Future of Fintech | Edition #73 – June 2023

Summary of fintech news from 6th to 12th June

Hey there, fintech enthusiasts!👋

As another epic Tuesday arrives, we're all set to dive into a sizzling cup of the freshest fintech updates. We've brewed a captivating concoction, blending flavours from six fintech segments that will tantalize your taste buds and leave you craving more! Savour this invigorating blend, brimming with brilliance and infused with the weekly wonders of the fintech world!

The fintech landscape soared to new heights, with the magnificent European mountains dominating the horizon. But hold on, because that's not where the adventure ends! The spotlight also shone brightly on the vibrant territories of LATAM, where financial innovation ran free and untamed. Brace yourselves for the dazzling performance of Embedded Finance wizards, dedicated to crafting the future of embedded payments. So grab your favourite brew, raise those cups high, and let's toast to the spellbinding fusion of finance and technology!

2 brothers. 7 lines of code. A multi-billion dollar startup. Welcome to the captivating story of Stripe, for which these numbers are just the tip of the iceberg. Unlock their triumphs in our 50-page report - Stripe’s Economic Infrastructure Playbook - revealing their strategies from creators' economy to omnichannel commerce, digital assets & web3, embedded finance, and Generative AI. Join the ride and uncover the secrets of Stripe's fintech success. 🚀

Here's a quick look at how Stripe’s "platform of platforms" strategy is being implemented:

Get ready to take a sip of #Edition73 - a rich brew filled to the brim with cutting-edge innovation that's straight-up redefining the financial game.

Here's the TL;DR

Boosting open banking capabilities - American Express partnered with Plaid and Yodlee for data sharing, enhancing digital capabilities. At the same time, Brazil's Nubank hit 1 million accounts in Mexico within one month of launch.

The fintech fiesta flexes its muscles globally when Lunar launched its Nordic payment infrastructure to enable instant payments. And, Amazon Pay tapped Affirm to be its first buy now, pay later player in the US.

Focusing on seamless fintech interactions - SEB Embedded teamed with Enfuce to launch card programmes for its customer. Not just that, NASDEX and Rio Exchange entered into a strategic partnership, enabling NASDEX to offer licensed security products & services using Rio Exchange.

More collaboration across lending and payments - Worldpay from FIS and Volt teamed to equip merchants with Open Banking payments. And, Jifiti and FIS joined forces to launch embedded lending solutions for banks.

Continuing the fintech feast - FIS acquired BaaS startup Bond to grow embedded finance. At the same time, GFT and Metaco partnered for digital asset custody and tokenization solutions.

For the longer read, let's get going –

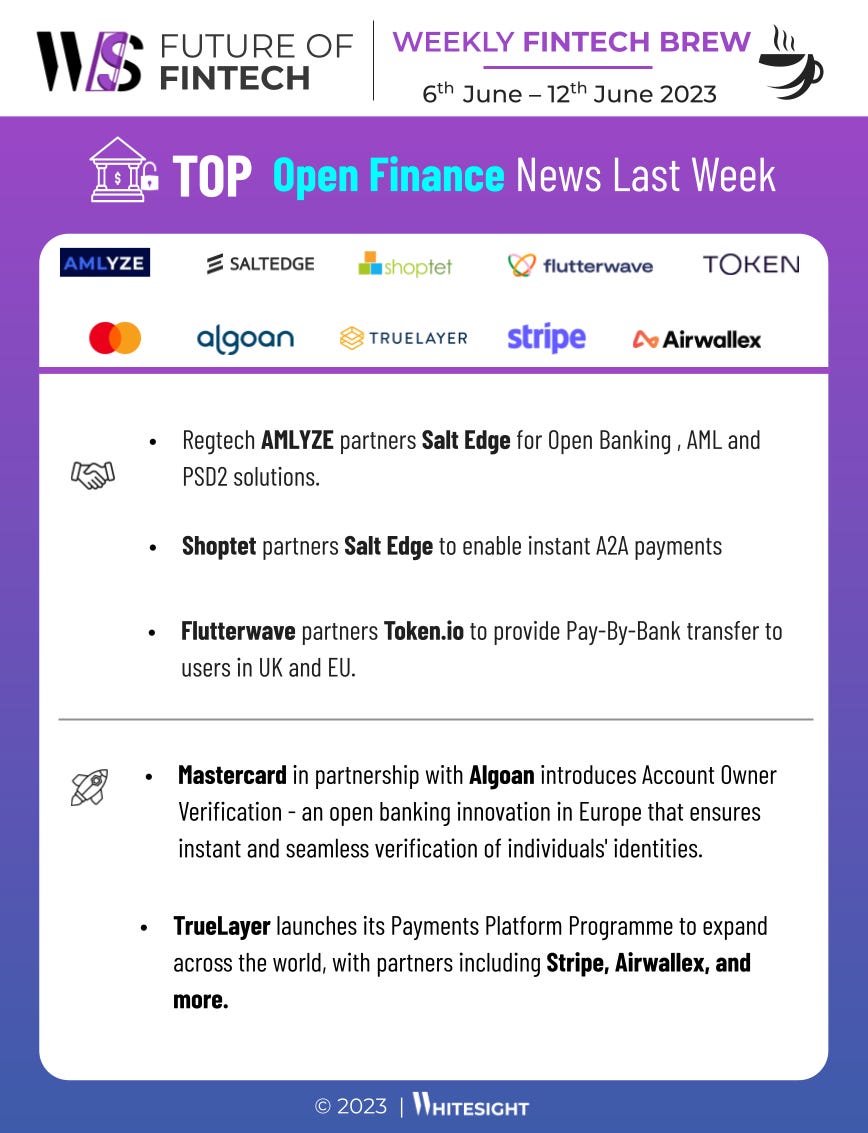

Welcome to the wild world of Open Finance, where fintech folks this week came together to spread the magic of open banking solutions across the globe.

Regtech AMLYZE collaborated with the open banking platform Salt Edge in order to enhance their client offering by leveraging both companies' expertise related to anti-money laundering (AML), Open Banking, and PSD2 solutions.

Flutterwave, Africa’s payments technology company partnered with Token.io. As a result of the partnership, Flutterwave will be able to provide enhanced access to UK and EU e-commerce merchants, and Token.io will be able to provide businesses in Africa with a Pay By Bank method.

Mastercard launched open banking innovation in Europe –Account Owner Verification, in partnership with Algoan, to accelerate financial inclusion. The product will offer businesses and collaborators the possibility to enable a frictionless experience for their clients, by instantly verifying the identity of the individuals.

As the world of Digital Finance gathered pace last week, players put their customer-first approach in the quest for seamless money management online.

Israeli digital bank One Zero announced its plan to introduce a generative AI chatbot capable of providing immediate replies to free-flowing customer queries.

Starling Bank launched ‘Hide references’, a feature that lets customers hide payment references. The feature is designed to help survivors of economic abuse by muting unwelcome or abusive references that can accompany bank transfers.

Step right into the Embedded Finance kingdom, where expanding and embedding fintech innovations were geared towards Europe.

ClearBank and Allica Bank partnered to bolster business banking for UK SMEs. The real-time clearing bank will sort out the payments rails and account infrastructure for the fintech challenger bank, enabling it to focus on helping SMEs and providing them with tailored support.

Sweden-based Buy Now, Pay Later provider Klarna announced its launch in Romania with its ‘Pay in 3‘ service and shopping app.

Last week, in the realm of Fintech Infrastructure, fintech pioneers injected a wide range of innovation, from credit to transaction.

France-based Numeral partnered with BPCE Payment Services to launch a full-API gateway across all SEPA payment schemes. Through the partnership, regulated fintech companies can send, receive, and reconcile payments across all SEPA credit, instant credit, and direct debit payment schemes with one API.

Finastra collaborated with S&P Global Market Intelligence. The collaboration aims to help reduce risk, improve automation, and fast-track transaction processing for clients that use Finastra and S&P Global Market Intelligence’s solutions.

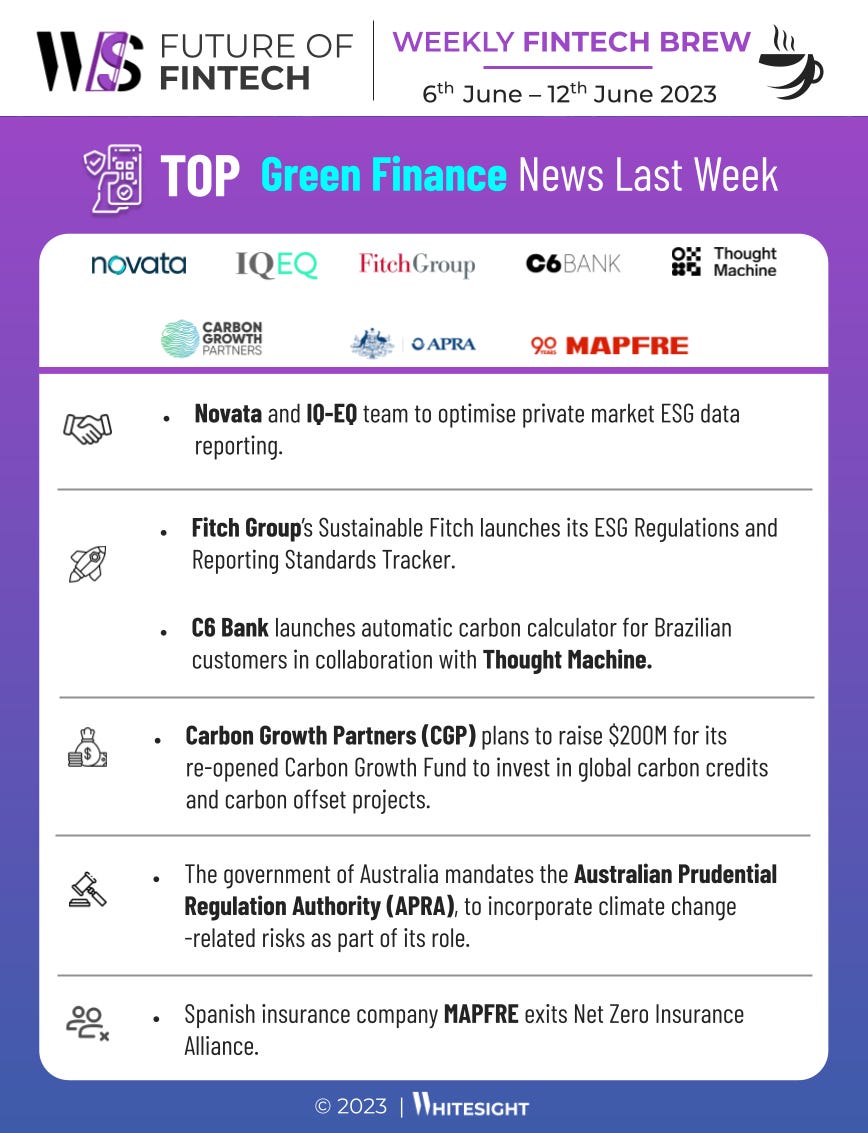

In the planet-friendly world of Green Finance, regulators led the charge while financial trailblazers worked their magic to transform the fintech playground into an eco-friendly haven.

The Government of Australia mandated Australia’s financial regulator, the Australian Prudential Regulation Authority (APRA), to incorporate climate change-related risks as part of its role.

Spanish insurance company MAPFRE announced its decision to discontinue its membership in the Net-Zero Insurance Alliance (NZIA), marking the latest in a string of major insurers exiting the UN Environment Program (UNEP)-backed climate action-focused industry group.

In the thrilling arena of DeFi, the web3 adventure buzzed with legalities, integrations, licenses, and more. From custody of digital assets to exploring wallets, the excitement knew no bounds.

Cryptocurrency custody firm BitGo reached a preliminary agreement to buy Prime Trust, another crypto custody specialist regulated in the state of Nevada. The financial terms of the deal were not disclosed.

MetaMask integrated with Fireblocks' multi-party computation (MPC) platform. The new integration will give Fireblocks users access to MetaMask Institutional’s portfolio management capabilities and all-in-one dashboard, letting them do native token swaps and Ether.

Some other happenings in the fintech universe 🪐

Looking for some bite-sized fintech headlines to snack on with your tea? Get ready to indulge in some yummy fintech goodness!

Brightflow AI acquired CircleUp to merge data, and machine learning capabilities with Brightflow AI's financial intelligence toolkit, forming a comprehensive solution for consumer companies seeking business growth.

Thunes’ Series C funding round exceeded $60M and was led by Marshall Wace, a London-based hedge fund, and the newly raised Southeast Asian private equity firm 01Fintech.

Brazil-based travel tech company Onfly closed a $16M Series A funding to further scale the sales, marketing, and technology departments.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include –

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️