Future of Fintech | Edition #75 – June 2023

Summary of fintech news from June 20th to 26th

Hey, fintech fanatics!👋

Get ready to dive into Finstatic Tuesday, where we're about to drop the latest edition of our Future of Fintech newsletter. We've worked our magic and brewed up a tantalizing concoction, blending the flavours of six fintech realms that will tickle your taste buds and leave you craving more! This mix of fintech fabulousness is just what you need to shake off those Tuesday blues and get your groove back. Soak up the excitement, packed with the mind-blowing wonders of the fintech universe! 🚀

Apple, the innovative maestro, began with cool desktop computers and continued to astound us with even cooler inventions like the iPad, Apple Watch, and AirPods. It also dipped its toes into the vast ocean of financial services by introducing an innovative payment solution embedded within every iPhone 6 and 6 Plus mode., all without a banking license. Discover the captivating tales of its recent financial escapades in From iPhone to iBank: Analyzing Apple's Embedded Finance Adventures. 🚀

The fintech realm is reaching sky-high levels, with the majestic skylines of the UK ruling the horizon and the tech terrains of the USA. But hold up, the thrill doesn't end there! We've got our spotlight shining bright on the buzzing territories of Asia, where financial innovation is taking the stage by storm. Brace yourself for an epic show put on by the open finance wizards, who are tirelessly revolutionizing open banking payments and catering to diverse industries. Raise your glasses to the mind-blowing fusion of fintech brilliance! 🥂

Level up your financial experience with a sip of #Edition75—a mind-blowing brew that mixes finance with awesome, game-changing innovation.

Here's the TL;DR

The fintech frenzy thriving on enhancing payments - Worldpay from FIS and Volt team to provide merchants with an A2A payments infrastructure. At the same time, Treasury Prime partnered with Checkout.com to improve enterprise payment solutions.

The focus was on being “responsible” as Plaid announced new product releases for fintechs to share fraud instances. Also, Accenture invested in Parfin to build responsible, compliant Web3 infrastructure for financial institutions.

The small business-centric fintech fiesta continues as Novo launched ‘Novo Debit Card’ for small businesses. Not just that, SAP Fioneer launched tailored banking solutions for SMEs.

Fintchaverse goes global - CaixaBank and Iberpay launched SEPA Request-to-Pay in Europe. And, Deutsche Bank filed for a digital asset custody licence In Germany.

The fintech titans join hands to make fintech a global phenomenon - Froda, Lunar and Visa launched embedded loan solutions for small businesses in Denmark. Also, Finastra and ADVANTAQ team to streamline compliance onboarding for Caribbean banks.

For the longer read, let's get going –

Venture into the wild and untamed realm of Open Finance, where fearless fintech trailblazers from the UK boldly unveil groundbreaking open banking services to amaze end users.

UK-based A2A payment solution provider Token.io launched virtual settlement accounts that enable payment providers to use A2A for e-commerce. The new offering will enable payment providers to see real-time notifications of settlements while collecting and holding funds in various currencies.

UK-based data intelligence platform Bud Financial partnered with Fluro to improve its decision-making through transaction AI and Open Banking data. In doing so, it will improve both its existing and new customer decision engines and affordability assessments.

Uk-based Volt raised a $60m Series B round to fund expansion into new international markets such as APAC and the Americas. The funds will also support Volt’s product development in existing markets across Europe, the UK, and Brazil.

Last week's Digital Finance realm was a dazzling display of launches and licences with fintech players harmonizing and joining forces to unleash innovation across every segment of the market.

Mox Bank secured a Type 1 licence from the Hong Kong Securities and Futures Commission (SFC) to introduce Hong Kong and US equity trading services. According to Mox, the licence reflects its expansion into wealth management and investment, broadening its existing deposit and loan business.

Neo Financial launched a secured credit card designed to help Canadians build a history of borrowing and boost their credit scores. Neo Secured Credit will offer unlimited cashback and rewards that are usually reserved only “for top-tier, annual fee credit cards.”

Welcome to the Embedded Finance kingdom, where the fintech trailblazers have teamed up to create a supercharged force that brings an incredible lineup of embedded services.

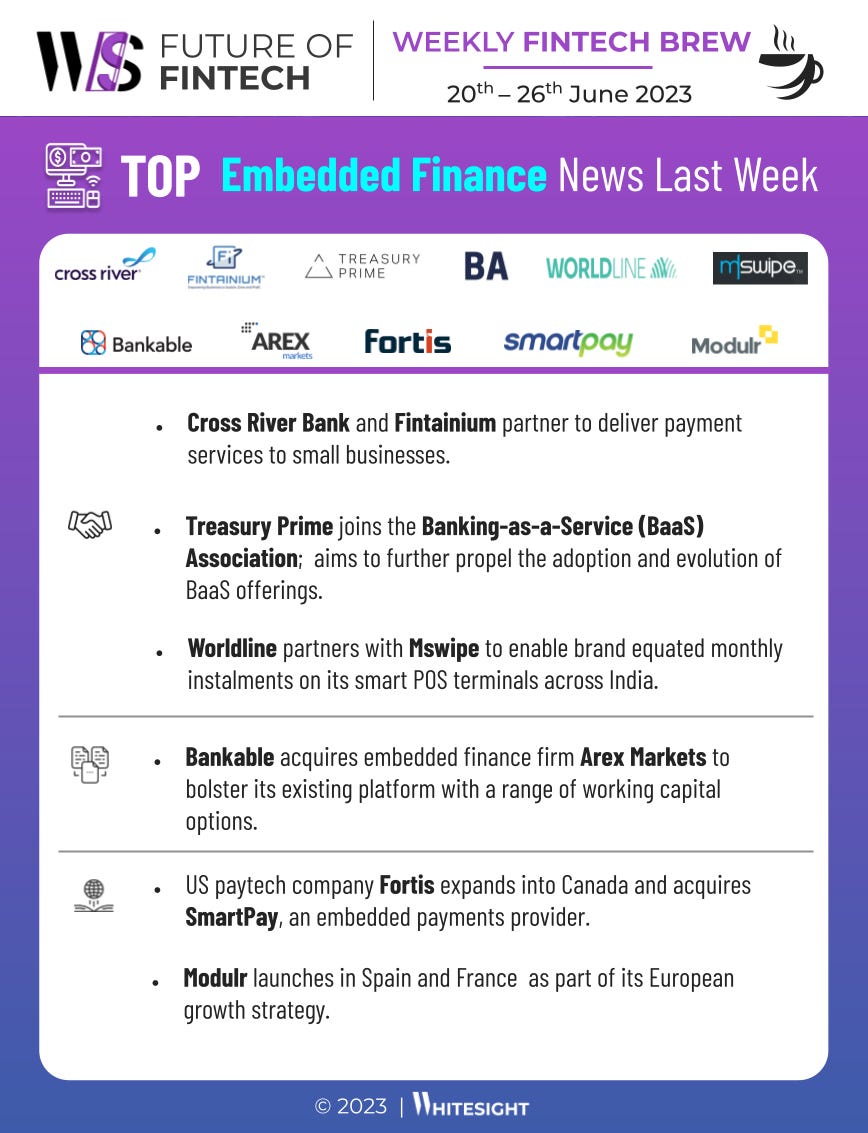

Banking-as-a-Service player Bankable acquired embedded finance firm Arex Markets to bolster its existing platform with a range of working capital options. Through the combined company, established neobanks, multinational brands, and fintech companies can embed credit and working capital into their payment flows.

Cross River Bank and Fintainium partner to deliver payment services to small businesses. The collaboration will allow Cross River to provide Fintainium with a range of payment services, including connectivity to the ACH network, check processing with positive pay fraud prevention, and push-to-card capabilities.

Modulr was launched in Spain and France as part of its European growth strategy. This allows the embedded payments leader to add a layer of specific localisation in these markets, increasing the competitiveness of regional firms both in-country and across the UK and EEA.

In the realm of Fintech infrastructure, collaboration was the name of the game! Fearless fintech players joined forces and crafted solutions to cater to all kinds of segments all over the world.

UK digital payment platform Silverbird teamed with Tuum, a modular core banking platform. The partnership will help the company on its mission to boost financial inclusion for international SMEs.

Jordan Ahli Bank launches social payment app Qawn powered by Thought Machine. With Qawn, Jordan Ahli Bank aims to help a diverse group of users send and receive money, request payments through chat, or scan a QR code for hassle-free money management.

In the eco-centric universe of Green Finance, fintech players teamed up and painted the entire realm with the vibrant green hue of sustainability.

Mastercard launched its card recycling program, which aims to combat the environmental impact of expired credit and debit cards made from first-use plastic. Under the new initiative, MasterCard will collect, transport, and recycle expired cards to give banks a method of securely disposing of the cards.

Karma Wallet partnered with Marqeta on a sustainable prepaid card initiative. Using the Karma Wallet Card, consumers will receive cash back from local, ethical, and sustainable merchants, while getting eco-friendly rewards and learning about the impact of companies they shop with.

Last week, in the thrilling world of DeFi - players secured licenses, creating an exciting web3 adventure.

Xapo Bank, a crypto-friendly bank backed by SoftBank, DST Global and Rabbit Capital, announced its plans to expand across India and the rest of South Asia in an effort to increase cryptocurrency services in the region. The bank has begun offering its full suite of crypto and financial services to Indian customers.

Banco Inter announced its plans to work with the tokenization of Treasury bonds and intends to test blockchain solutions for client negotiation and transactions between banks.

Some other happenings in the fintech universe 🪐

Looking for some bite-sized fintech headlines to snack on with your tea? Get ready to indulge in some yummy fintech goodness!

PhonePe launched a platform for merchant lending to boost SME lending.

Google Workspace integrated Stripe to help businesses accept payments in Google Calendar.

UK fintech TreasurySpring raised $29M to scale its cash investment platform.

Welsh fintech Mypinpad raised $13M to fuel the expansion of its SaaS offering.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include –

OakNorth: A blueprint for profitable growth in digital banking

WhatsApp says hello to the banking & payments world in emerging markets

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️