Future of Fintech | Edition #74 – June 2023

Summary of fintech news from June 13th to 19th

What's up, fintech fanatics!👋

Feeling those Tuesday blues creeping in? Don't worry, we've got just the remedy for you! We've brewed a captivating concoction, blending flavours from six fintech segments that will tantalise your taste buds and leave you craving more! This dose of fintech goodness is just what you need to shake off those Tuesday blues and get your groove back. Savour this invigorating blend, brimming with brilliance and infused with the weekly wonders of the fintech world! 🚀

The fintech landscape reaches breathtaking heights as majestic European mountains dominate the horizon and soar across the tech terrains of the USA. But hold your horses because the adventure doesn't stop there! The spotlight also casts its brilliant glow on the vibrant territories of Asia, where financial innovation thrives unrestrained. Get ready to be dazzled by the captivating performance of digital finance wizards, tirelessly dedicated to transforming companies and customers into digital champions. Cheers to the awe-inspiring fusion of fintech brilliance! 🥂

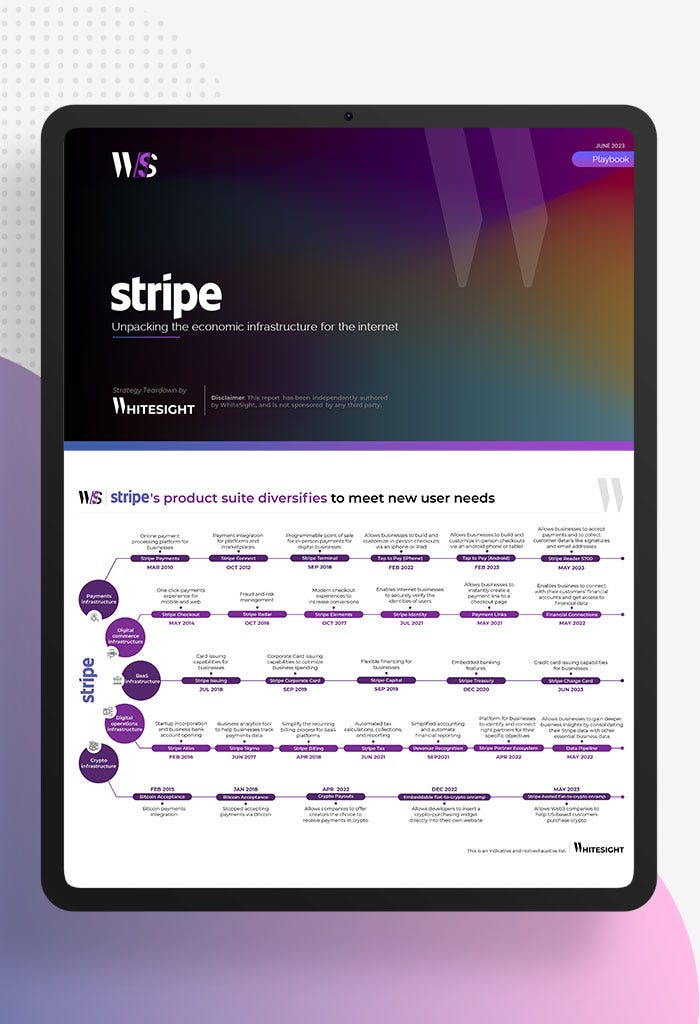

Stripe is leading the fintech revolution, empowering a diverse range of businesses globally. Discover the tactics fueling Stripe’s fintech success in our 50-page report. Unravel their strategy, including bets on creators’ economy, omnichannel commerce, digital assets & web3, embedded finance, and Generative AI.

Coming back to regular programming – get ready to elevate your financial experience with a single sip of edition 74—a thrilling brew that infuses the realm of finance with cool, game-changing innovation.

Here's the TL;DR

The fintech frenzy flourishes as big players foster a foundation of trust. - Volt became an approved Shopify open banking partner. At the same time, Citi TTS selected Pismo to enrich Global Demand Deposit Account (DDA) solutions

The fintech yacht crossed borders when Score & Secure Payment (SSP) teamed with Tink to enhance its payments solution across Europe. And S.Korea's KakaoBank teamed with SCBX to acquire the license for a virtual Thai bank.

The user-centric fintech fiesta continues as Walmart-backed Fintech ONE decided to offer users a 5% APY on savings accounts. Not just that, Huawei and Sunline jointly launched the Digital CORE Solution to help banks go digital.

Flexible payments gained traction last week as UAE's NymCard acquired Spotii for customised BNPL services to its clients. Also, Vivo partnered with Tabby to enhance the consumer experience with flexible payment options.

In the Defi world - Binance exited the Dutch market citing regulatory challenges. At the same time, BlackRock filed for Bitcoin ETF using Coinbase as its custodian.

For the longer read, let's get going

Step right into the untamed realm of Open Finance, where daring fintech pioneers uncover groundbreaking open banking remedies for the masses.

Paycepaid partnered with Envestnet | Yodlee to supply synchronised data for holistic customer financial hardship assessment. Under this agreement, Paycepaid will leverage consumer-consented financial data provided by Envestnet | Yodlee under Australia’s Consumer Data Right (CDR) to assist with near real-time financial hardship assessment of its customers.

Plaid introduced a new identity verification experience based on a 'verify once, verify everywhere' system that allows users to fast-track KYC compliance across Plaid-powered apps and services.

Last week's Digital Finance realm was a symphony of launches, with fintech players joining forces, bringing innovation to every segment of the market.

Revolut unveiled a new membership plan - Ultra, featuring a Mastercard branded platinum card. This premium offering is designed to connect Revolut customers to the travel and lifestyle benefits they desire.

The Bancorp and Chime entered into a long-term extension of their partnership. With the renewed agreement, Bancorp continues to serve as Chime's banking partner and holds member deposit accounts. While Chime will continue to focus on designing innovative, easy-to-use, FDIC-insured banking services.

One Zero Bank added Generative AI to its customer service platform to deliver rapid and precise responses to its customers and raised growth capital on OurCrowd, through smaller (accredited) investors.

Step right into the Embedded finance kingdom, where the fintech trailblazers forged mighty alliances, offering fintech users a dazzling array of embedded services tailored to their every desire.

Pay Over Time platform Wisetack and consumer instalment financing provider Citizens partnered to offer pay-over-time options for home services projects through Wisetack’s network of merchants and SaaS integrations.

The FCA-regulated, cross-border payment and foreign exchange specialist Universal Partners selected Muse Finance to offer invoice and trade finance. With the two core services, their customers will have the cash flow management tools they need to scale anywhere in the world without encountering liquidity concerns.

In the Fintech infrastructure realm, fearless fintech trailblazers crafted a myriad of groundbreaking use cases through daring partnerships and unleashing a torrent of innovative solutions.

Huawei and Sunline launch Digital CORE Solution to help banks go digital. Both companies unveiled several joint solutions at Huawei Intelligent Finance Summit (HIFS) 2023.

Tillo partnered with Banked to integrate its catalogue of global rewards and incentives into Banked’s payment experience to help merchants drive customer engagement and loyalty. Banked's merchants will now be able to enhance customer engagement by offering enticing digital rewards and incentives at checkout.

Experian launched Experian Mule Score to assist companies with identifying and closing money mule accounts that are leveraged to run scams and house fraudulently obtained funds.

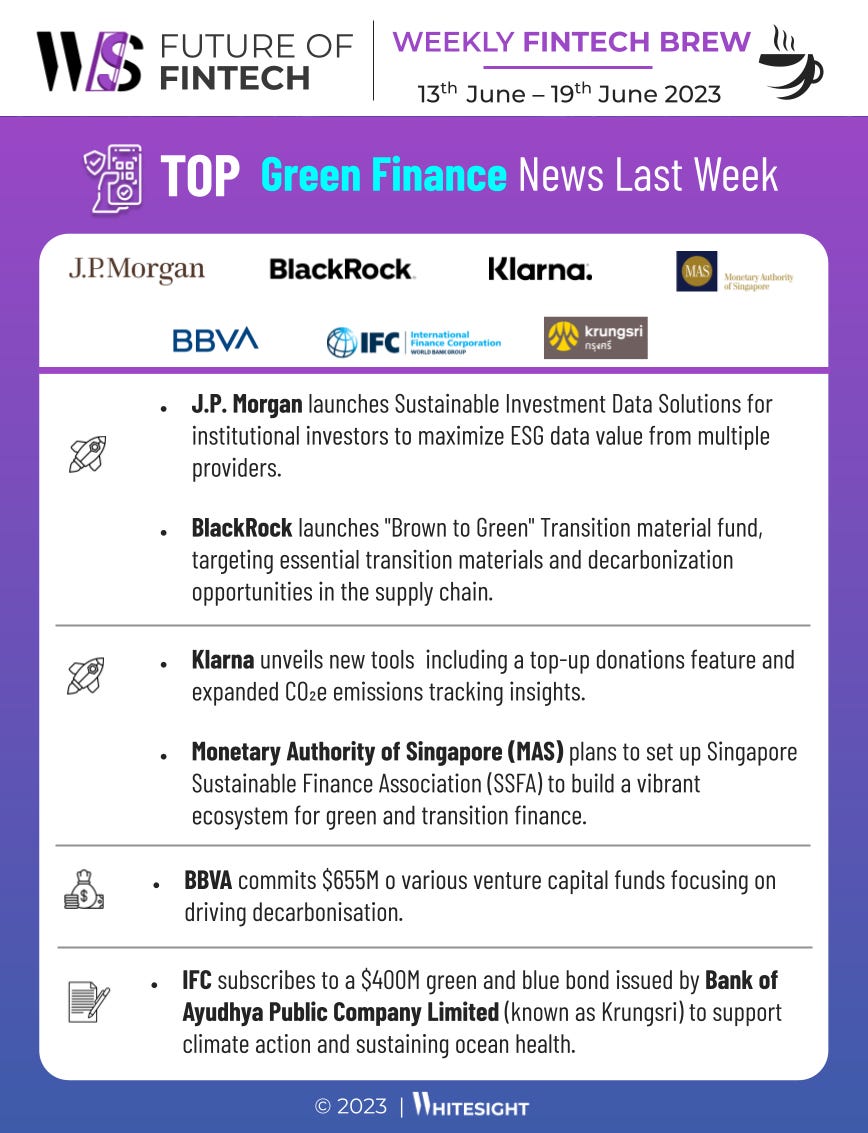

In the eco-centric universe of Green finance, a whirlwind of groundbreaking launches swept through the fintech playground, transforming it into a utopia of sustainability.

J.P. Morgan launched Sustainable Investment Data Solutions, a new platform targeted at institutional investors aimed at enabling them to extract and maximize the value of ESG data from multiple sustainable investment (SI) data providers and address the challenges of using internal and external SI data.

Klarna unveiled new tools, including a top-up donations feature and expanded CO₂e emissions tracking insights enabling consumers to make more informed purchasing decisions.

In the thrilling expanse of DeFi's realm, the web3 odyssey crackled with legalities, licenses, and resplendent launches, intertwining like a mesmerizing wonderland.

Sygnum Singapore obtained an in-principle approval of a Major Payment Institution Licence (MPIL) from the Monetary Authority Of Singapore. The expanded Singapore offering includes a regulated crypto brokerage service.

Polygon Labs rolled out Open Database called "The Value Prop", hosting as many as 39 use cases and over 300 applications.

Some other happenings in the fintech universe 🪐

Looking for some bite-sized fintech headlines to snack on with your tea? Get ready to indulge in some yummy fintech goodness!

OneVest raised $12.8M in Series A funding as it aims to dramatically improve the wealth management experience for both financial institutions and their customers.

Gold loan platform Oro Money to raise its second funding round , aims $12-15M in the new round.

AI-Backed web3 data platform Mnemonic raised $6M in a seed extension round led by Salesforce Ventures.

IndusInd Bank partnered with Wise on the multi-partner Indus Fast Remit platform to offer low-cost and seamless online inward remittance to India.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include –

OakNorth: A blueprint for profitable growth in digital banking

WhatsApp says hello to the banking & payments world in emerging markets

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️