Future of Fintech | Edition #72 – June 2023

Summary of fintech news from 30th May to 5th June

Hey there, Fintech fanatics!👋

As another tea-rrific Tuesday dawns upon us, we're all geared up to indulge in a steaming cuppa of the latest happenings in the fintech field. We've mixed together a fintech brew, blending the flavours across six fintech segments, that'll leave you craving for more! Sip through this fresh serving, brimming with brilliance, and infused with the weekly wonders of the fintech world!

In a thrilling journey through the world of fintech, last week's headlines took us on a whirlwind adventure. The spotlight shone brightly on LATAM and the Middle East, where the magic of open and digital finance transformed financial offerings.

The realm of Digital Finance stole the show, with digital players achieving incredible milestones and unlocking the secret to profitability. So, raise your cuppas high and let's celebrate the captivating fusion of finance and technology! Cheers! ☕

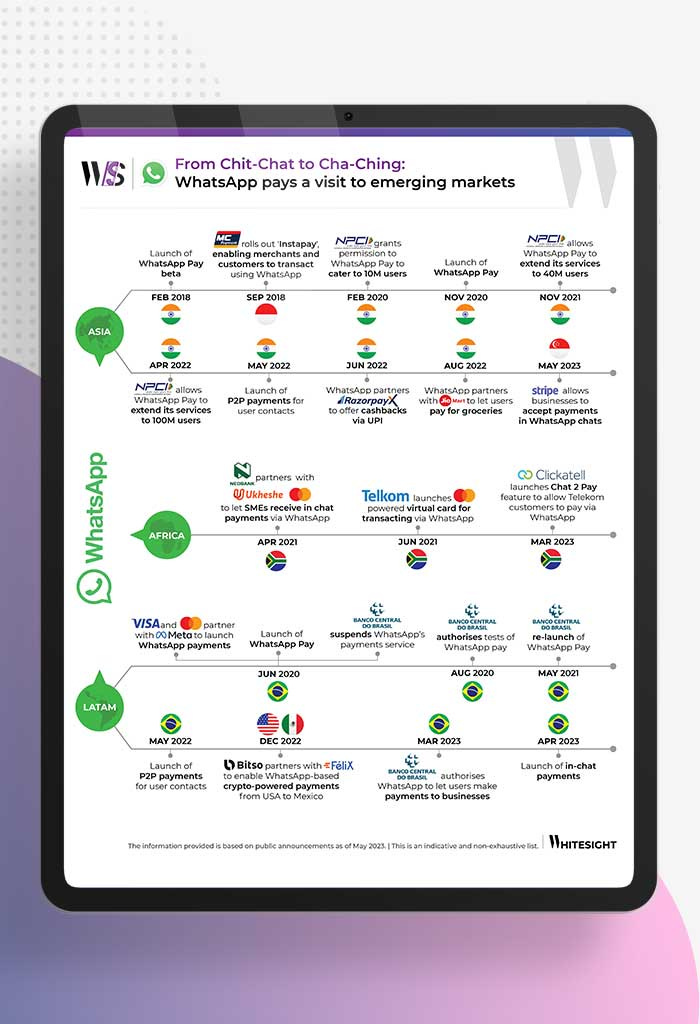

Digital payments and mobile wallets are all the rage now that everyone's hooked up to the internet. And that’s where tech giants like WhatsApp are jumping in to shake things up! With a whopping 2 billion users, WhatsApp is bringing some serious game to the table, making peer-to-peer and peer-to-merchant transactions a breeze. "WhatsApp says hello to the banking & payments world in emerging markets" captures how this messenger platform is championing digital commerce and making sure everyone's included in the money game.🚀

Now serving Edition #72 - a rich brew hot-off-the-press and bubbling with all the weekly scoop to delight your curious tastebuds!

Here's the TL;DR

The fintech net was cast across Europe, with Heeros and Enable Banking partnering to allow SMEs to utilise the open APIs of European banks, and Mastercard and Fabrick teaming to develop embedded finance solutions for the digitalisation of businesses and fintechs across Europe.

Spreading fintech access to the masses – AAZZUR partnered with Salt Edge to broaden its open banking offerings. TransUnion joined forces with Monevo and incuto to offer increased access to credit to consumers in the UK.

Keeping the "Trust" game going - Digital bank Trust launched its latest product as part of a broader plan to expand and position itself by end-2024 to become Singapore’s fourth-largest retail bank by customer volume. Meanwhile, Ikano Bank selected TCS BaNCS as part of its pan-European core banking transformation that aims to support the rapid launch of new products and expansion into new markets.

Supporting the surge of financial innovation - Revolut surpassed a whopping 30 million customers worldwide. Not just that, but Germany’s Deutsche Telekom also extended its validation nodes to Polygon, signalling its support for the network’s ecosystem.

Weaving a whirlwind of financial finesse, Weavr teamed up with Visa for the adoption of embedded finance solutions among B2B SaaS companies. At the same time, Sberbank opened access to its in-house DeFi platform to allow developers to test its capabilities.

For the longer read, let's get going –

Prepare for some piping-hot news straight from the realm of Open Finance! Global collaborations set the stage ablaze as industry giants united to revolutionise payments and lending:

Tarabut Gateway completed the KSA Open Banking certification and launched its open banking services within the Regulatory Sandbox, based on the Open Banking Framework released by the Saudi Central Bank (SAMA).

Colombia Fintech Association, FinTech México, Belvo, and other associations partnered to propose joint standards for Open Finance in LATAM. The aim of the document is to set on fostering comprehensive regulatory bodies across the Latin America region, which aims to enhance cross-border transactions and implementations.

Welcome to the thrilling Digital Finance arena, where milestones echo like epic beats as many digital banks crack the profitability code in the global fintech playground:

UK digital bank Monzo reported 2.3x growth in revenue for FY2023 and moves into profitability by boosting customer numbers to 7.4 million and growing deposits by 34% to $6.49B.

Brex announces significant momentum and growth of two of its products — Empower™, Brex’s spend management platform, and Brex business accounts — each achieving $100M in ARR.

Aspire, a Singapore-based B2B fintech company, hit profitability just months after closing its $100M series C funding round. The company plans to double down on Southeast Asia and expand across the broader Asia-Pacific region.

Step right into the Embedded Finance landscape, where expansion is the talk of the town for the week as ecosystem players come together to expand offerings through strategic synergies:

Synctera partnered with the National Bank of Canada (NBC) as part of its expansion into Canada. As a result of this partnership, they will continue to unlock human potential through financial innovation by bringing BaaS to customer-focused enterprises and entrepreneurs in Canada.

Worldpay From FIS and Affirm teamed up to expand Pay-Over-Time solutions. This multi-year partnership enables Worldpay clients to seamlessly integrate Affirm and offer flexible and transparent payment options

In the captivating universe of Fintech Infrastructure, while some companies were eyeing global expansion, others were focused on transforming their very core.

FintechOS announced a series of accomplishments, including launching in North America with five banks in 2022, overall revenue growth of 70% year over year and much more.

Experian chose identity verification solution provider IDVerse to support its customer’s digital onboarding and expand its digital footprint across the globe.

Green Finance’s green pastures observed quite a round of funding greens pour into the scene the past week:

HSBC launched an ESG Index that uses AI to help measure the improvement of a company’s ESG credentials and its potential for positive financial performance.

Open banking firm Tink and ecolytiq teamed to offer Tink’s new and existing customers the option to integrate sustainability-based services, featuring scalable implementation across various markets.

In the wonderous world of DeFi, the web3 spaceship was seen journeying towards the nooks and corners of the world:

Crypto exchange Gemini announced its plans to secure a licence in the United Arab Emirates (UAE) to tap into the surging interest in digital assets in the region.

Tether invested in an energy production and sustainable bitcoin (BTC) mining facility in Uruguay. The news came after Tether laid out plans earlier this month to allocate a part of its profits to bitcoin investments, including regular purchases of BTC and funding infrastructure.

Some other happenings in the fintech universe 🪐

Looking for some bite-sized fintech headlines to snack on with your tea? Take a bite into some of this additional fintech goodness:

Japanese fintech company GIG-A created a multilingual app - a mobile financial service offering allowing users to easily and inexpensively open bank accounts, and manage their deposits.

Fintech Sway raised 111% ($671390) of its $599496 target from 335 investors through its crowdfunding campaign.

Klarpay AG expanded its product offering to include local Automated Clearing House (ACH) payments in more than 40+ currencies.

Swiss lending startup Teylor raised $294.4M to support its credit platform for SME financing.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include –

WhatsApp says hello to the banking & payments world in emerging markets

OakNorth: A blueprint for profitable growth in digital banking

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️