Future of Fintech | Edition #70 – May 2023

Summary of fintech news from 16th to 27th May

Hey there, Fintech fans!👋

Here’s to another Tuesday where we dance to the tunes of some tech-tastic scoop and tame the Tuesday blues! We bring you our latest edition, the Future of Fintech fabulous folio — a fusion of flavours from six sensational segments, meticulously mixed to produce a fintech cuppa that will leave you craving for an encore. Freshly brewed and overflowing with innovation, this newsletter is your golden ticket to a taste of the weekly fintech updates!💡

Embark on a fintech odyssey, traversing the globe from Australia's vibrant isles to the tech-powered landscapes of the US. Hold tight; we’re only getting started! Take an exhilarating journey into the snowy realm of the UK, where the landscape is adorned with fintech treasures. Last week, Embedded Finance visionaries blazed trails, sparking a revolution of trends. Toast to the fusion of finance and technology as we eagerly await the unfolding headlines. 🗞️

UK-based SME lender OakNorth has established itself as a true standout in the industry. The bank has ingeniously fused its lending prowess to mid-corporates in the UK with the strategic licensing of its cutting-edge technology to banks. The result? Not only is it harnessing substantial income from lending operations, but it has also unlocked an unprecedented wave of revenue from technology licensing. Witness OakNorth's meteoric rise as it propels forward as a profitable, scalable, and growth-centric force in the financial realm in our latest report, "OakNorth: A Blueprint for Unstoppable Digital Banking." 🚀

Get your fintech curiosity primed for an extraordinary delight! Brace yourself for the irresistible allure of #Edition 70, serving a hot array of fintech delicacies to tempt your taste buds!

Here's the TL;DR

The focus is on credit - In a major move, The Australian Government announced that it aims to regulate the BNPL sector as a consumer credit product under the Credit Act to better protect consumers against financial abuse. On the other hand, Prism Data partnered with Plaid to help lenders enhance credit decisions using Open Banking data.

Bringing the banking bonanza to the broad masses – While Salt Edge teamed up with Skaleet to bring open banking solutions to more institutions, BKN301 Group went live with Finastra to roll out a Banking as a Service solution.

Multiplying market presence - Neobank N26 unveiled an interest-bearing Savings Account in Spain, and Standard Chartered partnered with Worldpay from FIS to expand the market of its Straight2Bank Pay solution.

Savings and lending create a savvy sensation as Step unveiled a 5% savings account for users with a monthly direct deposit of $500+. Meanwhile, Temenos launched AI-powered digital mortgages for fast, responsible lending.

Fintech's footprint forges a global frontier - Visa and Reward launched a Global Merchant Marketplace in UAE, giving banks access to prime merchant offers. Klarna and Airbnb teamed up to offer flexible payments for guests in the US and Canada.

For the longer read, let's get going –

Behold the scoop from Open Finance, where pioneers unite and ventures ignite to spread the transformative power of "open access" to all.

Fintech MX announced a free Data Access solution to help financial institutions provide tokenised API connections. Data Access provides organisations with the tools they need to monitor and manage data recipients while giving consumers greater control over their data.

Zimpler launched cross-border payouts through SEPA to enable its customers to send EUR instantly to all 20 Eurozone countries. Zimpler aims to support a larger number of European merchants, with the solution set to be available for B2C and B2B clients alike.

Experience the reign of the Digital Finance dynamos, where some transition and others race ahead in the global fintech chase, consistently leaving us in awe.

According to The Telegraph, The Bank of England is set to decline Revolut's British bank licence application due to concerns about its balance sheet.

In parallel, Revolut expanded its business in Australia, intending to obtain a banking licence in the country while focusing on international payment services for its clients.

Nubank announced that it sees itself more as a "money platform" as it turns 10, aiming to be no longer viewed purely as a neobank.

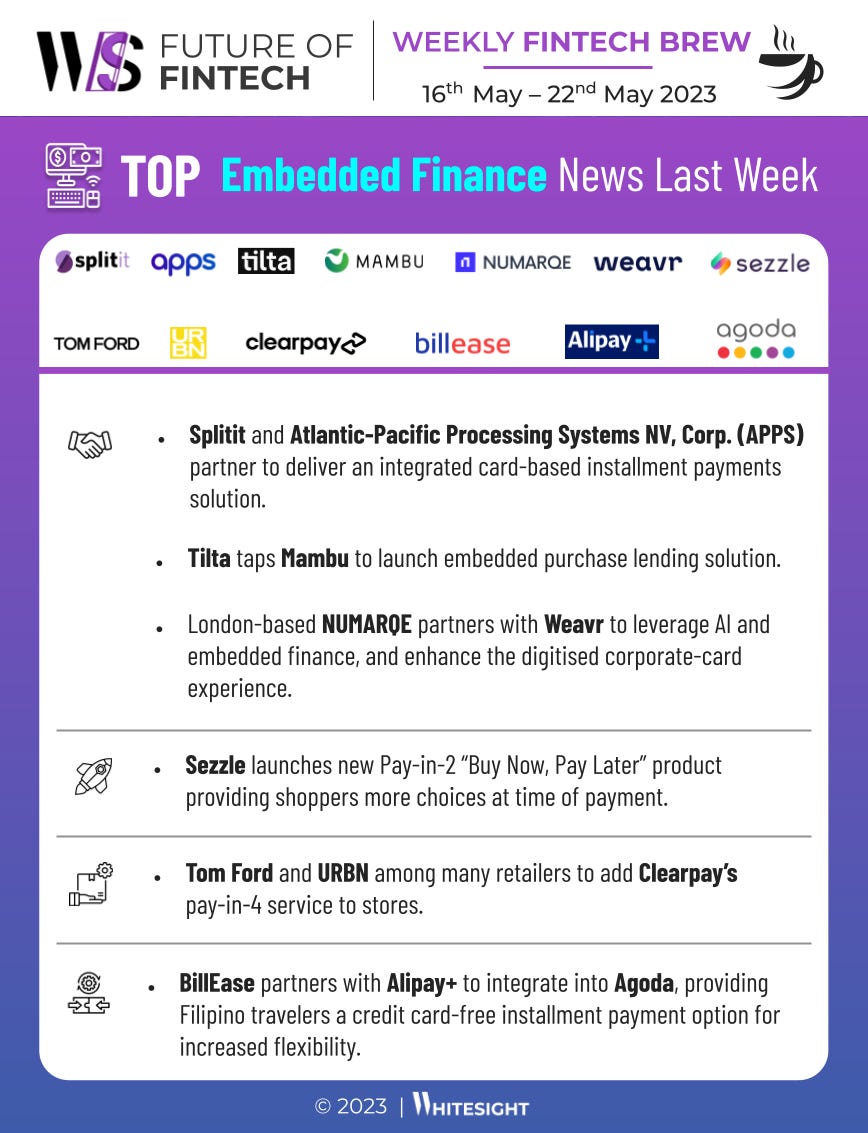

Enter the realm of Embedded Finance, a world of revolution and revelation, where visionary players unite to reshape the landscape with relentless innovation!

Berlin-based fintech Tilta launched its revenue-share embedded purchase lending solution on Mambu. The platform will now be able to bring solutions to market faster, cut costs and allow collaboration thanks to Mambu’s API-driven approach.

London-based NUMARQE partnered with Weavr to leverage AI and embedded finance and enhance the digitised corporate-card experience.

In the Fintech Infrastructure landscape, bold visionaries set out to break boundaries, leveraging their pioneering spirit to reshape the finance game and carve new paths.

Loanspark partnered with Mastercard, Middesk, and LexisNexis to enhance, speed up, and secure service delivery for its co-branded partners and their business customers.

TransUnion launched TruIQ Analytics Studio to help businesses make better decisions with Nimble. TruIQ Analytics Studio is a robust data science and analytics solution providing businesses with on-demand access to its rich datasets.

Towards the greener lands of Green Finance, innovative players were seen orchestrating an eco-revolution, harmonising finance and sustainability.

NayaOne and Cogo joined forces to fast-track the process for banks and financial institutions to integrate carbon footprint management tools into their banking apps.

Nationwide Building Society launched a 0% green mortgage product to support decarbonising housing stock.

In this enthralling arena of DeFi, the curtains rise, and the stage is set for a breathtaking performance of decentralised innovation.

Uniswap V3 got deployed on Polkadot via Moonbeam Parachain, bringing improvements in capital efficiency, flexible fees, and user experience.

Verida integrated Polygon ID into Verida Wallet, enabling users to manage digital identities, access Polygon blockchain assets, and protect their privacy through Polygon ID zero-knowledge credentials.

Some other happenings in the fintech universe 🪐

Craving for some tempting bite-sized fintech headlines to savour alongside your tea? We're here with a delectable serving of some more fintech tea to appease your curious taste buds:

Fabrick acquired mobile payments firm Judopay as it looks to become a market leader in the UK.

PayPal intends to sell its Xoom cross-border business to refocus on higher-growth areas.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include –

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️