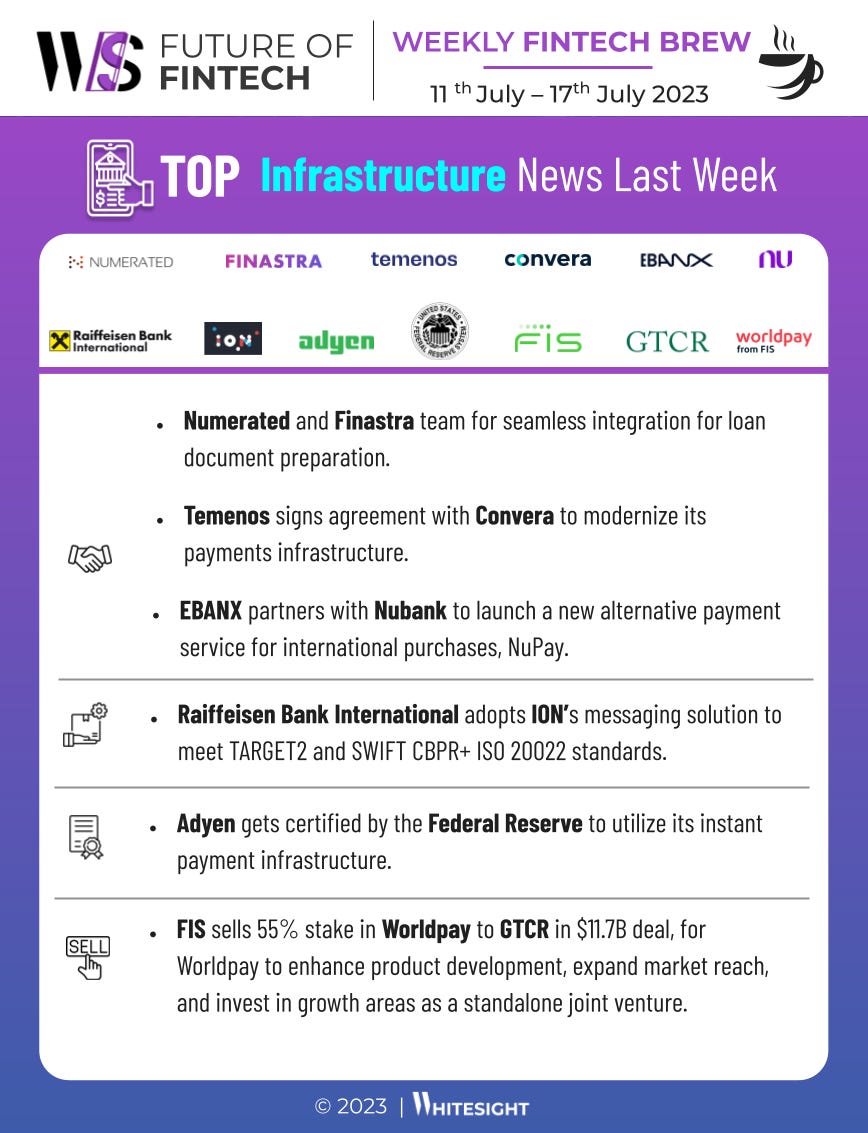

Step into the realm of Fintech Infrastructure, where fintech trailblazers level up their skills and unite to revolutionize every aspect of payments.

Adyen received certification to utilize the FedNow(R) Service, the Federal Reserve's instant payment infrastructure. Adyen aims to meet U.S. merchant needs through expanded real-time payments and utilizing the financial technology platform's payout capabilities.

Brazil-based fintech EBANX partnered with Nubank to launch a new alternative payment service for international purchases, NuPay. Following this partnership, the two Brazilian firms aim to give merchants and traders around the world the possibility to offer their clients the new payment method NuPay.

Unleash the power of Green Finance and join finance titans as they don their sustainability armour and charge towards a greener tomorrow.

In the 2023 AGM season, BNP Paribas Asset Management took a firm stance on corporate climate strategies, rejecting over 50% of resolutions and specifically targeting Scope 3 emissions. BNPP AM additionally demonstrated a significant level of support for shareholder resolutions on environmental (88%) and social (96%) issues, designed to improve company performance.

The European Investment Bank (EIB) announced several loans to finance climate action projects in Argentina, Brazil and Chile. All of the projects are part of the European Union’s Global Gateway initiative that supports projects improving global and regional connectivity in the digital, climate, transport, health, energy and education sectors.

Step into the thrilling world of DeFi, where some players upskilled themselves while others engaged in legal battles.

Polygon introduced POL - the next-generation native token as part of its latest network upgrade. With this, Polygon aims to transform its network into the Value Layer of the Internet.

The Commodity Futures Trading Commission (CFTC) joined the SEC in filing a civil complaint against Celsius Network and its founder and former CEO Alex Mashinsky. The CFTC’s complaint charges the defendants with fraud and material misrepresentations regarding the operation of its digital asset platform.

Some other happenings in the fintech universe 🪐

Looking for some bite-sized fintech headlines to snack on with your tea? Get ready to indulge in some yummy fintech goodness!

Collective, a San Francisco-based fintech that provides financial tools for self-employed business owners, raised $50M to integrate more AI tools into its platform

CapStack, a bank-to-bank marketplace aimed at ‘de-riskifying portfolio’”, raised $6M toward its effort to build an integrated operating system for banks.

Digital bank Timo bolstered its position with a fresh $10M investment from its current shareholder base.

BNP Paribas acquired Kantox- a fintech specialising in the automation of currency risk management. BNP Paribas considers the acquisition a part of its “Growth Technology Sustainability 2025” plan.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include –

Adaptable Platforms, Strong Alliances: BaaS consolidation in action

OakNorth: A blueprint for profitable growth in digital banking

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️