Future of Fintech | Edition #71 – May 2023

Summary of fintech news from 23rd to 29th May

Hey there, Fintech fanatics!👋

It's a terrific Tuesday at the Fintech Cafe, where we are getting ready to sip on the steaming cuppa of our latest edition of the FoF newsletter — a mesmerising blend of flavours from six sensational segments, meticulously mixed to concoct a fintech brew that will leave you craving more. Freshly brewed and brimming with brilliance, this newsletter is infused with the weekly wonders of the fintech world!💡

Last week’s fintech voyage took us jet-setting across the globe, exploring the enchanting realms of Asia and riding the tech waves along the dazzling shores of Australia. Brace yourself for an exhilarating journey into the mountains of Europe, where fintech treasures await at every peak. Witness how Fintech Infrastructure visionaries ignited a revolution of trends via significant partnerships, with many testing the waters with AI to provide better financial services. Let's raise our cuppas to the magical fusion of finance and technology!

The fintech sector has been going through quite the rollercoaster ride for the past few years, witnessing a journey with slow progress, declining values, and puzzling obstacles. Surging interest rates, inflation on the rise, and an uncertain economy have thrown some serious curveballs. As both public and private markets experience a downward trend, a burning question emerged: is this just a temporary correction or the onset of a complete crash? Delve into the answers and unravel the patterns behind this gripping downward spiral in our newest blog post, “Fintech valuation dip - Correction or crash?"

Prepare to sip through the diverse offerings of #Edition 71, a rich brew blended with the cutting-edge fintech wonders that are redefining the boundaries of innovation.

Here's the TL;DR

The fintech frenzy flexed its muscles globally as Airwallex picked TrueLayer to enable open banking payments in Europe. ZA Bank also announced its plans to launch digital asset retail trading in Hong Kong.

Cultivating confidence in credit – Revolut received a Direct Credit Society (SCD) licence from Brazil's Central Bank. At the same time, Barclays Bank invested $3.2M in Trade Ledger for end-to-end credit management automation.

Igniting innovation, Fifth Third Bancorp acquired Rize Money to further capitalise on technology and innovation. Meanwhile, Bluestone Mortgages and Experian teamed to launch an open banking solution for automated lending decisions.

Focusing on finessing payments, while Atome partnered with Amazon to offer deferred payment options during checkout for Amazon customers in Singapore, Finastra integrated with Priority Software to enable embedded Bacs payments.

More fintech news flows from Europe – as UK-based Starling Bank’s CEO Anne Boden stepped down amidst a profit boost, handing the reigns of the company to John Mountain. On the other hand, Deutsche Digital Assets launched a physically backed multi-asset crypto ETP – DDA Crypto Select 10 ETP.

For the longer read, let's get going –

In the latest scoop from the realm of Open Finance, government organisations took charge to bring forth the transformative force of "open access" to benefit everyone.

The National Bank of Georgia approved the rules for connecting open banking, ensuring the protection, trust, and reliability of services for all users.

Australia’s Westpac tapped into the government’s open banking regime to verify a borrower’s income to approve a mortgage application - helping the bank accelerate the rollout of its 10-minute digital mortgage.

In the Digital Finance arena - new launches echoed as fintech trailblazers paved their way ahead in the global fintech ecosystem.

Pan-European fintech Monese launched XYB, an end-to-end ‘coreless’ banking platform provider. XYB aims to offer a dynamic and interconnected platform that goes beyond conventional technology infrastructure.

Mexico's bank regulator, The Comisión Nacional Bancaria y de Valores (CNBV), approved fintech Ualá's purchase of ABC Capital, solidifying its path to a banking licence in Mexico.

In the Embedded Finance world, revolutions and revelations intersect, and visionary players work together to transform the financial sector.

SaaS platform Actyv.ai partnered with Unity Small Finance Bank for BNPL offerings to SMBs. The partnership will enable both companies to leverage each other’s distribution network and credit appetite to offer AI-driven and ring-fenced credit to SMBs.

Hokodo and Mangopay teamed up to deliver a payment solution catering to B2B platforms, enabling them to expand their payment capabilities. Mangopay users can now start accepting payments with Hokodo in minutes and provide a better payment experience that can guarantee more conversions

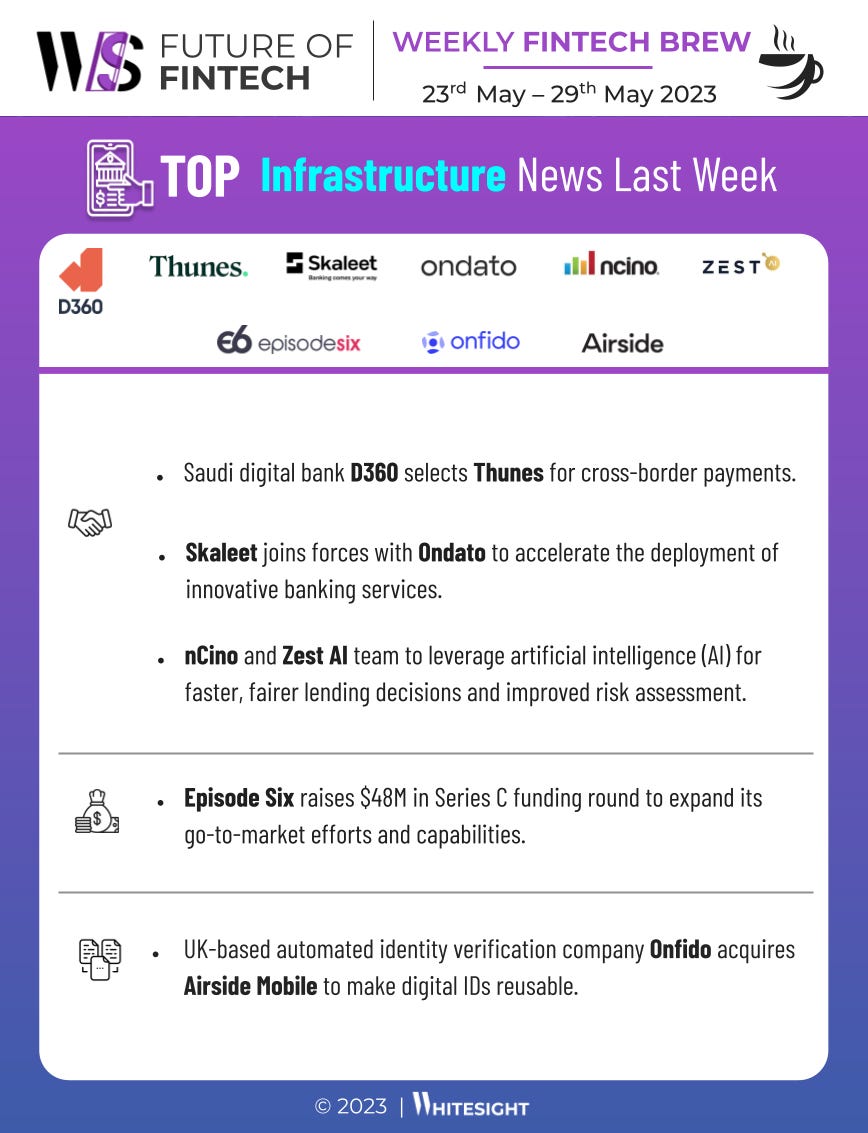

In the intriguing world of Fintech Infrastructure, fintech visionaries were seen to be joining forces to accelerate the deployment of innovative banking services.

Global payments and banking infrastructure provider Episode Six raised $48M in a Series C funding round to expand its go-to-market efforts and capabilities.

Saudi digital bank D360 selected Thunes for cross-border payments. This collaboration will empower D360 customers in Saudi Arabia to make fast and cost-effective B2B business payments and international remittances worldwide.

nCino and Zest AI teamed up to leverage artificial intelligence (AI) for faster, fairer lending decisions and improved risk assessment in the financial sector.

In the lush landscape of Green Finance, industry players made significant strides in their efforts to greening finance and achieve sustainability.

JPMorgan Chase secured major deals worth over $200M to remove and store 800,000 metric tons of carbon dioxide from the atmosphere. The agreements are expected to enable J.P. Morgan to match its entire unabated direct operational emissions footprint by 2030.

TransUnion signed an agreement with Constellation to purchase renewable energy equivalent to the annual electricity use of its Chicago headquarters.

In the enthralling DeFi universe, the stage was set for a breathtaking performance of decentralised innovation.

CoinDCX added AI and machine learning upgrades to its self-custody wallet Okto to boost security as well as analyse and monitor patterns in usual and unusual crypto transactions.

Binance received an operation licence from Thailand's Securities and Exchange Commission. Binance's operations in Thailand will be conducted through a joint venture with the holding company Gulf Energy Development Public Company Limited, titled Gulf Binance Co., Ltd.

Some other happenings in the fintech universe 🪐

Craving for some tempting bite-sized fintech headlines to savour alongside your tea? We're here with a delectable serving of some more fintech tea to appease your curious taste buds:

PhonePe secured another $100M from General Atlantic; expanding the new funding to $850M in an ongoing financing round.

OpenFin secured $35M in Series D Investment - aims to help accelerate the adoption of OpenFin OS across the financial industry and beyond.

Accounting software firm Tipalti landed $150M in incremental growth financing from JP Morgan Chase and Hercules Capital.

US fintech Pesto raised $11M and debuts asset-backed credit card.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include –

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️