Future of Fintech | Edition #69 – May 2023

Summary of fintech news from 9th to 15th May

Hey there, Fintech fans!👋

Here’s to another Tuesday infused with a tech-tinged triumph! Behold the beauty that is our latest edition of the Future of Fintech newsletter — blended with a symphony of six sensational fintech sectors, creating a delectable brew that will leave you wanting more. Served fresh and brimming with innovation, this newsletter is your passport to a tasty dose of the weekly Fintech Frenzy!💡

The freshest fintech finds had us cascading across every corner of the globe, from the vibrant lands of Europe to the epic tech terrains of the USA. But hold on tight, 'cause that's just the appetizer! Prepare to be whisked away on a whirlwind adventure through the tropical turn-ups in Latin America, where significant opportunities arose for the fintech realm! Last week, the fintech infrastructure had pioneers forging paths of innovation and setting ablaze new trends! Cheers to the fusion of finance and technology, and let the headlines unfold!

As one of the major players in the world of big tech, Apple has been spearheading the integration of financial services into their already impressive array of offerings. Over time, the company has steadily introduced a wide range of financial products and services that have helped to position it as a major force in the financial world. By exploring the events that have brought it to this point, one can begin to understand how Apple is laying the foundation for a robust business model built around its financial offerings - a model that could very well serve as the cornerstone for its future endeavours.

Intrigued? Prepare to unlock the secrets of Apple’s Embedded Finance Playbook, a groundbreaking report from WhiteSight that provides an exclusive look into the tech giant's calculated progression towards boosting its high-margin services revenue through the implementation of embedded finance strategies. 🚀

And as a special offer for the first 100 buyers of this report, we're excited to offer a 50% discount when you use the promo code AEF50. Don't miss out on this incredible opportunity to gain a deeper understanding of Apple's financial strategy - act fast and take advantage of this limited-time offer now!

Get ready to tantalise your fintech taste buds like never before! Presenting you #Edition 69, a sumptuous fintech feast that will leave you drooling for another serving.

Here's the TL;DR

Payment pioneers pushed past their parameters last week, as Mastercard unveiled a new digital account opening tool by leveraging open banking technology, and Tarabut Gateway teamed with Visa on open banking solutions.

Expanding the fintech game to fresh fields – while Revolut began offering loans in France, beginning with the roll-out of customer credit products, Airwallex officially got launched in Israel.

It's all about the SaaS – Capchase launched Capchase Pay which helps Software as a Service (SaaS) companies close deals faster by offering flexible payment terms. At the same time, Temenos teamed up with Amazon Web Services (AWS) to offer its core banking solutions as SaaS.

Fueling fintech with features, MoneyLion added a search feature powered by ChatGPT to its marketplace. Meanwhile, Experian teamed with Kyckr to speed up onboarding and verification for customers and suppliers.

Amping up the DeFi game – Standard Chartered signed an MoU with Dubai International Financial Centre (DIFC) for collaboration on digital assets. Temenos and R3 also joined forces for retail CBDC use cases in commercial banks.

For the longer read, let's get going –

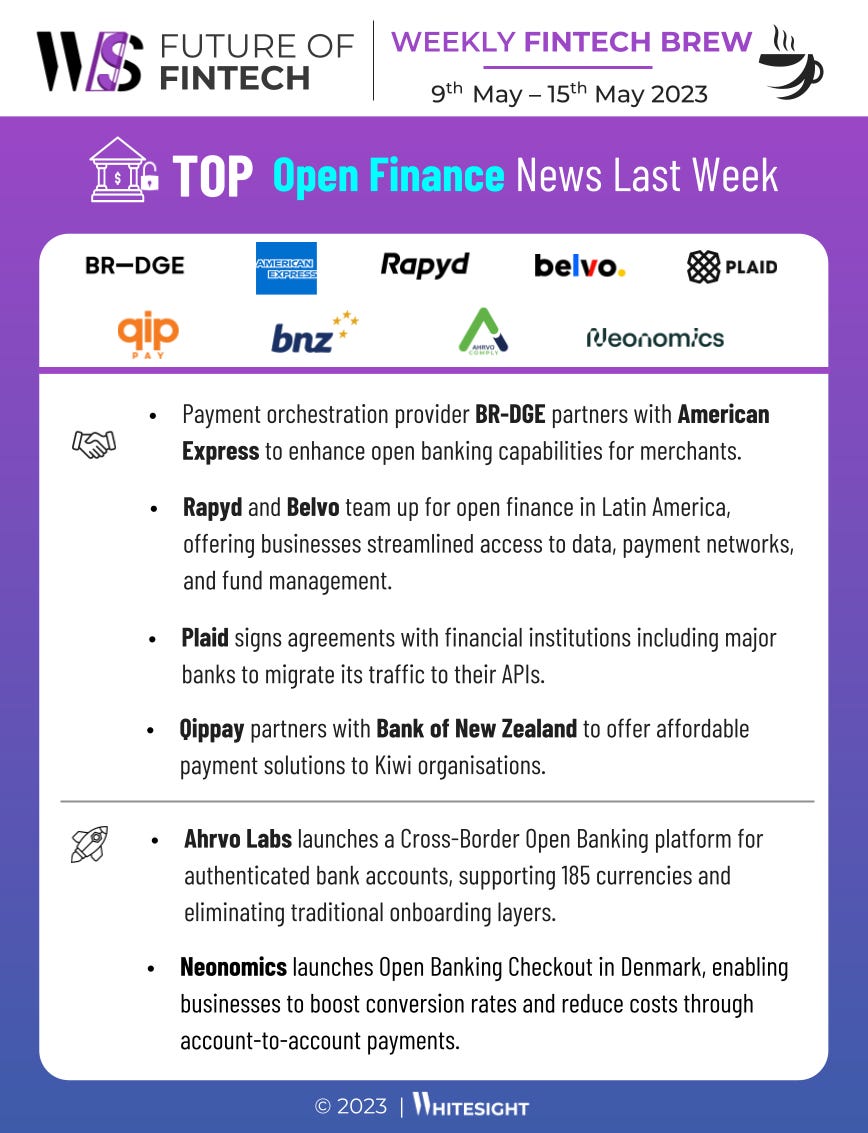

Behold the scorching flames of the Open Finance game, where mighty players unite, and new ventures ignite, all to spread this segment’s transformative "openness" to the masses.

Ahrvo Labs launched a Cross-Border Open Banking platform for authenticated bank accounts, supporting 185 currencies and eliminating traditional onboarding layers.

Rapyd partnered with Belvo for Open Finance in Latin America, offering businesses access to data, payment networks, and streamlined fund management in the region.

Witness the Digital Finance dynamos, dominating the game and driving forward to dazzle their targets. As some unleash new offerings, others join hands for innovative collaborations.

Revolut launched Exchange Traded Funds (ETFs) for its trading offering via a partnership with German fintech Upvest, allowing its European customers to invest directly in fractional ETFs.

Banco Sofisa partnered with Finastra to implement Vector Risk, a market and credit risk solution to help banks to control the risk of new products with no impact on IT resources.

The Embedded Finance world was a remarkable site of revolution and revelation, as players came together to reshape the landscape with relentless innovation!

Alviere and Hawk AI partnered to enhance global anti-money laundering efforts through AI-powered surveillance integrated into Alviere's platform.

Splitit signed a two-year agreement with Visa to provide merchants with payment instalment solutions embedded within their credit card process.

In the Fintech Infrastructure realm, visionaries embarked on a mission to defy limits, leveraging their pioneering prowess to pave new pathways and rattle the finance game.

Rapid Enterprise integrated its digital loan origination system – Decisioneer – with Mambu's cloud-based lending platform to provide small businesses with fast and customised financing solutions.

Fintech scaleup Credolab partnered with automated decisioning platform Taktile to simplify alternative data for financial organisations, enabling new product launches, risk reduction, and more accurate decisions.

Amidst the lush and flourishing landscapes of Green Finance, the tech titans claimed centre stage with their gleaming initiatives, casting a luminous glow upon the path of progress.

Clarity AI partnered with impact data and analytics provider GIST Impact to develop an innovative biodiversity impact assessment product for investors. The developed solution will let clients make informed investment decisions by enabling them to measure and size their exposure to companies that negatively impact biodiversity.

S&P Global's ESG and sustainability-focused business Sustainable1 launched Nature & Biodiversity Risk dataset to let companies and investors address nature-related risks and impacts.

Step into the daring realm of DeFi, where novel creations unfold like a mesmerising spectacle.

The Central Bank of Brazil announced that it will allow 10 commercial banks to participate in its CBDC pilot, with the second stage involving up to 20 participating institutions.

Financial technology company Digital Asset launched Canton Network, a privacy-enabled interoperable blockchain network for institutional clients, with participants including Deloitte, Goldman Sachs, and many others.

Some other happenings in the fintech universe 🪐

Craving for some tempting bite-sized fintech headlines to savour alongside your tea? Fear not, for we've got you covered with a delectable serving of more fintech scoop to appease your curious taste buds:

Petal raised $35M and spins off Prism Data, its B2B-focused data infrastructure and analytics subsidiary.

ABN Amro co-led a $12.5M seed round in fraud detection fintech ThreatFabric to enhance technical capabilities and fuel growth.

Salsa raised $10M to enable software platforms to integrate payroll features through its APIs.

And that's a wrap 👋

We hope you enjoyed this edition of the Weekly Fintech Brew!

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include –

From iPhone to iBank: Analysing Apple’s Embedded Finance Adventures

The State of Banking-as-a-Service in the UK & Europe in collaboration with Toqio

If you're someone who likes to read think pieces, you will likely love our monthly blog, Fintersections, where our team members analyse the convergence of FinTech with the world.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, sponsorships, and content marketing services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything FinTech and Web3, follow us on LinkedIn and Twitter, and don't be shy to show some ❤️