Future of Fintech | Edition #77 – July 2023

Summary of fintech news from 28th June to 10th July

Hola, fintech fanatics!👋

Ready to rock this Tuesday? We're back with the freshest brew of our Future of Fintech newsletter. This week, we've got some lit trends straight outta Europe and Africa!

Before we dive into last week's fintech trends, here are two insightful topics from the fintechaverse to explore this week -

Fintech Story of the Week: Revolut’s $20 Million Payments Flaw

Revolut, the British fintech firm, experienced a significant setback due to a flaw in its US payment system, which allowed criminals to exploit differences between American and European payment systems, leading to a theft of over $20 million. This issue, coupled with an ongoing wait for a British banking license and a drop in valuation, has increased pressure on the company.

For a detailed understanding of Revolut’s challenges in obtaining a UK banking license:

Strategy teardown: Starling Bank’s Success Strategy

UK challenger banks are making some serious waves lately! Take Starling Bank, for instance - they’re absolutely smashing it with customer growth, profitability, and making strides in SME banking.

Fancy a deep dive into their success? Whitesight’s got you covered with a killer analysis of Starling Bank’s playbook and the secret sauce that’s driving their success.

And with this, we welcome you, readers, to Edition #77 of the newsletter - a bomb-diggity blend of finance and innovation.

Here's the TL;DR

The fintech fiesta is sweeping the globe - Moneyhub partnered with MX to drive Open Finance adoption in Europe and North America. At the same time, Standard Chartered teamed with Atome for financial access to its customers in Singapore.

Building trust was the goal of the week as Boodil became a Shopify-approved payment partner for safe and seamless solutions at checkout. Also, Mambu deployed core banking services on Google Cloud Marketplace.

In the race to go digital, IFC partnered with Orange Bank Africa to increase digital lending for small businesses in West Africa. Not just that, Allo Bank tapped Tencent Cloud to power its digital banking services.

Powerful platforms proliferated as Divido launched 'Divido Connect', an embedded retail finance platform. And, Corlytics acquired Clausematch to create a global platform for managing regulatory risk.

In the DeFi realm - Namibia passed a bill to regulate crypto and digital assets by licensing and regulating virtual asset service providers. Also, the Bank of England partnered with Nuggets to improve CBDC security.

For the longer read, let's get going –

Embrace the awesomeness of Open Finance, where fintech rockstars reveal cutting-edge open banking services, with an emphasis on Europe.

Bkper teams up with Plaid to enhance financial connectivity for European customers - streamlining financial processes with near real-time data integration. With more than 1300 new institutions now integrated with Bkper, users can easily connect their Google environment with their financial institutions, consolidating assets from two continents in one secure, consistent location.

Kindgeek, a leading one-stop shop fintech software developer, and Salt Edge partnered for providing PSD2 and open banking solutions to the fintech landscape.

Last week’s Digital Finance realm was a total dazzle-fest where money flowed like crazy, and fintech players jammed together to unleash innovation on all fronts.

UK challenger bank Tandem secured a $22M capital raise from Quilam Capital after turning in its first full year of underlying profit last month. This capital puts momentum on its green lending proposition and allows it to capitalise on a number of exciting opportunities to further grow our business.

London-based Monzo teamed with insurtech Qover to provide travel insurance products for its premium account holders. The insurance is underwritten by Zurich Insurance Company and uses Qover’s embedded insurance platform.

Get hyped for the mind-blowing wonders of Embedded Finance, where innovators are making magic happen, serving diverse fintech users - from BNPL customers to SMEs.

The Saudi Central Bank (SAMA) granted "Tamara" a permit to provide Buy Now Pay Later (BNPL) solutions pursuant to Saudi Central Bank Law and Finance Companies Control Law.

Liberis, a global embedded finance platform, launched Cashback for Green – a funding initiative that rewards sustainable SMEs. In collaboration with its partners, Liberis will be rewarding SME customers with cashback when they invest their funding in green purchases.

In the Fintech Infrastructure realm, bold fintech players unleashed creativity and teamed up to revolutionize payments of every kind.

Mastercard introduced an AI-powered "Consumer Fraud Risk" tool to combat payment fraud and scams in the UK. The solution leverages large-scale payment data and real-time analysis to identify and prevent various types of scams before funds leave victims' accounts.

Fintech SumUp selected the A2A payment platform Form3 to provide direct access to the UK Faster Payments Scheme (FPS) and BacS Scheme. SumUp will connect to the Form3 platform via a single API, where Form3 will manage the payment processing.

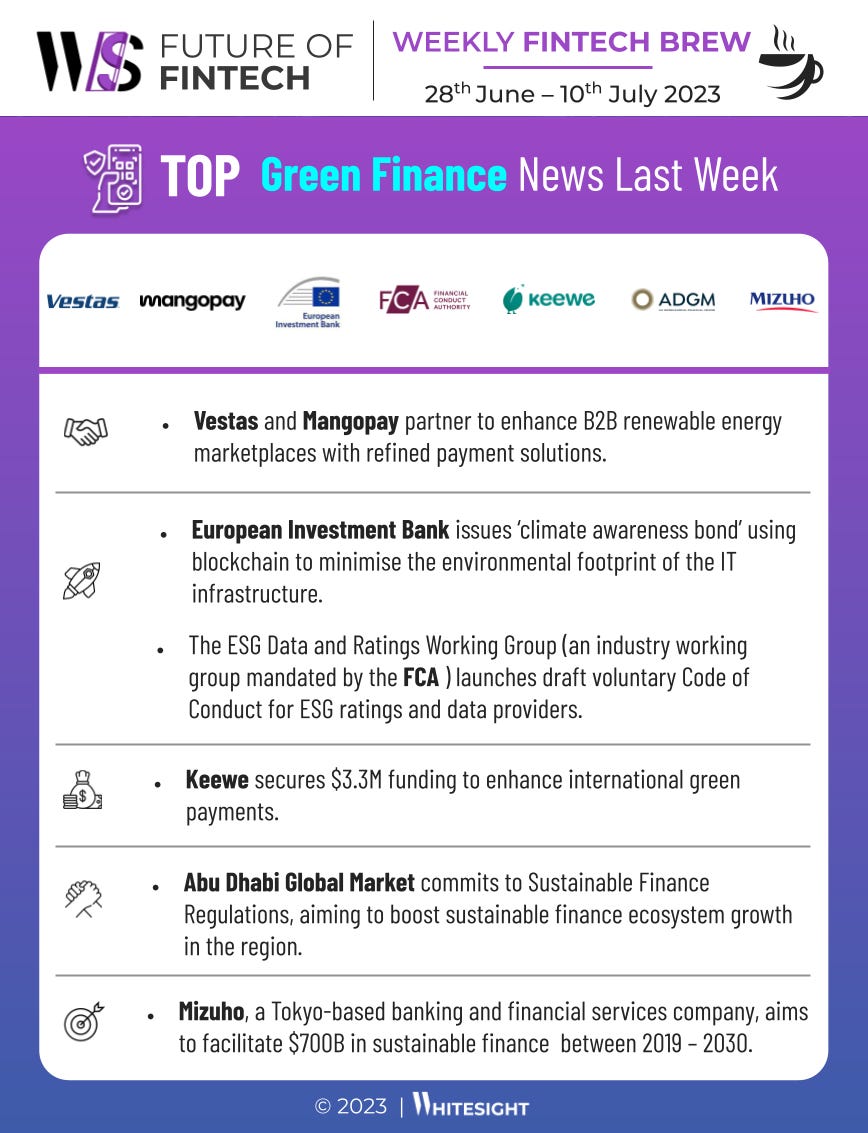

Get ready to dive into the eco-centric universe of Green Finance! It's where finance players suit up and gear towards sustainability like eco-warriors.

Barclays provided a loan of $105M to Moray West offshore wind farm - the project that aims to supply 50% of Scotland’s electricity. Barclays acted as the sole pre-hedge execution for the project executing interest rate, inflation and FX hedges, protecting the project and its stakeholders from adverse market movements in a volatile macroeconomic backdrop.

The Swiss Green Fintech Network (GFN) - which is a collaborative alliance of green fintech startups, was launched. It is dedicated to strengthening the green digital finance ecosystem in Switzerland.

Step into the thrilling world of DeFi, where financial regulators have taken the front seat to keep the web3 ecosystem in check and tight.

Saxo Bank received an order to dispose of its digital assets from the Danish Financial Supervisory Authority (DFSA) for operating outside the confines of regulations. In a terse warning, the DFSA noted that Saxo Bank’s decision to accumulate a portfolio of digital assets to offset market risks is a breach of the local financial rules.

The Monetary Authority of Singapore ordered that crypto service providers in Singapore would need to deposit customer assets under a statutory trust before the end of the year for safekeeping. The purpose of this is to mitigate the risk of loss or misuse of customers’ assets and facilitate the recovery of customers’ assets in the event of a DPT (Digital Payment Token or Cryptocurrency) service provider’s insolvency.

Some other happenings in the fintech universe 🪐

Looking for some bite-sized fintech headlines to snack on with your tea? Get ready to indulge in some yummy fintech goodness!

French revenue-based finance company Silvr secured $200M to fuel growth across France and Germany as well as expand further afield.

Insurtech Qover secured $30M in a Series C funding round to accelerate growth and profitability.

ZestMoney, a troubled fintech business, secured $5 to $7M from a number of investors, namely Quona Capital, a current backer.

Swiss fintech Numarics secured $11M to build the all-in-one business OS for SMEs.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include –

Adaptable Platforms, Strong Alliances: BaaS consolidation in action

OakNorth: A blueprint for profitable growth in digital banking

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️